Max Healthcare Institute Ltd - 20.07% quarterly sales growth

A hospital chain with highest operating profit margins among it's peers.

Company name - Max Healthcare Institute Ltd

Last closing price(NSE:MAXHEALTH) - ₹984.85 (as on 19-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

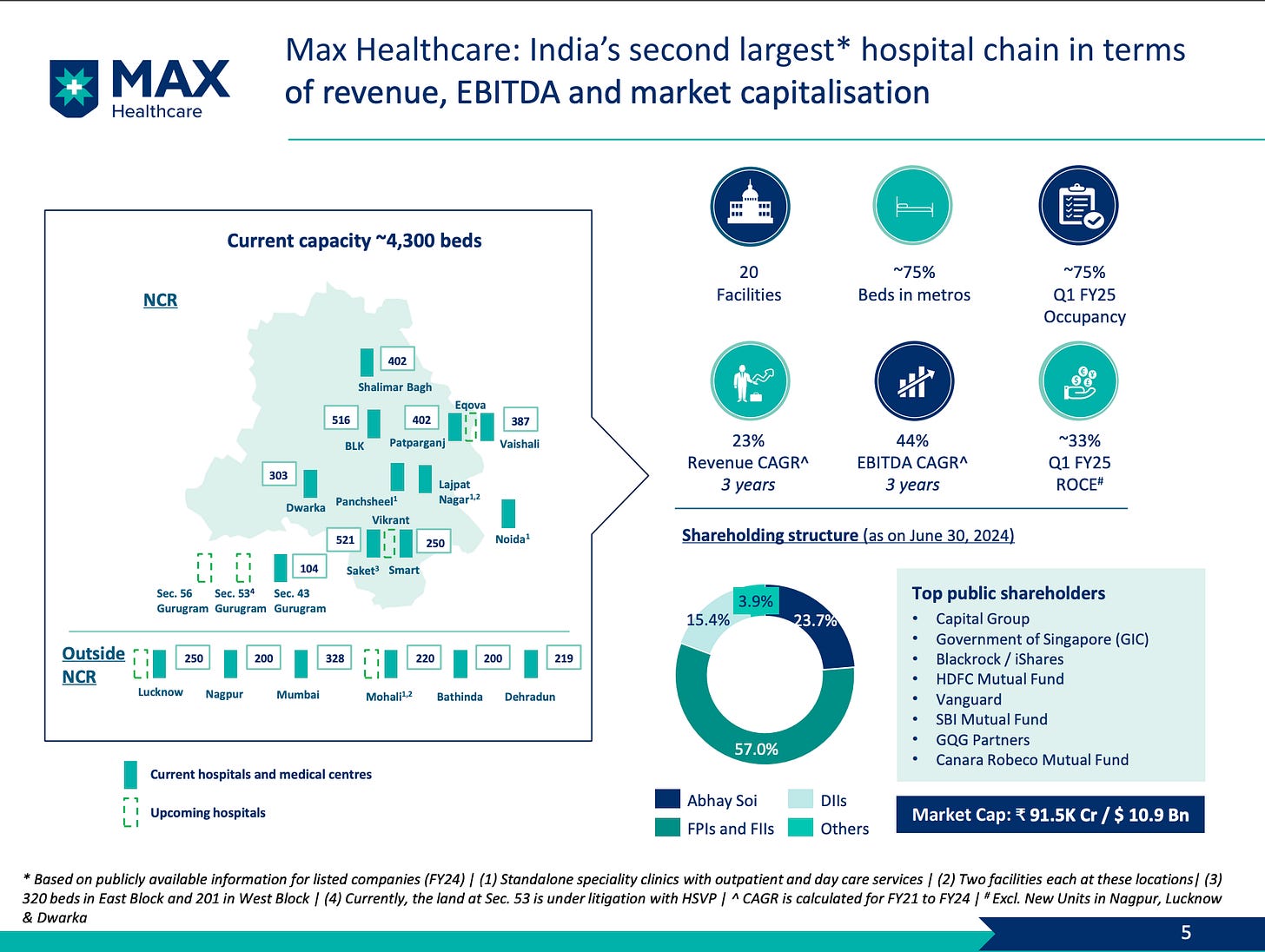

Max Healthcare is India’s second largest hospital chain in terms of revenue, EBITDA and market capitalisation.

