Rashi Peripherals - 74% increase in quarterly sales

A leading national distribution partners for global technology brands in India.

Company name - Rashi Peripherals Ltd.

Last closing price(NSE:RPTECH) - ₹414.2 (as on 16-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

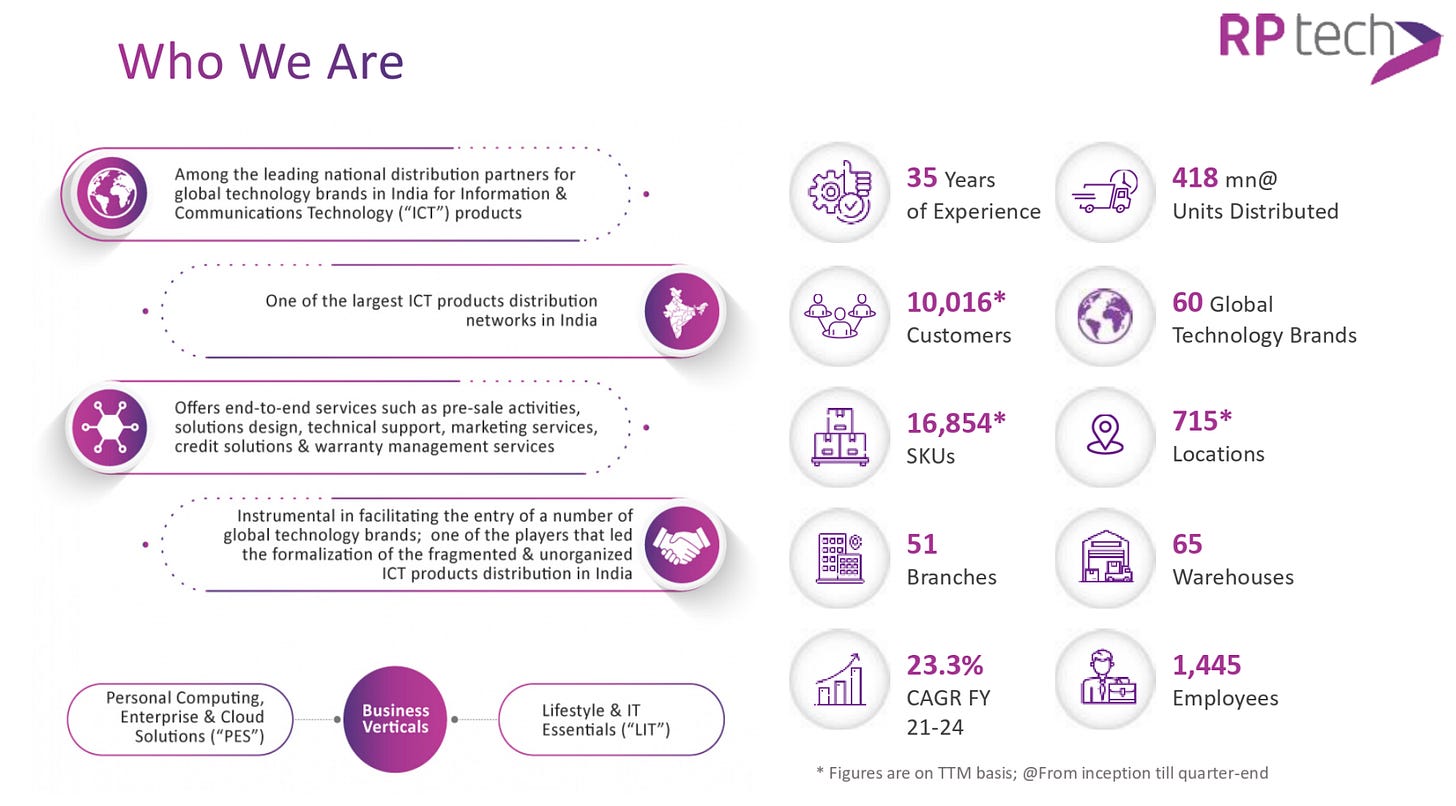

Incorporated in 1989, Rashi Peripherals Ltd(RPTech) is among the leading national distribution partners for global technology brands in India for Information and Communications Technology(ICT) products.

