TARC Ltd - +322% growth in pre-launch sales

Company name - TARC Ltd

Last closing price(NSE:TARC) - ₹231.83 (as on 09-Sep-2024)

Estimated reading time - 4 minutes

Executive Summary

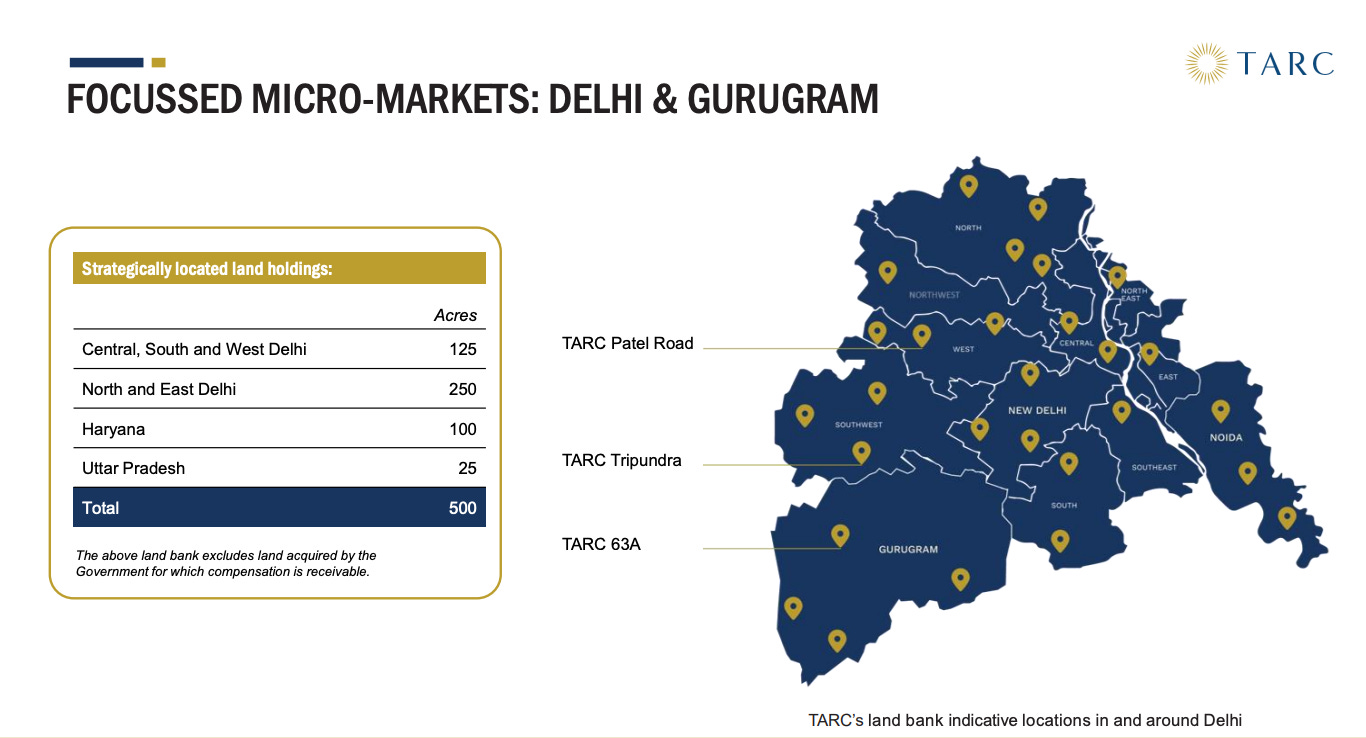

TARC Ltd is a real-estate company operating in the luxury residential real-estate vertical in the Delhi and Gurugram region. The company has a land bank of 500 acre in this region.

The company reported a 322% increase in pre-sale value in FY 2024(compared to FY 2023).

The company has shared a guidance of +310% (5000Cr) in sales targeted for FY 2025.

