Bliss GVS Pharma - quarterly EPS growth of 57%

Business and financials analysis - September 2024

Last closing price (BLISSGVS) - ₹127.77 (as on 4-Sep-2024)

Summary

Significant EPS growth of 57% in Q1-2025 vs Q1-2024.

The company reported a 25% improvement in profit margins in FY 2024 compared to the last financial year (16% → 20%).

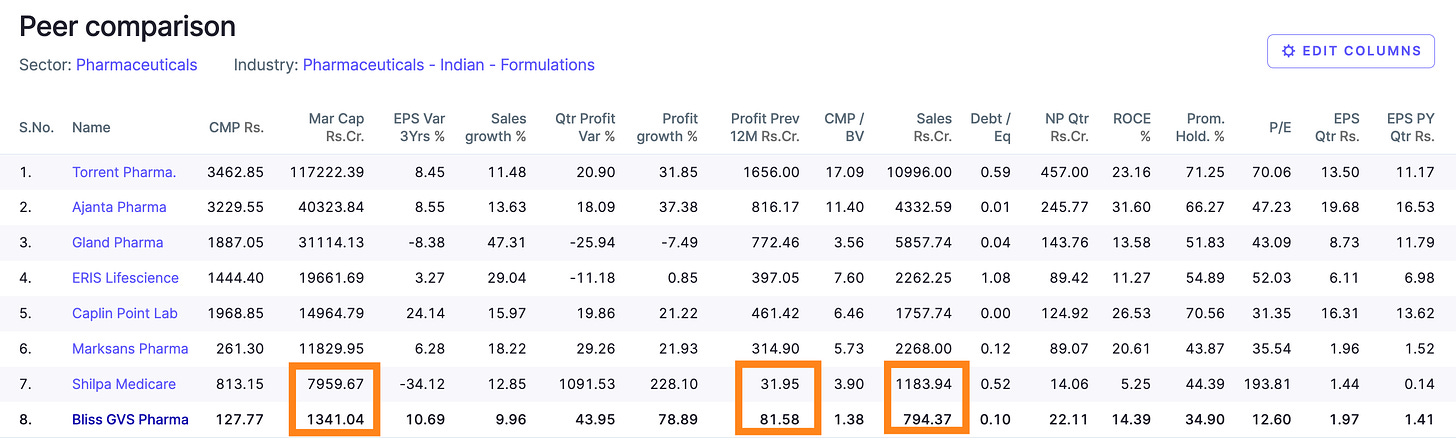

The company’s total sales are 49% lower than Shilpa Medicare , a company of the same sector, but the market cap is lower by 593%. This shows a potential for growth in market cap of Bliss GVS.

Stock price chart

Detailed analysis

About the company

Incorporated in 1984, Bliss GVS Pharma Limited is engaged in manufacturing, marketing, trading and export of pharmaceutical formulations in the form of suppositories, pessaries, capsules, tablets, and syrups.

Fundamental analysis

Product Portfolio:

The company manufactures, markets, and exports over 150 branded formulations across 60+ therapeutic segments, including anti-malarial, anti-fungal, anti-bacterial, antibiotic, anti-inflammatory, contraceptive, and anti-diabetic. It sells these formulations as suppositories, pessaries, capsules, tablets, and syrups. Its portfolio includes over 150 brands such as P-Alaxin, Lonart, Funbact, and LofnacRevenue split : Exports - ~94%, Domestic - ~6% in FY ‘24

Financial analysis

Overview

Debt in control at 0.1 and healthy ROCE at 14.4%.

Price to book value is at 1.38 only.