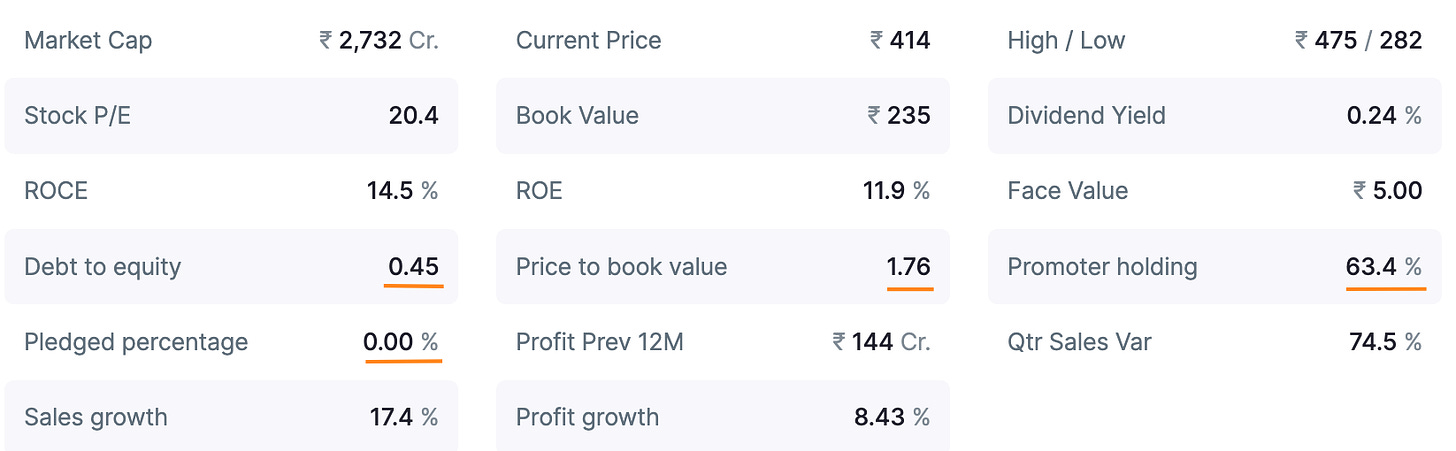

The promoter holding is at 63.4% and pledged percentage is 0%.

The total sales increased by 74% in the latest quarter.

The company has been repaying it’s debt and the debt-to-equity ratio has reduced significantly from 1.48 in FY 2023 to 0.45 currently.

