JSW Energy Ltd- operating profit margins up by 46%

Company name - JSW Energy Ltd.

Last closing price(NSE:JSWENERGY) - ₹782.35 (as on 20-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

JSW Energy Ltd and its subsidiaries are primarily engaged in the business of generation of power from its power assets. It is the holding company for the JSW group's power business.

The company significantly improved operating profit margins by 46% in FY 2024.

The government aims to increase renewable energy consumption via RPOs(Renewable Purchase Obligation) from 22% to 30% in FY25 and 43% by 2030. JSW Energy will benefit from this given it’s pipeline of renewable energy projects.

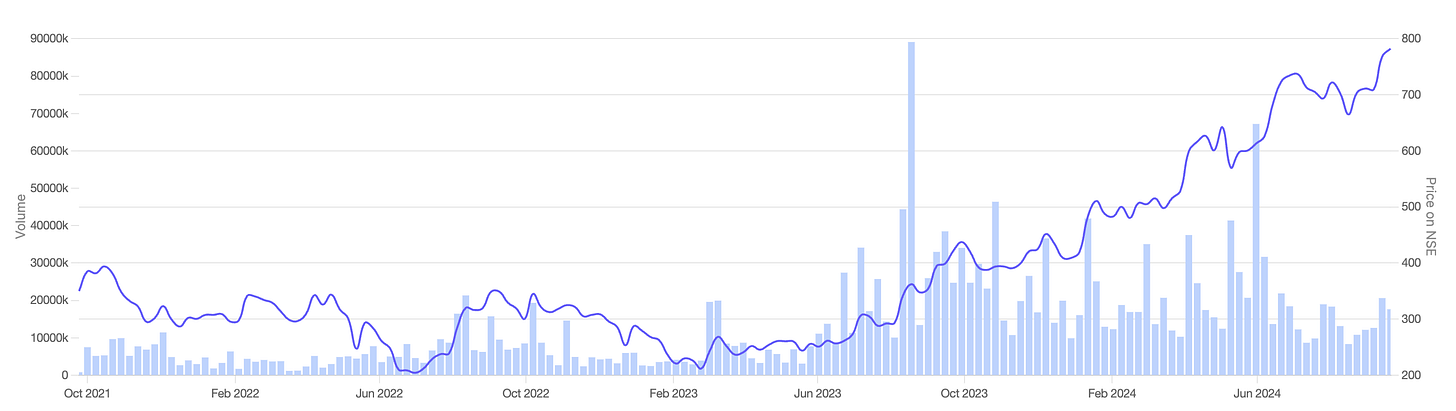

Stock price chart

Detailed analysis

About the company

JSW Energy Ltd and its subsidiaries are primarily engaged in the business of generation of power from its power assets. It is the holding company for the JSW group's power business.

