Samvardhana Motherson International Ltd - 81.4% annual EPS increase

India's largest auto-ancilliaries company by market cap,

Company name - Samvardhana Motherson International Ltd

Last closing price(NSE:MOTHERSON) - ₹212.98 (as on 26-Sep-2024)

Estimated reading time - 3 minutes

The updated performance of all our past analyses is available here.

Executive Summary

The MSSL group is amongst the world's largest manufacturers of exterior rear-view mirrors with a dominant market share, and is a leading global player in polymer-based interior and exterior modules. The group is also the largest manufacturer of wiring harnesses for passenger vehicles in India. It is also India’s largest auto-ancilliaries company by market cap.

The company has had a strong track record of 20%+ sales growth in the last 9 quarters, with the latest sales growth reported at 28.52%.

The annual net profit increased by 80% and the EPS increased by 81.4% in FY 2024.

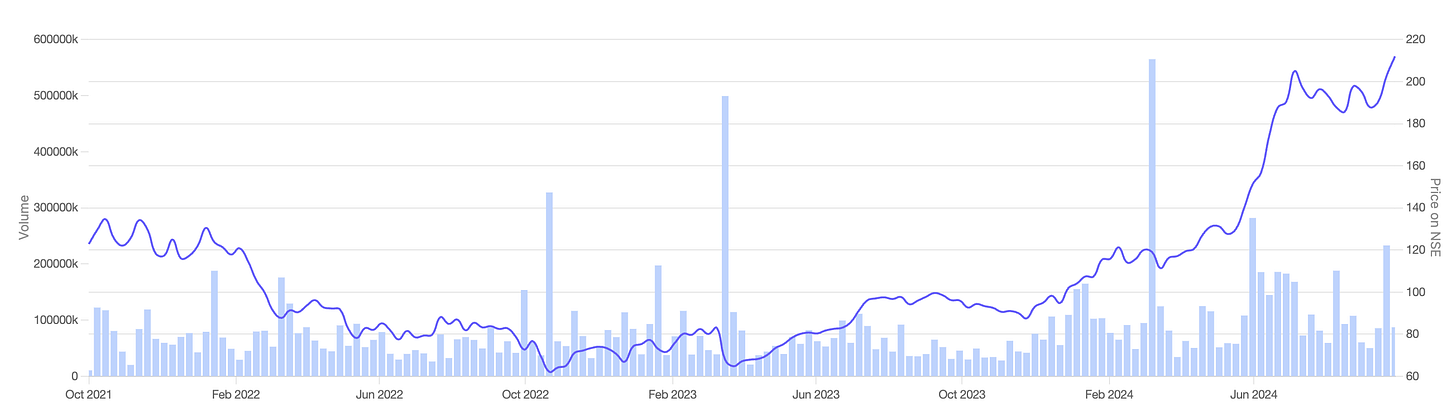

Stock price chart

Detailed analysis

About the company

The MSSL group is amongst the world's largest manufacturers of exterior rear-view mirrors with a dominant market share, and is a leading global player in polymer-based interior and exterior modules.

The group is also the largest manufacturer of wiring harnesses for passenger vehicles in India. It is also India’s largest auto-ancilliaries company by market cap.

It operates 5 business divisions - Wiring Harness, Vision Systems, Modules and Polymer Products, Integrated Assemblies and Emerging Businesses.

Future prospects

What is the company’s plan to maintain earnings growth in future?

The company is focused on improved ROCE and absolute profitability.

It is well-positioned to benefit from tailwinds in emerging markets.

Continuously evaluating growth opportunities and acquisitions.

Impact of key acquisitions like Yachiyo, AD Industries, and Lumen to be visible from FY'25 quarter 1 onwards.

Potential risks that can hamper the future growth?

Logistic costs increased due to the Red Sea crisis and congestion at Asian ports, leading to longer lead times and higher inventories.

Light vehicle production remains largely flat year-on-year, with significant growth from India and China offset by softness in developed markets, especially Europe.

