Arvind Smartspaces Ltd - annual net profit +82%

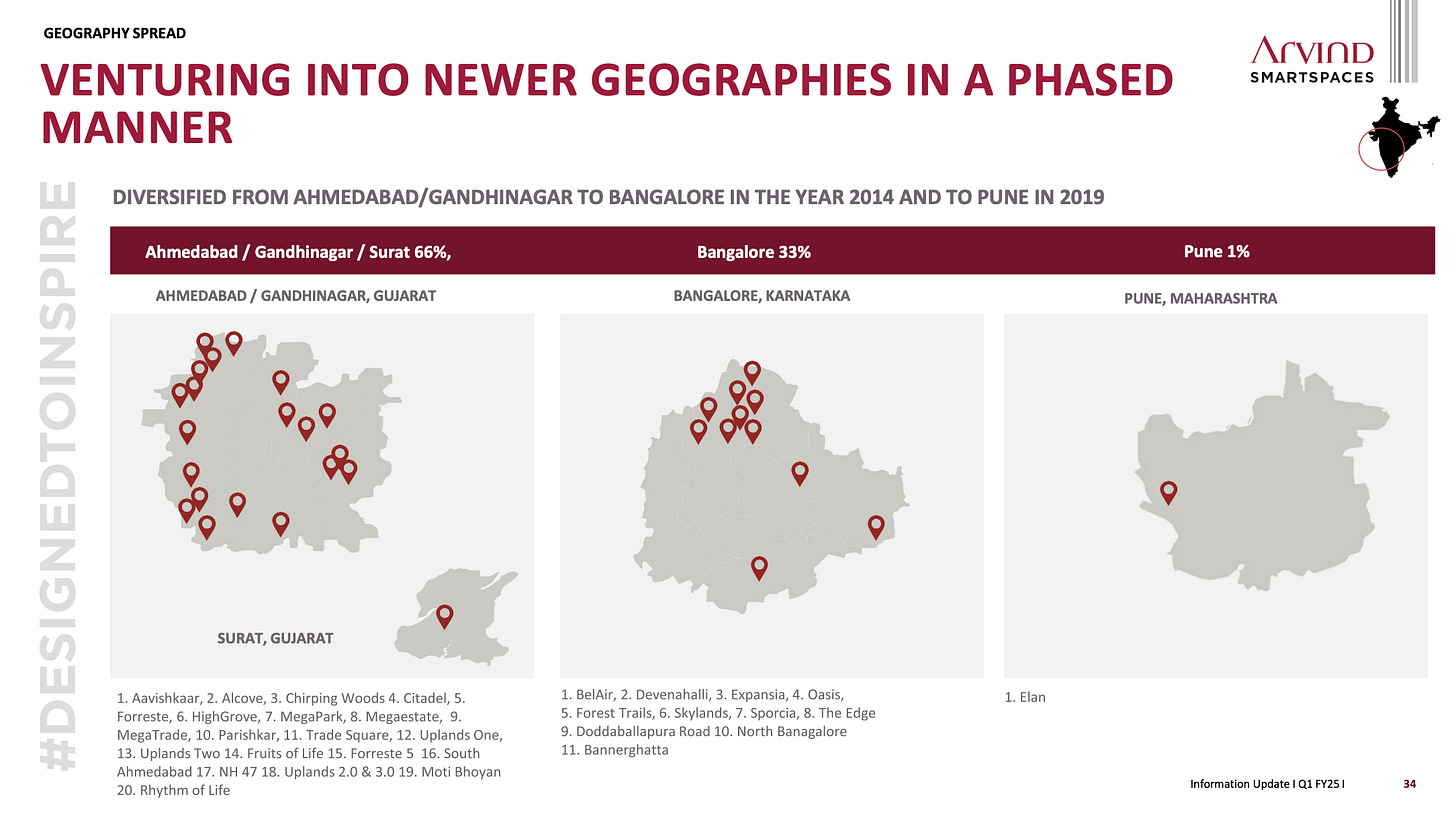

A residential real-estate developer operating in Gujarat, Karnataka and Maharashtra

Note - We are observing precaution in the current market conditions. The market sentiment is very high on greed currently, with NIFTY50 making newer highs. But the broader market(NSE:CNX500) is showing opposite signs. Only few large cap stocks are participating in the rally, and majority of the mid and small cap stocks are not holding their breakouts. Both small and mid-cap indexes have been underperforming compared to NIFTY50 in the last 3 weeks. A correction in the overall market is anticipated and protecting capital is important.

