Aadhar Housing Finance Ltd - 37% increase in annual net profit

Company name - Aadhar Housing Finance Ltd.

Last closing price(NSE:AADHARHFC) - ₹457.8 (as on 12-Sep-2024)

Estimated reading time - 4 minutes

Executive Summary

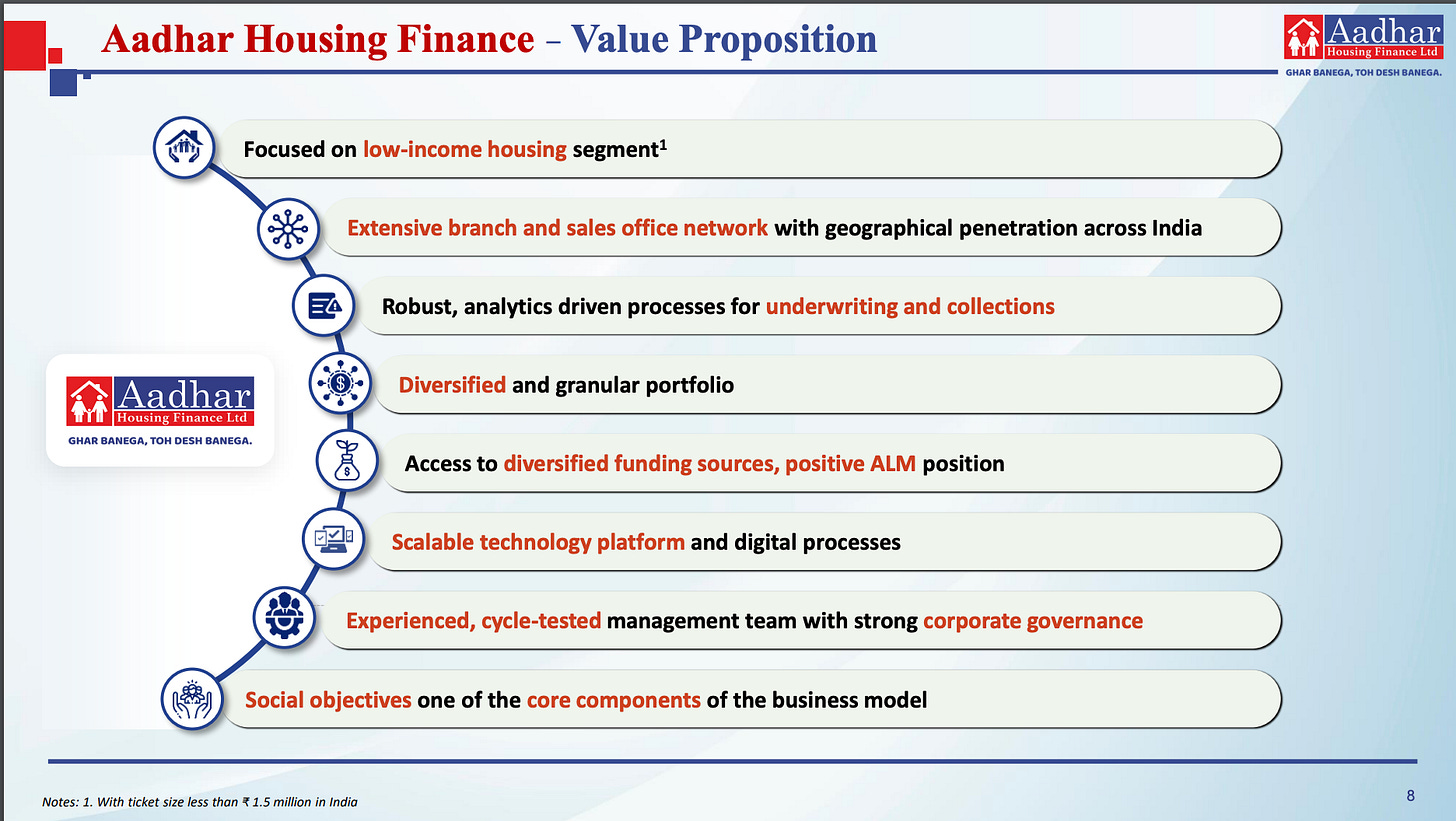

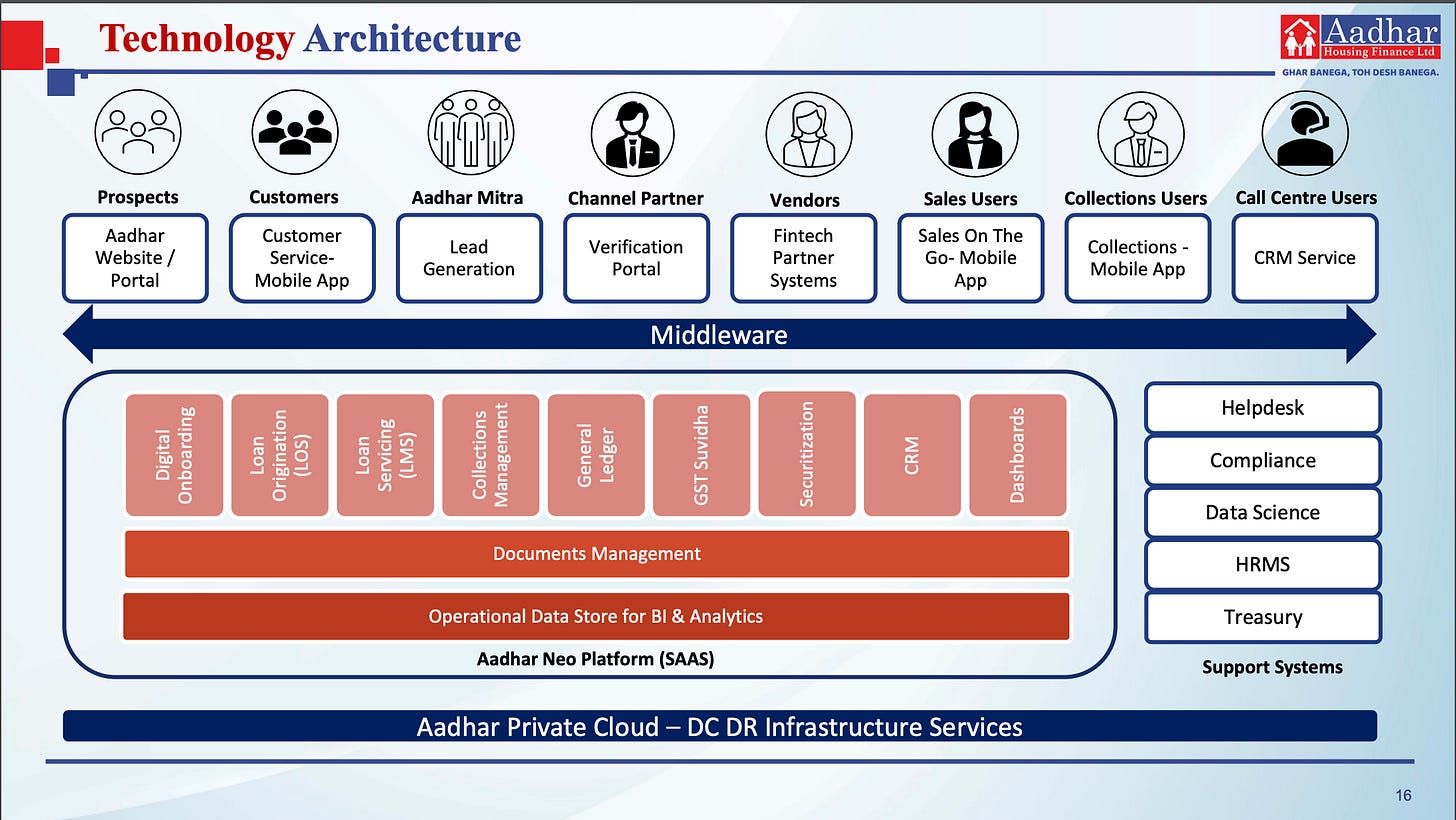

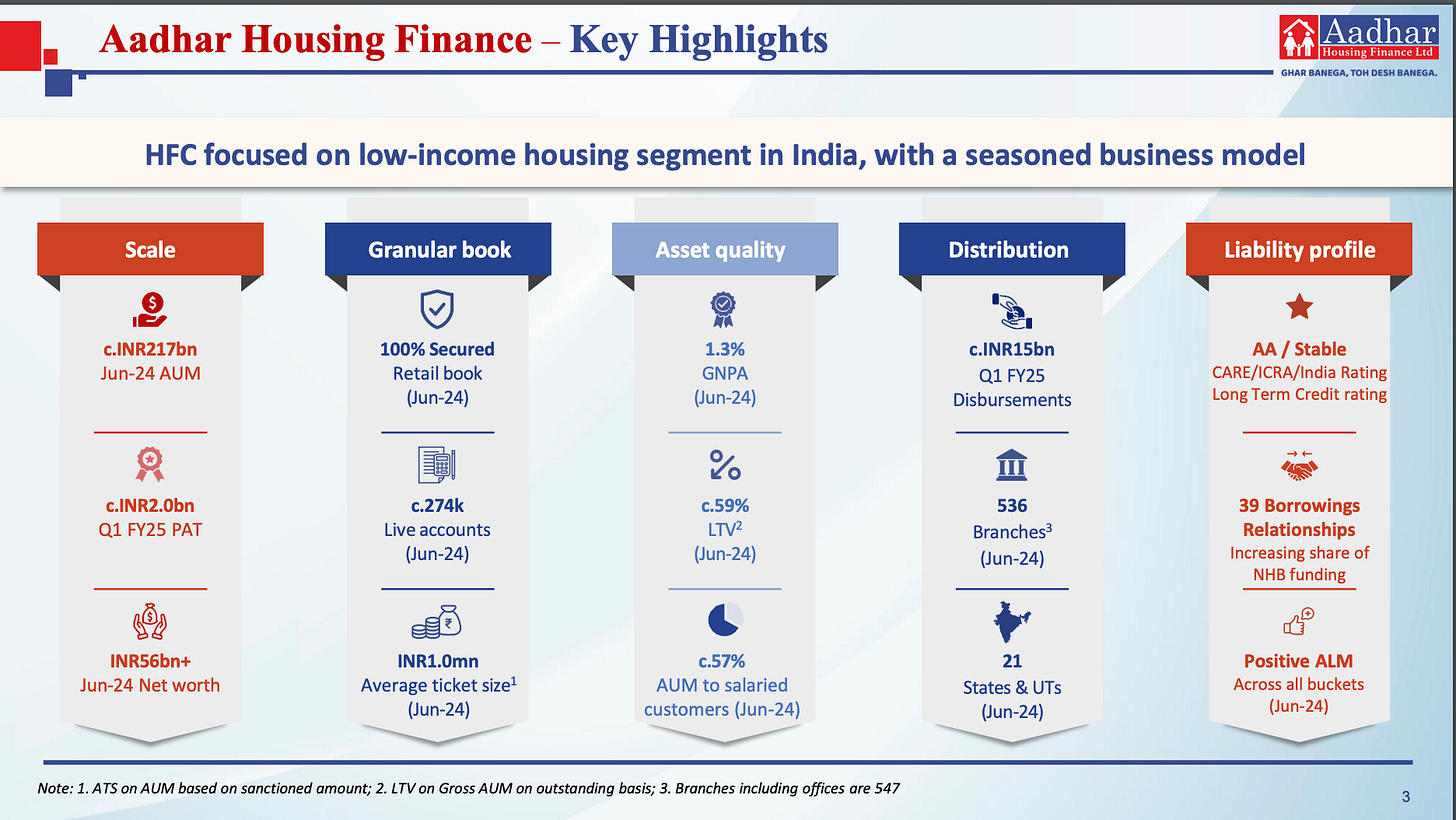

Aadhar Housing Finance is a technology backed housing loan company focused on the low-income housing segment. Their average ticket size is ~ ₹10 lacs.

The company has a consistent track record of growing net profit from 100Cr in FY 2018 to 749Cr in FY 2024. The net profit and EPS increased by 37.4% in FY 2024.

