Epack Durable Ltd - quarterly sales growth-77%

Business and financial analysis - September 2024

Company name - Epack Durable Ltd.

Last closing price(NSE:EPACK) - ₹265.2 (as on 06-Sep-2024)

Executive Summary

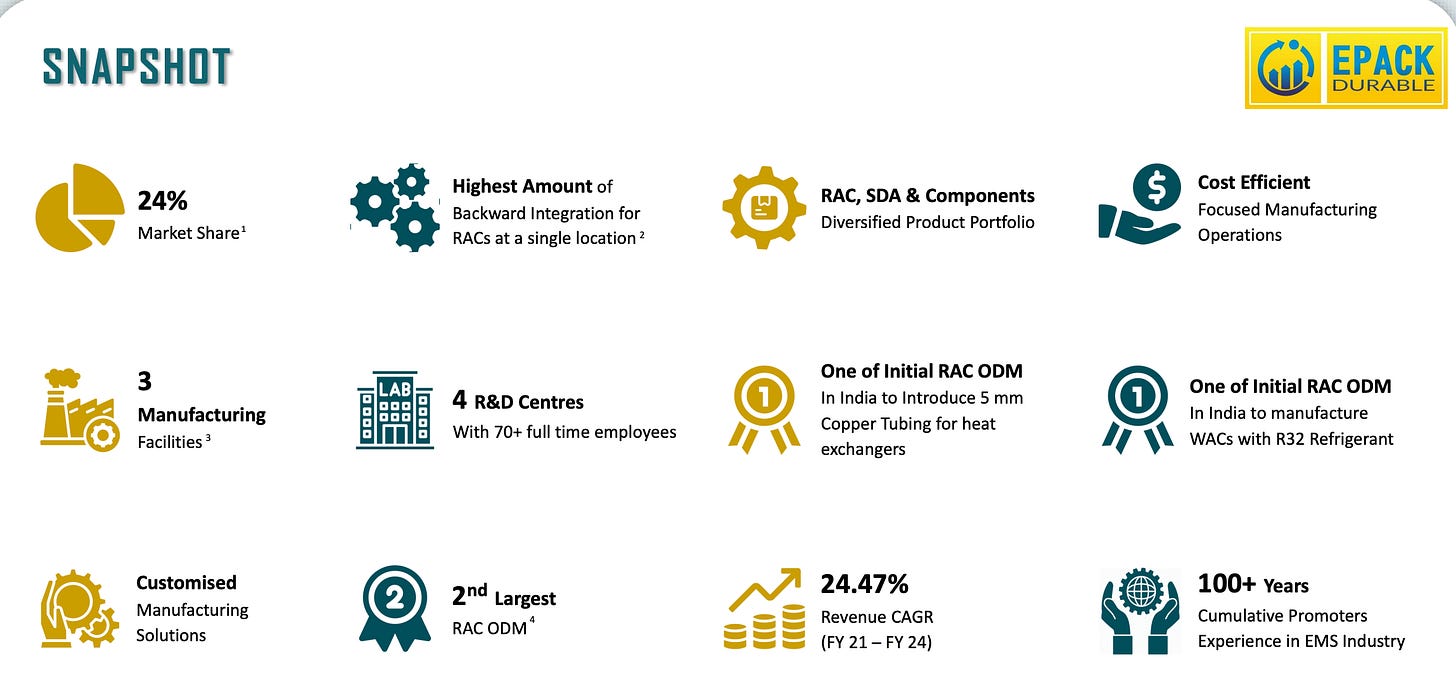

Epack Durable Ltd is the 2nd largest room air conditioner Original Design Manufacturer(ODM) in India with a 24% domestic market share.

Strong quarterly sales growth reported at +77%, led by the commencement of operations of the new Sri City manufacturing unit, with net profit growth of 155%.