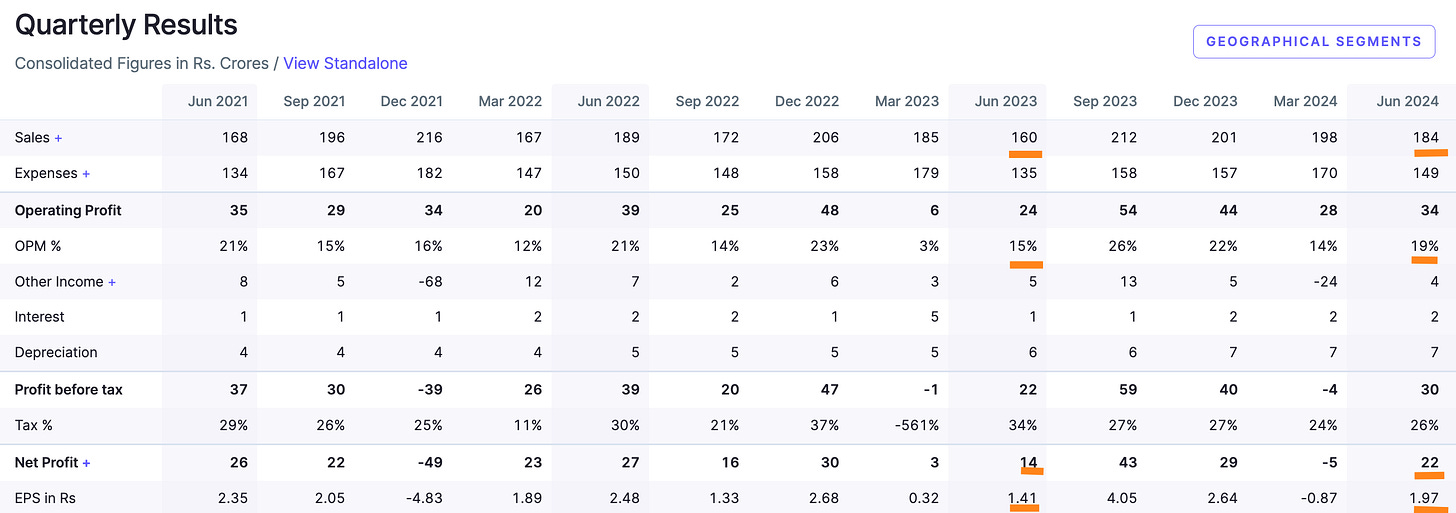

Quarterly results

Company reported a sales growth of 15% in Q1-2025 quarter compared to Q1-2024.

The operating margin increased from 15% to 19% quarter-on-quarter

The net profit increased by 57%.

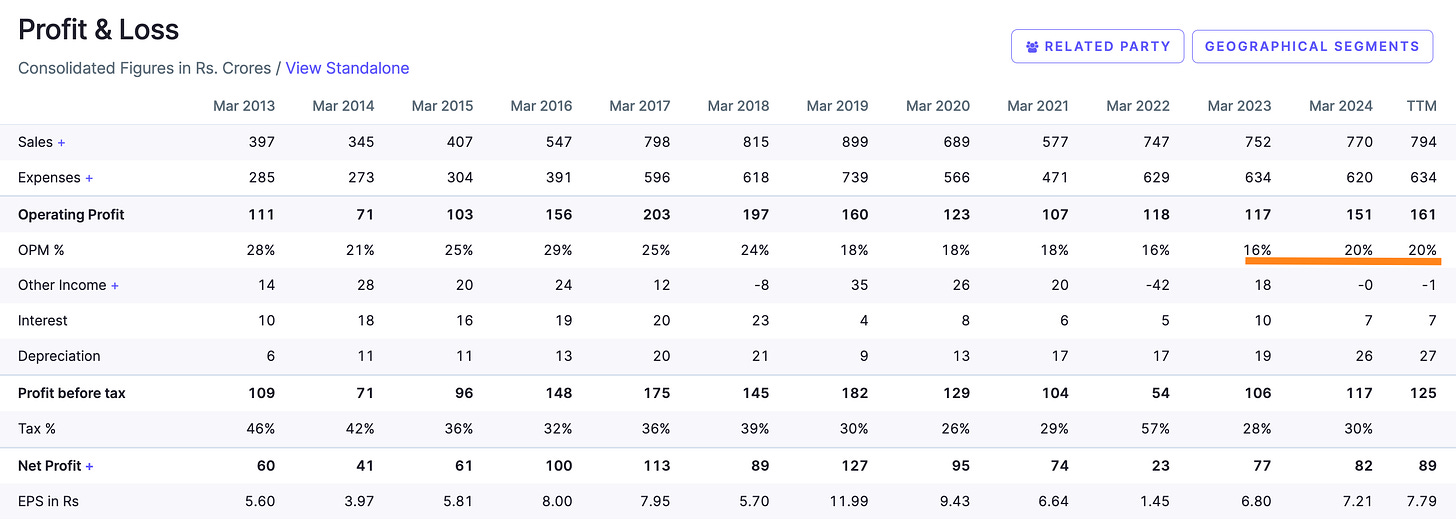

Annual results

The annual operating profit margins increased by 25%, compared to last year.

Peer comparison

The company’s total sales are 49% lower than Shilpa Medicare , a company of the same sector, but the market cap is lower by 593%. This shows a potential for growth in market cap for Bliss GVS.

Disclaimer

This is not a stock recommendation. It’s our analysis of the stock basis the data available today, and the viewpoint can change in future.