Stock price chart

Detailed analysis

About the company

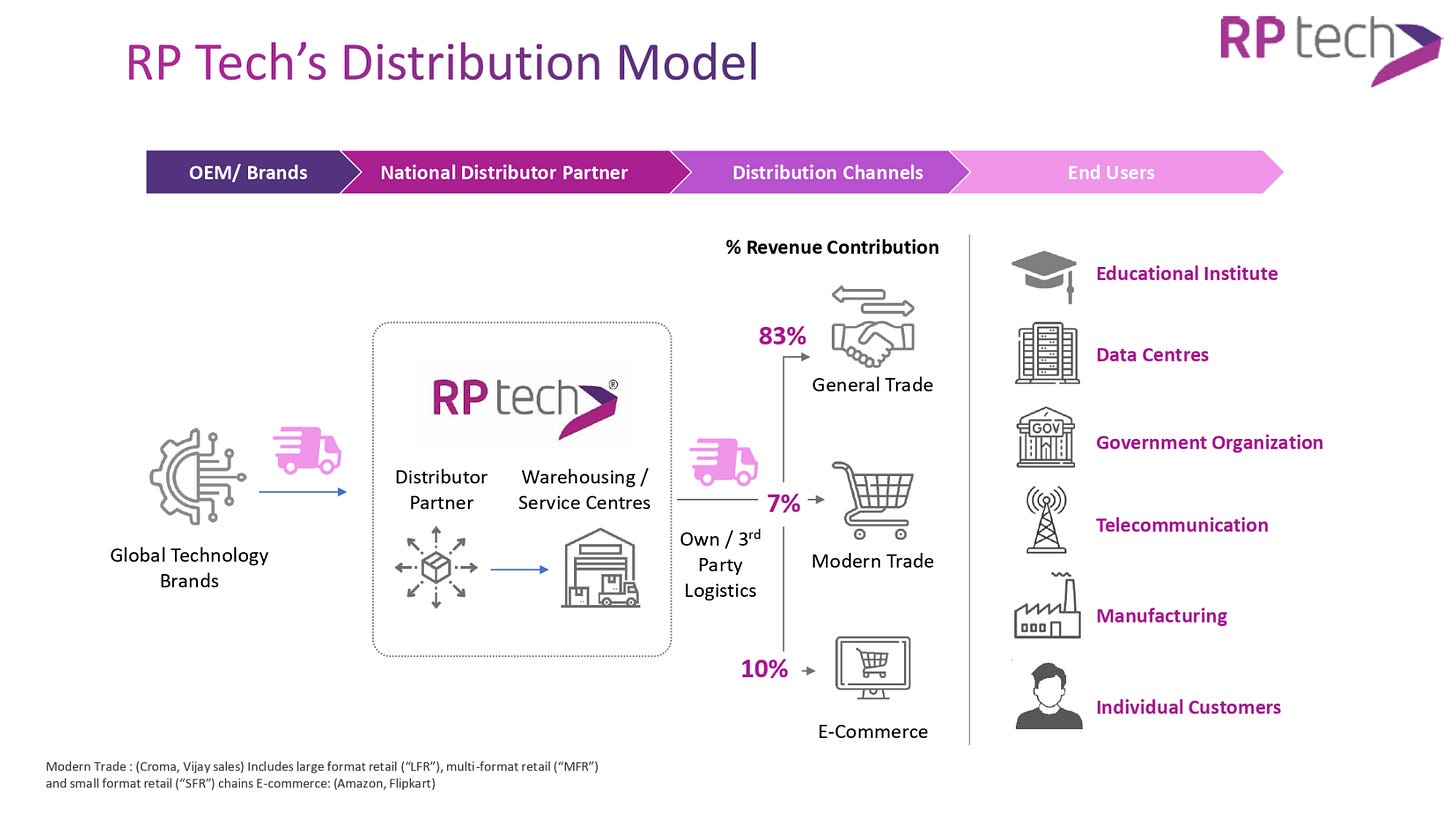

Incorporated in 1989, Rashi Peripherals Ltd(RPTech) is among the leading national distribution partners for global technology brands in India for Information and Communications Technology(ICT) products.

It offers end-to-end services such as pre-sale activities, solutions design, technical support, marketing services, credit solutions and warranty management solutions to it’s clients.

It’s a preferred distribution partner for 60 global brands including Nvidia, Lenovo, HP, Western digital, Logitech etc.

Financial analysis

Overview

The promoter holding is at 63.4% and pledged percentage is 0%.

The debt-to-equity ratio is at 0.45 and price to book value (PBV) is at 1.76.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The total sales increased by 74%.

The interest payment (debt repayment) reduced by 44% as the company has repaid significant debt.

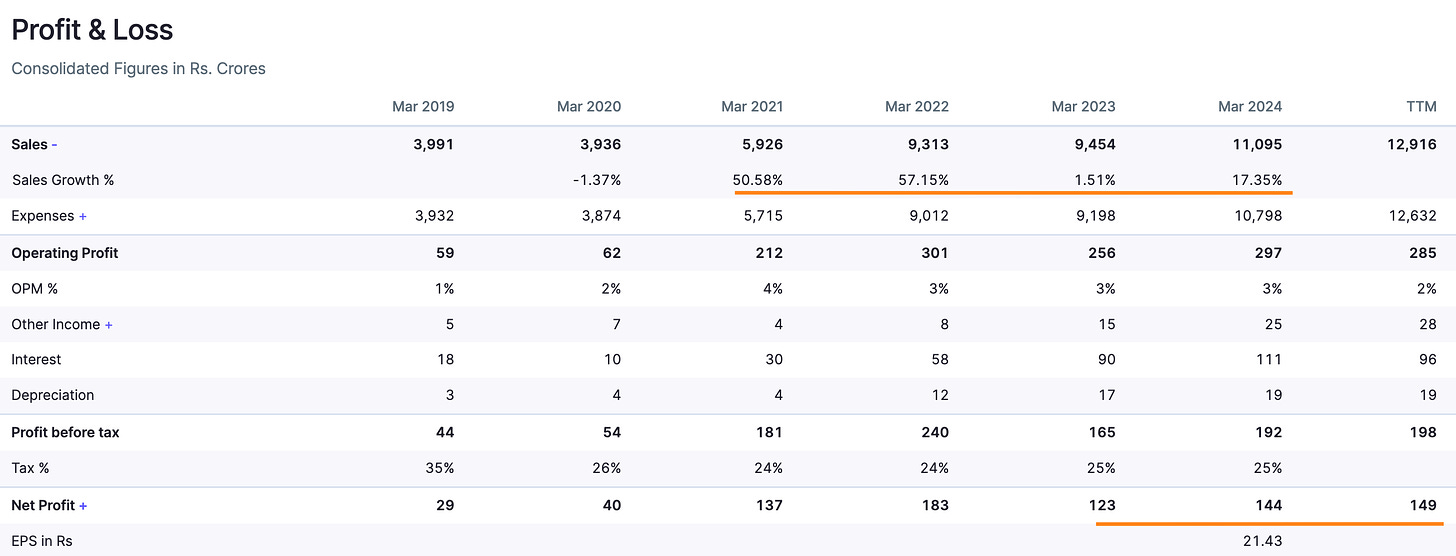

The operating profit margins(OPM) have reduced in the last 4 quarters from 4% to 2% in the previous year.

The net profit increased by 11%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company has faced reduced growth due to disruptions in the sourcing supply chains, and congestions at the ports.

The company has had a consistent track record of profitability, with trailing-twelve-months(TTM) sales trending at +16.4%.

The company has been repaying it’s debt and the debt-to-equity ratio has reduced significantly from 1.48 in FY 2023 to 0.45 currently.

Timing analysis

Institutional volume signs seen in the week of 1st July(16x) and 8th July(11x).

Did you find our analysis on Rashi Peripherals Ltd valuable? Help us reach more investors like you.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in