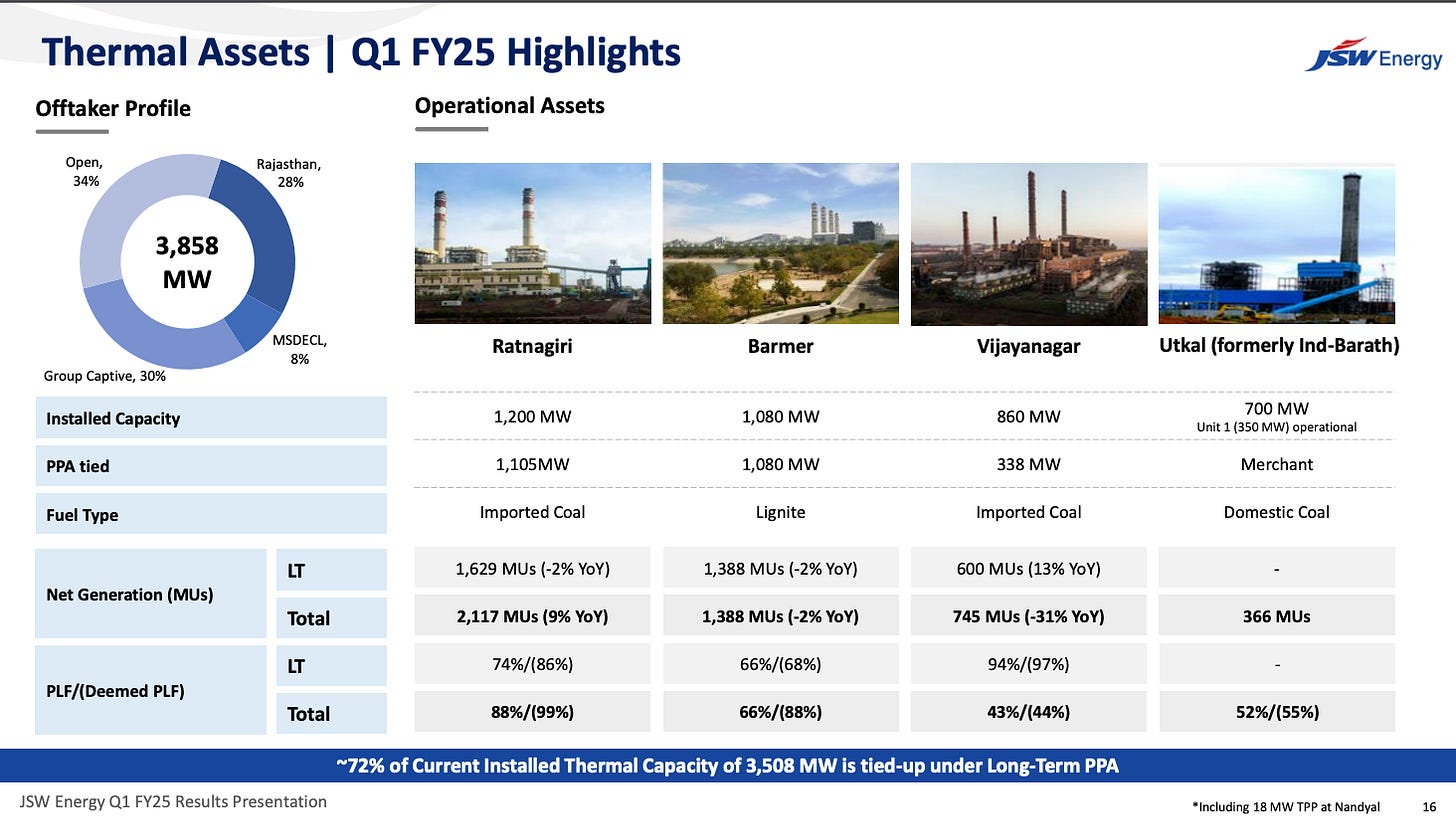

Presently the company has long terms PPAs(Power Purchase Agreements) for 72% of thermal capacity and 100% of renewable capacity.

Future prospects

What is the company’s plan to maintain earnings growth in future?

