Crest Ventures Ltd - 8.5x increase in quarterly EPS

Company name - Crest Ventures Ltd

Last closing price(NSE:CREST) - ₹448.65 (as on 11-Sep-2024)

Estimated reading time - 3 minutes

Executive Summary

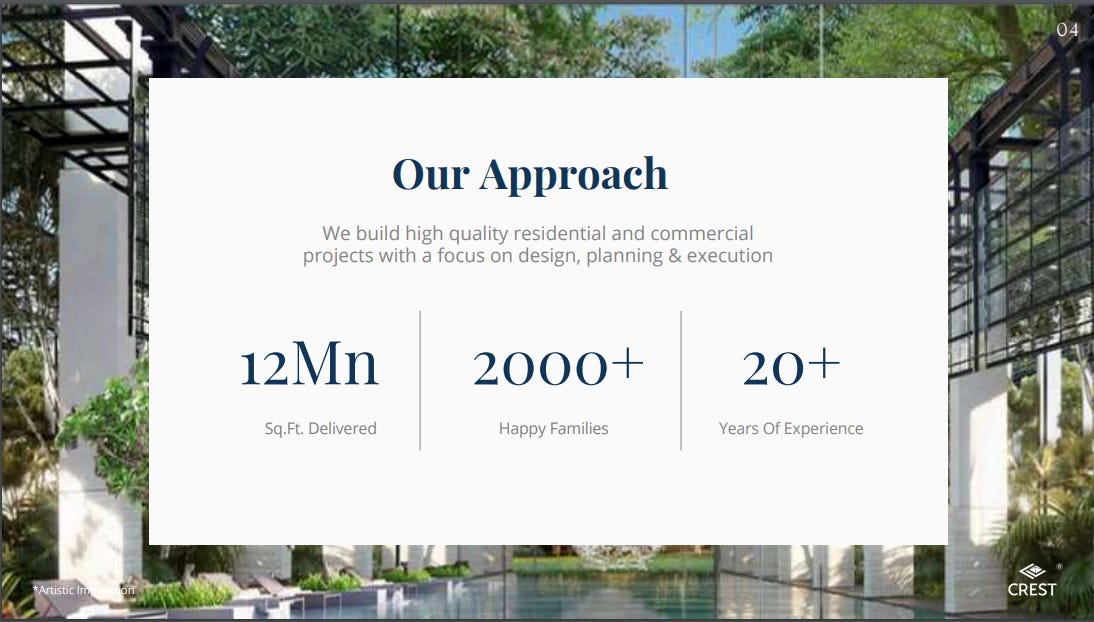

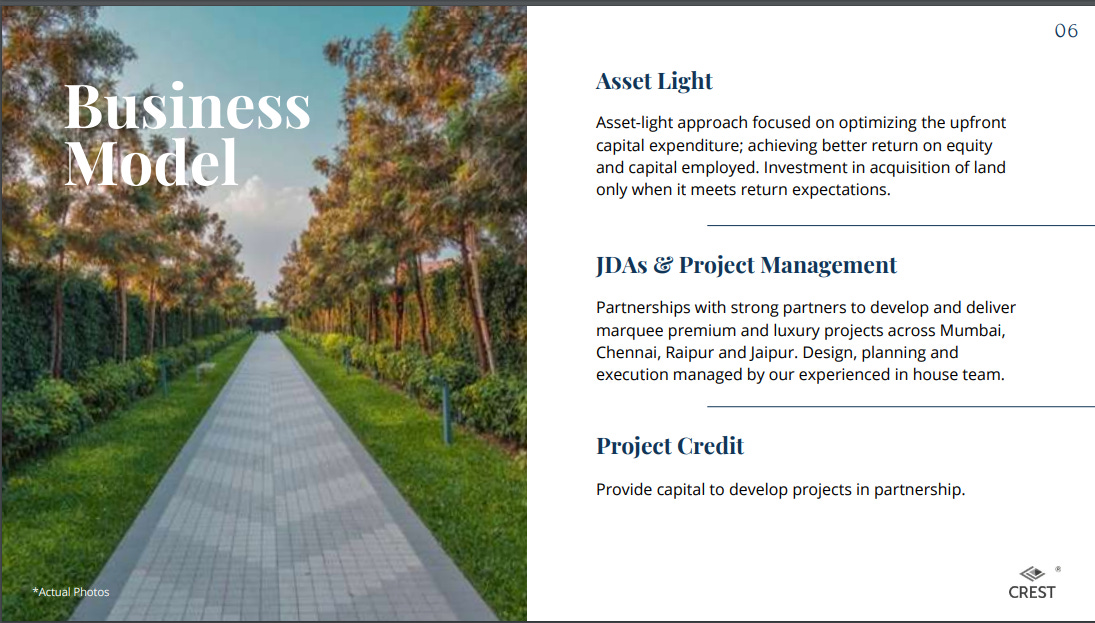

Crest Ventures Ltd, based in Mumbai, is a RBI registered NBFC. The company operates two primary business verticals - real estate and financial services/credit with a track record of 20+ years and a healthy projects pipeline.