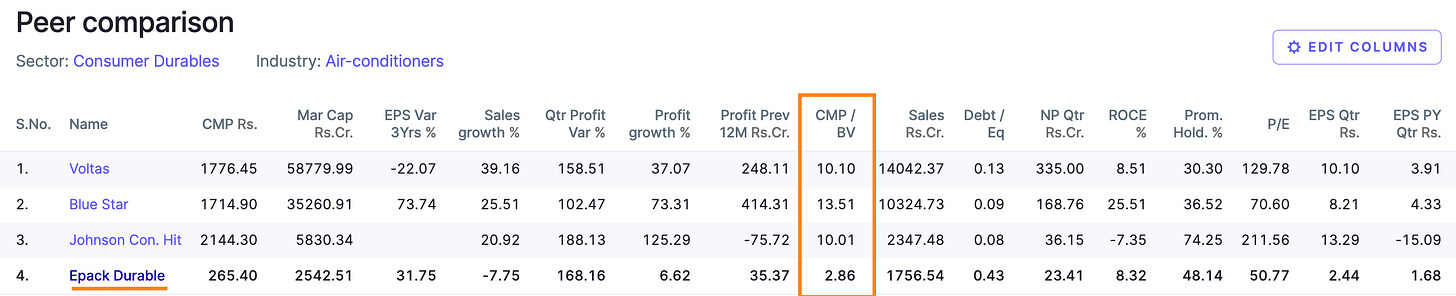

The price to book value of the peers is in the range of 10 to 13. Epack Durable Ltd is currently at a price to book value of 2.86. This shows a potential for growth in the stock price.