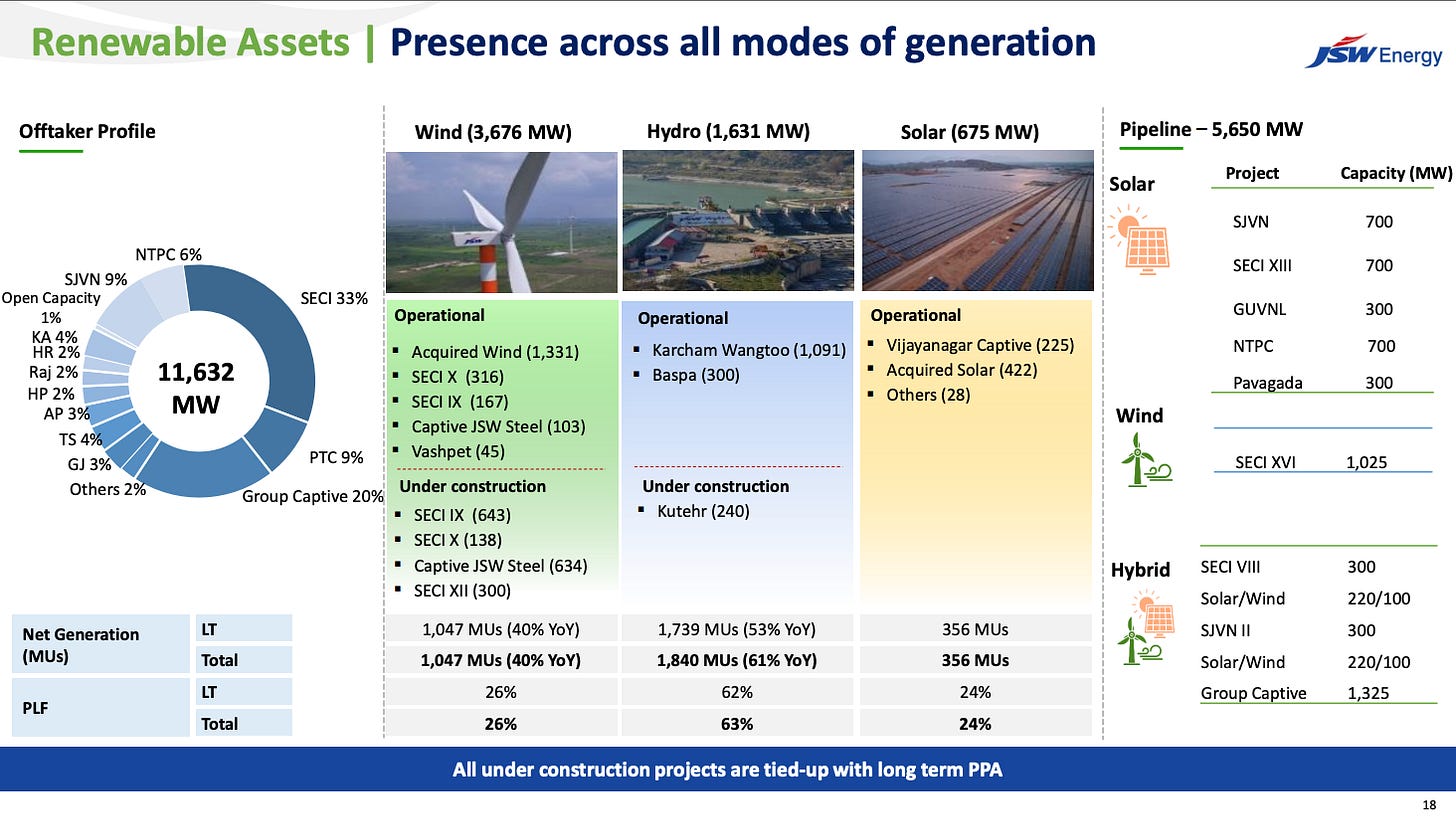

The hydro generation increased 61% YoY on account of better hydrology. This is expected to boost future growth.

The company has a robust pipeline of projects totaling 5.7 GW, with 2 GW already signed under PPAs.

The government aims to increase renewable energy consumption via RPO(Renewable Purchase Obligation) from 22% to 30% in FY25 and 43% by 2030. JSW Energy will benefit from this given it’s pipeline of renewable energy projects.

Potential risks which can hamper the future growth?

Company not able to deliver on the pipeline of new projects on the committed time.

