IDBI Bank Ltd update - 41% quarterly EPS growth

Business and fundamental analysis

(Last closing price - ₹93.6)

Summary

The company has posted highest ever quarterly net profits, and EPS.

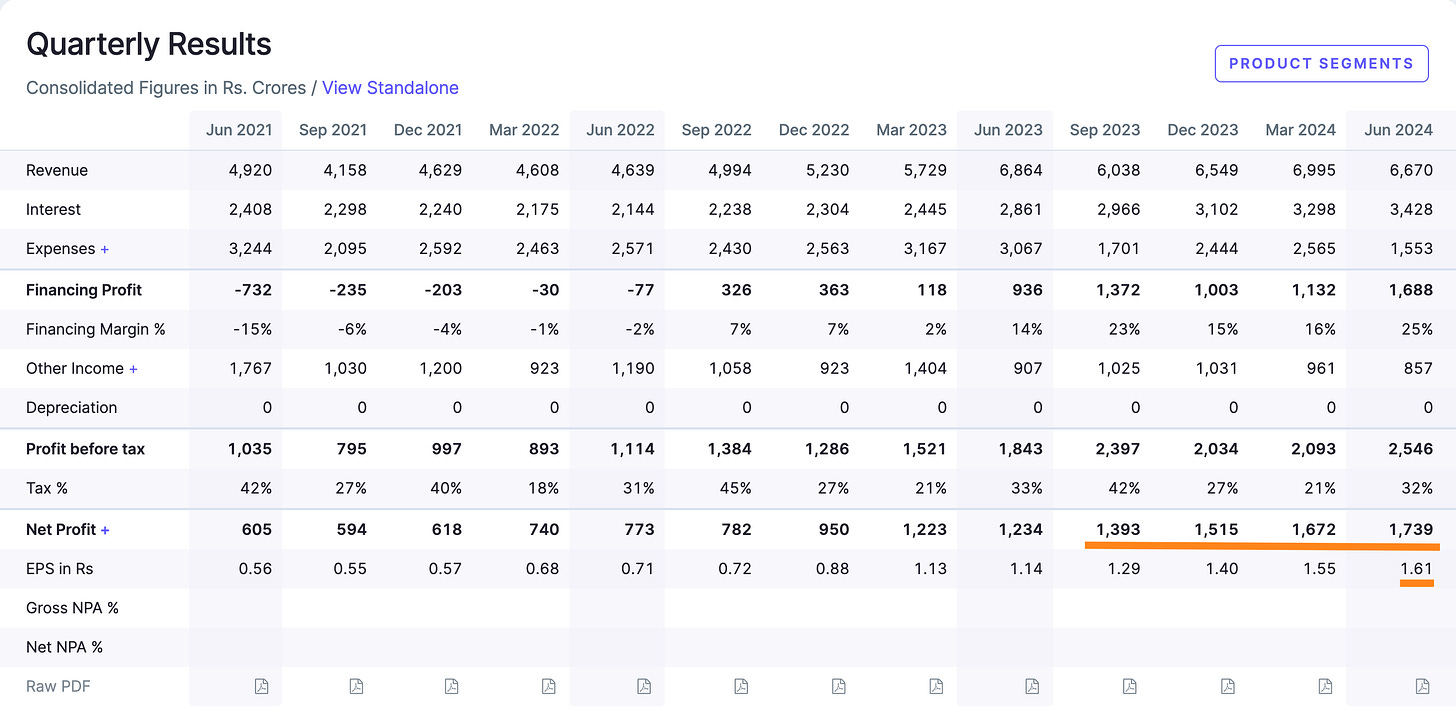

The EPS growth rate of IDBI bank is significantly higher compared to the top 5 private bank peers.

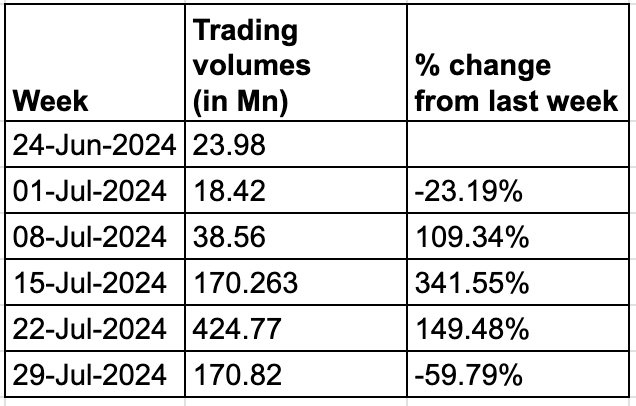

Spike in trading volumes observed in July 2024.

