MRF Ltd - +70% annual operating profit margin

A tyre sector leader and India's most expensive stock.

Note - We are observing precaution in the current market conditions. The market sentiment is very high on greed currently, with NIFTY50 making newer highs. But the broader market(NSE:CNX500) is showing opposite signs. Only few large cap stocks are participating in the rally, and majority of the mid and small cap stocks are not holding their breakouts. Both small and mid-cap indexes have been underperforming compared to NIFTY50 in the last 3 weeks. A correction in the overall market is anticipated and protecting capital is important.

Company name - MRF Ltd

Last closing price(NSE:MRF) - ₹140973.9 (as on 27-Sep-2024)

Estimated reading time - 3 minutes

The updated performance of all our past analyses is available here.

Executive Summary

Madras Rubber Factory Limited (MRF) is the parent company of the MRF Group. The company is engaged in the business of manufacturing tyres.

The p manufactures tyres (flagship) for Passenger cars, Two-wheelers, Three Wheelers, OTR, Trucks, Farm tractors, LCVs, Tubes & flaps, SCV, Pick up cars, MCV and ICV.

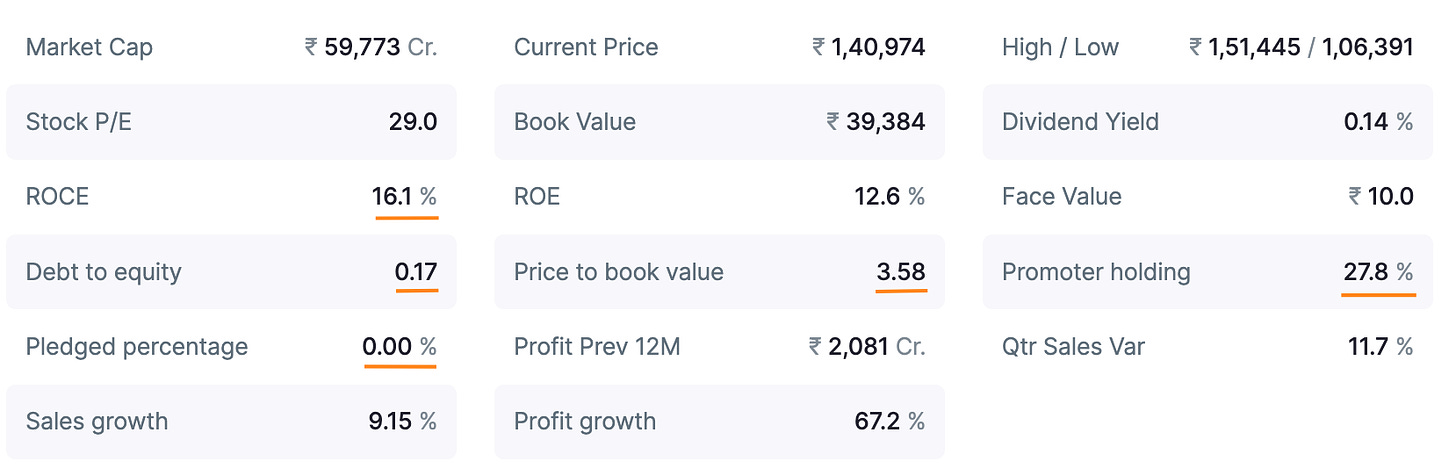

The debt-to-equity is 0.17% and the ROCE is at 16.1%

The company improved annual operating profit margins significantly by 70%. This led to a net profit increase of 70.6% and EPS increase of 70.65%.

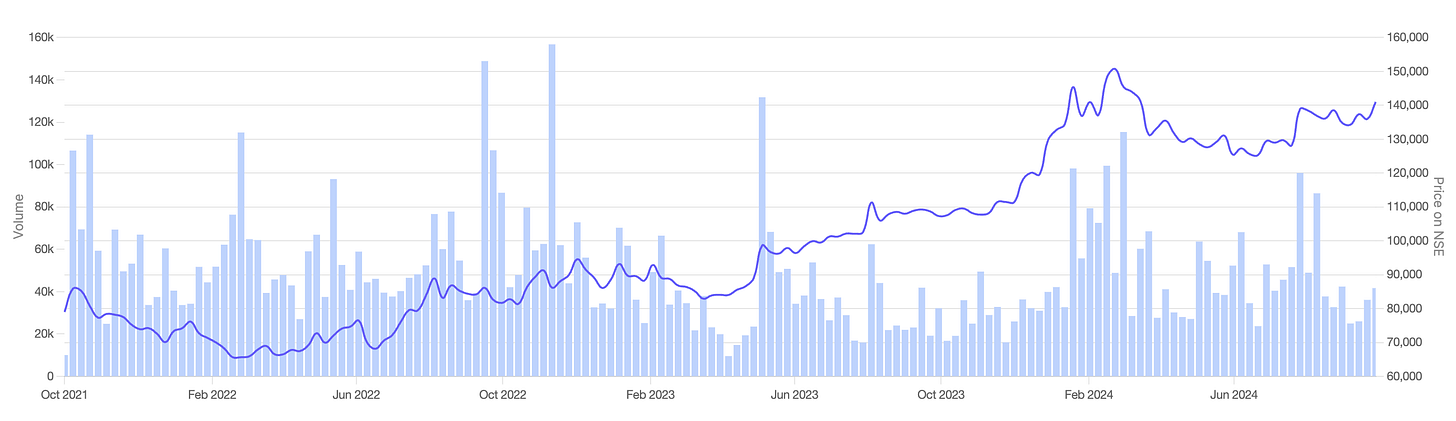

Stock price chart

Detailed analysis

About the company

Madras Rubber Factory Limited (MRF) is the parent company of the MRF Group. The company is engaged in the business of manufacturing tyres.

The company manufactures tyres (flagship) for Passenger cars, Two-wheelers, Three Wheelers, OTR, Trucks, Farm tractors, LCVs, Tubes & flaps, SCV, Pick up cars, MCV and ICV.

It also manufactures Sports goods, Paints & Coats and Pretreads. It also manufactures Puzzles, games, and toys for kids through its brand Funskool.

It also has the distinction of being the most expensive stock in India currently.

Future prospects

What is the company’s plan to maintain earnings growth in future?

Increasing % share of exports

Positioning products for SUVs to the OE manufacturers

Potential risks that can hamper the future growth?

Slowing growth in the automotive sector overall

Financial analysis

Overview

The promoter holding is 27.8% and the pledged percentage is 0%.

The debt-to-equity is 0.17% and the ROCE is at 16.1%

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company reported a 11.74% growth in sales in the latest quarter.

A 11.1% dip in operating profit margin was reported.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The annual sales increased by 9.39%.

The company improved operating profit margins significantly by 70%.

This led to a net profit increase of 70.6% and EPS increase of 70.65%

Peer comparison

MRF has the highest sales growth among it’s peers at 9.15%.

Tyres sector participation - we covered CEAT Ltd on 25-Sep and the price has moved +7.62% since then.

Did you find our analysis on MRF Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in