Company name - Arvind SmartSpaces Ltd.

Last closing price(NSE:ARVSMART) - ₹826.45 (as on 30-Sep-2024)

Estimated reading time - 3 minutes

We recently covered Hitachi Energy India Ltd on 26-Sep, and the timing of our analysis worked out as it reached +10% yesterday. The updated performance of all our past analyses is available here.

Executive Summary

Arvind Smartspaces Ltd was listed in 2015 through a demerger from Arvind Ltd. It is a real-estate company focused on residential projects, currently operating in Gujarat, Karnataka and Maharashtra.

The company has a fast growing project portfolio - delivered 4.9 msf, ongoing projects of 26.7msf and planned projects of 46 msf.

The annual net profit increased by 82% and EPS increased by 62%.

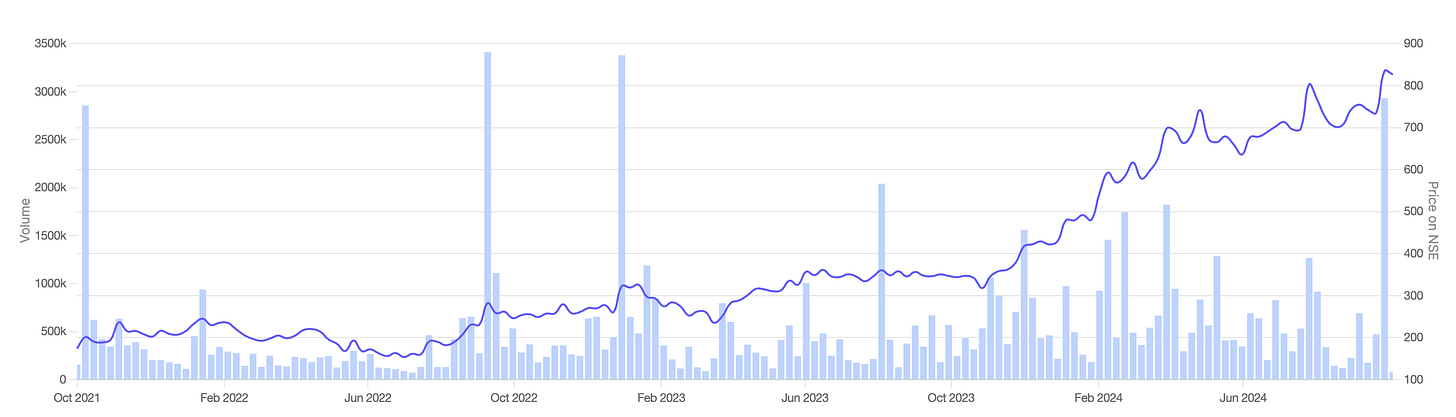

Stock price chart

Detailed analysis

About the company

Arvind Smartspaces was listed in 2015 through a demerger from Arvind Ltd.

It is a real-estate company focused on residential projects, currently operating in Gujarat, Karnataka and Maharashtra.