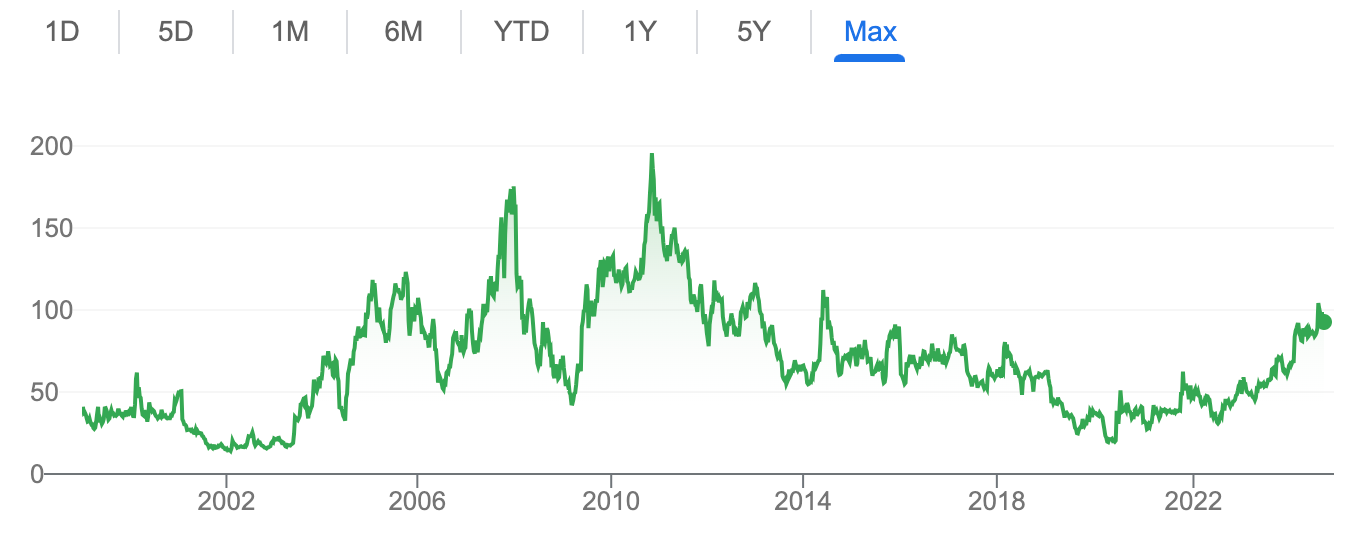

Company has posted lifetime high profits, and the price is 55% below it’s lifetime high price of ₹203.

Stock price chart

Detailed analysis

Fundamental analysis

IDBI bank is the 6th largest private bank in India by market cap (₹101708 Cr.)

