Fino Payments Bank Ltd - annual EPS increased by 32.4%

A technology-enabled payments bank

Note - As we had anticipated, NIFTY50 index and overall broader markets(NSE:CNX500) corrected in the last 2 weeks. There are fewer suitable opportunities to analyse and hence a gap of 7 days from the last post. We continue to observe precaution in the current market conditions. The indexes have revived a bit in this week, but they are still not back to a clear uptrend.

Company name - Fino Payments Bank Ltd

Last closing price(NSE:FINOPB) - ₹412.3 (as on 11-Oct-2024)

Estimated reading time - 3 minutes

We recently covered INDIAGLYCO and CGPOWER, and the timing of our analysis worked out as they reached +10% in this week. The updated performance of all our past analyses is available here.

Executive Summary

Fino Payments Bank Ltd is a technology-enabled financial inclusion bank, focused on providing digital payment solutions and services to unbanked and underbanked populations, primarily in rural and semi-urban areas of India.

The company upgraded their annual revenue growth guidance from 20% to 25% for FY 2025.

The annual net profit increased by 32.3% and EPS increased by 32.4%.

Stock price chart

Detailed analysis

About the company

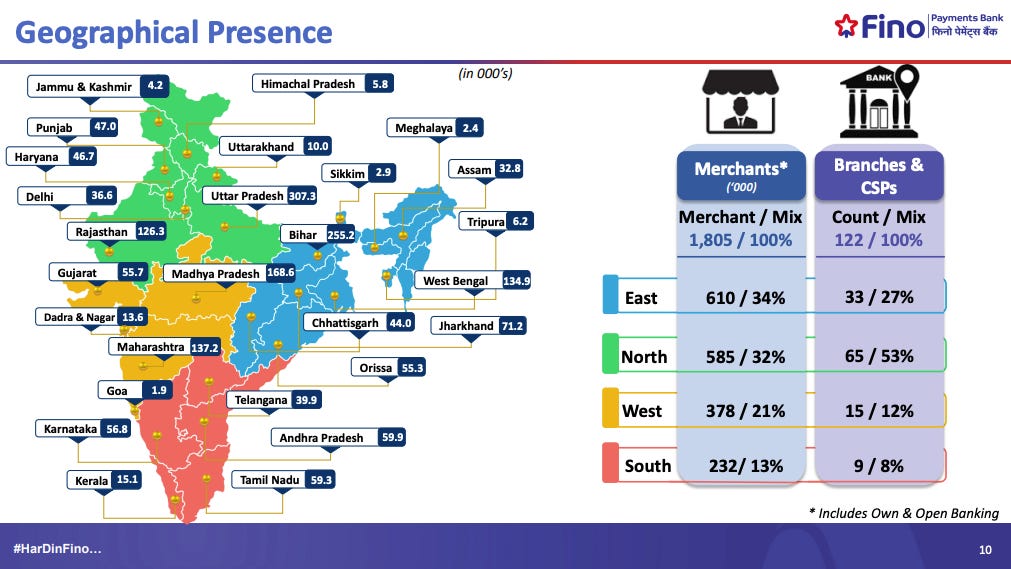

Fino Payments Bank Ltd is a technology-enabled financial inclusion bank, focused on providing digital payment solutions and services to unbanked and underbanked populations, primarily in rural and semi-urban areas of India.

The bank offers services such as savings accounts, remittances, insurance, and digital payments through a robust network of merchants and digital channels.

The company upgraded their annual revenue growth guidance from 20% to 25% for FY 2025, with the Q1 earnings.

Future prospects

What is the company’s plan to maintain earnings growth in future?

Digital Business Contribution: Digital throughput grew by 170.8% YoY to ₹132.6k Cr, contributing 6% of overall revenue in FY24. The bank aims to further increase digital contribution to 16-17% of overall revenue in FY 25.

Small Finance Bank (SFB) Transition: The bank is working towards becoming a Small Finance Bank (SFB), which will allow it to offer a broader range of financial products and improve its profitability through lending services. The application to RBI has been submitted.

Partnerships and B2B Expansion: The bank intends to scale its B2B operations through partnerships and use its UPI switch to facilitate digital payments for businesses, contributing significantly to revenue growth.

TAM strategy - The bank is moving from a transaction-based business model to a more customer-centric approach, where the bank seeks to establish deeper, long-term relationships with customers through enhanced engagement and diversified offerings.

Potential risks that can hamper the future growth?

Regulatory Updates: No new updates on the Small Finance Bank (SFB) license application; internal preparations ongoing for technology and partnerships.

Competitive Landscape: Concerns regarding competition from larger conglomerates entering the banking correspondent network.

Digital Monetization and Profitability – While digital revenue is growing, monetization of digital services is still in early stages.

Financial analysis

Overview

The promoter holding is 75%, and pledged percentage is 0%.

The ROCE is at 7.07% which is in same range as majority of the private banks.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has reported significant revenue growth of 36% and reached highest revenue till date in a quarter.

The net profit increased by 26.3%.

The EPS increased by 29.7%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a significant revenue growth of 57%.

The net profit increased by 32.3% and EPS increased by 32.4%.

Peer comparison

The company has reported highest sales/revenue growth among it’s peers in the private banks segment at 48.86%.

Timing analysis

Institutional high trading volume signs seen recently in the weeks of 19-Aug(5X), 26-Aug(4.5X) and 2-Sep(5X).

Did you find our analysis on Fino Payments Bank Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in