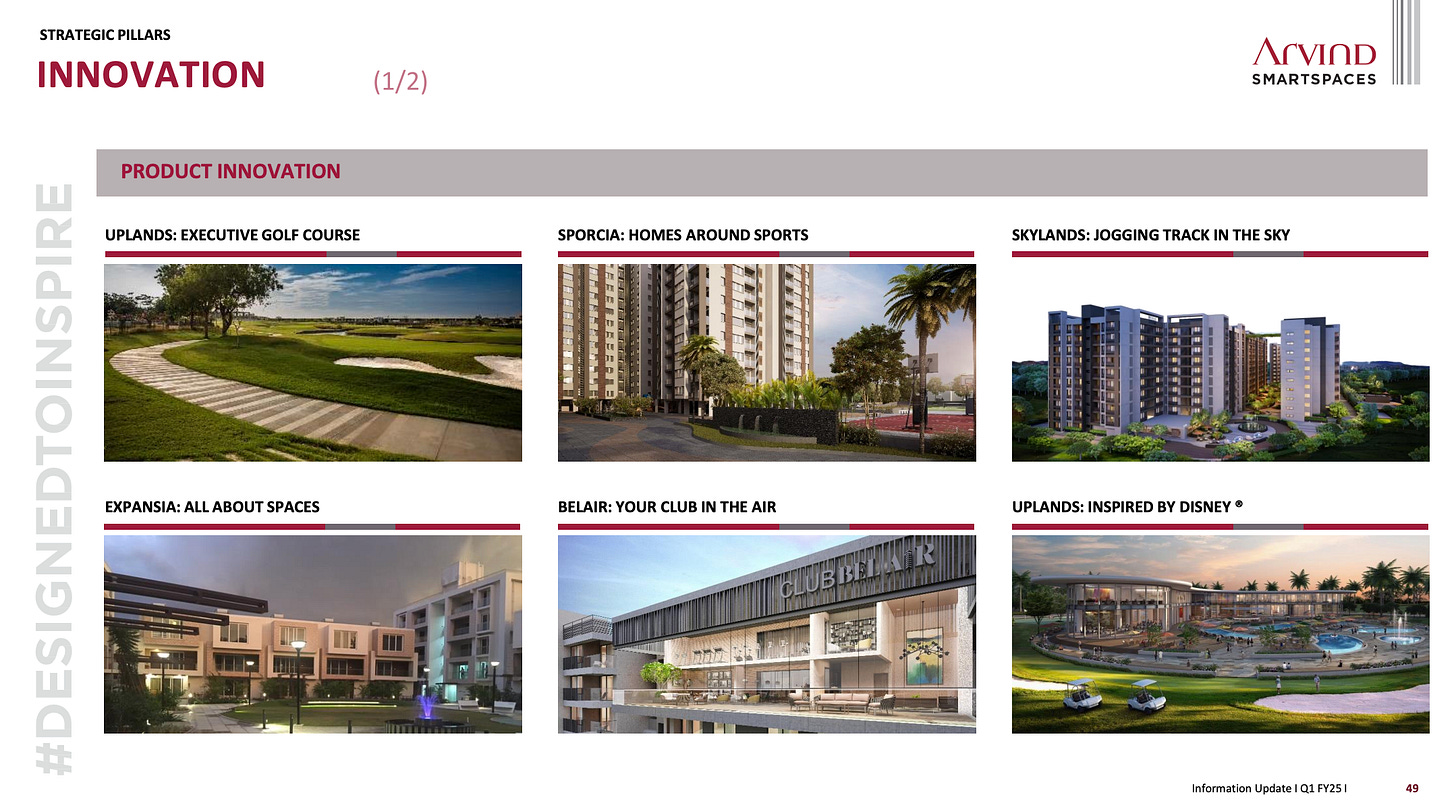

The company is poised to ride the growth wave of spike in demand of premium housing in India.

The company has a higher share of JDA(Joint Development Agreements) projects with the land-owners. This helps them keep an asset light model, enables faster turn-around and have a robust OCF(Operational Cash Flow) generation.

Growing project portfolio -

Delivered 4.9 msf

Ongoing projects of 26.7msf

Planned projects of 46 msf

Future prospects

What is the company’s plan to maintain earnings growth in future?

The company recently announced separate business and PnL heads for each zone, who will develop expertise and handle the nuances of each zone.

The company is focused on premium residential market.

The company has a robust pipeline of projects.

Potential risks that can hamper the future growth?

A potential slow down in over-all real-estate, or supply increasing demand in near future.

As the company plans to enter newer regions, with each region having it’s nuances, can they still deliver similar sales given local competition from established players.

