Raymond Ltd - quarterly sales growth 98%

Company name - Raymond Ltd

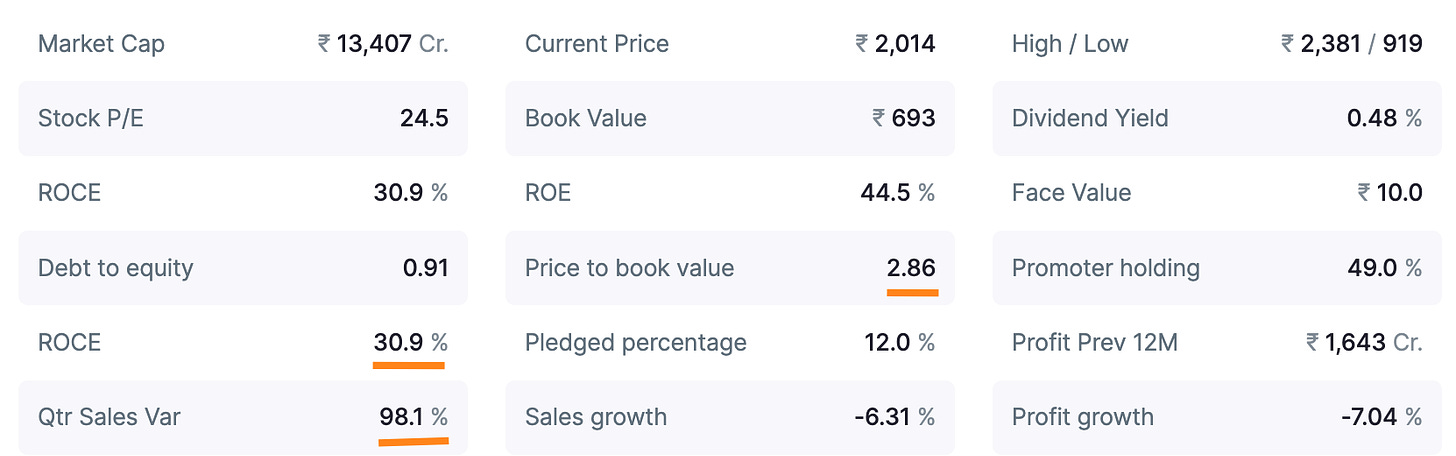

Last closing price(NSE:RAYMOND) - ₹1998.8 (as on 06-Sep-2024)