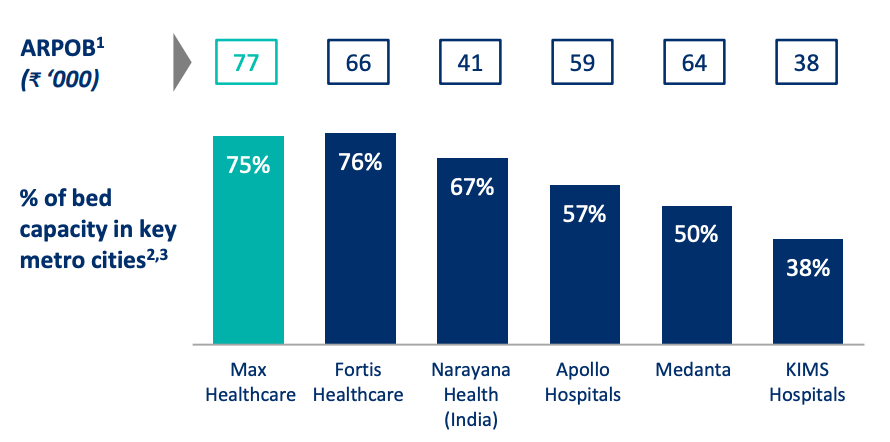

Max Healthcare has the highest ARPOB among it’s peers at ~₹77,000 and highest operating profit margin at 27.23%.

The company has maintained a consistent track record of double digit sales growth over last 12 quarters, with 20.07% sales growth reported in the latest quarter.

Stock price chart

Detailed analysis

About the company

Max Healthcare is India’s second largest hospital chain in terms of revenue, EBITDA and market capitalisation.

Learn something new -

One of the primary performance metric for hospitals is - ARPOB - Average Revenue Per Occupied Bed.

Max Healthcare has the highest ARPOB among it’s peers.

Future prospects

(What is the company’s plan to maintain earnings growth in future?)

