Surya Roshni Ltd - operating margins increased by 33%

One of the most respected and trusted brand in Steel Pipes, Lighting & Consumer Durables.

Note - We are observing precaution in the current market conditions. As informed earlier, we were anticipating a correction in the markets and NIFTY50 has corrected 4% in the last 4 trading days. The market trend direction is unclear currently, and hence protecting capital is important.

Company name - Surya Roshni Ltd

Last closing price(NSE:SURYAROSNI) - ₹732.35 (as on 03-Oct-2024)

Estimated reading time - 3 minutes

The updated performance of all our past analyses is available here.

Executive Summary

Established in 1973, ‘SURYA’ is one of the most respected and trusted brand in Steel Pipes, Lighting & Consumer Durables (FMEG) and PVC pipes in India and Globally.

Strong in-hand order book of about ₹ 600 crore as on 30th June 2024 for Oil & Gas sector, Water Sector and Exports business.

The company improved the quarterly operating margins significantly by 33%, and EPS by 56%.

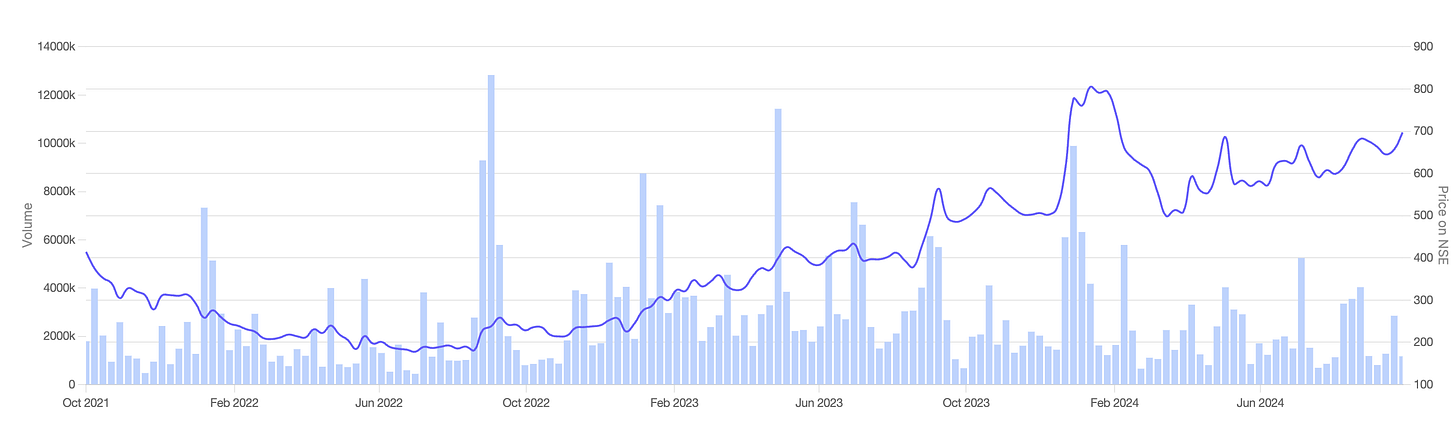

Stock price chart

Detailed analysis

About the company

Established in 1973, ‘SURYA’ is one of the most respected and trusted brand in Steel Pipes, Lighting & Consumer Durables (FMEG) and PVC pipes in India and Globally.

The company operates two segments -

Lighting and Consumer Durables

Steel Pipe and Strips Segment

Future prospects

What is the company’s plan to maintain earnings growth in future?

Strong in - hand order book of about ₹ 600 crore as on 30th June 2024 for Oil & Gas sector, Water Sector and Exports business.

Anticipating revenue growth of 12%-15% for FY25 driven by consumer aspirations and government focus on infrastructure.

Focused on higher value-added products with higher margins, with 75% of capex directed towards these segments.

Spiral pipe plant in Gwalior with an annual capacity of 60,000 tons expected to start operations by December 2024.

Expansion into the residential pump segment with ‘Surya Water Pumps’ launched in July 2024, targeting government-driven initiatives like ‘Har Ghar Jal Yojana’.

Potential risks that can hamper the future growth?

Raw Material Price Volatility - Fluctuating steel and raw material prices can impact margins if costs cannot be passed to customers.

Dependence on Government Projects - Slowdowns or delays in government infrastructure projects could reduce order volumes and revenue growth.