EPS improved by 26% in Q1-2025.

Stock price chart

Detailed analysis

About the company

Aadhar Housing Finance is a technology backed housing loan company focused on the low-income housing segment. Their average ticket size is ~ ₹10 lacs.

The company has a consistent track record of AUM and profit growth, and a focus on using technology to scale and and control their NPAs.

The company listed on the stock exchanges recently on 15-May-2024.

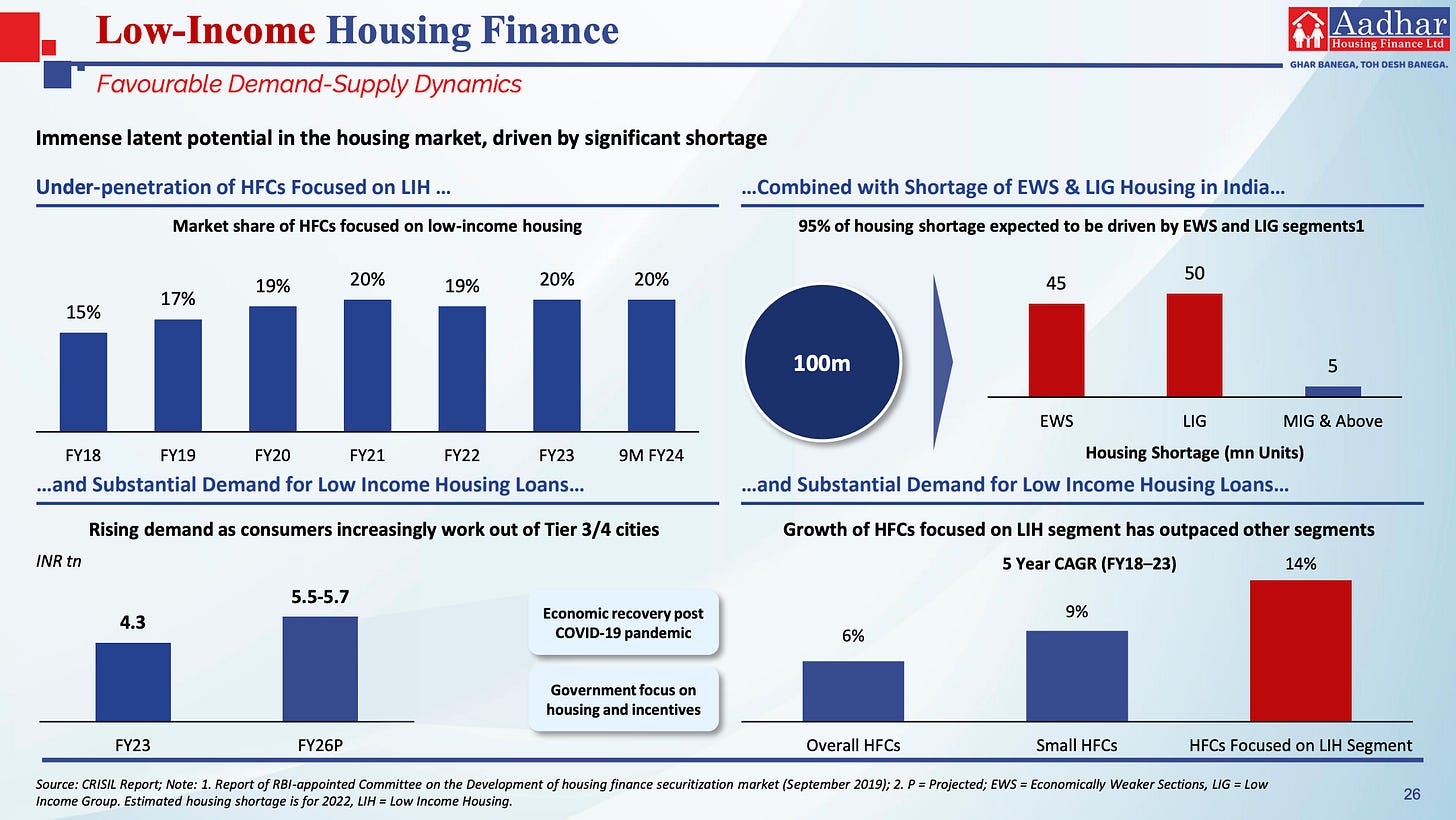

Future potential of low-income housing sector -

Financial analysis

