Eicher Motors Ltd - annual EPS increased by 37.14%

Owner of an iconic motorcycle brand

Note - We are observing precaution in the current market conditions. The market sentiment is very high on greed currently, with NIFTY50 making newer highs. But the broader market(NSE:CNX500) is showing opposite signs. Only few large cap stocks are participating in the rally, and majority of the mid and small cap stocks are not holding their breakouts. Both small and mid-cap indexes have been underperforming compared to NIFTY50 in the last 3 weeks. A correction in the overall market is anticipated and protecting capital is important.

Company name - Eicher Motors Ltd

Last closing price(NSE:EICHERMOT) - ₹4972.65 (as on 1-Oct-2024)

Estimated reading time - 3 minutes

The updated performance of all our past analyses is available here.

Executive Summary

Eicher Motors Limited, incorporated in 1982, is the listed company of the Eicher Group in India and a leading player in the Indian automobile industry and the global leader in middleweight motorcycles. It is the owner of the iconic Royal Enfield brand.

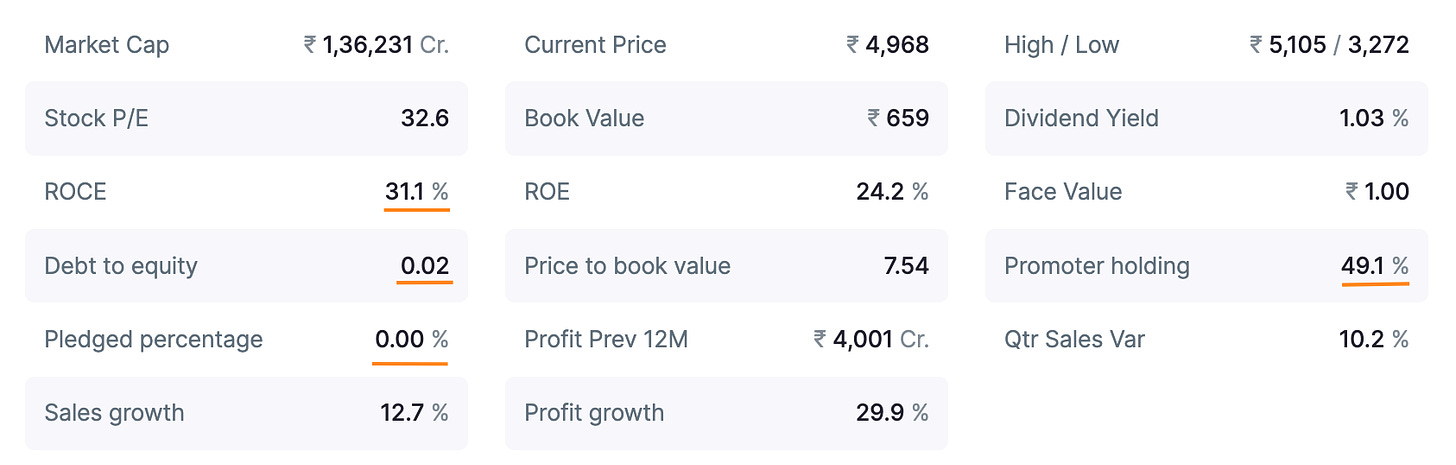

The company is debt-free with debt-to-equity at 0.02 and the ROCE is strong at 31.1%.

The annual net profit increased by 37.3% and EPS increased by 37.14%.

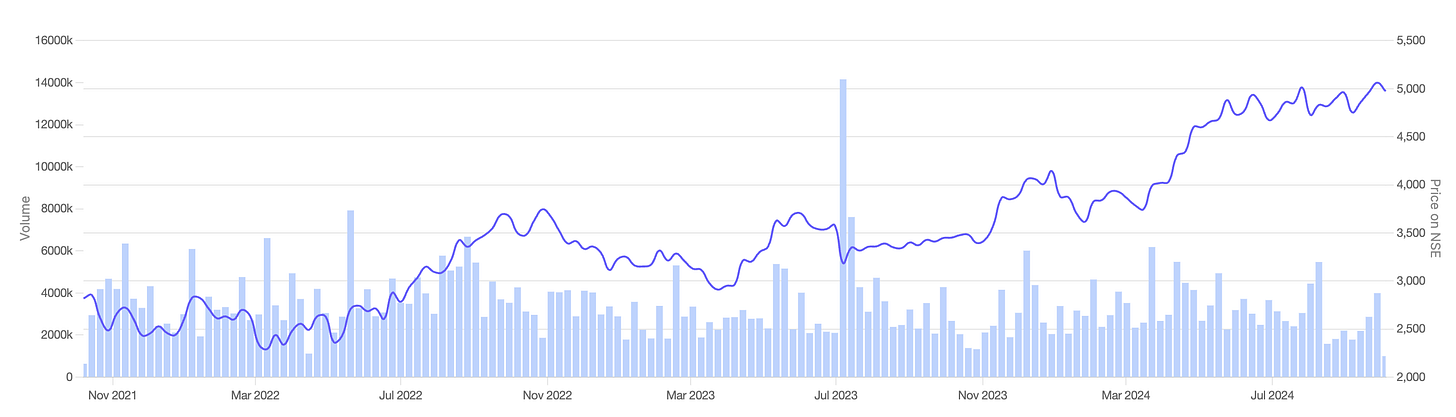

Stock price chart

Detailed analysis

About the company

Eicher Motors Limited, incorporated in 1982, is the listed company of the Eicher Group in India and a leading player in the Indian automobile industry and the global leader in middleweight motorcycles.

