Cartrade Tech Ltd - quarterly EPS up 70%

An auto-platform benefiting from the excess automotive supply in the market

Company name - Cartrade Tech Ltd.

Last closing price(NSE:CARTRADE) - ₹981.8 (as on 18-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

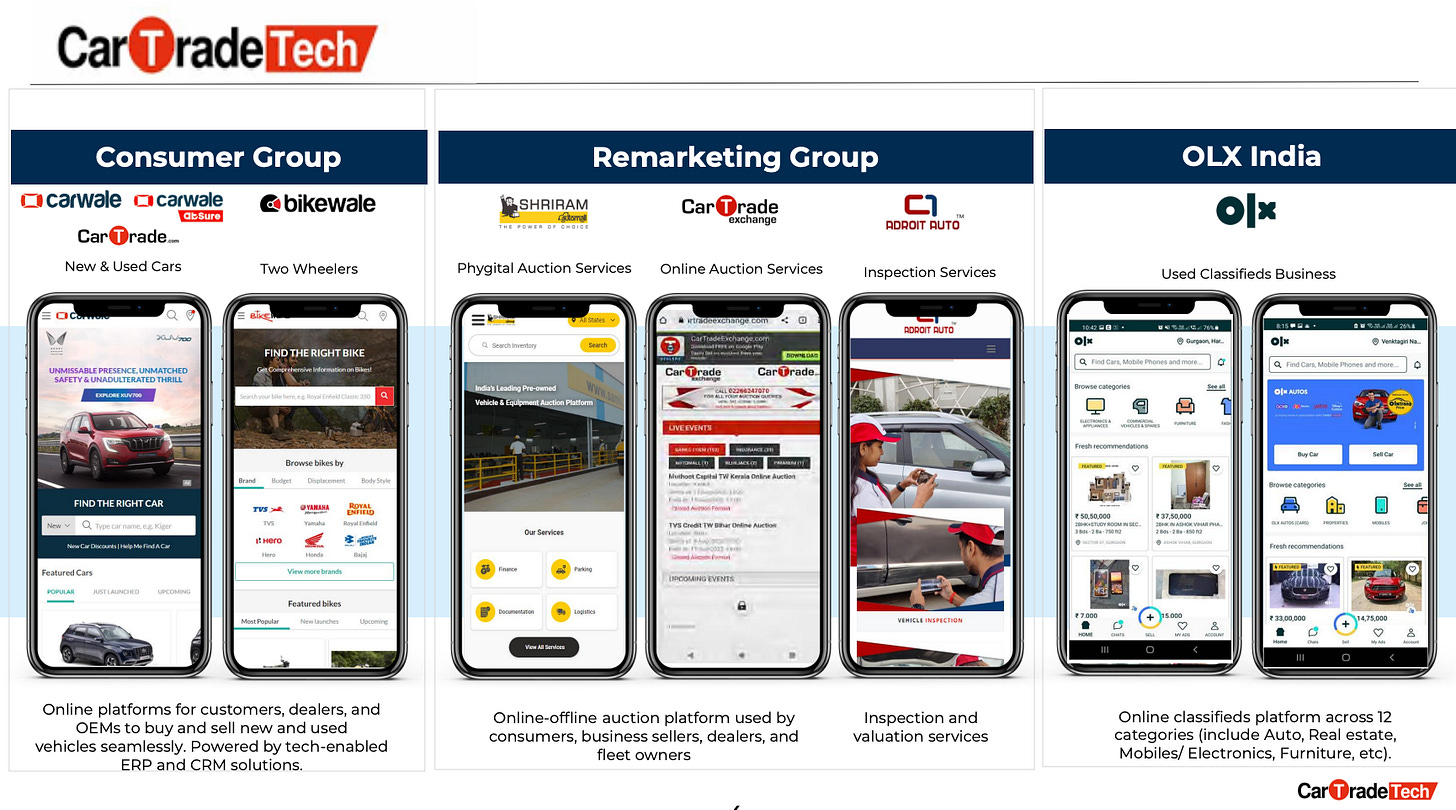

Incorporated in 2009, CarTrade Tech Ltd is a multi-channel auto platform provider company with coverage and presence across vehicle types and Value Added Services. The company operates various brands such as CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto, Olx.

