Amber Enterprises India Ltd - 41% quarterly sales growth

A company with 27% market share in room air conditioners.

Company name - Amber Enterprises India Ltd

Last closing price(NSE:AMBER) - ₹4645.2 (as on 13-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

Amber Enterprises India Ltd is a company operating in electronics B2B segment as a OEM and ODM provider for RACs, with a market share of 27.3% in the RAC(Room Air Conditioner) market.

Promoter holding is at 39.9% and pledged percentage is 0%.

The company reported a significant quarterly sales growth of 41.09% overall, net profit increased by 59.5% and EPS increased by 58.55%

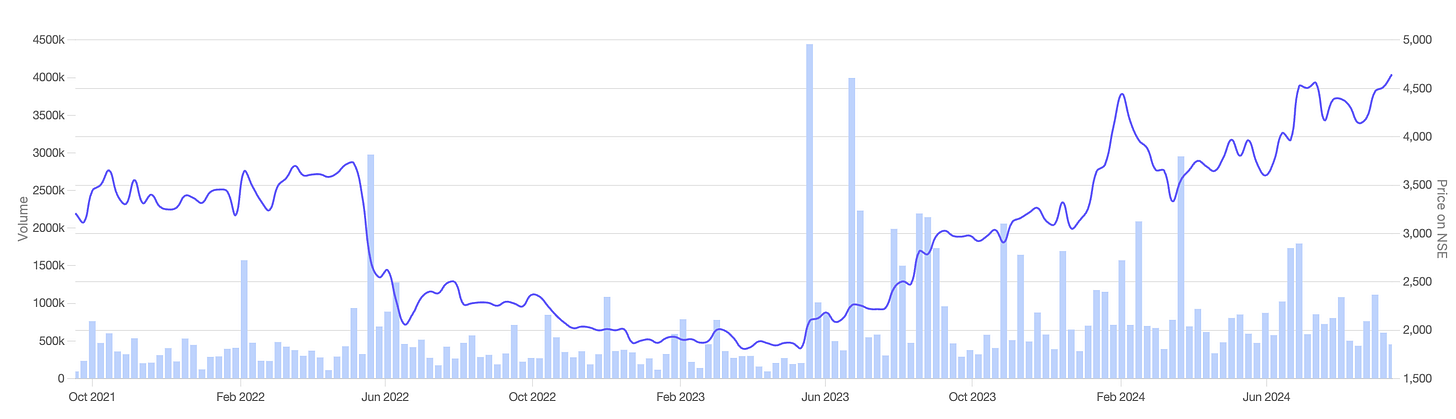

Stock price chart

Detailed analysis

About the company

Amber Enterprises India Ltd is a company operating in electronics B2B segment as a OEM and ODM provider for RACs, with a market share of 27.3% in the RAC(Room Air Conditioner) market.