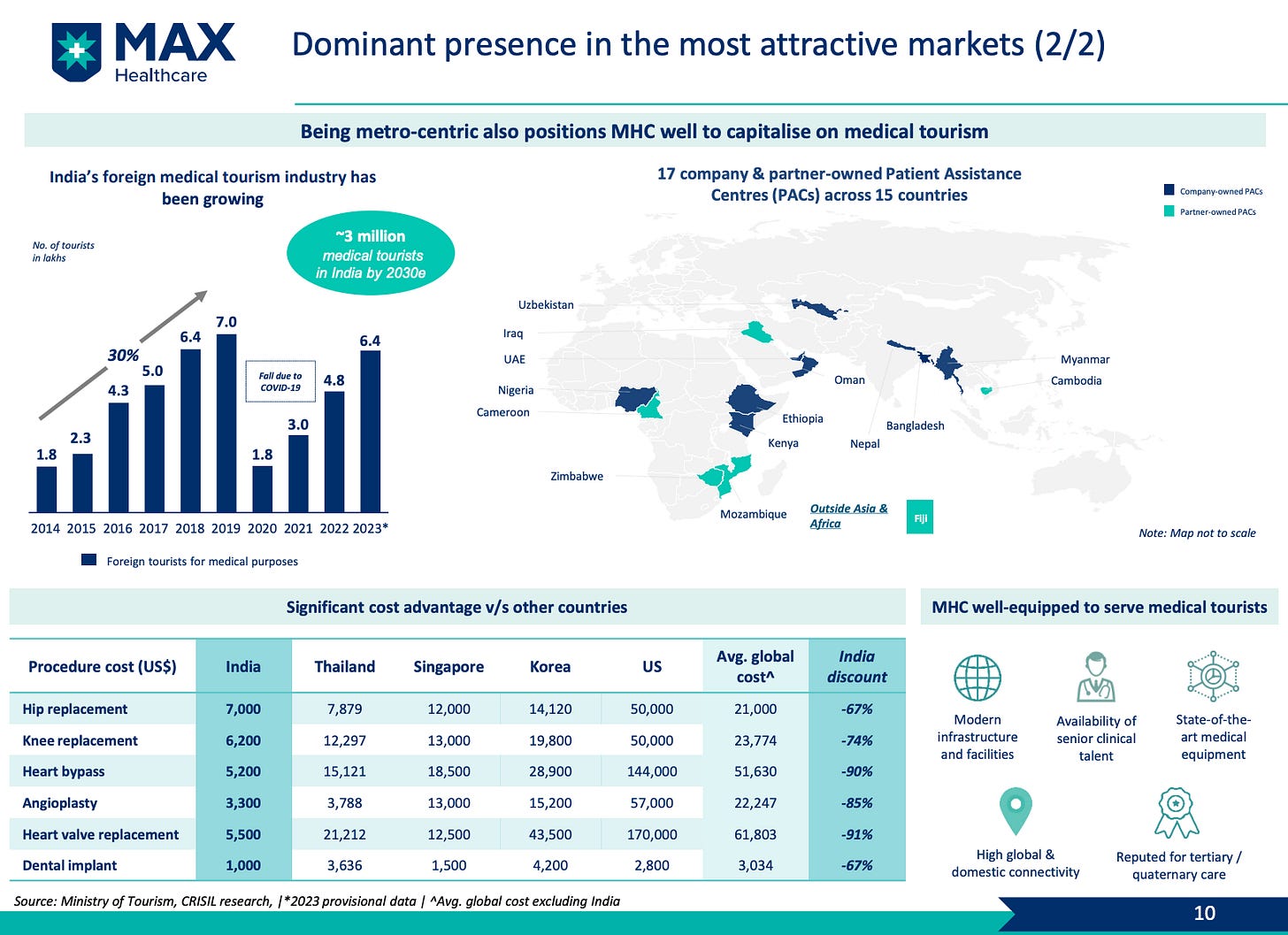

Capitalise on the growing medical tourism trend

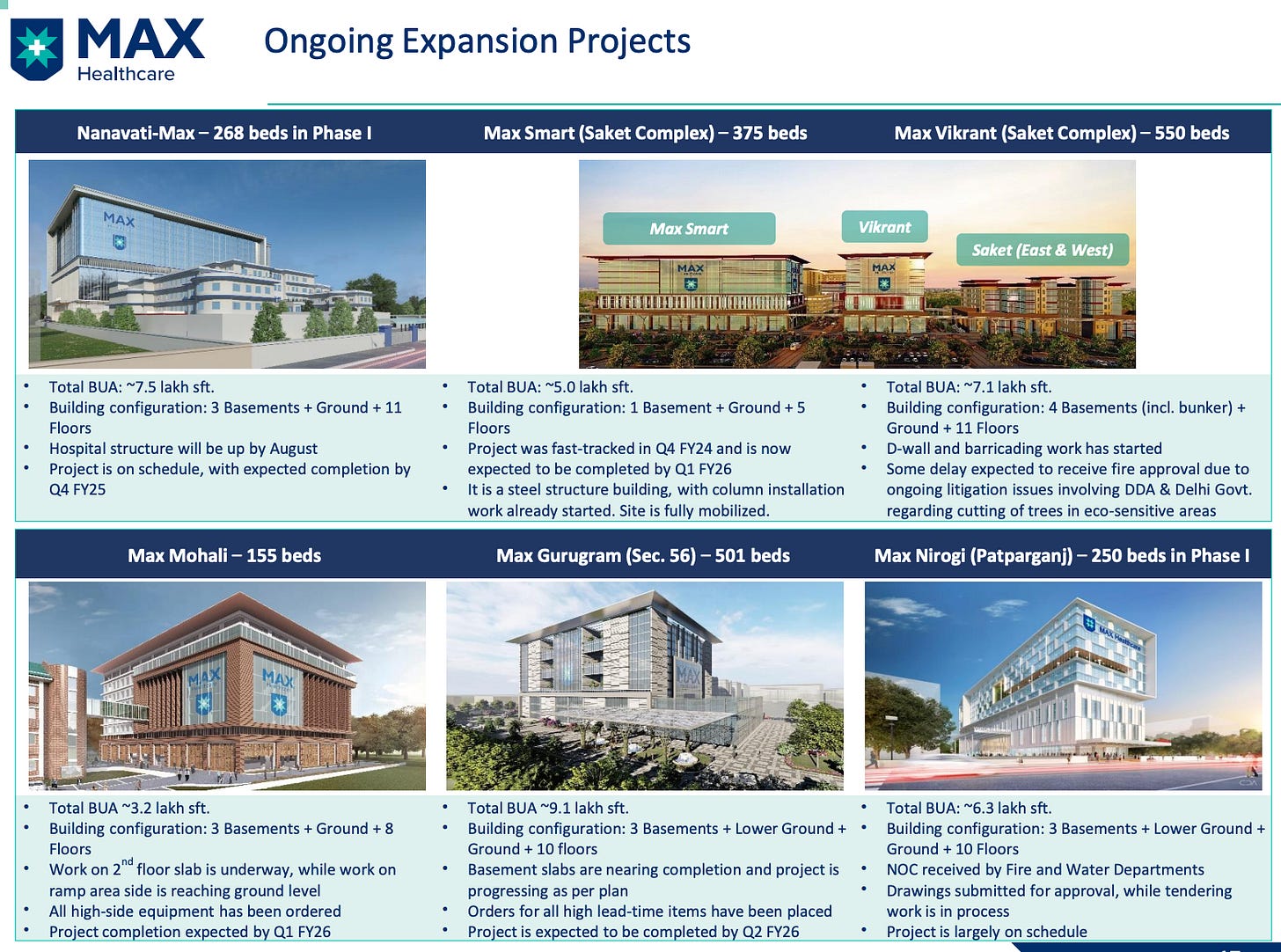

Capacity expansion with new projects

Financial analysis

Overview