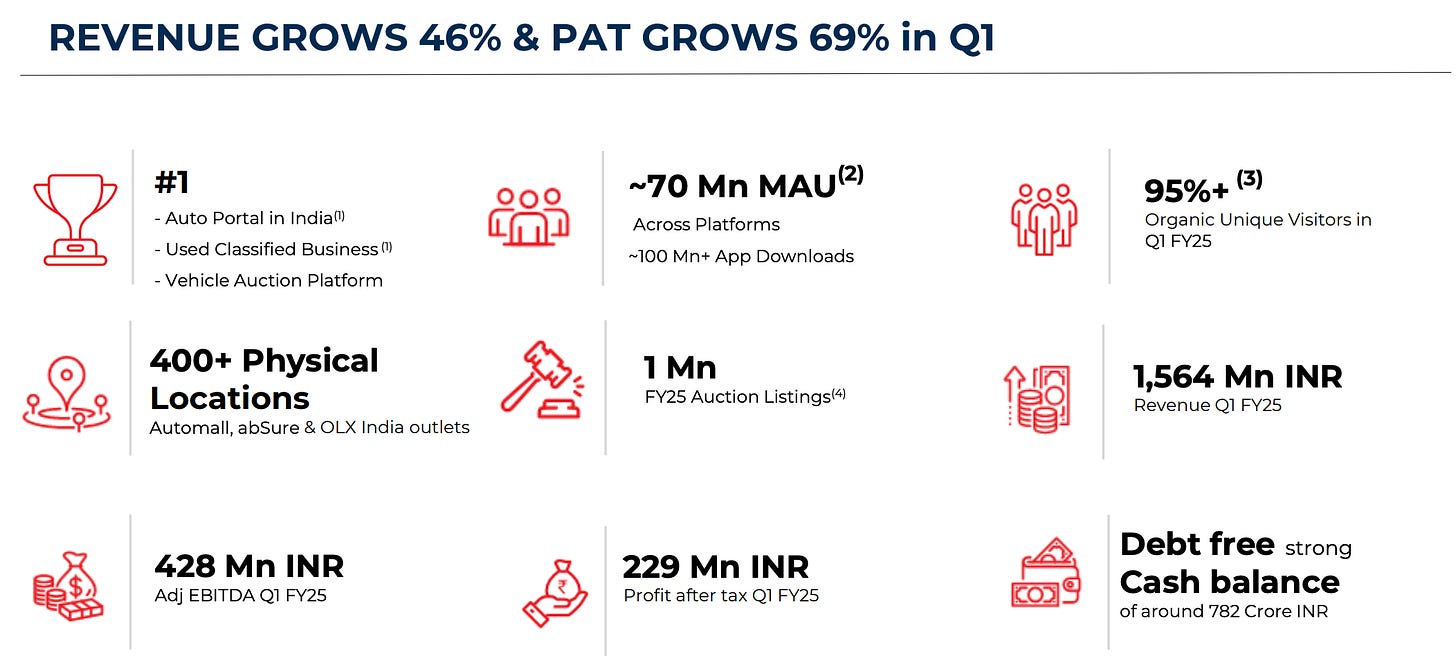

Latest quarter results - sales increased by 64%, net profit increased by 64.2% and EPS increased by 70%.

The automotive sector is in a condition where supply exceeds the demand which is favourable for companies like Cartrade. To clear the inventories, the manufacturers have increased advertising spending on such platforms.

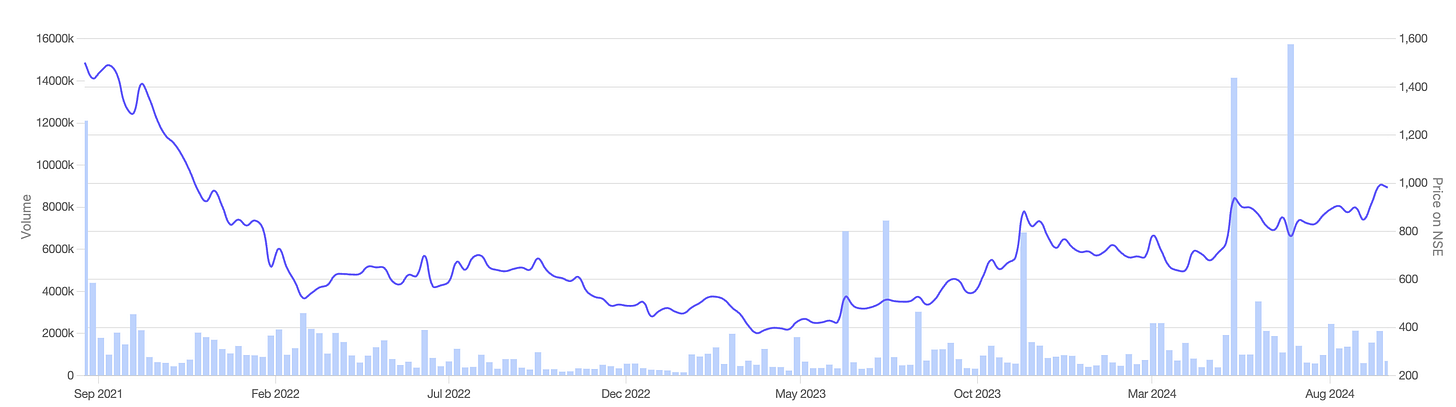

Stock price chart

Detailed analysis

About the company

Incorporated in 2009, CarTrade Tech Ltd is a multi-channel auto platform provider company with coverage and presence across vehicle types and Value Added Services. The company operates various brands such as CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto, Olx.

The platform connects new and used automobile customers, vehicle dealers, vehicle OEMs, and other businesses to buy and sell different types of vehicles.

The company offers a variety of solutions across automotive transactions for buying, selling, marketing, financing, and other activities.

They operate 3 business groups - Consumer group, Remarketing group and Used classifieds business(Olx India).

Financial analysis

Overview

The pledged percentage is 0% and the debt-to-equity is 0.05.

The price-to-book value(PBV) ratio is healthy at 2.21.

Note - the promoter holding is low, but the promoter chairman has been with the company since it’s inception in 2009.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has had a consistent track record of 35%+ sales growth in the last 4 quarters. The latest quarter sales growth was +64%.

The net profit increased by 64.2% and EPS increased by 70%.

Reason for such high growth - the automotive sector is in a condition where supply exceeds the demand, and vehicle manufacturers are sitting with excessive inventories. To clear these inventories, they have increased spending on advertisement platforms which Cartrade operates.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported 34.7% sales growth in FY 2024.

The operating profit increased 135% on account of increased sales and improved operating margins from 9% to 16%.

Trailing-tweleve-months(TTM) EPS is already trending at +63.6%.

Peer comparison

There is no listed peer in a similar space like CarTrade.

Timing analysis

Institutional high trading volume signs seen recently in the week of 06-May(19X), 24-Jun(10X) and 09-Sep(3.7X).

Did you find our analysis on Cartrade Tech Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in