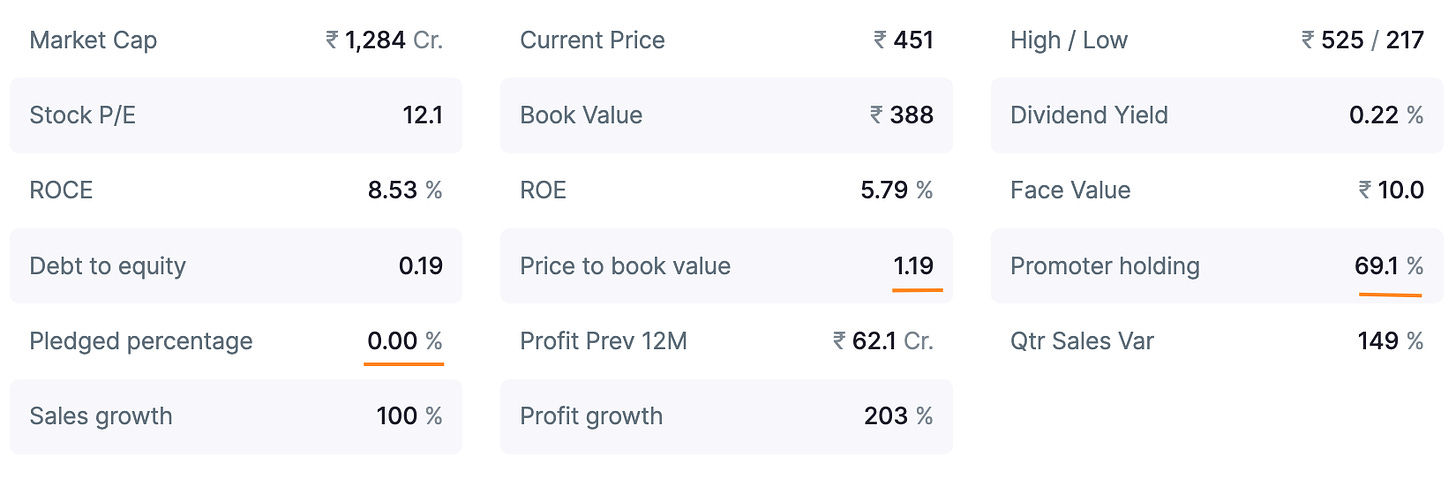

The promoter holding is at 69.1% and the pledged percentage is 0%.

Latest quarterly results - sales growth reported at +149%, +55% increase in operating margin (OPM) and 8.5X increase in EPS.

The price to book value is at 1.19 for the company, where as for the peers it is in the range of 2 to 5.

Stock price chart

Detailed analysis

About the company

Crest Ventures Ltd, based in Mumbai, is a RBI registered NBFC. The company operates two primary business verticals - Real estate and financial services/credit with a track record of 20+ years.