Executive Summary

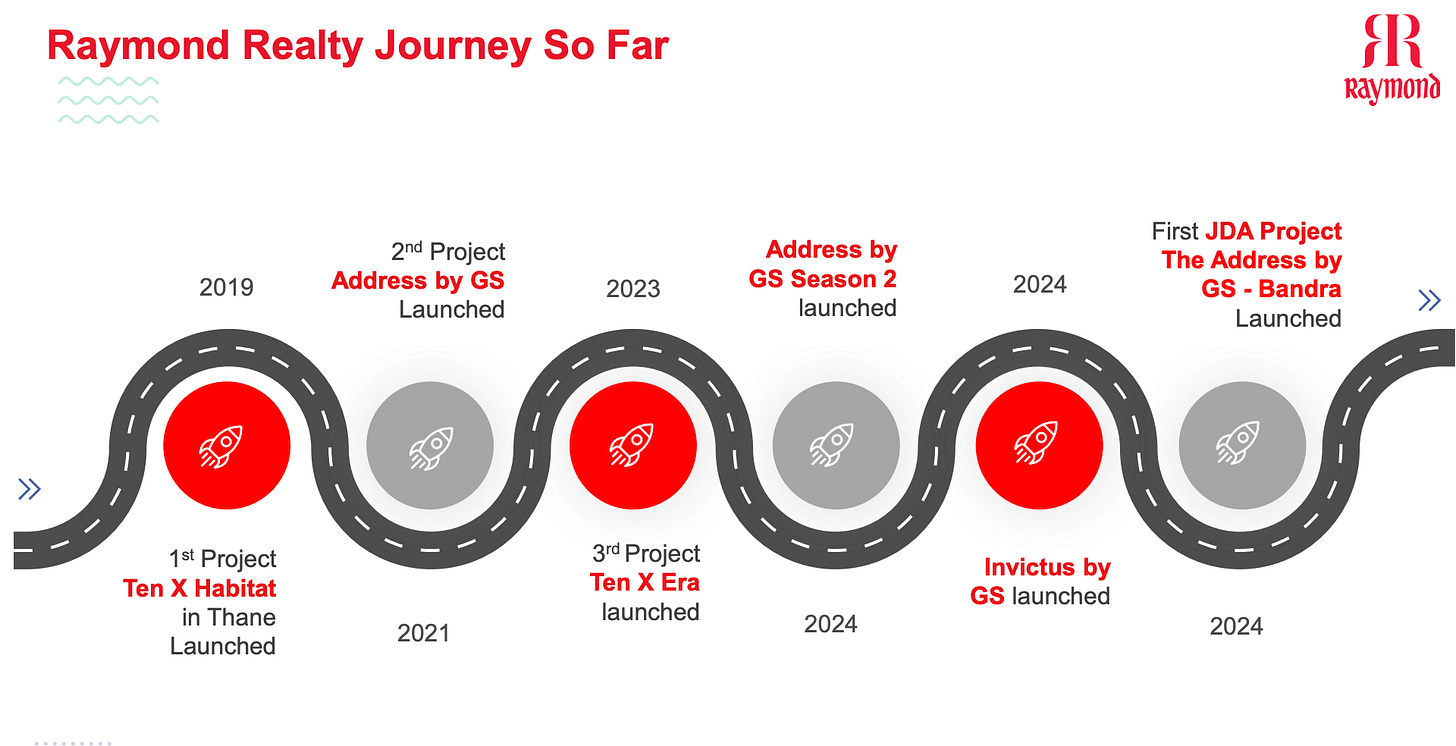

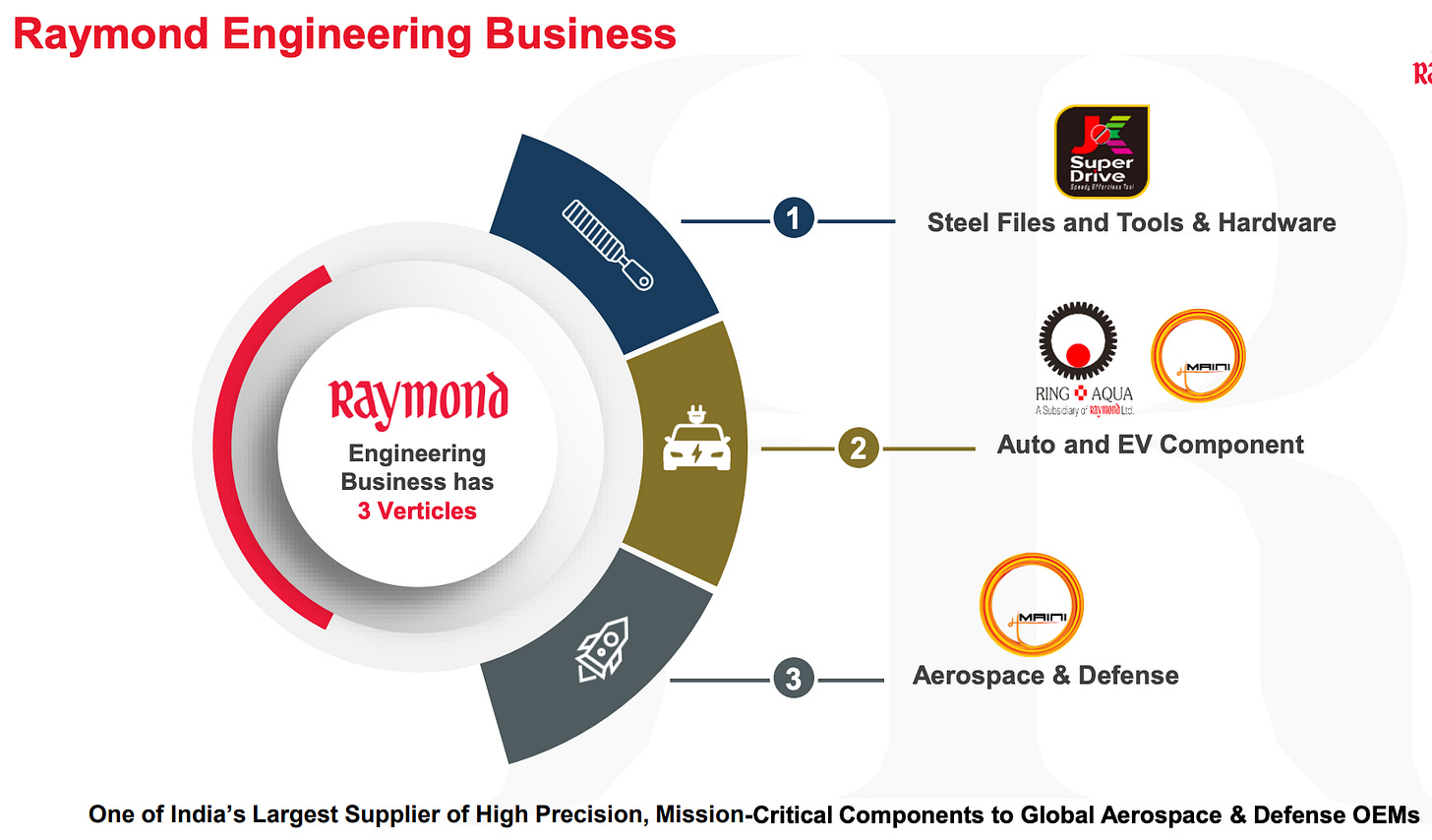

Raymond Ltd incorporated in 1925, is a diversified businesses group with interests in real-estate and engineering. They recently demerged their textile and apparels business to Raymond Lifestyle Ltd which has been listed.