Financial analysis

Overview

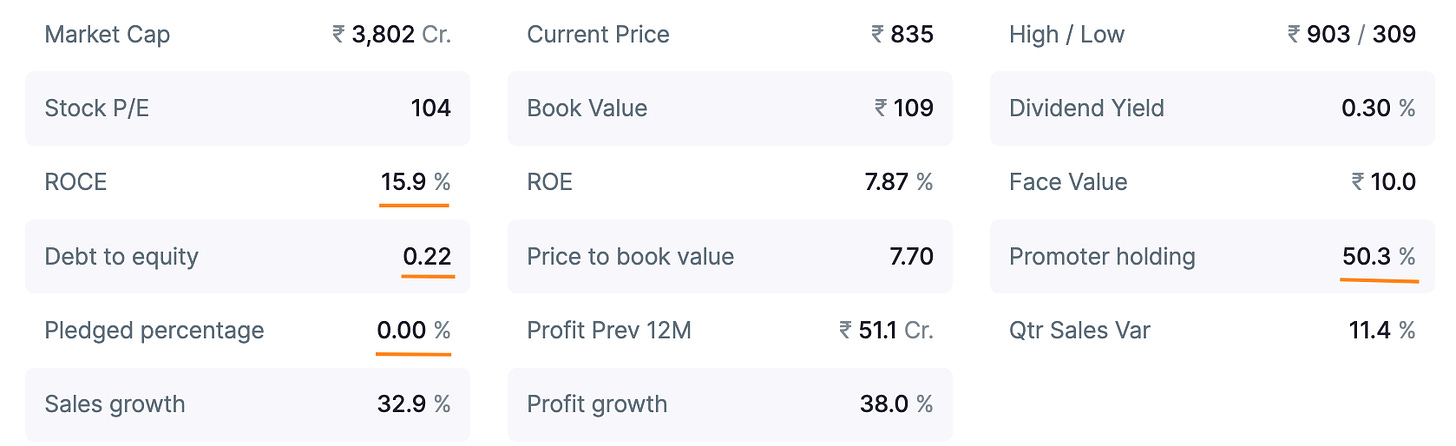

The promoter holding is 50.3% and the pledged percentage is 0%.

The company has a ROCE of 15.9% and debt-to-equity of 0.22.