Overview

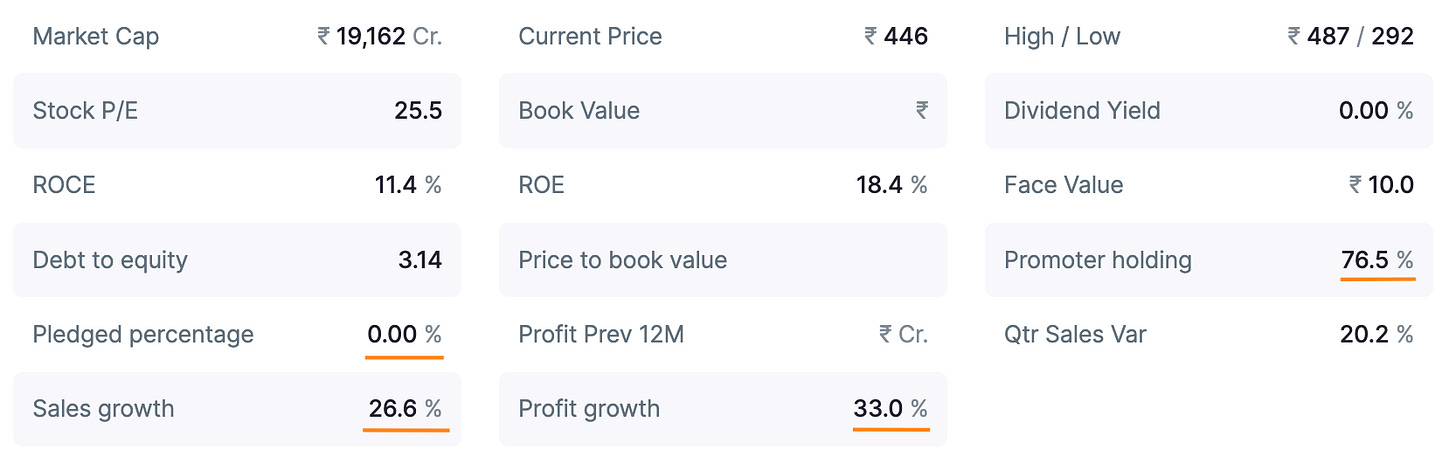

The promotor holding is 76.5% and the pledged percentage is 0%

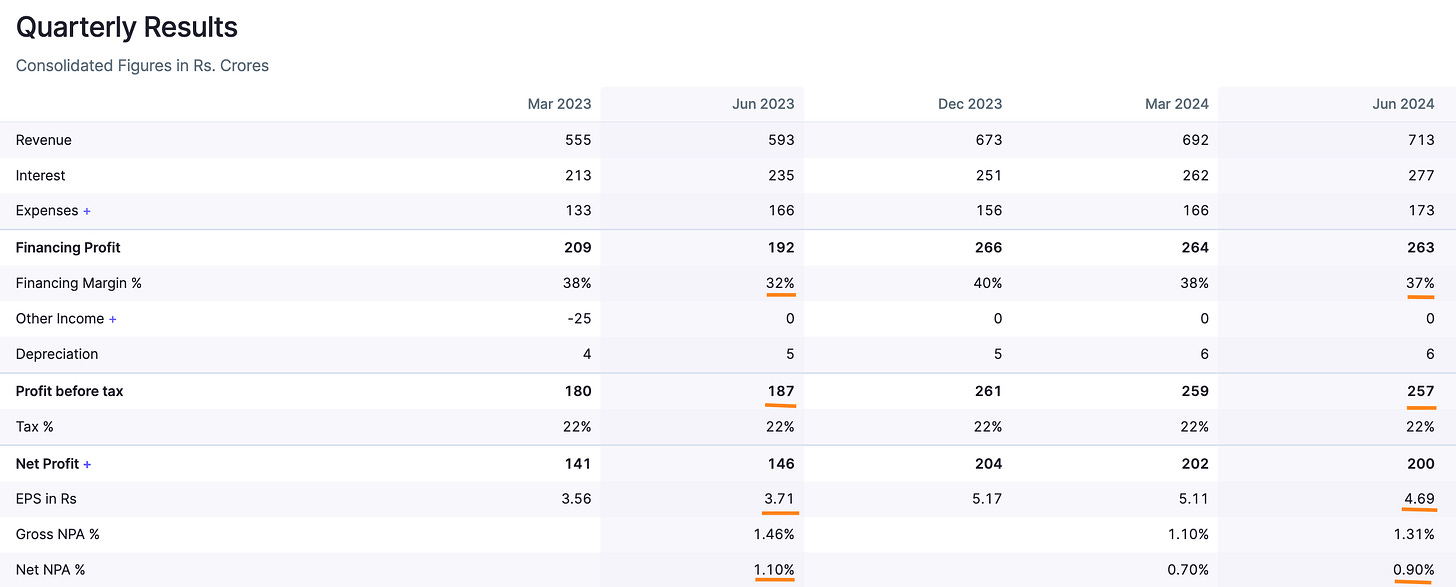

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The net profit increased by 37%.

Financing margins improved by 15.6%.

EPS improved by 26%.

Net NPA(non-performing assets) improved by 18%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the last financial year -

The company has a consistent track record of growing net profit from 100Cr in FY 2018 to 749Cr in FY 2024.

The net profit and EPS increased by 37.4% in FY 2024.