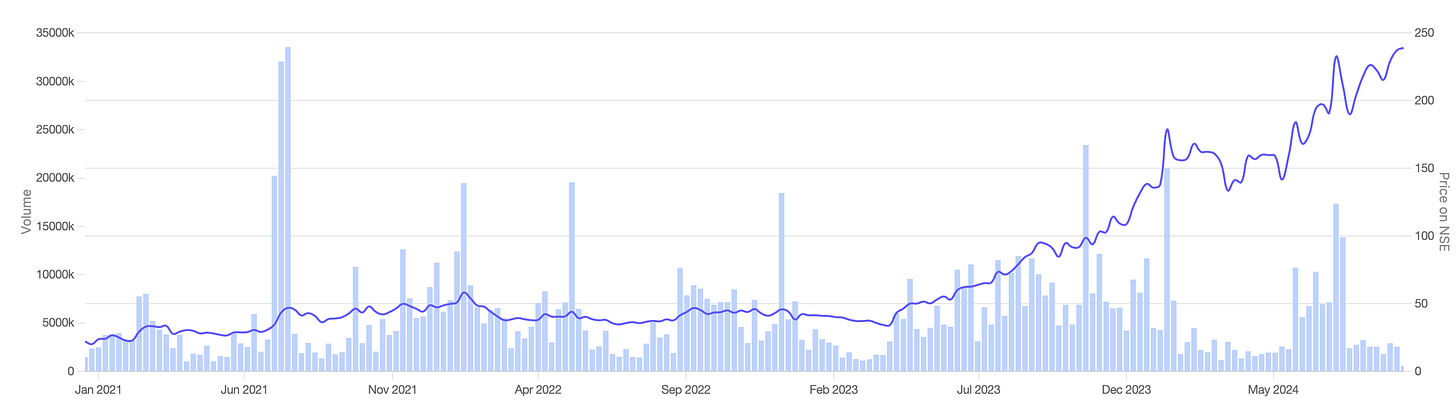

Stock price chart

Detailed analysis

About the company

TARC Ltd. (The Anant Raj Corporation) started out as a construction and contracting company and evolved to become one of the largest real estate development companies and land bank holders in the New Delhi Metropolitan Area.

The company‘s key focus area is luxury residential real-estate vertical. The name of the company has been changed from Anant Raj Global Ltd. to TARC Ltd. in April 2021. The company currently holds a land-bank of 500 acre in Delhi and Gurugram regions.

Market potential for growth

The potential in luxury residential real-estate market -

Recently DLF was in the news for selling 1113 luxury residential units in Gurugram worth ₹7200Cr within 72 hrs of pre-launch of a new project. (ref).

TARC Ltd is operating in the same luxury residential market, and has seen significant growth in pre-launch sales (+322%) in the last financial year and plans to continue the momentum. The company has an edge with 500 acre of land-bank in Delhi and Gurugram region.