Strong quarterly sales growth reported of 98% in the latest quarter Q1-FY 2025.

The price-to-book value of the peers is between 5 to 8, whereas of Raymond Ltd it is currently at 2.87. This shows potential for price growth.

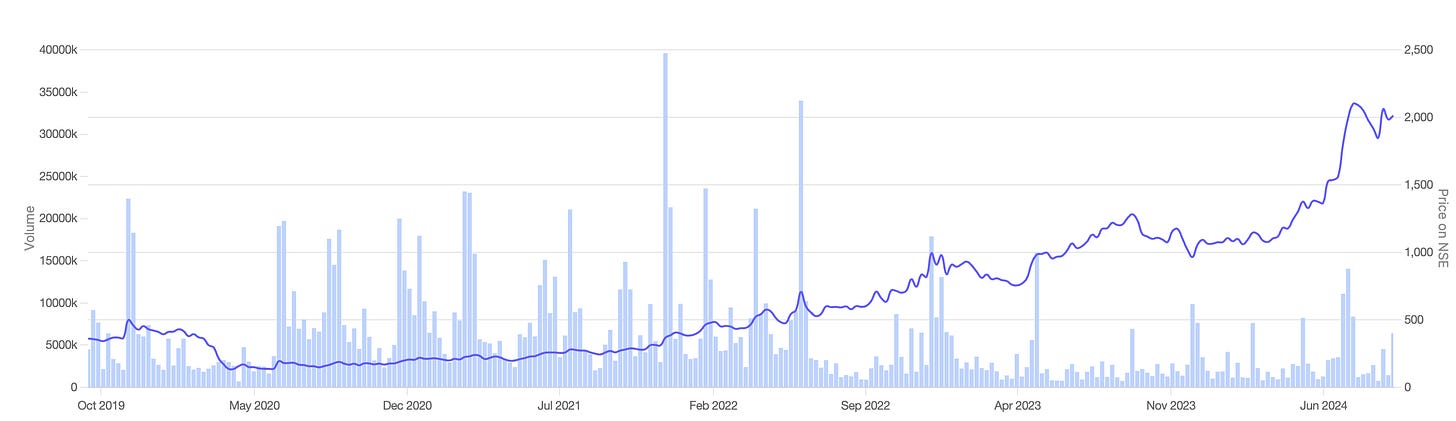

Stock price chart

Detailed analysis

About the company

Raymond Ltd incorporated in 1925, is a diversified businesses group with interests in real-estate and engineering. They recently demerged their textile and apparels business to Raymond Lifestyle Ltd which has been listed.

The total revenue split between real-estate and engineering business is ~54%:46%, and EBITDA split is ~60%:40% respectively. (as of Q1 FY25)

Financial analysis

Overview

The company has a very strong ROCE(return on capital employed) of 30.9%.

Strong quarterly sales growth of 98.1% in the latest quarter Q1-FY 2025.

Price to book value is low at 2.86.