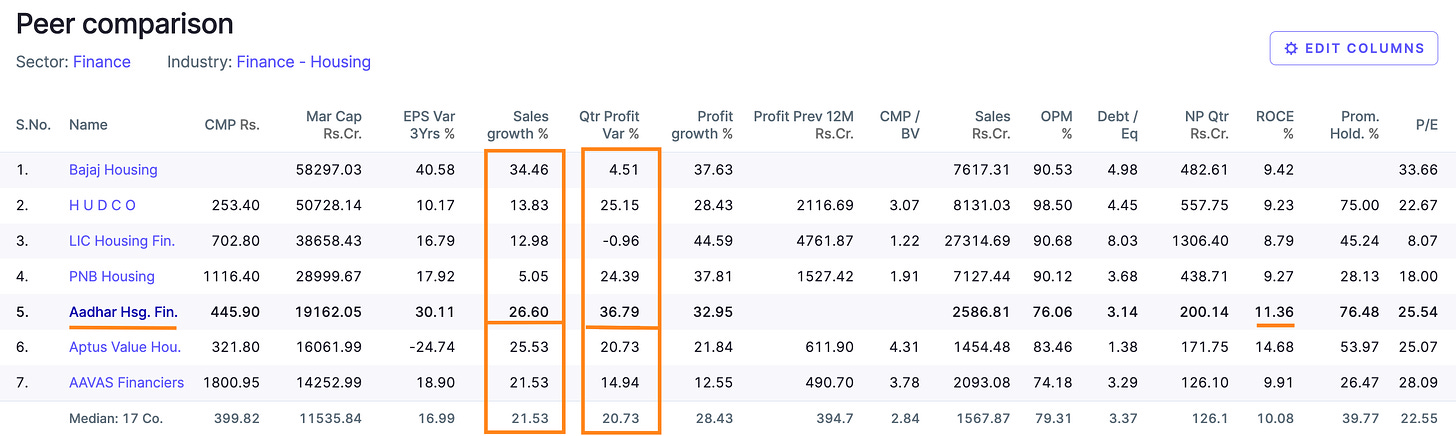

Peer comparison

The company has reported the highest quarterly profit growth among it’s peers at 36.79%.

The sales growth is the 2nd highest among the peers at 26.6%.

The company’s ROCE is 2nd highest among the peers at 11.36%.

Timing analysis

Institutional volume signs seen in the week of 2-Sep with 3X spike in trading volumes.

Did you find our analysis on Aadhar Housing Finance Ltd valuable? Help us reach more investors like you.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in