Quarterly results

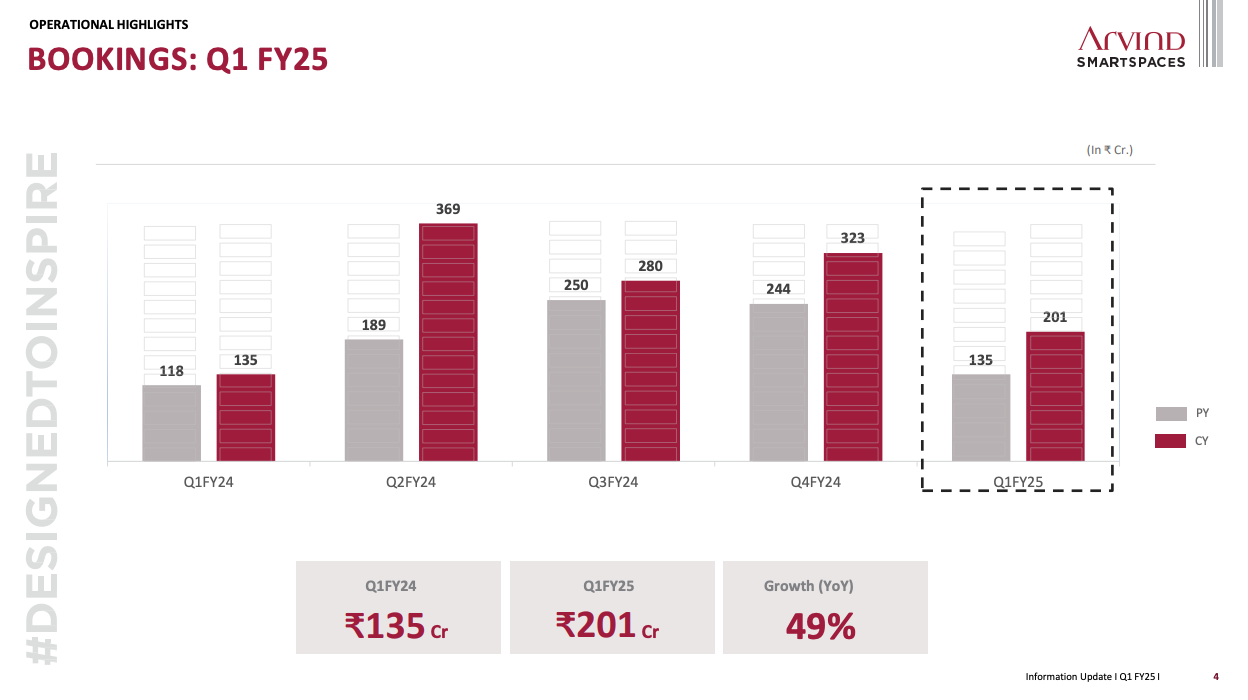

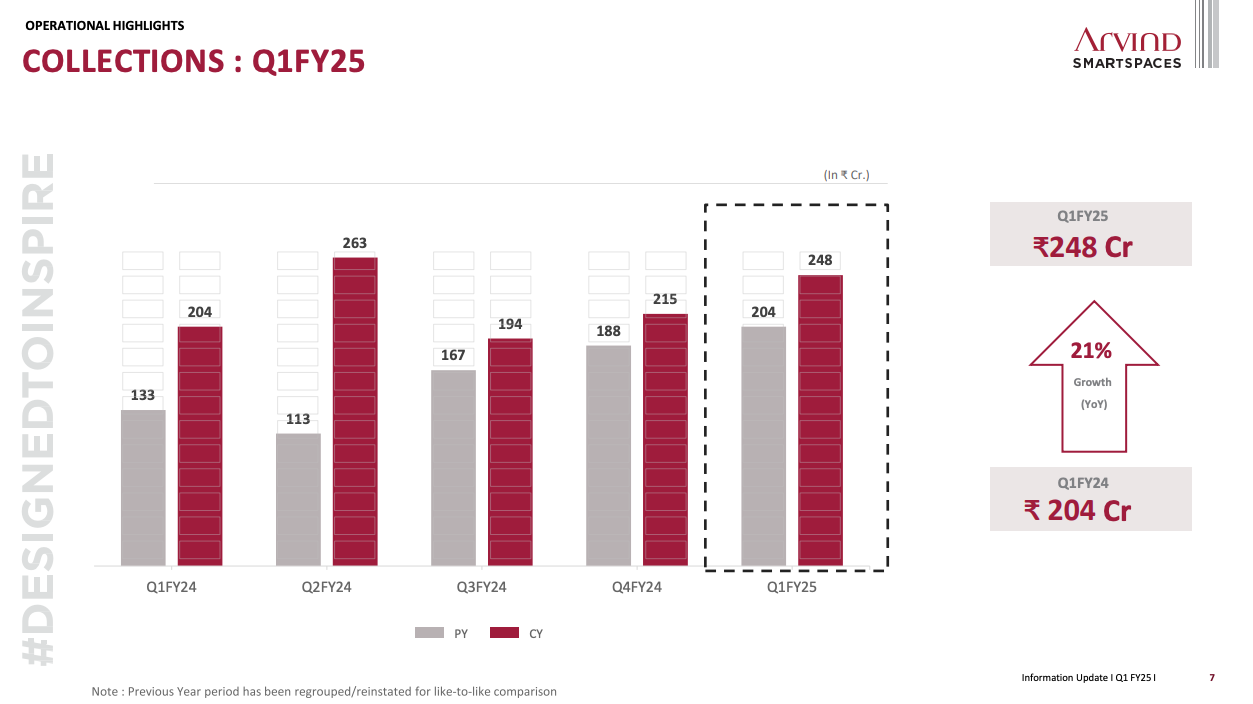

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The overall reported sales, operating profit and net profit numbers show a de-growth compared to last 3 quarters because of the accounting mechanism for real-estate.

The metrics critical in this context are bookings(+48%) and collections(+21%).

The current quarter shows lower EBITDA and PAT margins due to periodical costs and lower booking values compared to budgeted expectations.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The total reported sales increased by 33.3%.

The operating profit increased by 228% on account of increased sales and operating margins.

The net profit increased by 82% and EPS increased by 62%.

Long term debt reduced by 36% from ₹143Cr to ₹91Cr.

Peer comparison

The company has reported highest EPS 3yr variance at 49.9%.

Timing analysis

Institutional high trading volume signs seen recently in the week of 23-Sep(17X).

Did you find our analysis on Arvind SmartSpaces Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in