Financial analysis

Overview

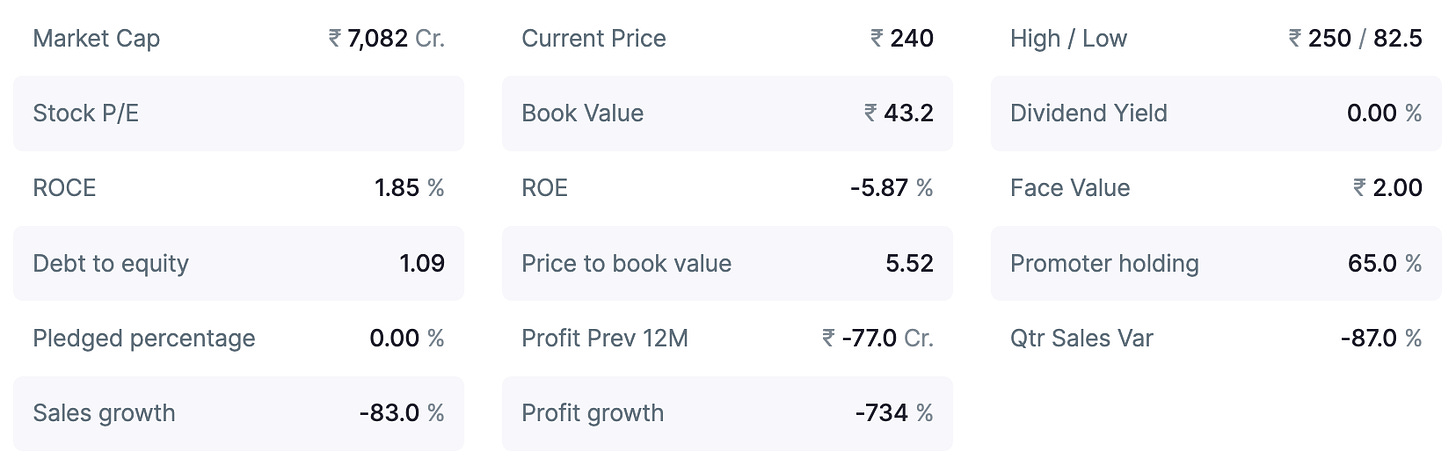

The promotor holding is strong at 65%, and the pledged percentage is 0%.