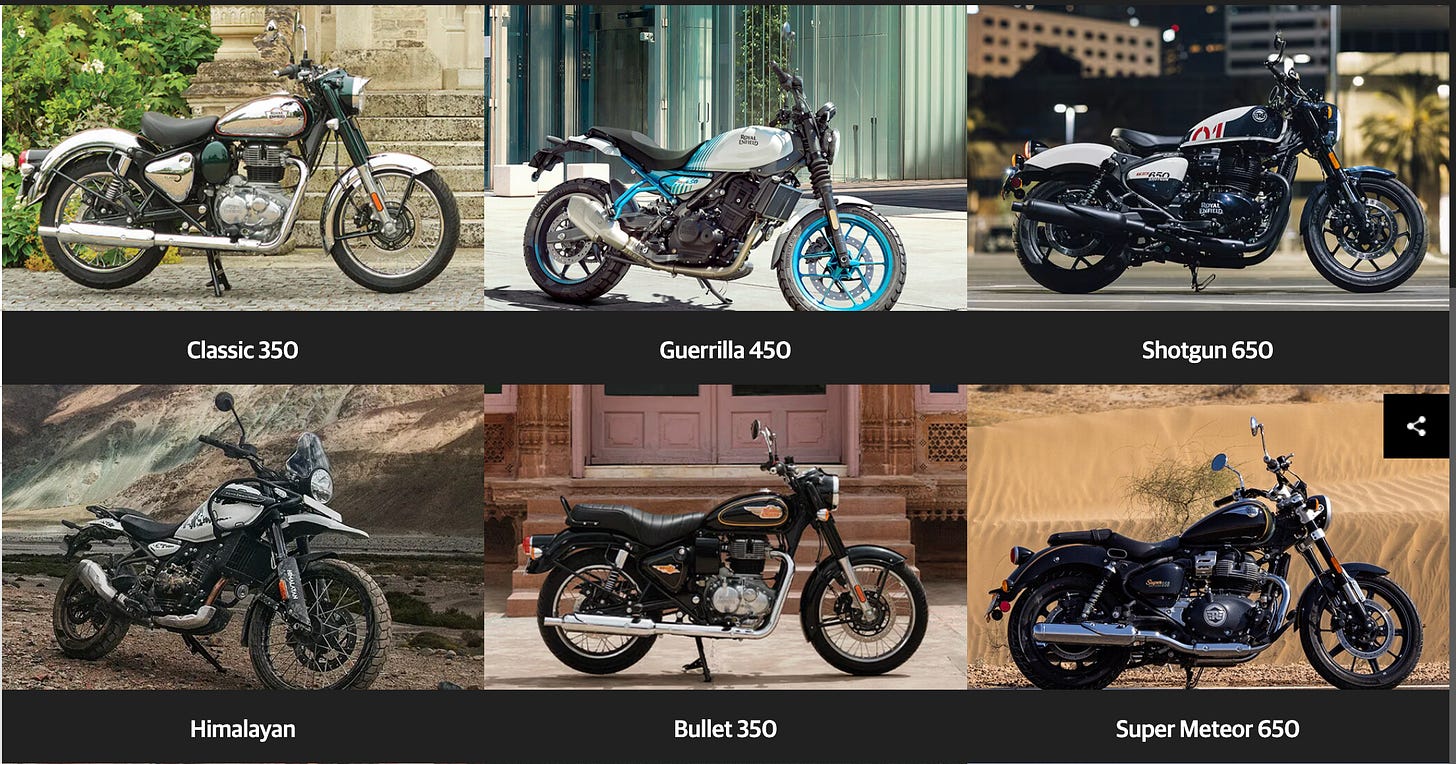

It is the owner of the iconic Royal Enfield brand which is focused on mid-sized motorcycles (250-750 cc). Classic, Bullet, Himalayan are some of the brands that come under its Royal Enfield brand. It is sold in 60+ countries globally.