Stock price chart

Detailed analysis

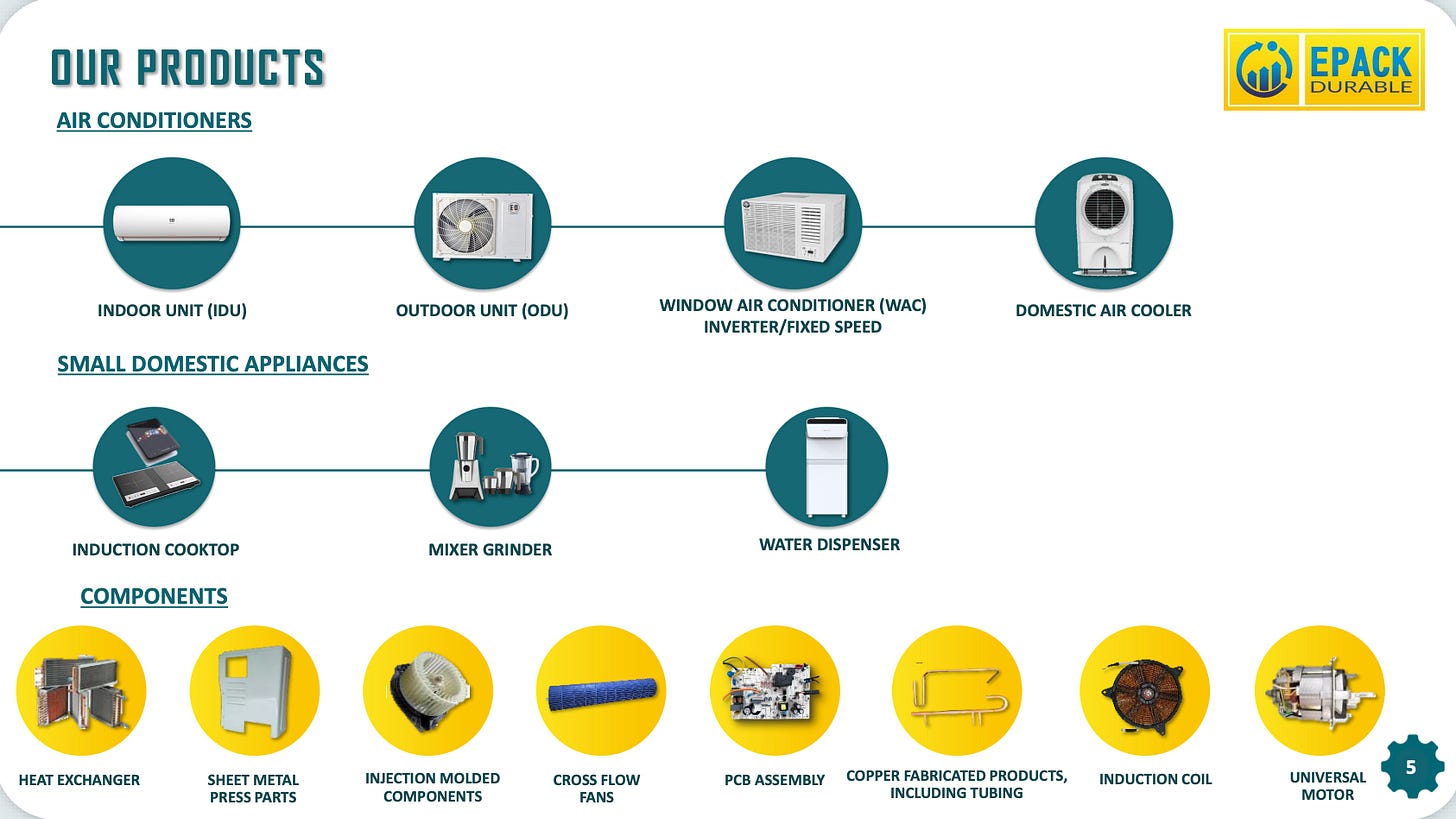

About the company

Epack Durable Ltd is the 2nd largest room air conditioner Original Design Manufacturer(ODM) in India with a 24% domestic market share.

They operate 3 business divisions -air conditioners, small domestic appliances and components.

The company has 3 vertically integrated manufacturing facilities located in Dehradun, Bhiwadi and Sri City.

The clients list includes Akai, Bajaj Electricals, Blue Star, Butterfly, Carrier, Godrej, Morphy Richards, Philips etc.

Financial analysis

Overview

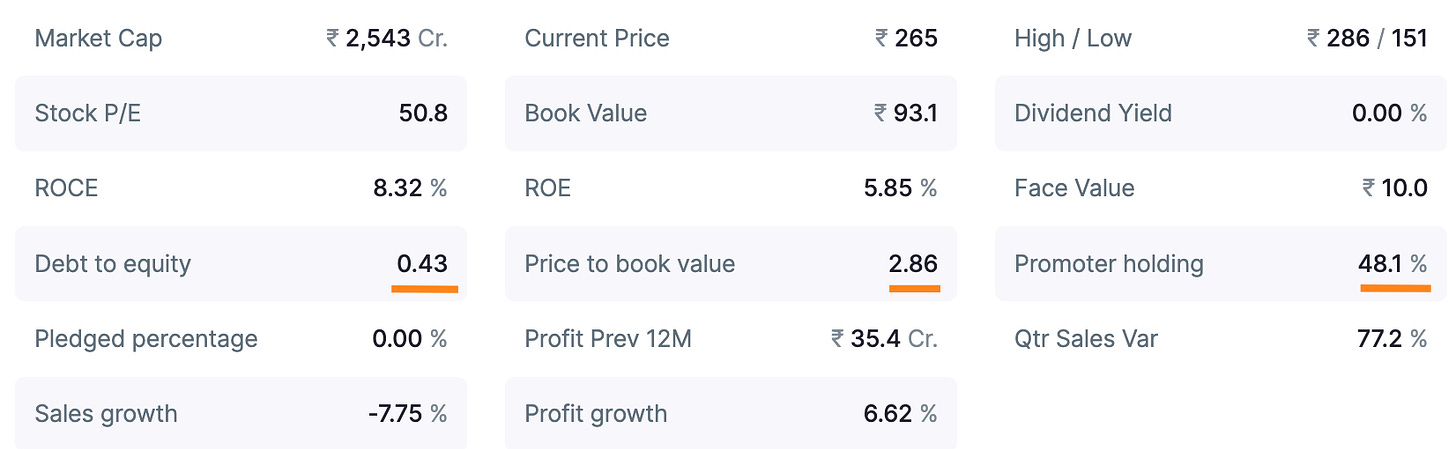

The price to book value is 2.86.

Debt-to-equity ratio is 0.43.

Quarterly results

Growth in the key metrics compared to the last year’s same quarter in the latest quarter Q1 - 2025 -

Strong sales growth reported at +77%, led by commencement of operations of the new Sri City manufacturing unit.

Net profit growth - +155%

EPS growth - +45%

Annual results

Growth in the key metrics in the financial year 2024 compared to the last financial year -

The company is going through a turnaround with the commencement of the new manufacturing unit at Sri-city.

It reported a decline in sales by -7.75% in FY 2024, but with the +77% growth in sales in Q1-2025, the TTM(Trailing 12 Months) growth is already up by +23.73%.

The TTM net profit growth is +42.85% compared to the FY 2024.

Peer comparison

The price to book value of the peers is in the range of 10 to 13. Epack Durable Ltd is currently at a price to book value of 2.86. This shows a potential for growth in the stock price.

Did you find our analysis on Epack Durable Ltd valuable? Share this ahead with your friends.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in.