Financial analysis

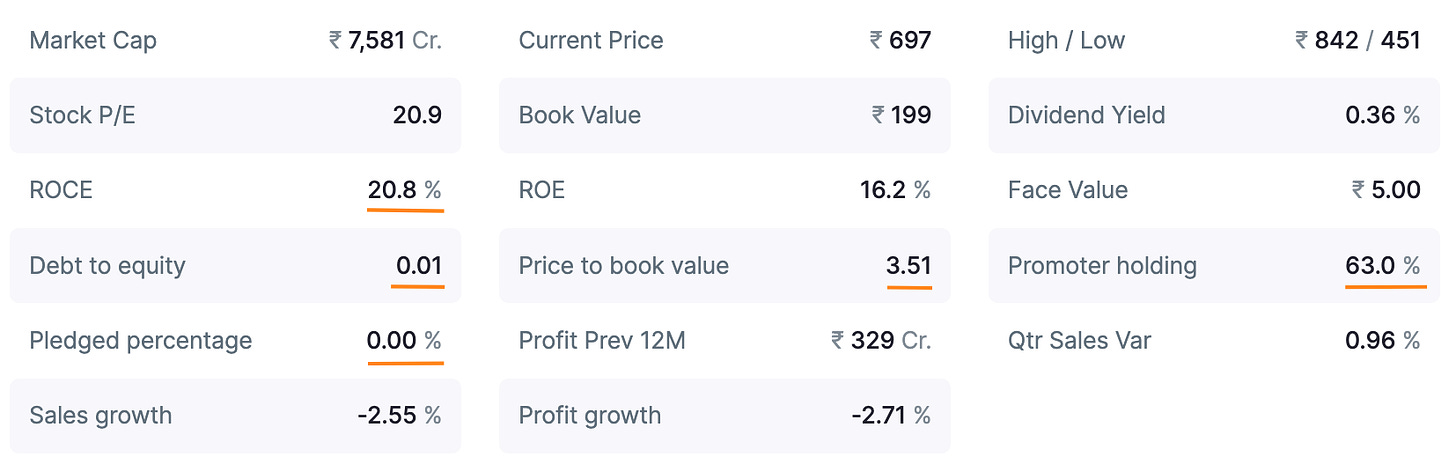

Overview

The company is a zero-debt company, and has surplus cash of ₹156 Cr.

The promoter holding is 63%, and pledged percentage is 0%.

The company has a strong ROCE at 20.8%, and price to book value at 3.51.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The sales growth was muted at 0.96%, but company improved the operating margins significantly by 33%.

This resulted in a operating profit growth of 32% and EPS growth of 56%.

EBITDA/Ton for Steel Pipe and Strips segment increased by 38% on account of better product-mix.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The overall sales growth was negative at -2.34%.

The trailing-twelve-month(TTM) operating profit is +6.4% and EPS is +10.14% is on account of improved margins.

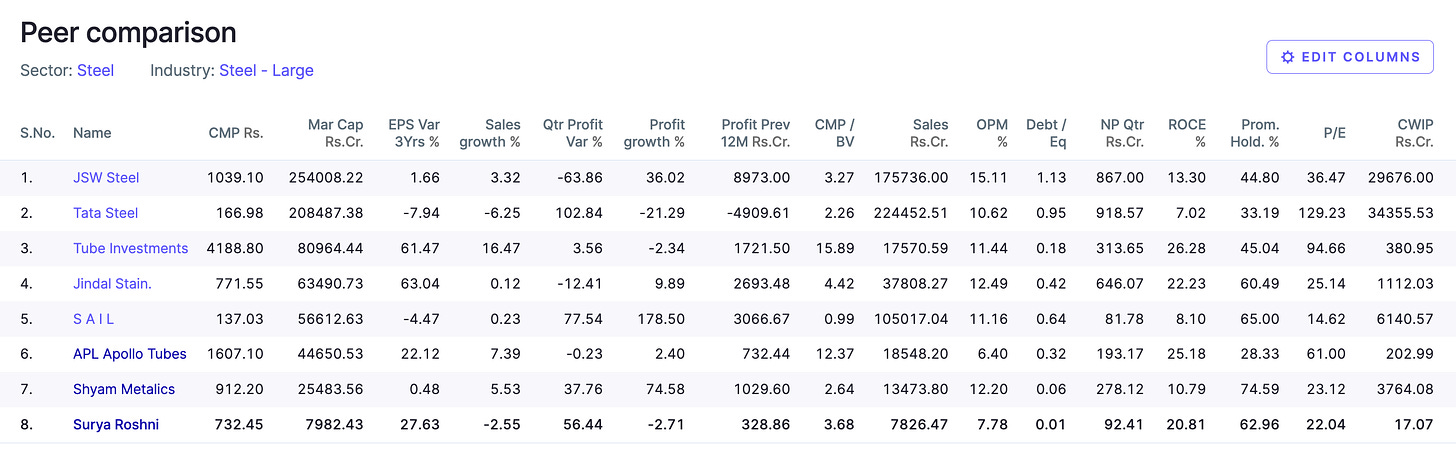

Peer comparison

A peer in the similar product category of tubes - ‘APL Apollo Tubes Ltd’ has (compared to Surya Roshni Ltd) -

Market cap - ₹ 40,923 Cr.(5.39x higher)

Profit in last 12 months - ₹ 732(2.2x higher)

Price to book - 11.4 (3.25x higher) and P/E of 55.9 (2.6x higher)

This shows a potential for Surya Roshni Ltd’s market cap to grow if it is able to maintain it’s growth rate.

Timing analysis

Institutional high trading volume signs seen recently in the weeks of 05 Aug(3.1x), 12 Aug(3.3x) and 19 Aug(3.7x).

Did you find our analysis on Surya Roshni Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in