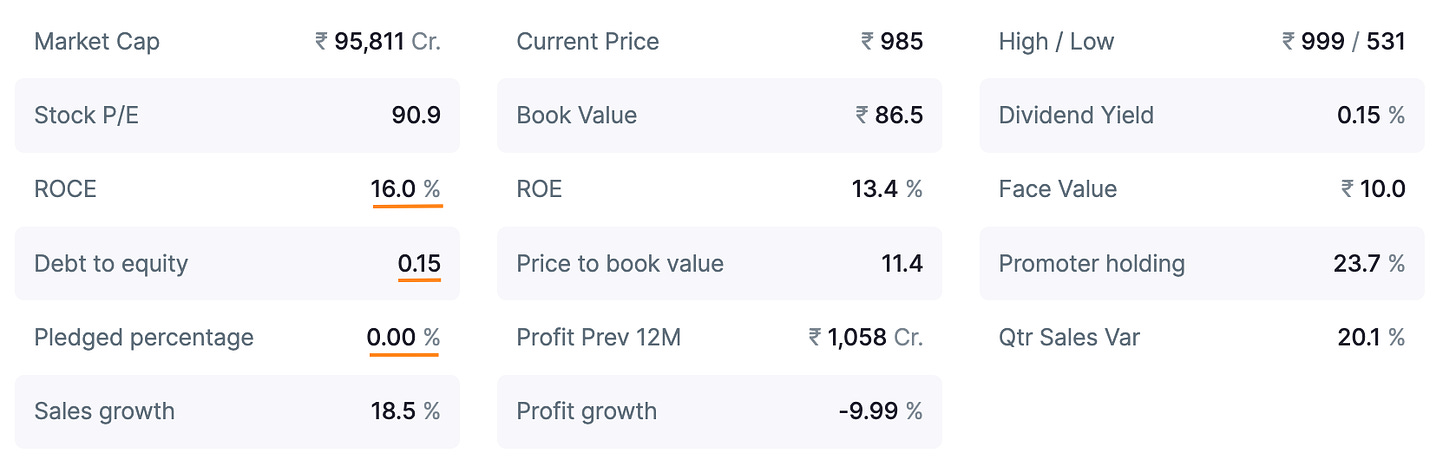

The company has a ROCE of 16% and pledged percentage of 0%.

The debt-to-equity is under control at 0.15.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

