Computer Age Management Services Ltd - 48.4% ROCE

India’s largest registrar and transfer agent("RTA") of mutual funds.

Note - As we had anticipated, NIFTY50 index and overall broader markets (NSE:CNX500) corrected in the last 2 weeks. We continue to exercise precaution in the current market conditions. The indices have recovered a bit in this week, but they are still not back to a clear uptrend.

Company name - Computer Age Management Services Ltd

Last closing price(NSE:CAMS) - ₹4600.6 (as of 14-Oct-2024)

Estimated reading time - 3 minutes

New notes update - we have recently published a series on ‘How do we trade in the stock market?’. It answers many of your queries around trading.

The updated performance of all our past analyses is available here.

Executive Summary

The company is a mutual funds transfer agency. It provides investor services, distributor services and asset management companies (AMC) services. It is India’s largest registrar and transfer agent(“RTA”) of mutual funds with an aggregate market share of 68%.

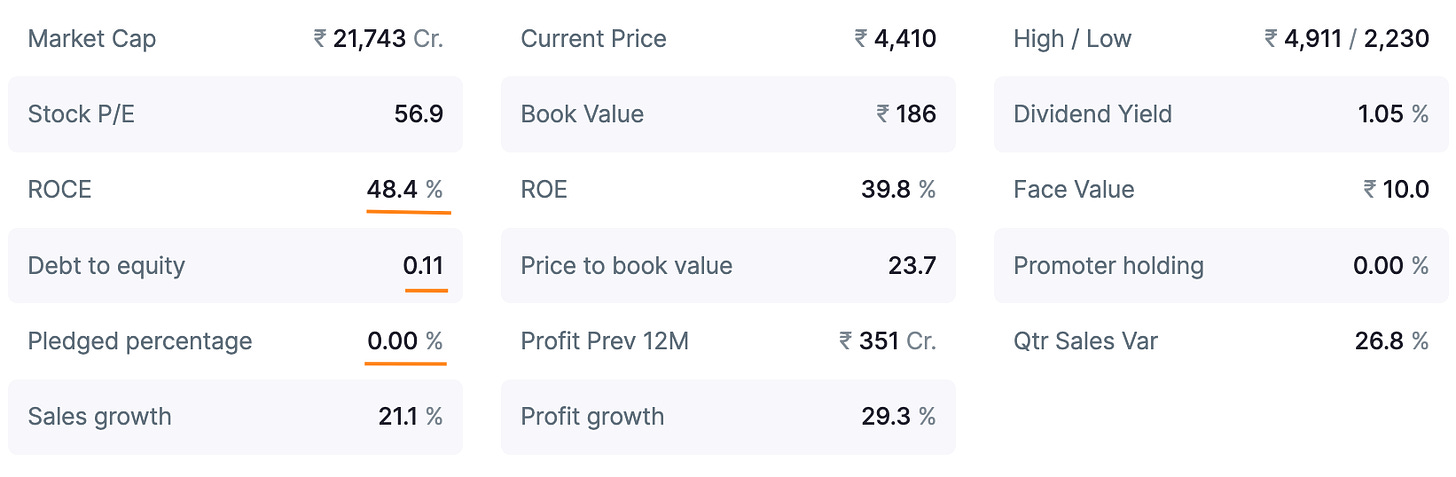

The debt-to-equity is low at 0.11 and the ROCE is very strong at 48.4%.

In the last quarter, the net profit increased by 40% and EPS increased by 41.2%.

Stock price chart

Detailed analysis

About the company

The company is a mutual funds transfer agency. It provides investor services, distributor services and asset management companies (AMC) services.

It is India’s largest registrar and transfer agent(“RTA”) of mutual funds with an aggregate market share of 68%.

Future prospects

What is the company’s plan to maintain earnings growth in future?

Diversification into Non-MF Segments: CAMS is expanding its revenue streams by focusing on non-mutual fund segments like Account Aggregator, CAMSPay (payment services), and AIF services. The goal is to increase non-MF revenue contribution to 20% in 3.5 years

Technology Upgradation: Partnership with Google Cloud to rebuild its RTA platform, aiming for enhanced efficiency and new business opportunities.

Strategic Partnerships: Expanding geographical presence in GIFT City and partnering with new financial institutions to grow its AIF and international business.

Potential risks that can hamper the future growth?

Regulatory Risks: Changes in SEBI or IRDA regulations can impact the company’s operations, especially in core segments.

Client Concentration: Reliance on a few large AMCs for substantial revenue could pose a risk if client relationships are disrupted.

Competition: Increasing competition from new fintech entrants could pressure margins and market share.

While non-MF revenue has grown, profitability from segments like insurance services remains limited. The ambitious platform rebuild also poses execution risk.

Financial analysis

Overview

The pledged percentage is 0%.

