Galaxy Surfactants Ltd - a potential turnaround story

A company making raw materials for FMCG companies

Company name - Galaxy Surfactants Ltd.

Last closing price(NSE:GALAXYSURF) - ₹3171.6 (as on 20-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

Galaxy Surfactants Ltd was incorporated in 1986. It’s a leading manufacturer of Performance Surfactants and Specialty Care products with over 205 product grades.

The company has had a track record of double digit sales growth, but last FY was negative growth. With the latest quarterly results reported positive, it can be a potential turn around story.

The management expects higher volume growth this year due to - above average monsoons, increased rural spending, consumption-incentivising budget.

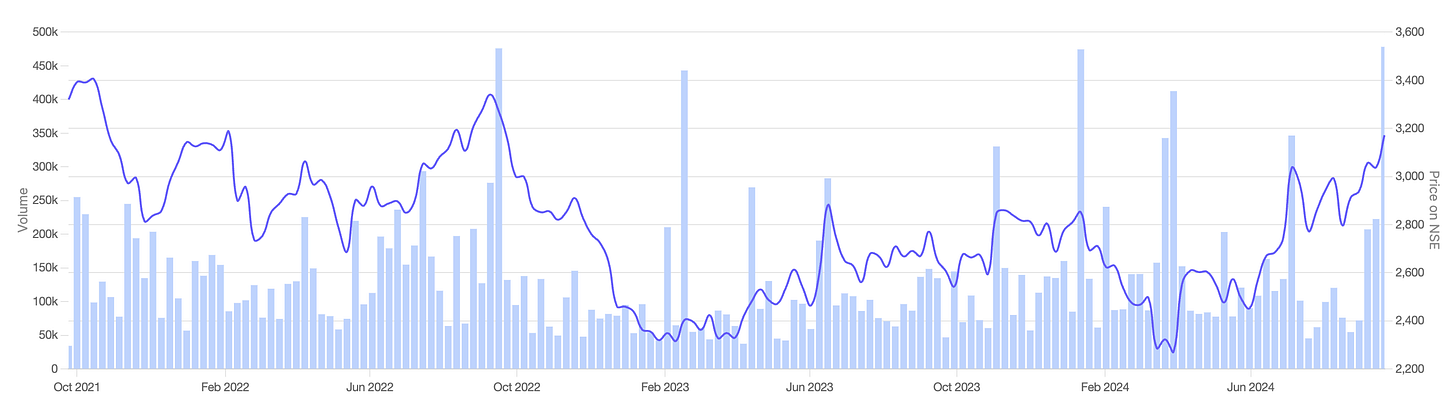

Stock price chart

Detailed analysis

About the company

Galaxy Surfactants Ltd was incorporated in 1986. It’s a leading manufacturer of Performance Surfactants and Specialty Care products with over 205 product grades.

The company is India’s Largest Manufacturer of Oleo chemical-based Surfactants and Specialty Care Products for Home Care and Personal Care Industries.

Future prospects

(What is the company’s plan to maintain earnings growth in future?)

The management expects higher volume growth this year due to - above average monsoons, increased rural spending, consumption-incentivising budget.

FMCG companies have started taking price cuts, which should lead to improved volume growth moving forward for the company’s products.

Growth in international markets - the company recorded a significant growth of 24.5% in Europe and Latin America and expects this momentum to continue.

Premium product launches, including high-end cleansing solutions and non-toxic preservatives, are expected to contribute positively to margins.

(Potential risks which can hamper the future growth)

Unavailability of containers and port congestion.

Elongated lead times and rationalized availability of raw materials.

Financial analysis

Overview

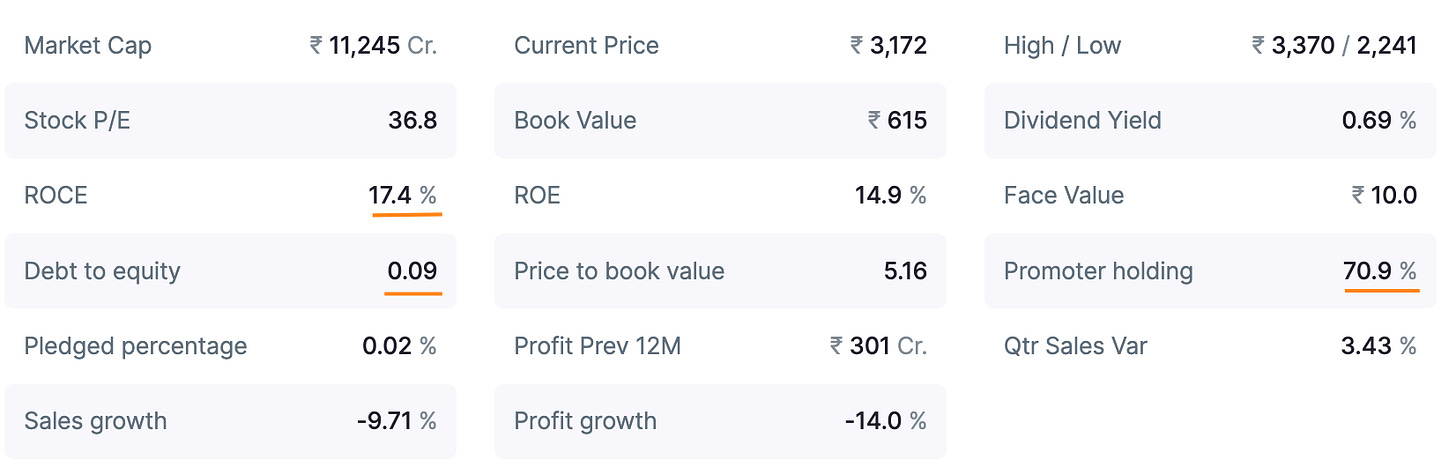

The promoter holding is 70.9% and pledged percentage is 0%.

The company has a strong ROCE at 17.4% and debt-to-equity at 0.09%.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company posted a positive sales growth 3.43% after 5 quarters of negative growth.

The EPS increased by 6%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company has had a track record of double digit sales growth, while last FY was negative growth. With the latest quarterly results reported positive, it can be a potential turn around story.

The company has also reduced long term borrowing by 48%.

Peer comparison

The majority of the peers with similar profit range have a price-to-book value of 6 to 8, while it’s 5.16 for Galaxy Surfactants.

Timing analysis

Institutional high trading volume signs seen recently in the weeks of 1st-July(3x) and 16-Sep(4.25x).

Did you find our analysis on Galaxy Surfactants Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in