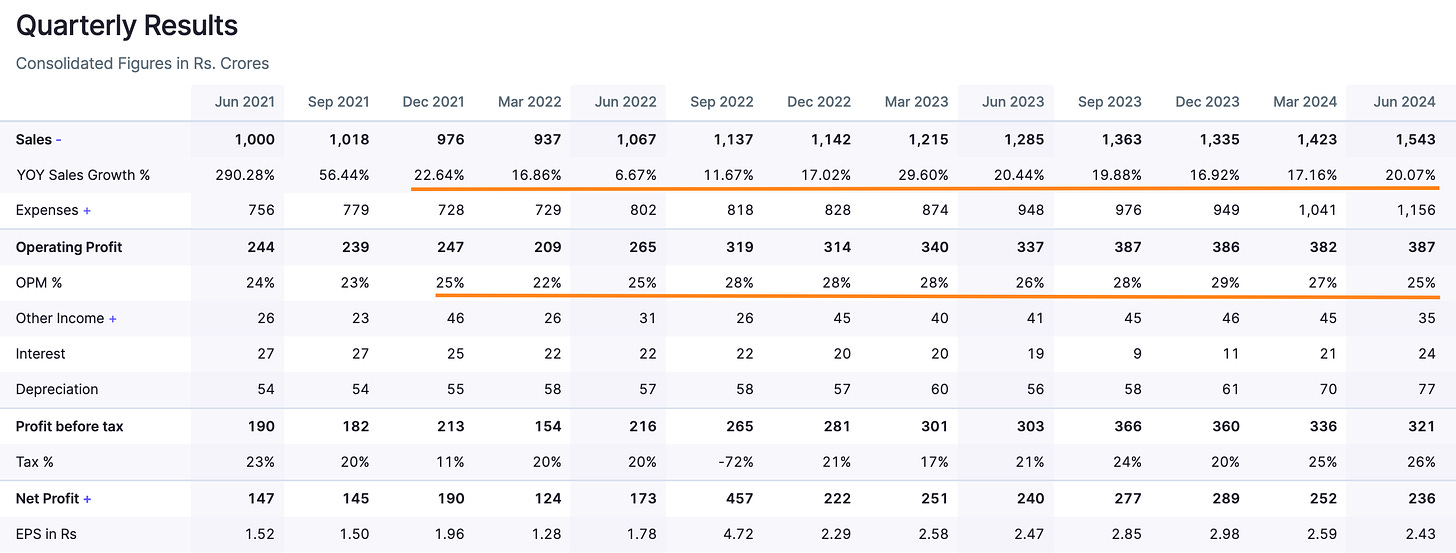

The company has maintained a consistent track record of double digit sales growth over last 12 quarters, with 20.07% sales growth reported in the latest quarter.

The company has also maintained high operating margins at 25%.

The operating profit increased by 14.8%

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

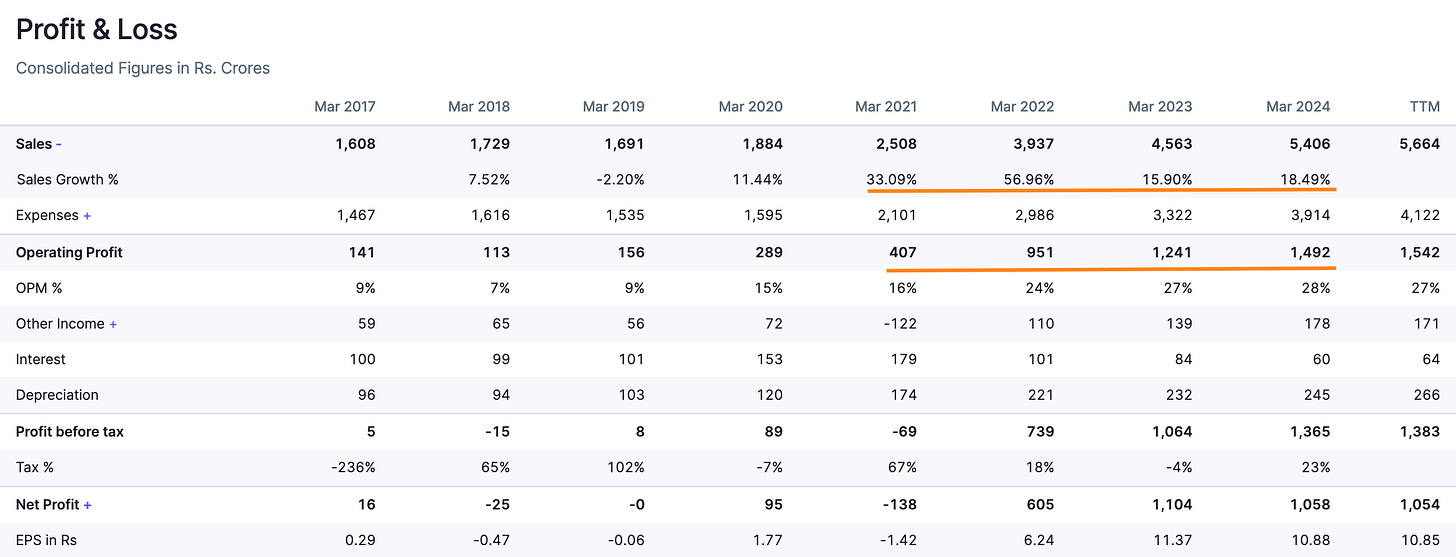

The company has maintained a track record of double digit sales growth with 18.49% growth reported in the last FY.

The company has also improved and maintained the operating profit margins at 28%.

Peer comparison

The company has the highest -

Operating profit margin (OPM) among it’s peers at 27.23%

Reported profit in last 12 months at 1057.64Cr.

Sales growth rate among peers of similar market cap at 18.53%.

Did you find our analysis on Max Healthcare Institute Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in