Go Digit General Insurance Ltd - quarterly net profit increased by 74%

A digital full stack insurance company with highest growth rate

Company name - Go Digit General Insurance Ltd

Last closing price(NSE:GODIGIT) - ₹371.25 (as on 17-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

Established in December 2016, Go Digit General Insurance Limited is a leading leading digital full stack insurance company that provides various insurance products such as motor, health, travel, property, marine, liability, and more, tailored to customers' preferences.

Quarterly net profit increased by 74% and annual net profit increased by 5X.

The company has reported the highest sales growth rate (37.95%) and profit growth rate(410%) among it’s peers in the insurance sector.

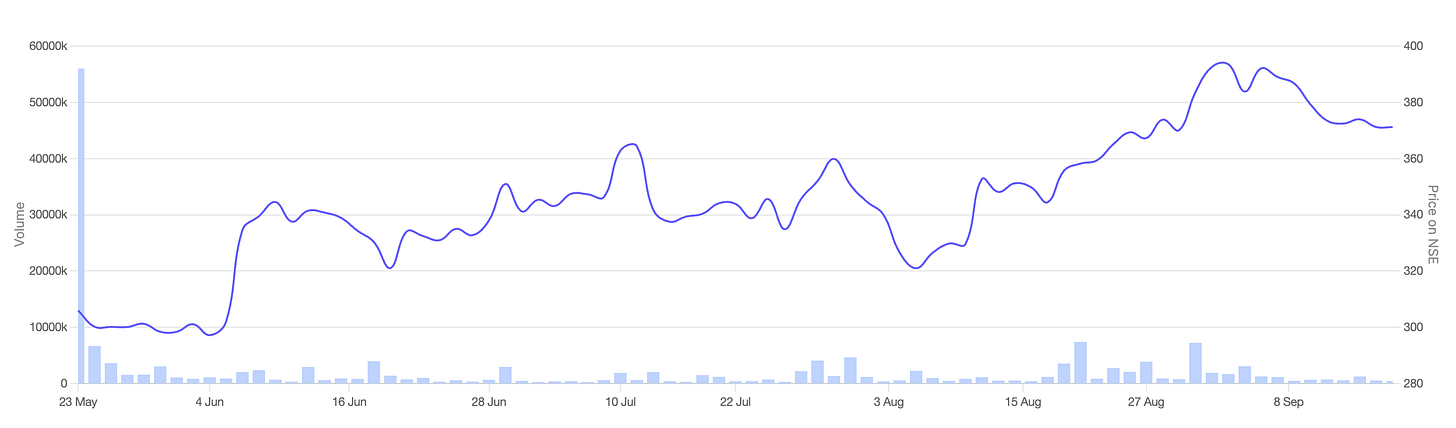

Stock price chart

Detailed analysis

About the company

Established in December 2016, Go Digit General Insurance Limited provides various insurance products such as motor, health, travel, property, marine, liability, and more, tailored to customers' preferences.

They are one of the leading digital full stack insurance companies, leveraging technology to power product design, distribution and customer experience for non-life insurance products. They recently got listed on the stock exchanges on 23-May-2024.