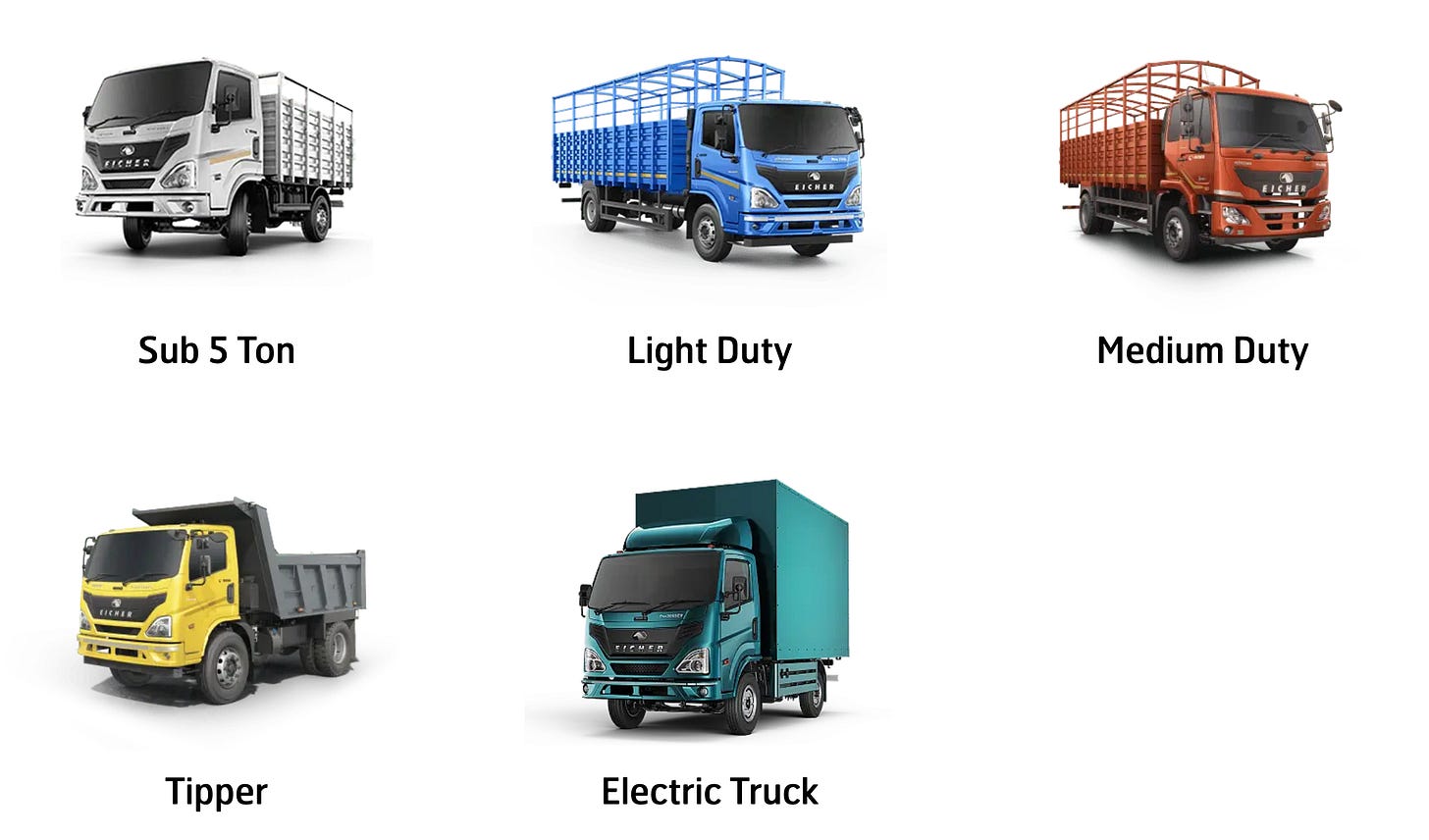

Eicher has a joint venture with Sweden’s AB Volvo to create Volvo Eicher Commercial Vehicles Limited (VECV). VECV is engaged in truck and bus operations, auto components business, and technical consulting services business.

Future prospects

What is the company’s plan to maintain earnings growth in future?

Continue to increase share of exports, currently at about 9%. Exports grew significantly by 57.5% to 1,192 units over Q1 of the previous year.

New product launches and confidence in upcoming festive season demand, with expectations of improved consumer engagement through brand activation efforts.

Transitioning from a forecast-based production model to an auto replenishment model aimed at improving dealer profitability and inventory management.

Company has also been working on electric 2-wheeler products and has made significant progress on the same.

Potential risks that can hamper the future growth?

The middleweight motorcycle segment is experiencing slower growth, attributed to market confusion due to increased competition.

The sales growth rate for 2-wheelers has reduced in the past year compared to last year.

Financial analysis

Overview

The promoter holding is 49.1%, and pledged percentage is 0%.

The company is debt-free with debt-to-equity at 0.02 and the ROCE is strong at 31.1%.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has reported sales growth of 10.2%.

The operating profit increased by 14%, on account of increase in operating margin by 3.8% along with the sales growth.

The net profit increased by 20% and EPS increased by 19.7%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a sales growth of 14.5%, and operating profit growth of 25.6% on account of increased profit margins.

The net profit increased by 37.3% and EPS increased by 37.14%.

Peer comparison

The company has highest - EPS variance in 3 years, highest profit in the last 12 months and highest operating margins among it’s peers.

The nearest peer in terms of market-cap TVS Motor Co has less than half the profits, and more than double the P/E. And almost similar market cap.

This shows a potential for growth in Eicher Motors Ltd’s market cap if it is able to maintain it’s growth rate.

Did you find our analysis on Eicher Motors Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in