Hitachi Energy India Ltd - quarterly operating profit +41%

A subsidiary of a global leader in electronics, industrial machinery, and infrastructure.

Company name - Hitachi Energy India Ltd

Last closing price(NSE:POWERINDIA) - ₹13346.7(as on 25-Sep-2024)

Estimated reading time - 3 minutes

We recently analysed Themis Medicare Ltd on 14th-Sep, and the timing of our analysis worked out as it reached +10% yesterday. The updated performance of all our past analyses is available here.

Executive Summary

Hitachi Energy India Ltd (formerly known as ABB Power Products and Systems India Ltd.) was created in 2019 as a Joint Venture between Hitachi and ABB's Power Grids. The company serves utility and industry customers, with a complete range of engineering, products, solutions, and services in areas of Power technology.

With the government’s push to increase share of renewable energy, Hitachi Energy is well positioned to benefit from it.

The operating quarterly profit increased by 41%, on account of 27.61% sales growth and 33% increase in operating margins.

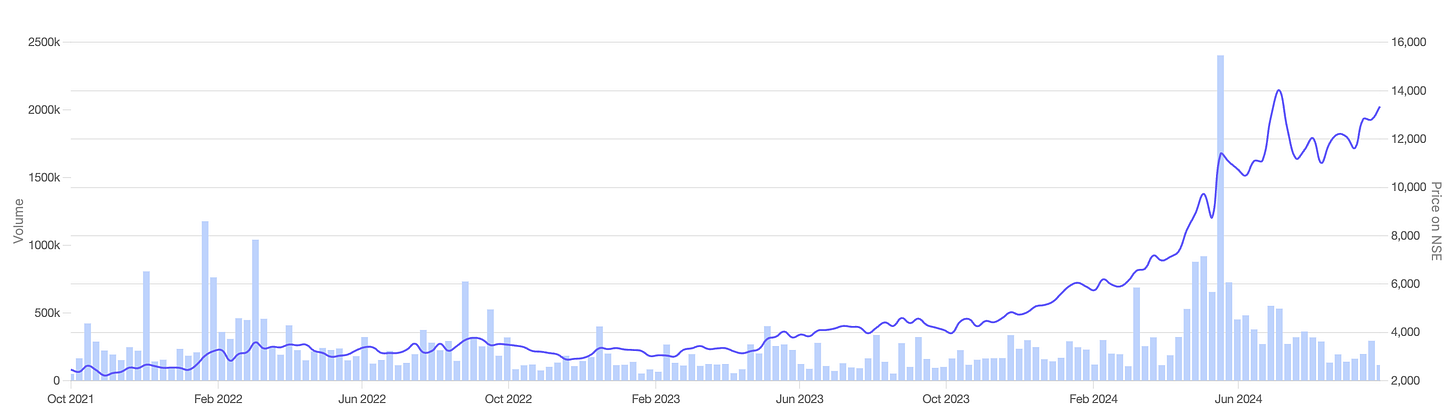

Stock price chart

Detailed analysis

About the company

Hitachi Energy India Ltd (formerly known as ABB Power Products and Systems India Ltd.) was created in 2019 as a Joint Venture between Hitachi and ABB's Power Grids. The company serves utility and industry customers, with a complete range of engineering, products, solutions, and services in areas of Power technology.

The Company has 19 factories across 8 manufacturing locations.

Future prospects

What is the company’s plan to maintain earnings growth in future?