Completed Projects

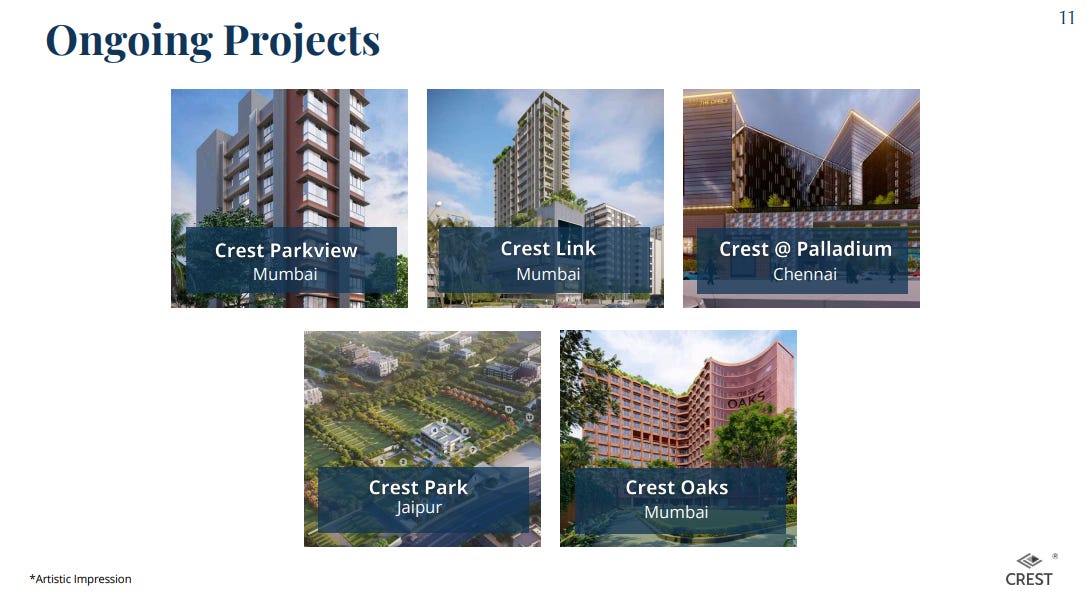

Ongoing projects

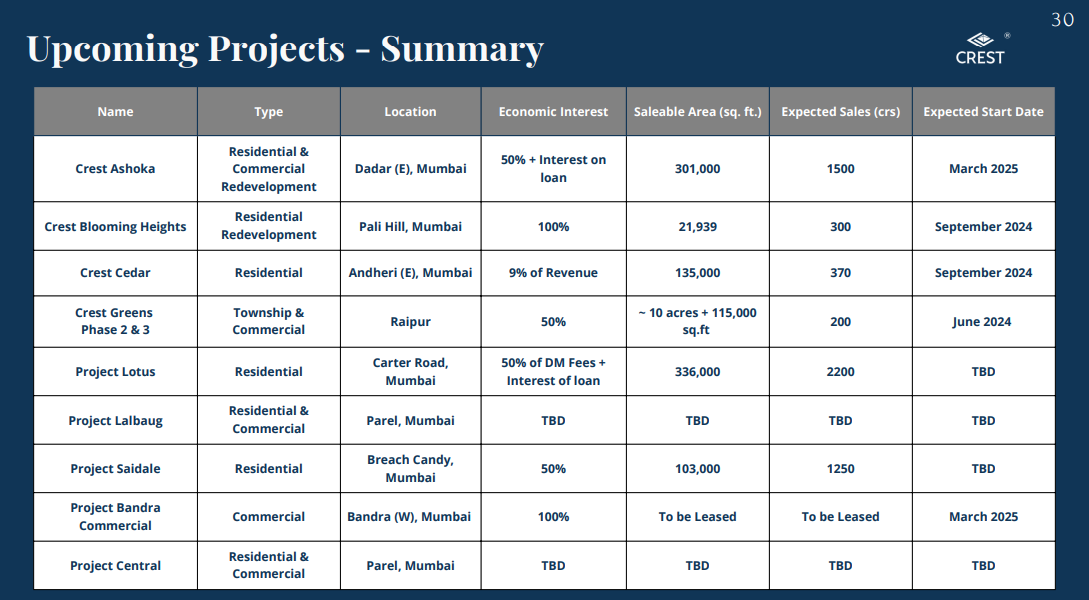

Projects in pipe-line

Financial analysis

Overview

The promoter holding is at 69.1% and the pledged percentage is 0%.