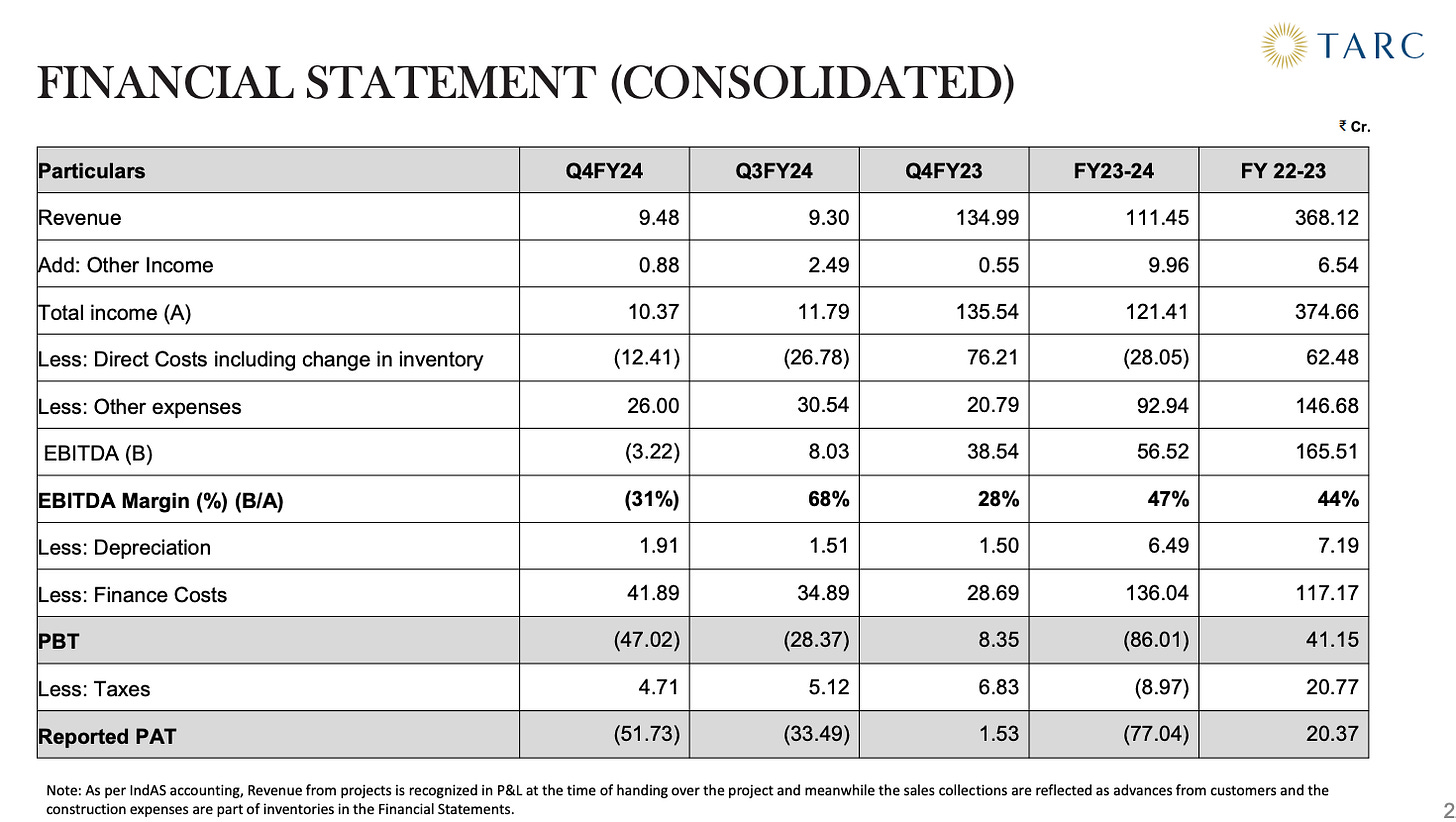

Note - The numbers reported on sales and profit growth are as per IndAS accounting where the revenue is recognised in the P&L at the time of the handover of the project. Hence, pre-launch sales is not accounted here.

