RPG Life Sciences Ltd - 29.5% annual EPS increased

A pharma company recognised among Dun & Bradstreet Top 500 value creators

Company name - RPG Life Sciences Ltd.

Last closing price(NSE:RPGLIFE) - ₹2248.2 (as on 20-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

RPG Life Sciences Ltd is engaged in the manufacturing and marketing of Formulations (Finished Dosage Forms) and Active Pharmaceutical Ingredients (APIs) in the domestic and international market.

The promoter holding has increased over last 3 years, currently at 72.8%.

The company has the highest ROCE among it’s peers at 34.6% and the annual EPS increased by 29.5%.

Stock price chart

Detailed analysis

About the company

RPG Life Sciences Ltd is engaged in the manufacturing and marketing of Formulations (Finished Dosage Forms) and Active Pharmaceutical Ingredients (APIs) in the domestic and international market.

The company is a part of the RPG group which is a diversified conglomerate with interests in areas of infrastructure, tyres, information technology, pharmaceuticals, energy and plantations.

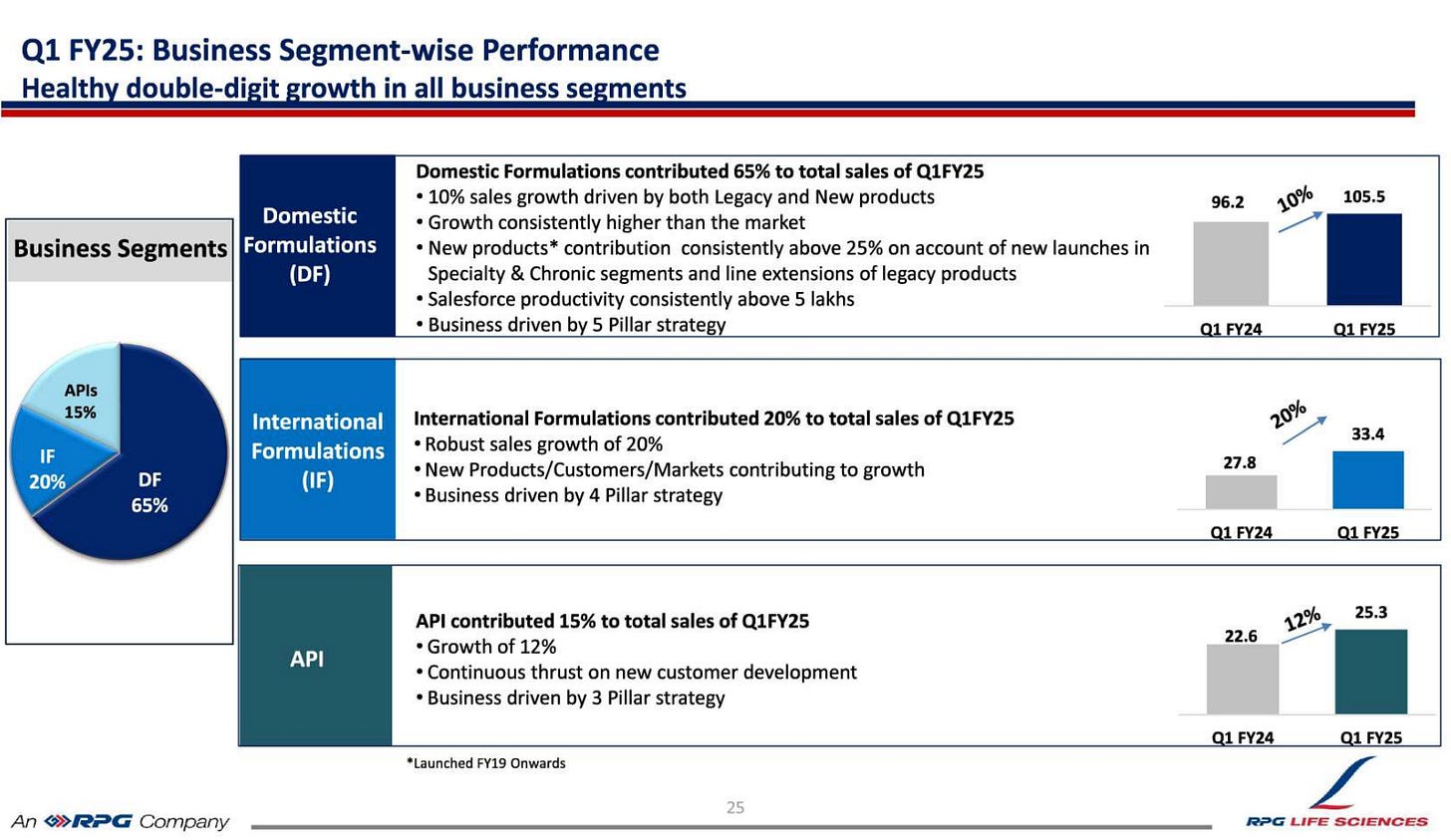

The company operates 3 business segments - Domestic Formulations(65% rev), International Formulations(20% rev) and APIs(15% rev)

Future prospects

(What is the company’s plan to maintain earnings growth in future?)

The growth in International formulations segment. It reported highest sales growth among all other segments at 20%.

Recognition in industry rankings like Dun & Bradstreet Top 500 value creators boosts confidence in achieving targets and creating multi Rs. 100 crores brands.

Capacity expansion and modernization projects nearing completion to support future growth. CAPEX strategy includes situational investments for new opportunities and new product development.

(Potential risks which can hamper the future growth)

Restrictions by emerging market countries on import licenses due to foreign exchange conservation impacting International Formulation business growth.

Fast prescription growth of generic drugs. Adoption will be a function of the % of doctors prescribing the generic drugs.

Financial analysis

Overview

The promoter holding is high at 72.8%. This has increased over the last 3 years, showing signs that the management has conviction on the company’s future growth prospects.

The company has a strong ROCE at 34.6%, and debt-to-equity is 0%.

The pledged percentage is 0%.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The sales increased by 11.94%, and operating profit by 21.85%.

The operating profit margin improved by 9%.

Net profit increased by 22.7% and EPS increased by 21.1%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company has maintained double digit sales growth for the last 3 years, with 13.5% growth in the latest FY.

The company has focused on improving operating profit margins with a 10% improvement reported in FY 2024.

The EPS increased by 29.5% in FY 2024.

Peer comparison

The company has highest operating margin among it’s peers at 22.51%, and highest ROCE at 34.65%

Timing analysis

Institutional high trading volume signs seen recently in the weeks of 15 Jul(10.8x), 22 Jul(11.75x) and 05 Aug(5.98x).

Did you find our analysis on RPG Life Sciences Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in