ION Exchange(India) Ltd - 35% quarterly EPS growth

Company name - ION Exchange(India) Ltd

Last closing price(NSE:IONEXCHANG) - ₹665.05 (as on 06-Sep-2024)

Estimated reading time - 3 minutes

Executive Summary

Ion Exchange (India) Ltd (Ion Exchange), formed in 1964, is a pioneer in water, wastewater treatment & environment solutions and caters to various industries, institutions, homes & communities.

The company has a strong ROCE of 27.5%, debt-to-equity of 0.15 and 0% pledged percentage.

The company has consistently posted double digit quarter-on-quarter sales growth with 18.44% growth in the latest quarter and EPS growth of 35.24%.

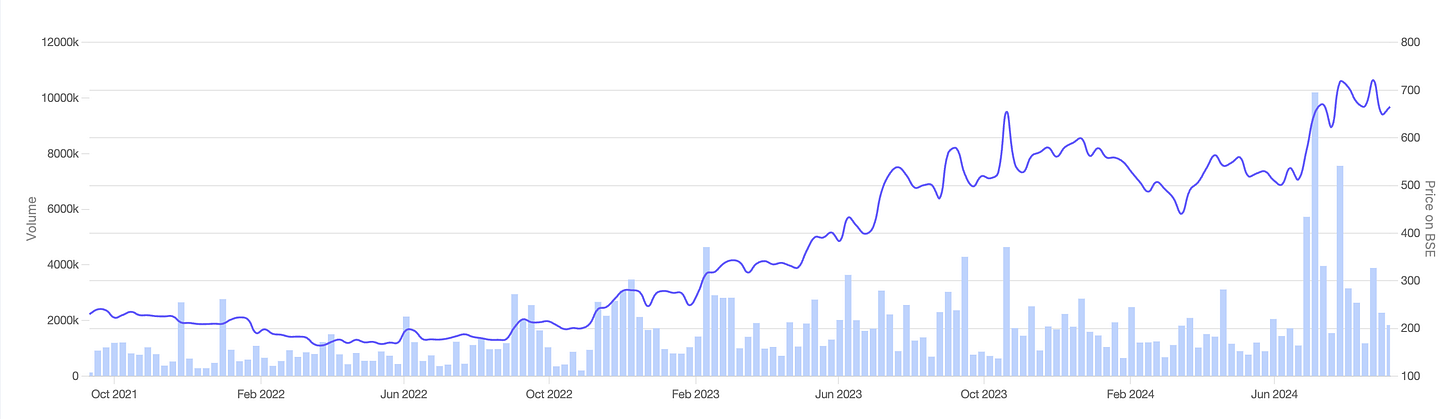

Stock price chart

Detailed analysis

About the company

Ion Exchange (India) Ltd (Ion Exchange), formed in 1964, is a pioneer in water, wastewater treatment & environment solutions and caters to various industries, institutions, homes & communities.

Headquartered in Mumbai, the company has 7 manufacturing and assembly facilities across India, 1 manufacturing facility in Portugal and 1 assembly facility each in UAE, Indonesia, Bangladesh and Saudi Arabia . It also has presence across other key geographies.

The company operates 3 business divisions with a revenue mix - Engineering(60%), Chemicals(29%) and Consumer products - 11% in FY 2024.

Financial analysis

Overview

The company has a strong ROCE of 27.5%.

Debt to equity is under control at 0.15, and pledged percentage is 0%.

Quarterly results

Growth in key metrics compared to the last year’s same quarter in the latest quarter Q1 - 2025 -

The company has consistently posted double digit quarter-on-quarter sales growth with 18.44% growth in the latest quarter.

The EPS growth of 35.24% was reported.

Annual results

Growth in key metrics in the last financial year 2024 compared to the last financial year

The company reported 18% sales growth in the last financial year.

The other metrics like net profit and EPS have stayed similar only. The latest quarterly results are showing an increase in the overall growth rate which will reflect in FY 2025 results.

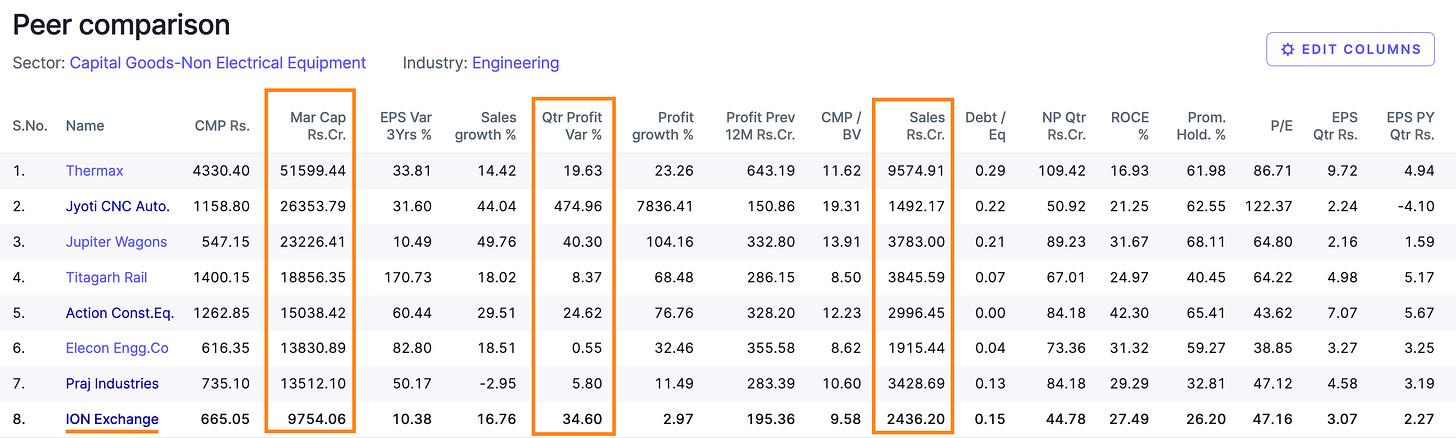

Peer comparison

The company’s quarterly profit growth is 4th highest in the sector, at 34.8%.

The last 12 month’s sales is 2436 Cr. The closest peer in terms of sales is Action Const. Eq. with 2996.45 Cr(+23%) in sales and market cap of 15038 Cr(+54%) compared to ION Exchange(India) Ltd. This shows a potential for growth in market capitalisation fueled by improved growth rate.

(Note - the peers listed are from Engineering - Capital Goods - Non-Electrical Equipment sector and don’t belong to only water treatment industry.)

Did you find our analysis on ION Exchange(India) Ltd valuable? Share this ahead with your friends.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in