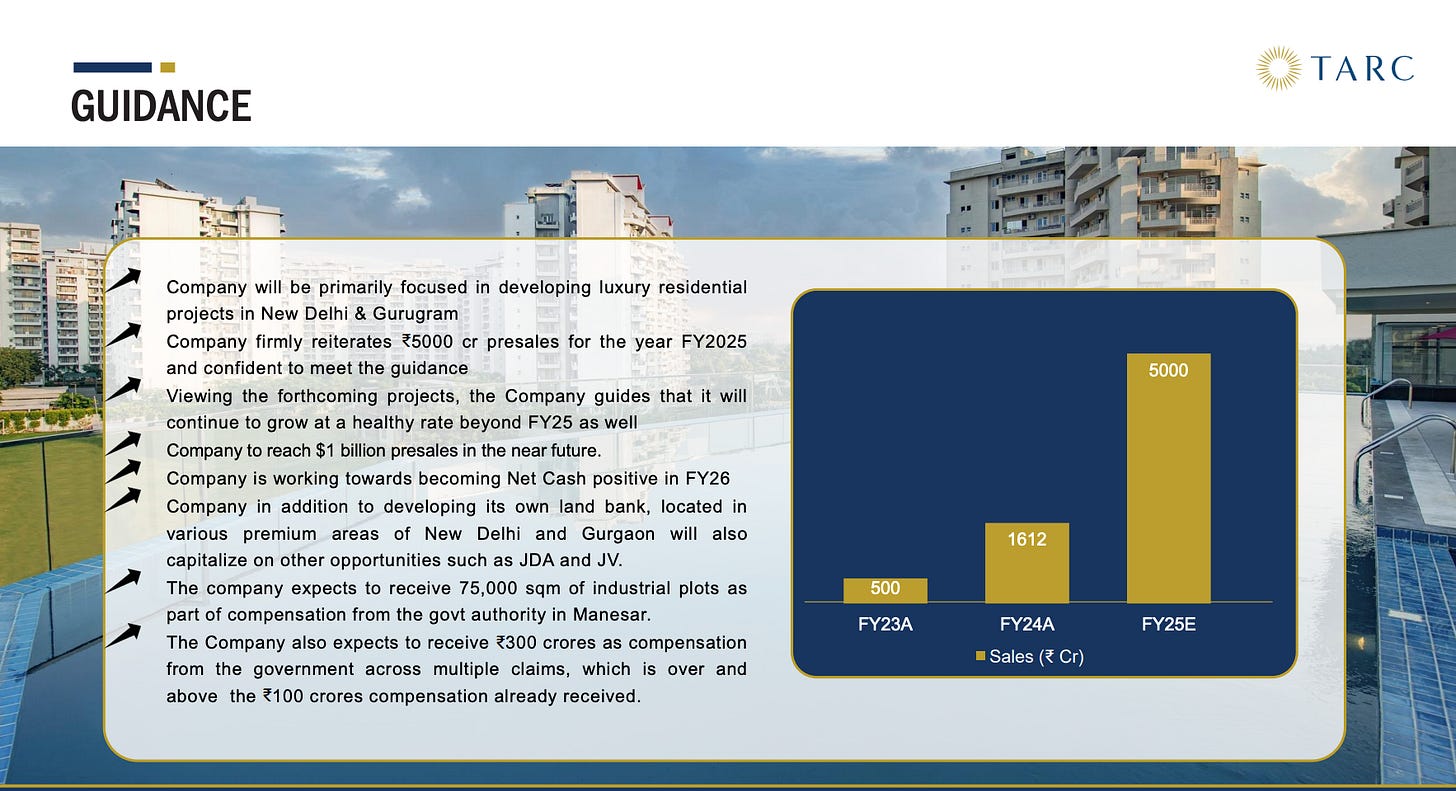

The guidance shared by the company management for FY 2025 -

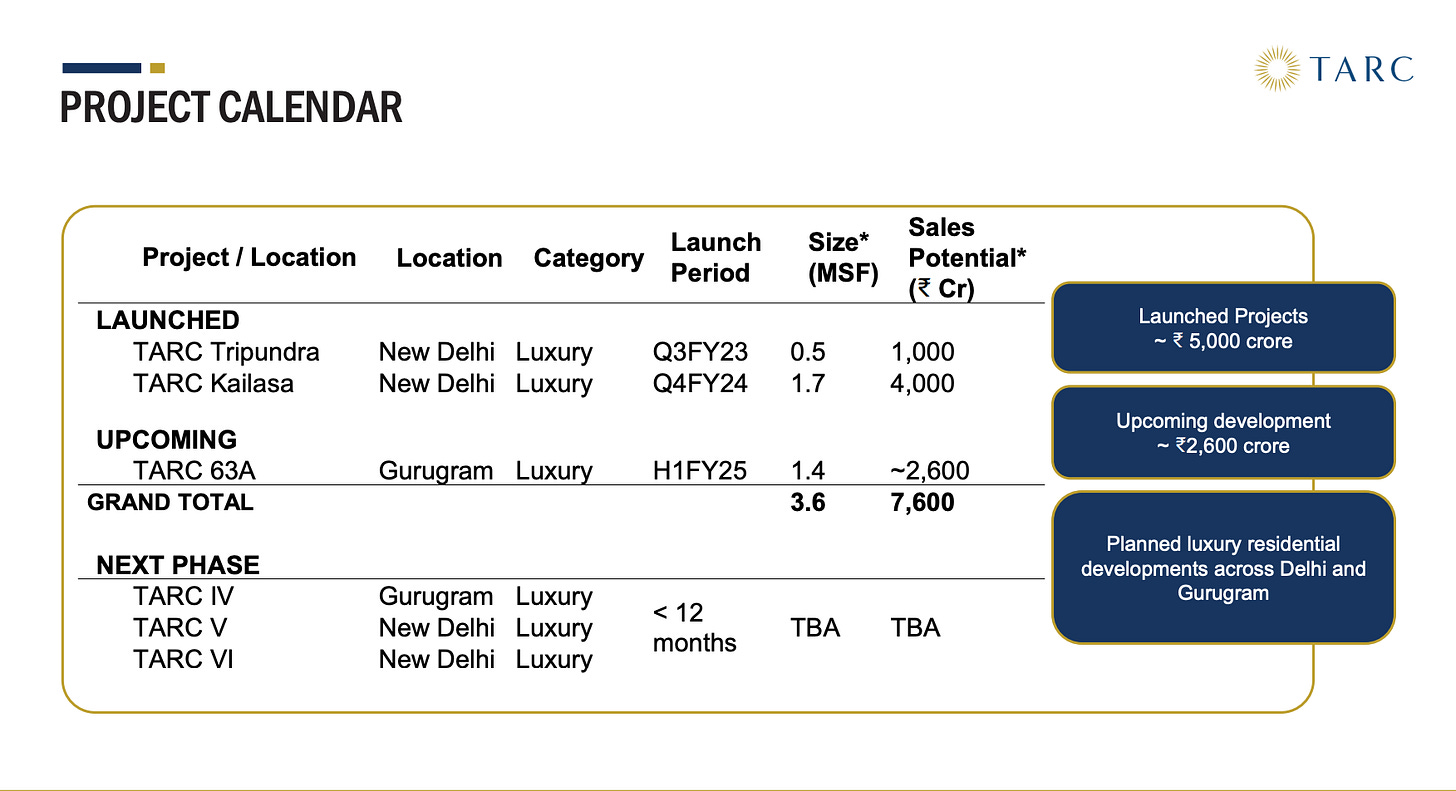

+310% (5000Cr) in sales targeted.