Financial analysis

Overview

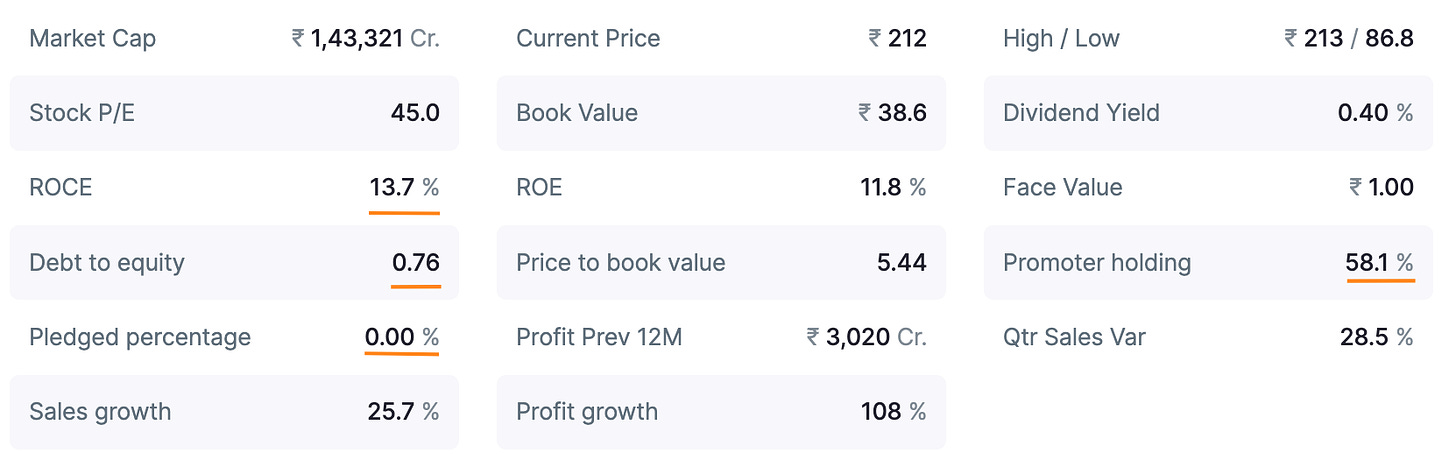

The promoter holding is at 58.1%, and the pledged percentage is 0%.

The company has a ROCE of 13.7%, and debt-to-equity is 0.76.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has had a strong track record of 20%+ sales growth in the last 9 quarters, with the latest sales growth reported at 28.52%.

The operating margins also improved by 11%.

Overall net profit increased by 58.9% and EPS increased by 65.1%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a strong sales growth of 25.26% in FY 2024, and operating profit increased by 12.5%.

The net profit increased by 80% and the EPS increased by 81.4%.

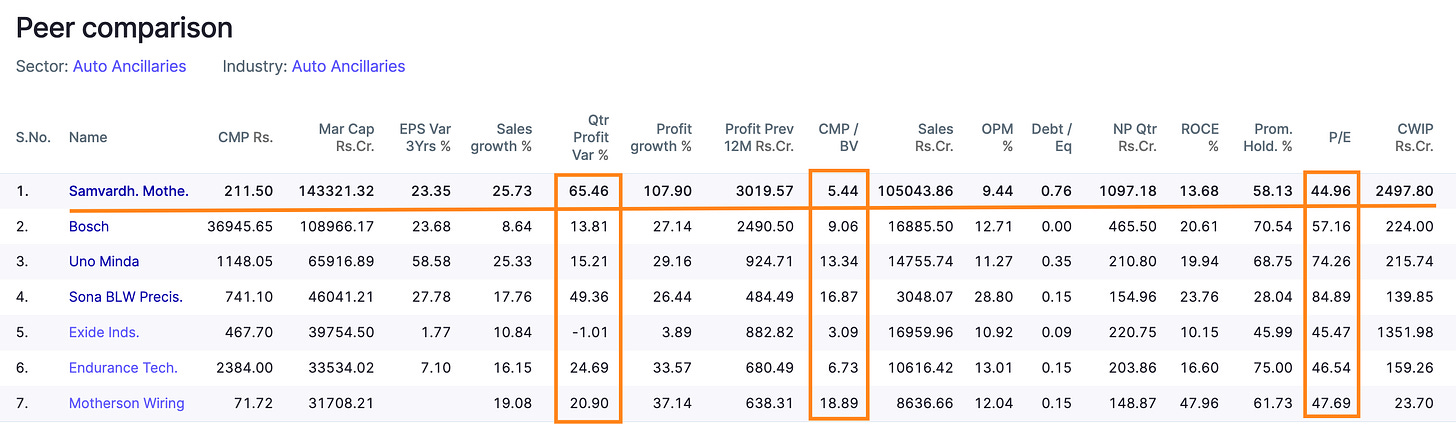

Peer comparison

Even though Samvardhana Motherson International Ltd is the largest among it’s peers in the auto-ancilliaries sector in terms of total sales and profits, it still has -

Highest quarterly profit growth

Lowest P/E at 44.96

Lowest Price-to-book value at 5.44.

Timing analysis

Institutional high trading volume signs seen recently in the week of 16-Sep(4.7x).

Did you find our analysis on Samvardhana Motherson International Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in