The debt-to-equity is low at 0.11 and the ROCE is very strong at 48.4%.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

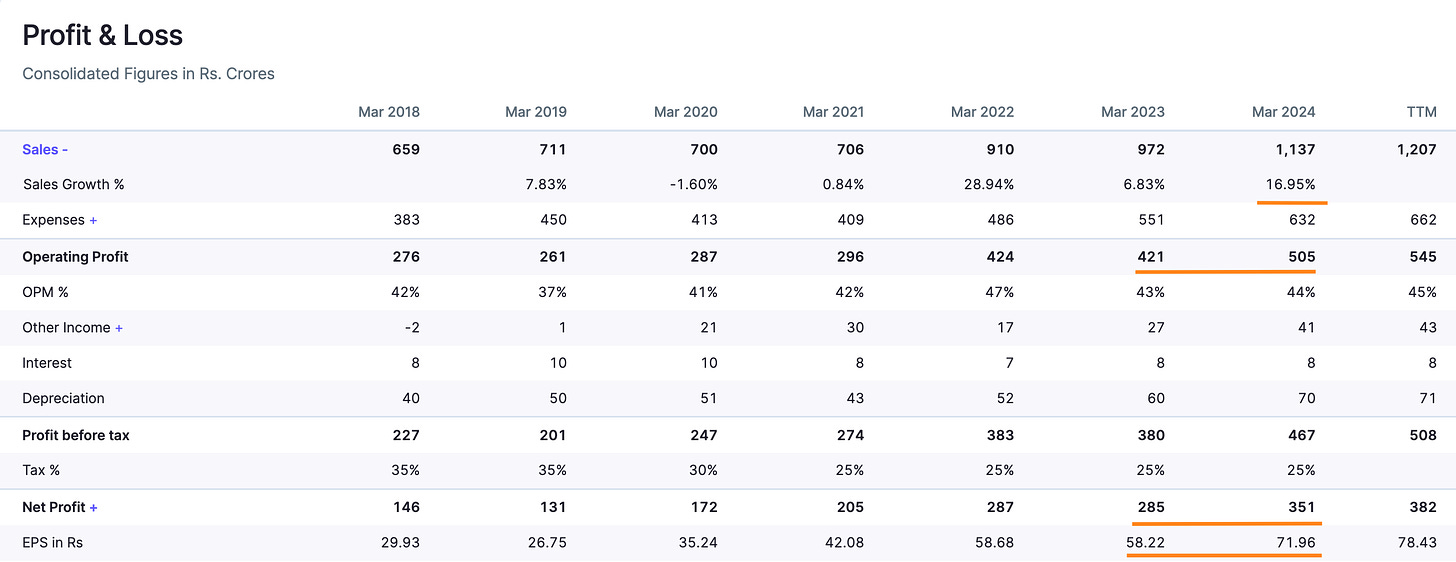

The company has reported significant sales growth of 26.83%, and a consistent double-digit sales growth track record overall.

The operating profit increased by 36%, on account of increased sales and operating profit margins.

The net profit increased by 40% and EPS increased by 41.2%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a sales growth of 16.95%, and operating profit growth of 19.95%.

The net profit increased by 23.15% and EPS increased by 23.6%.

Peer comparison

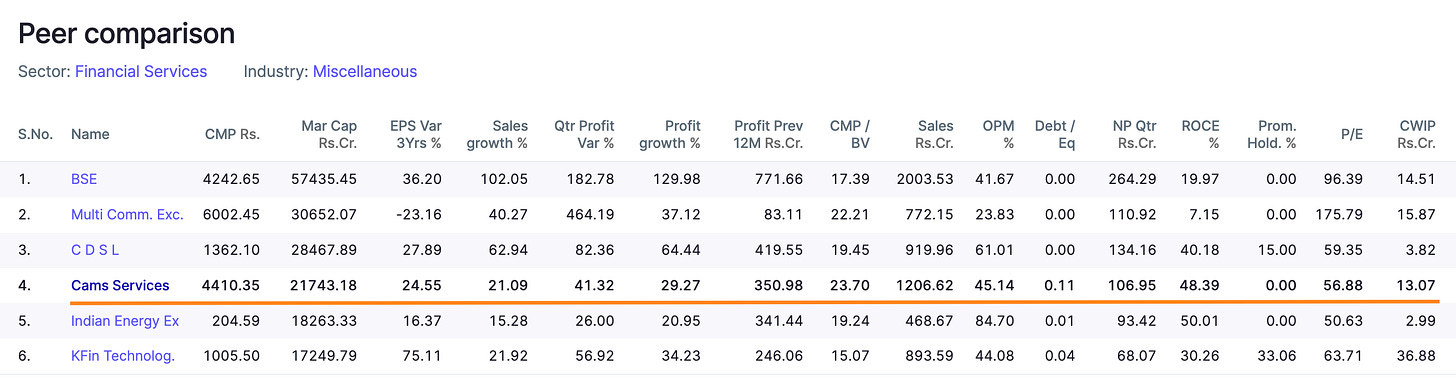

The nearest peer in the range is CDSL with a net profit of ₹419.55 Cr in the last 12 months, and market cap is higher by 33%. CAMS Ltd is currently at ₹350.98 Cr as last 12-month profits.

There is a potential for market cap to grow if CAMS Ltd is able to maintain its growth rate.

Did you find our analysis on Computer Age Management Services Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in