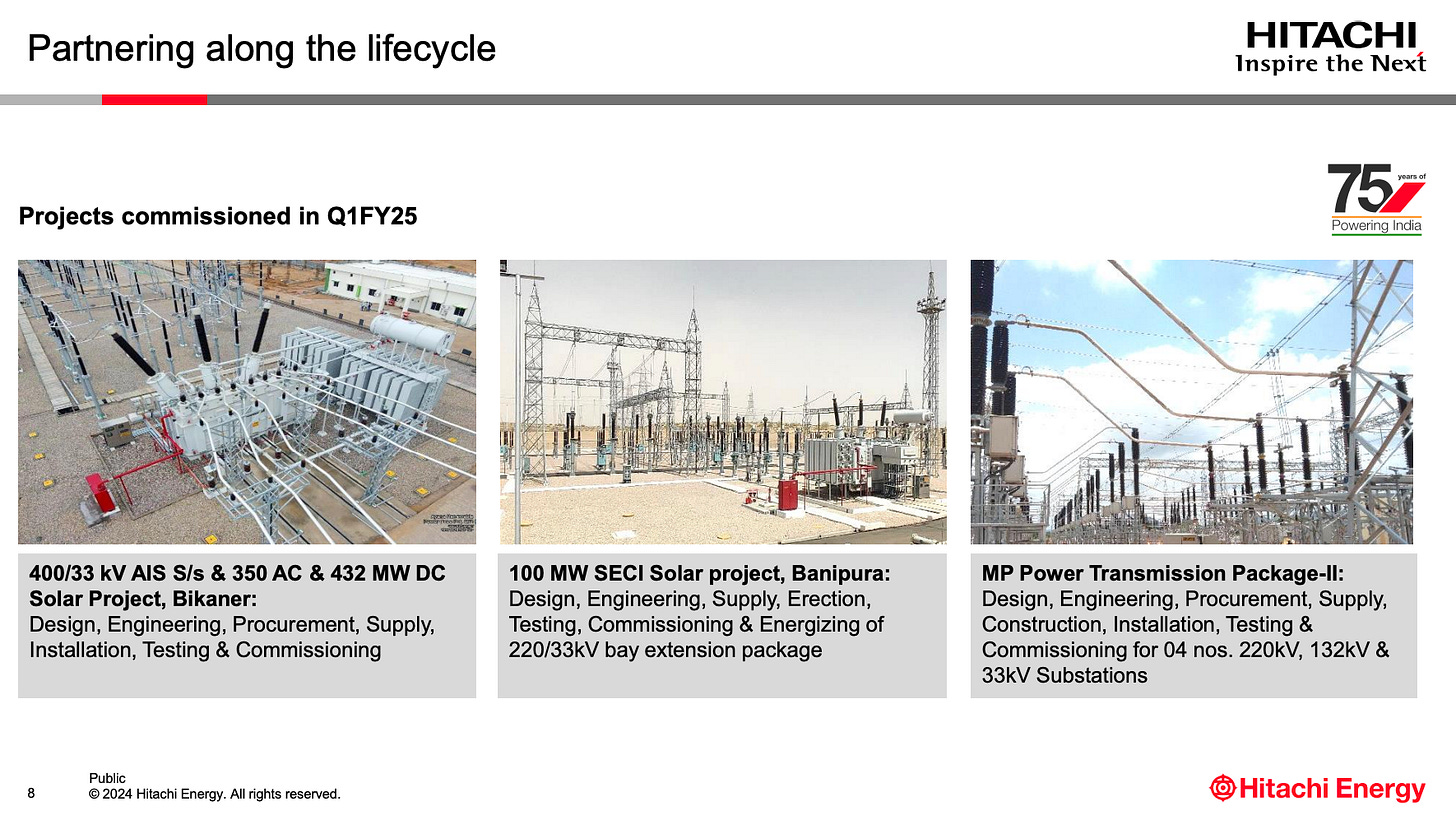

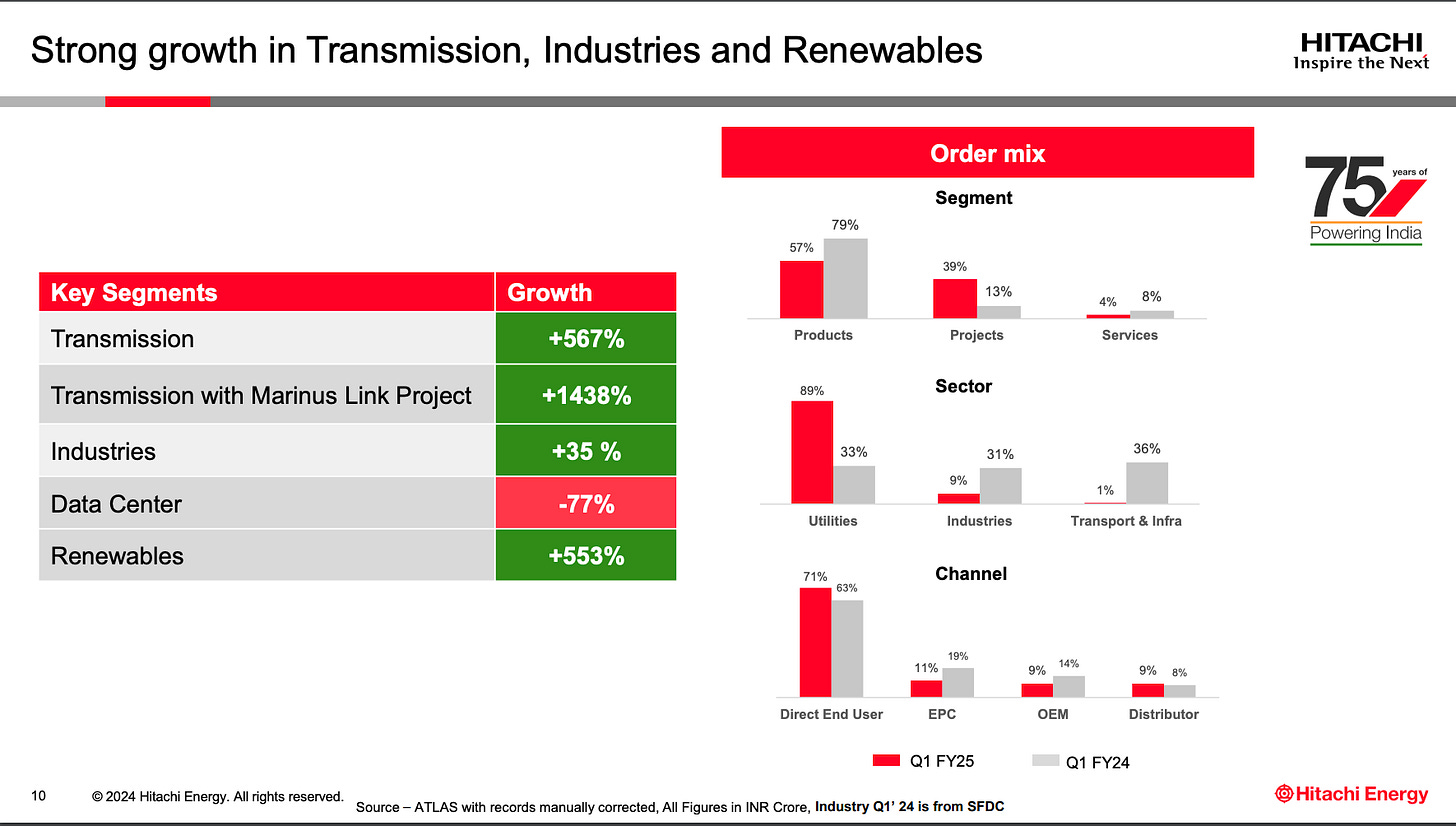

The government allocated Rs. 19,100 crores to Ministry of New and Renewable Energy recently, and Hitachi Energy is poised to benefit from these tailwinds.

The company received orders totaled Rs. 2,236.7 crores in Q1 FY '25.

Pursuing bids for upcoming HVDC projects.

Potential opportunities in high-speed rail projects and Vande Bharat project. The company is pursuing bids for these projects.

Exports contributing around 27% to total order book.

Potential risks that can hamper the future growth?

Increase in other expenses due to FOREX hedging impact, higher IT charges, and royalty expenses.

The competitors winning the bids in the projects that the company is pursuing.

Financial analysis

Overview

The promoter holding is 75%, and pledged percentage is 0%.

The debt-to-equity is under control at 0.16, with zero long term borrowings.

The company has a strong ROCE of 17.8%.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has had a turn-around performance in terms of sales growth with 23%+ sales growth in the last 3 quarters.

The operating profit increased by 41%, on account of 27.61% sales growth and 33% increase in operating margins.

Net profit increased 5x and EPS increased 4.3x.