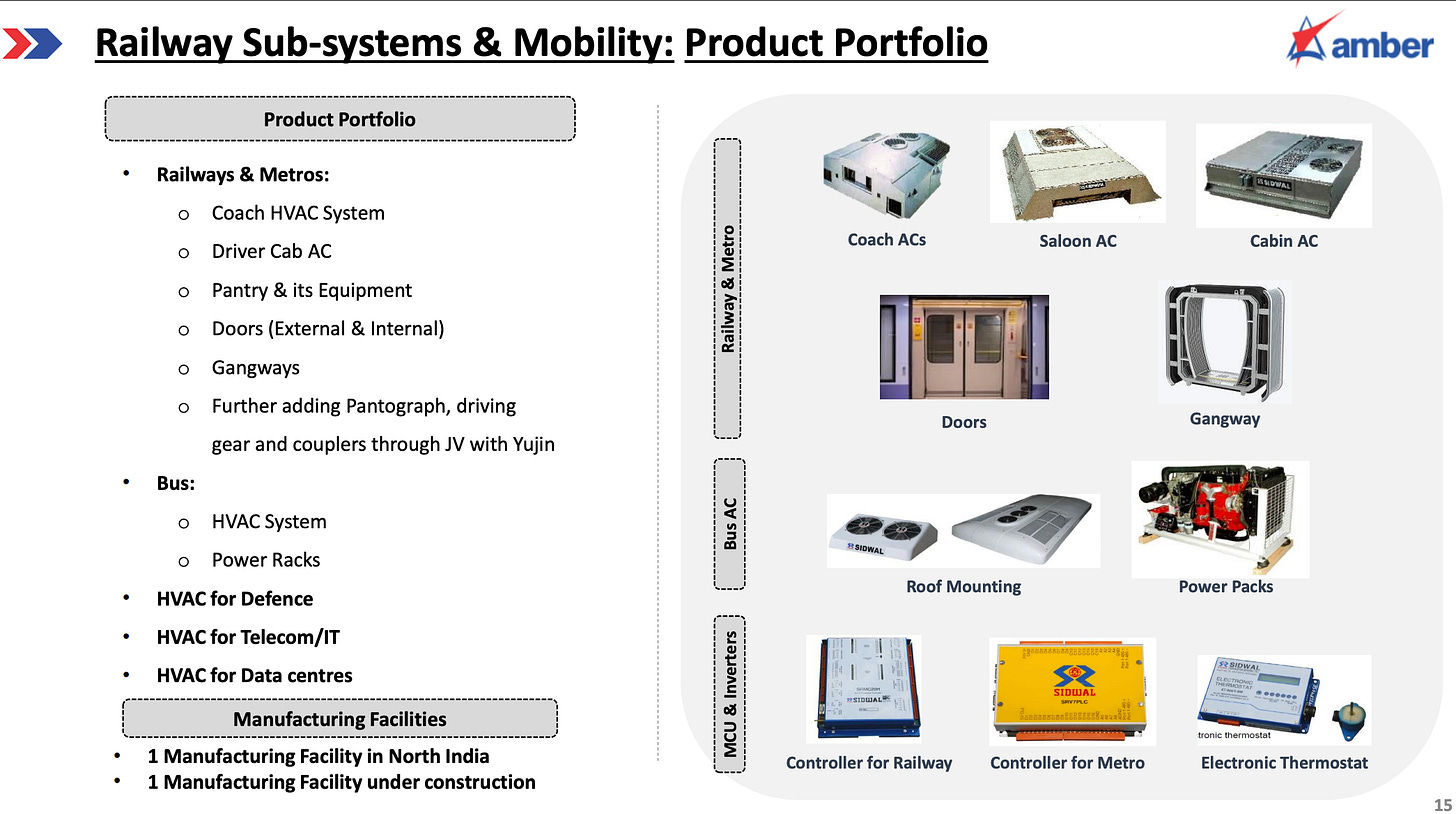

It operates 3 business divisions with following revenue split -

Consumer durables division(79.9%)

Electronics division(16.1%)

Railway subsystems and mobility division(3.9%)

Financial analysis

Overview

The company has a ROCE of 10.2%, with a management guidance of taking it to 15% in the current FY and 19% in 2 years.

Promoter holding is at 39.9% and pledged percentage is 0%.

Debt to equity is 0.75.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company reported a significant sales growth of 41.09% overall.

Net profit increased by 59.5% and EPS increased by 58.55%

The debt interest payment also increased by 15%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a negative growth of -2.86% in sales in the FY 2024, but the trending TTM(trailing twelve months) sales is already +10.4%.

The TTM net profit and EPS are +20.86% and +20.13% respectively.

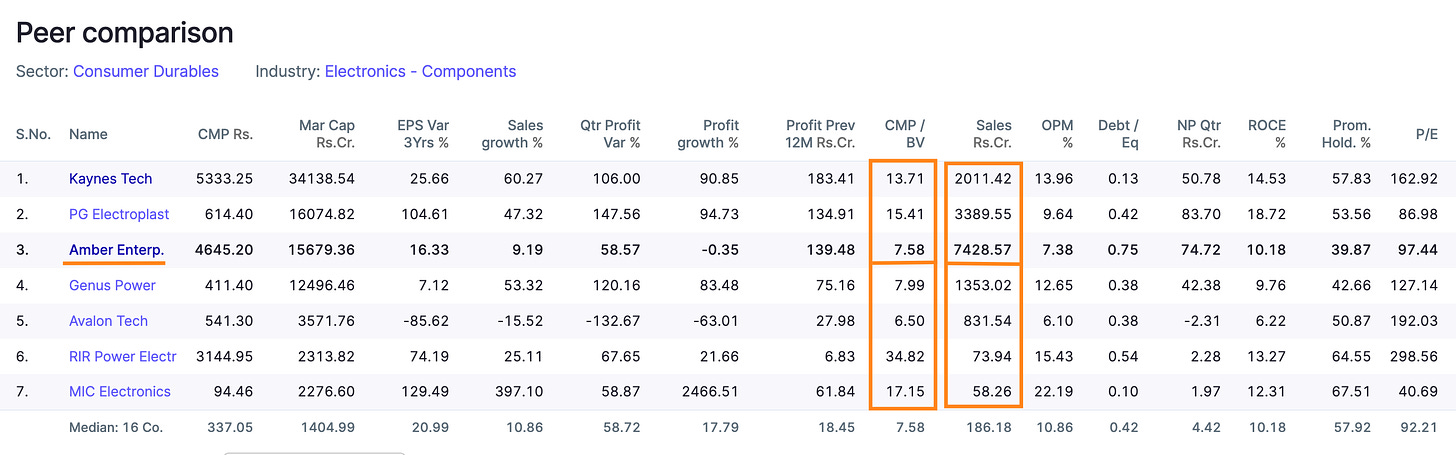

Peer comparison

The total sales of the company is highest among it’s peers, but it’s market cap is third highest with the first one having a 2.2x market cap compared to Amber Enterprises.

The price to book value of the peers with similar profit range is between 13 to 15, whereas it’s 7.58 for Amber enterprise.

This shows potential for growth if the company is able to maintain it’s revived growth rate.

Timing analysis

Institutional volume signs seen in the week of 18th June(3.2x), 24th June(3.4x) and 26th Aug(1.8x).

Did you find our analysis on Amber Enterprises India Ltd valuable? Help us reach more investors like you.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in