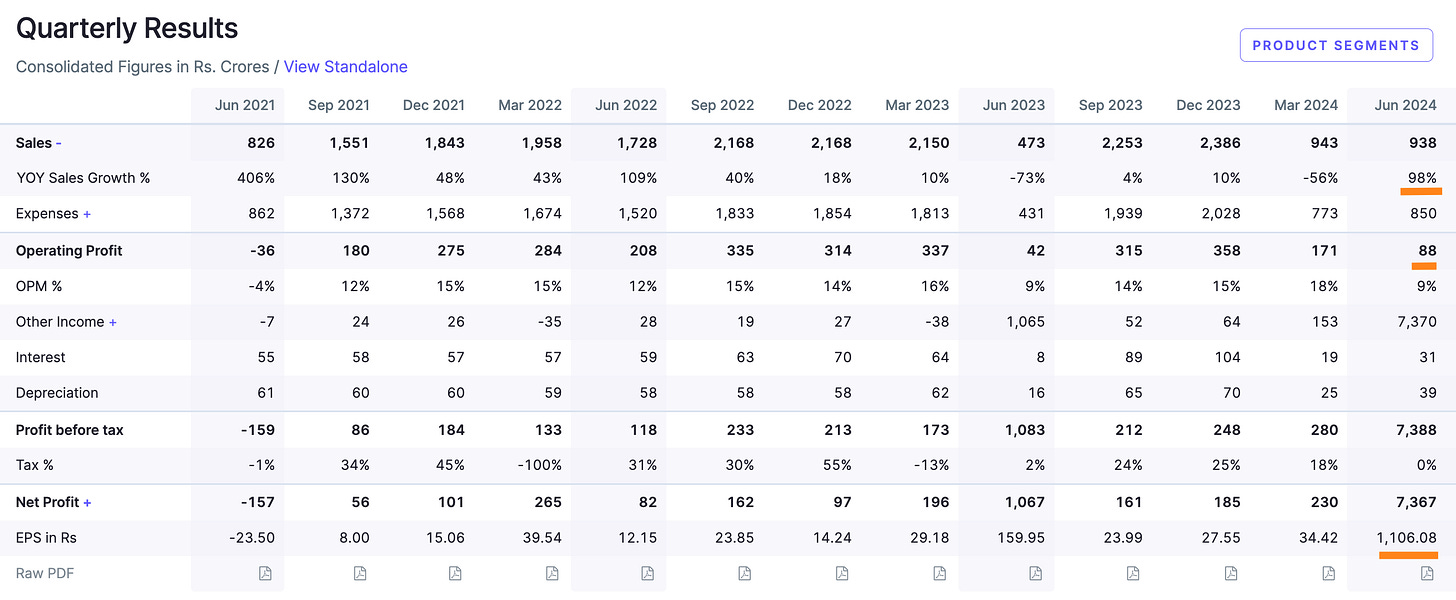

Quarterly results

Growth in key metrics compared to the last year’s same quarter in the latest quarter Q1 - 2025 -

Strong quarterly sales growth reported of 98%.

Operating profit growth of 109%.

Note - The company reported significant sales decline in Q1 and Q4 in the last financial year (FY 2024). They have reported a turnaround in Q1 - FY 2025, further results to be monitored.

Annual results

Growth in key metrics in the last financial year 2024 compared to the last financial year

Net profit increased by 305%. (Note - 74% contribution from other income)

Sales increased by 9.79%.

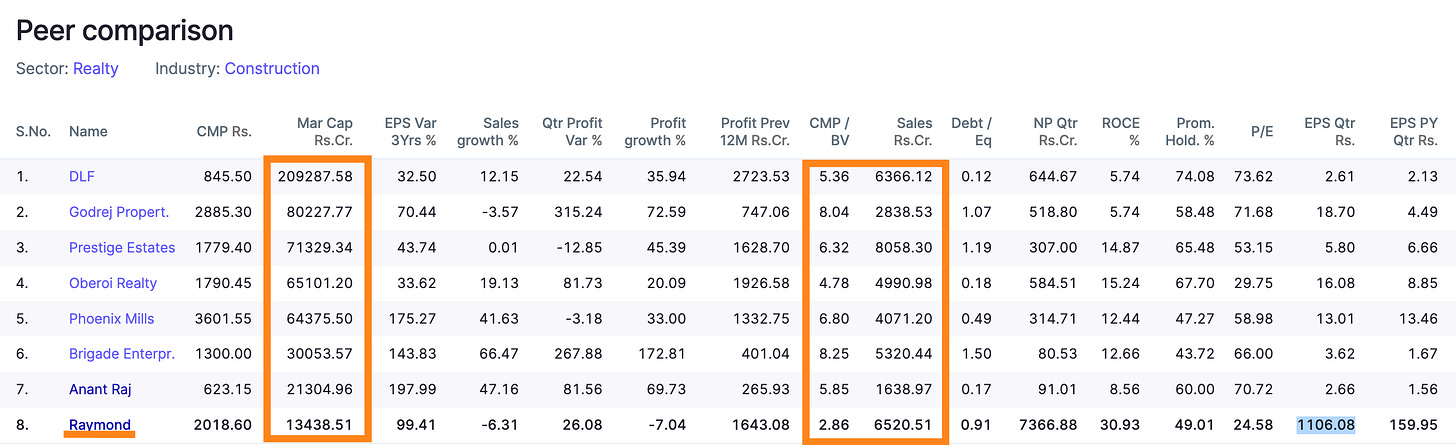

Peer comparison

(Note - the comparison shared above is with other real-estate business peers, but the group also has an Engineering business division as another revenue source and the numbers indicated are consolidated.)

The price-to-book value of the peers is between 5 to 8, whereas of Raymond Ltd it is currently at 2.87. This shows potential for price growth.

The ROCE is highest among the peers at 30.93%.

The company’s sales from real-estate is ~ 3521Cr(considering 54% revenue share). The real-estate peers with similar sales have 2x to 4x market cap.

Did you find our analysis on Raymond Ltd valuable? Share this ahead with your friends.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in