Their management team has immense experience in the insurance domain -

Recent awards and recognitions -

Financial analysis

Overview

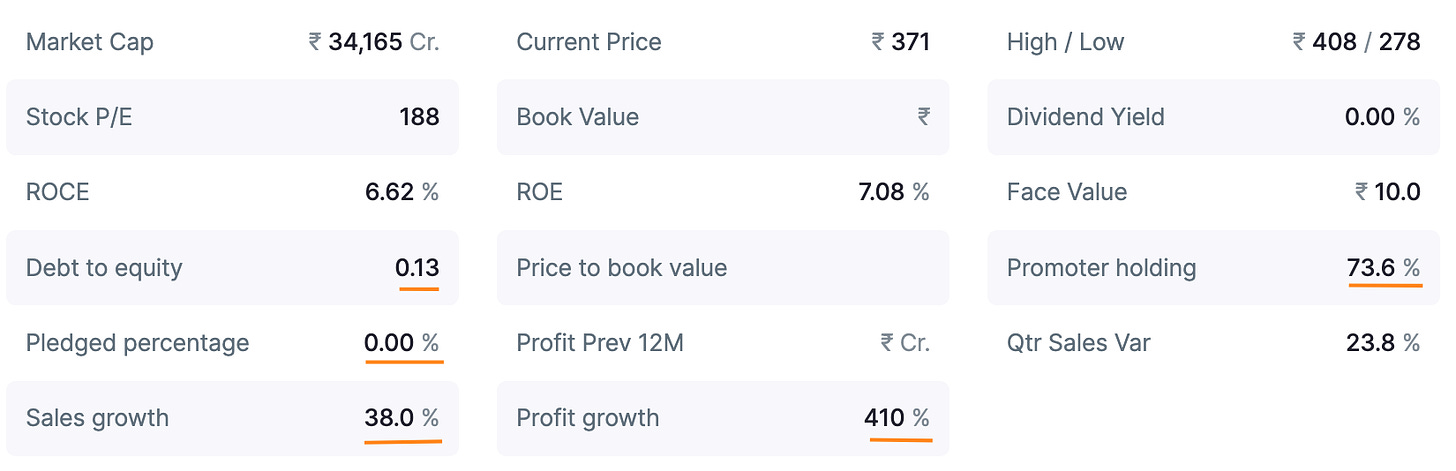

The promoter holding is at 73.6% and the pledged percentage is 0%.

Debt-to-equity ratio is at 0.13.

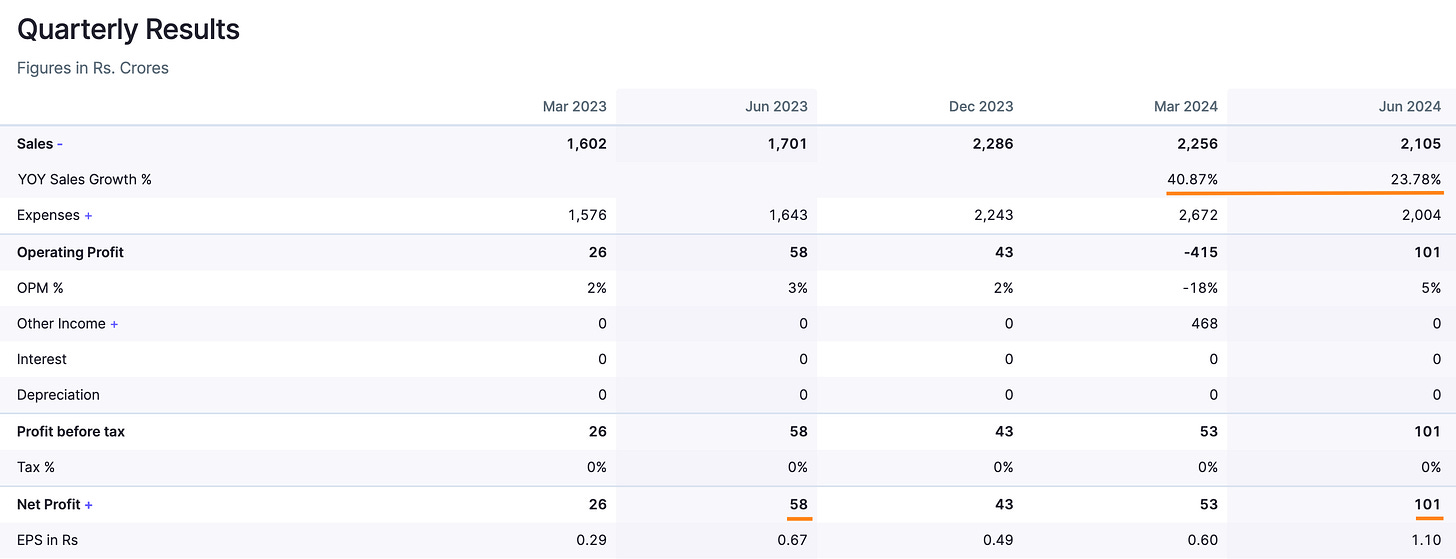

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The sales increased by 23.78%.

The net profit increased by 74% and EPS by 64%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company has had a high annual sales growth rate with +37.95% in the last financial year.

The company also improved operating margins by 200% in the last financial year.

The net profit and EPS both improved by 5X.

Peer comparison

The company has the highest sales growth rate (37.95%) and profit growth rate(410%) among it’s peers.

High P/E concern - The trending P/E has actually reduced from 188 to 129.7 with the last quarter results, and is expected to reduce further if the company is able to maintain the growth rate. This shows a potential for the company’s market cap to increase.

Timing analysis

Institutional participation led high volume signs seen in the week of 19 Aug(6.8x) and 26 Aug(6.4x).

Did you find our analysis on Go Digit General Insurance Ltd valuable? Help us reach more investors like you.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in