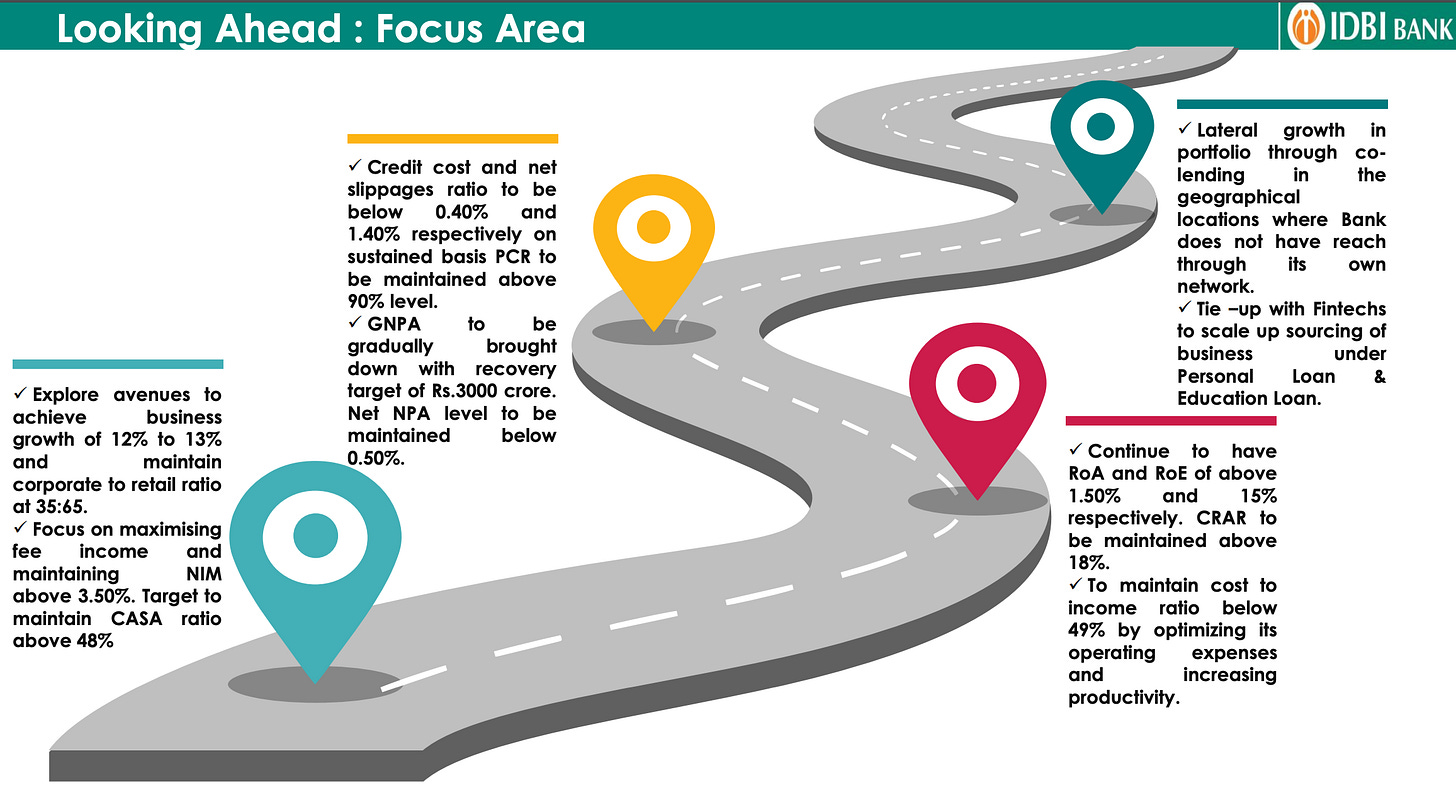

With India’s focus on ‘Viksit Bharat 2047’, the banking sector is poised to be one of the biggest beneficiaries with growth in demand for banking services.

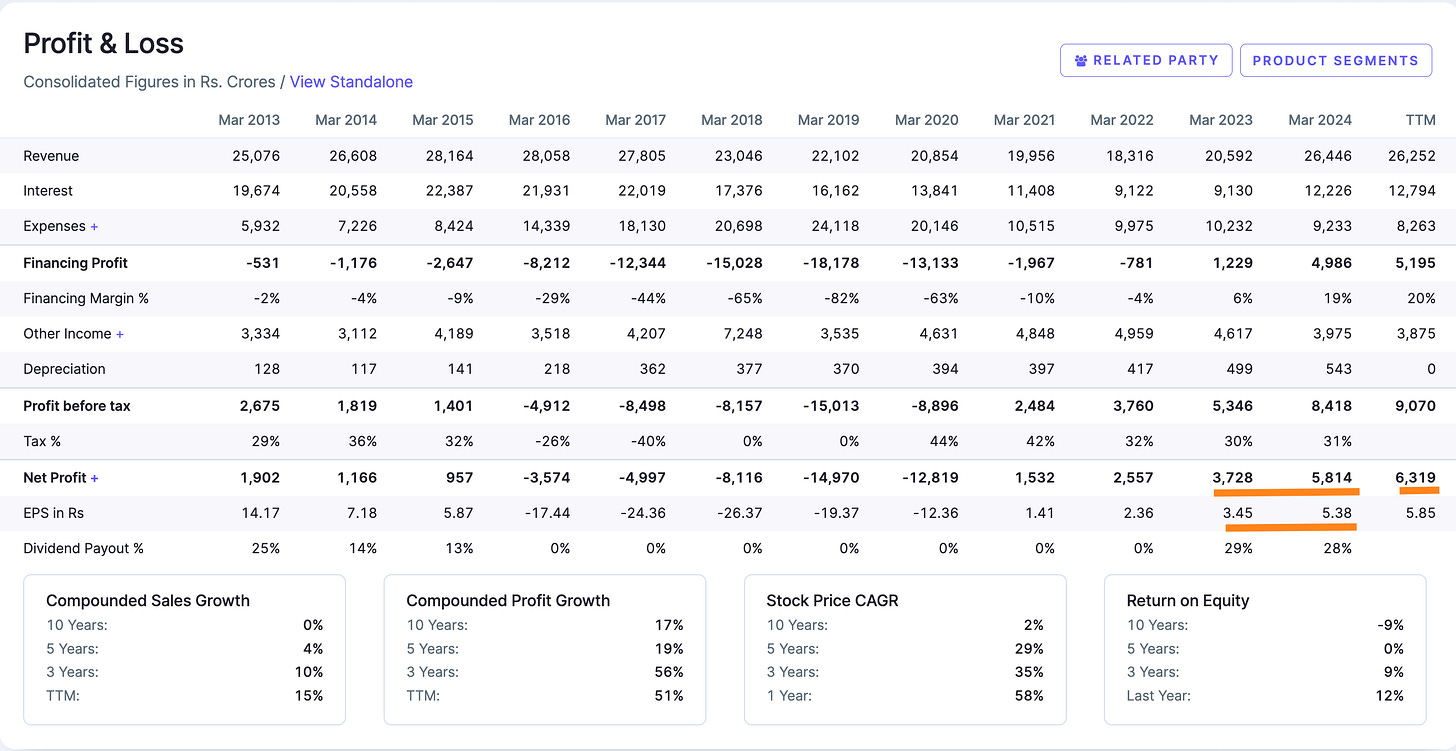

The bank has also come out of a negative phase of net losses due to NPAs between FY 2017 and FY 2020.

Financial analysis

Summary

Latest quarter results - Company posted an EPS growth of 41.22% compared to last quarter, with the highest ever net profit for any quarter (1739 Cr).

Yearly growth - 55.91% annual EPS growth in FY 2024 with the highest ever net-profit.

Future plans

What stands out

The EPS growth rate of IDBI is highest among it’s peers in the top 7 private banks. This highlights future growth potential in the stock price.

Price to book value - 1.99

Significant spike in trading volumes in the week of 15th and 22nd July 2024