Financial analysis

Overview

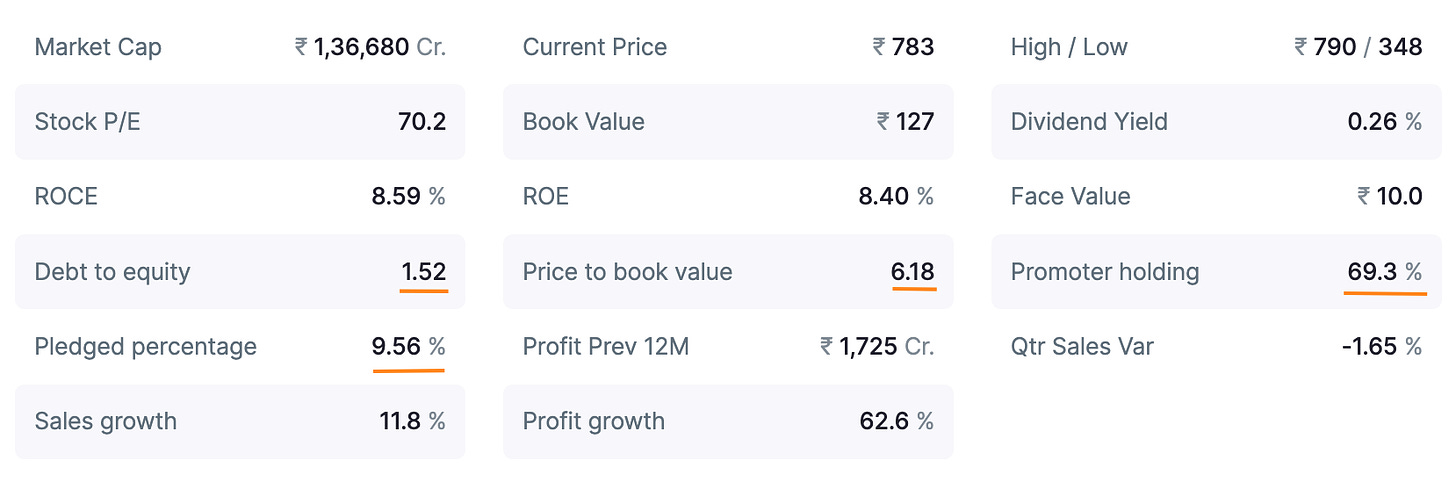

The company has 69.3% promoter holding. The pledged percentage is 9.56%.

The price to book value is at 6.18 and debt-to-equity is 1.52.

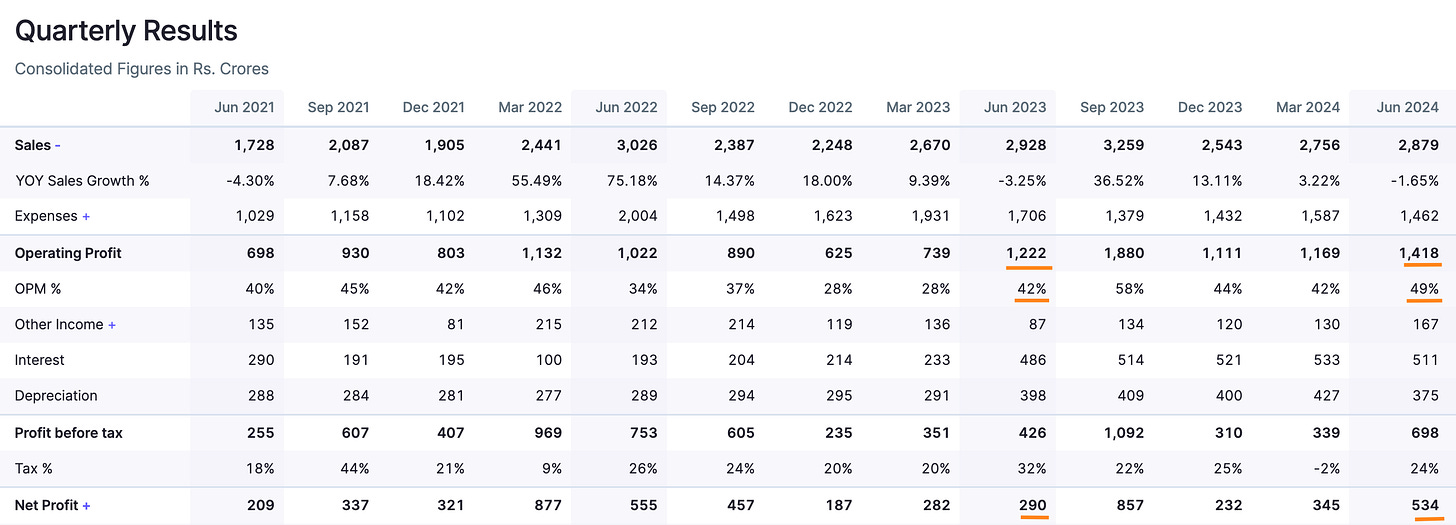

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The operating profit increased by 15.8% on account of increase in operating profit margins by 16.6%. The overall sales growth was muted at -1.65%.

The EPS increased by 84% and profit after tax (PAT) increased by 63.8%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company has been reporting consistent double digit sales growth in the last 3 years, with 11.17% growth in FY 2024.

The company significantly improved operating profit margins by 46% in FY 2024. and the EPS increased by 16.46%.

The company currently has the highest till date CWIP(Capital work in progress) deployed at ₹10285 Cr which will translate to increased capacity and sales in the coming years. This is 214% more than last FY.

Peer comparison

The company has the highest profit growth among it’s peers at 62.63%.

The debt-to-equity of JSW Energy is in the range with peers.

Did you find our analysis on JSW Energy Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in