Price to book value is 1.19

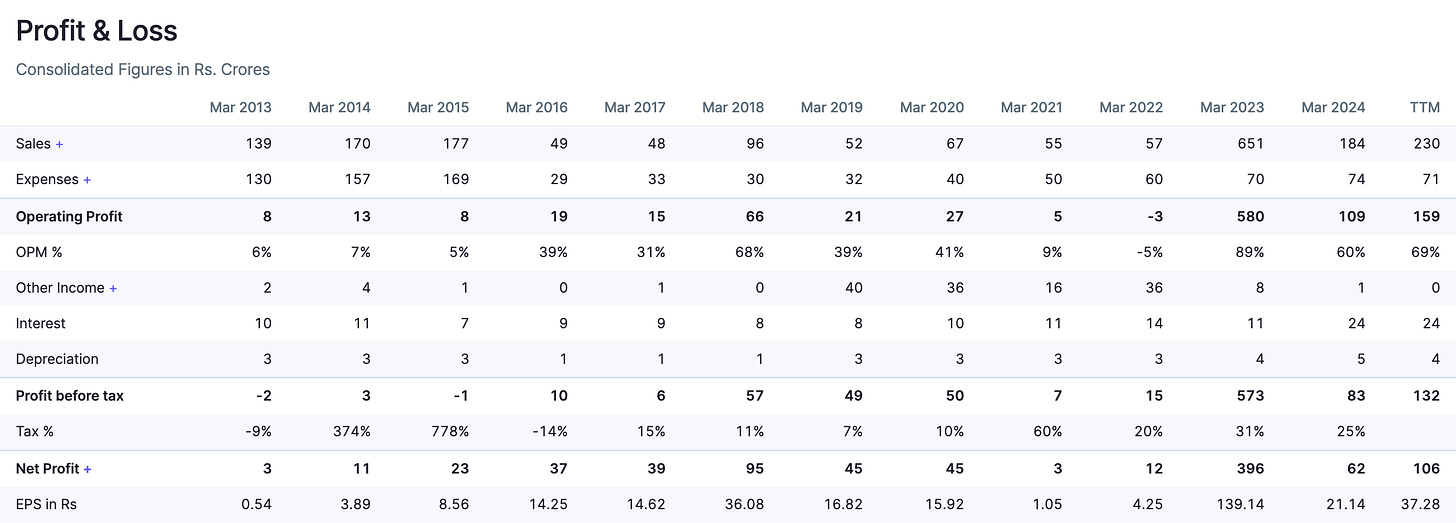

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

Significant sales growth reported at 149%. The company has been posting significant sales growth in the last 4 quarters.

55% increase in operating margin (OPM) reported.

Profit-before-tax(PBT) increased by 610%.

EPS increased 8.5X.

Annual results

Growth in the key metrics in the last financial year 2024 compared to the last financial year -

The overall sales growth in FY 2024 was negative at -72%, but the trailing-twelve-month(TTM) numbers are showing a turnaround.

TTM Sales is up by 25%.

TTM PBT is up by 59%

TTM EPS is up by 76%.

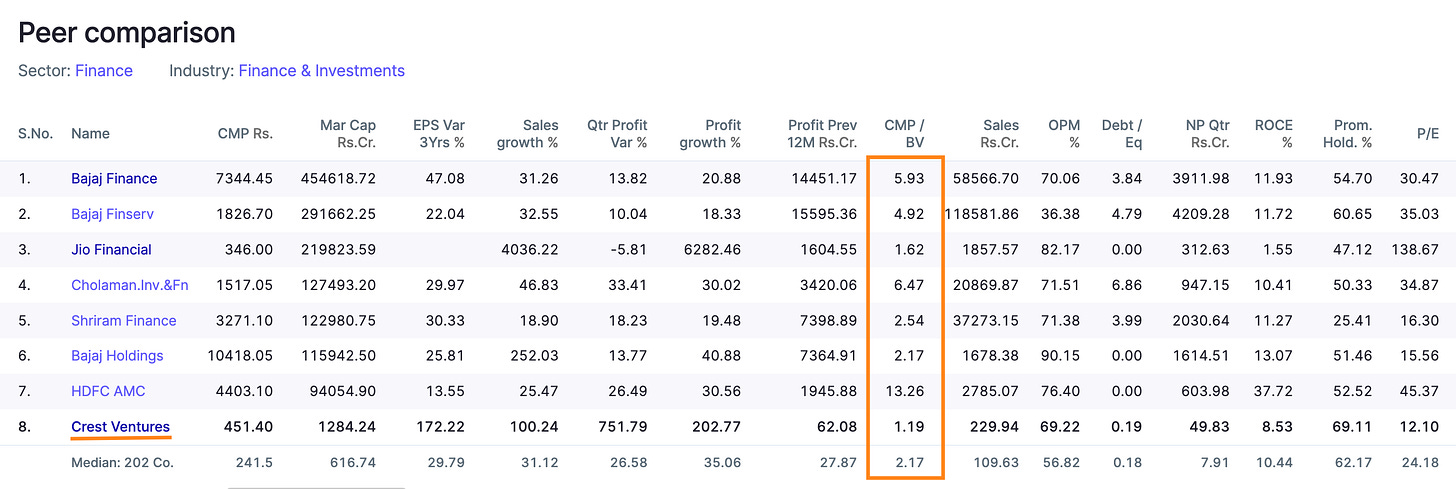

Peer comparison

The book value of the peers in the financial services domain is between 2 to 5, with median being 2.17.

Crest Ventures Ltd has a PBV of 1.19 currently which shows potential for the market cap and hence stock price to grow if the company is able to maintain the growth rate.

Timing analysis

Institutional volume signs seen recently in the weeks of 22-Jul(+3X) and 12-Aug<+4.3X>.

Did you find our analysis on Crest Ventures Ltd valuable? Share this ahead with your friends.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in