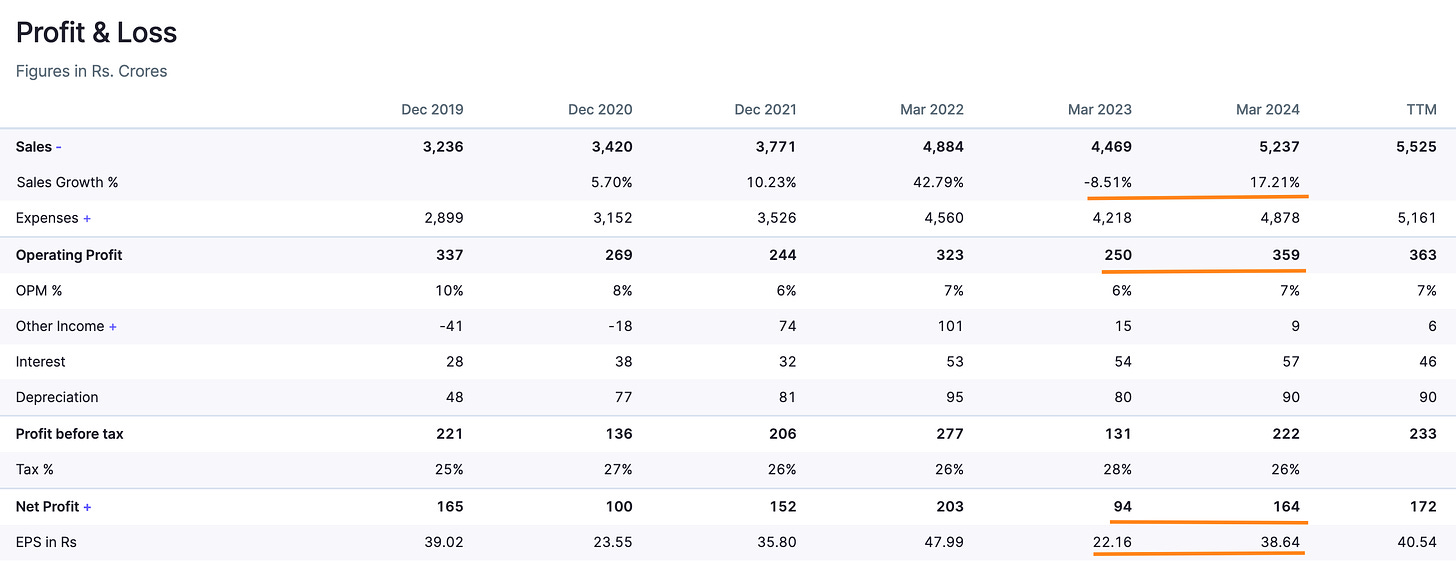

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company posted negative -8.51% sales growth in FY 2023, and posted a turn-around with +17.21% growth in FY 2024.

The operating profit increased by 43.6%.

The net profit and EPS increased by 74%.

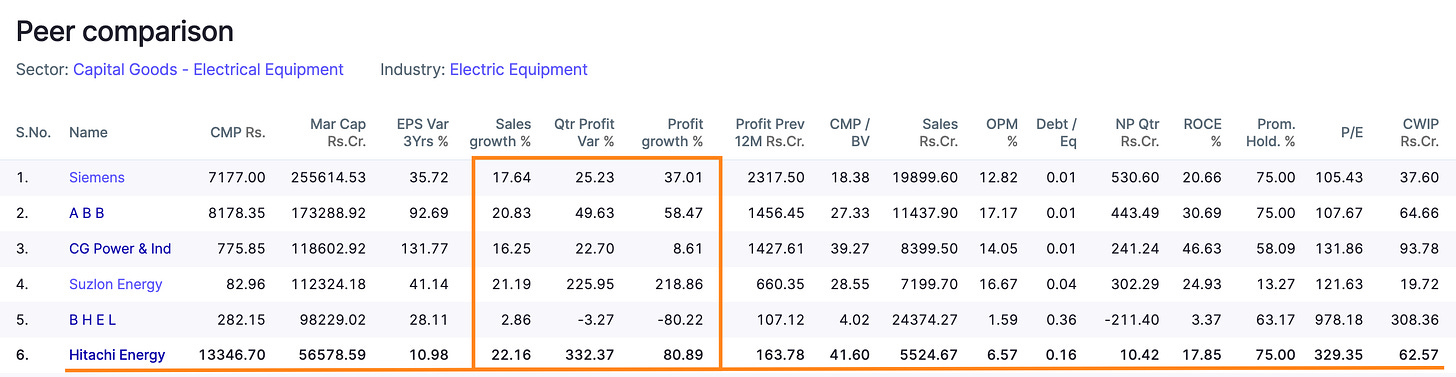

Peer comparison

The company has one of the highest sales growth, quarterly profit growth and annual profit growth among it’s peers.

Did you find our analysis on Hitachi Energy India Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in