The company is aiming to become debt-free in the next 3 years, and cash-flow positive in FY 2026.

Quarterly results

Reported numbers (as per IndAS accounting) -

Numbers including pre-sales -

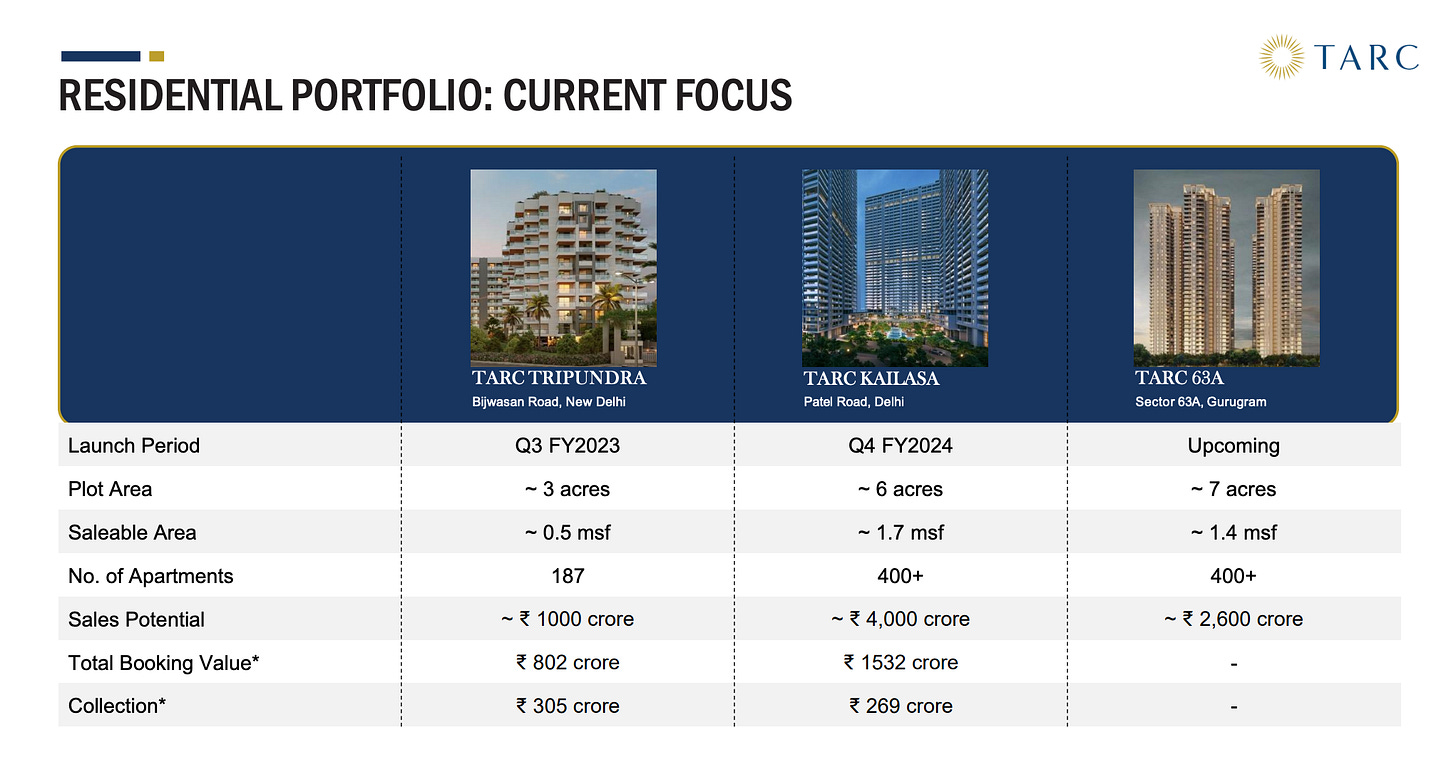

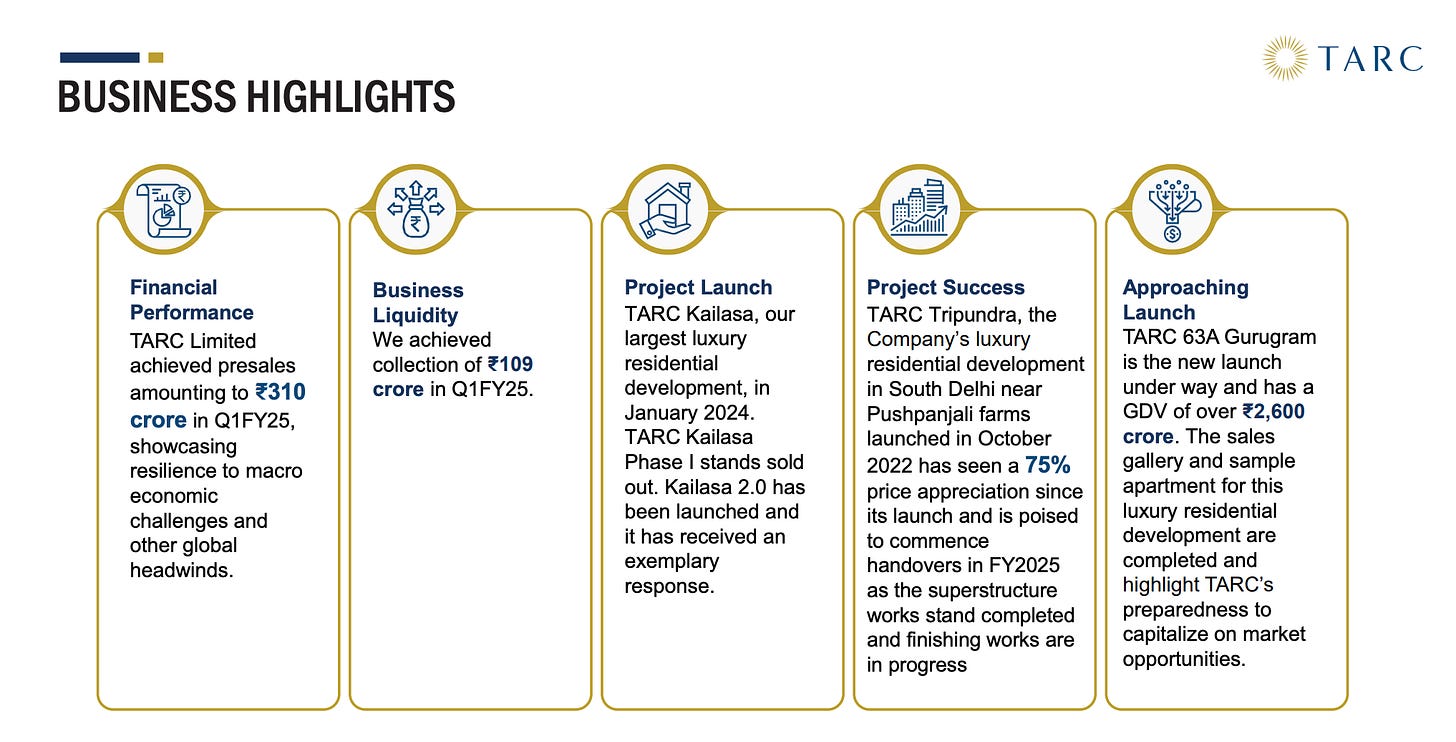

The company has achieved pre-sales of ₹310 Cr in Q1-FY2025.

Annual results

The company reported a 322% increase in pre-sale value in FY 2024(compared to FY 2023).

TARC launched ₹4000 Cr worth of luxury residential projects in FY 2024, and will be launching a new project with sales potential of ₹2600 Cr in Gurugram in FY2025.

These are expected to put the company on the path of achieving ₹5000 Cr in of pre-sale amount in FY2025.

Note - The numbers reported on sales and profit growth are as per IndAS accounting where the revenue is recognised in P&L at the time of handover of the project. Hence, pre-launch sales revenue is not accounted here.

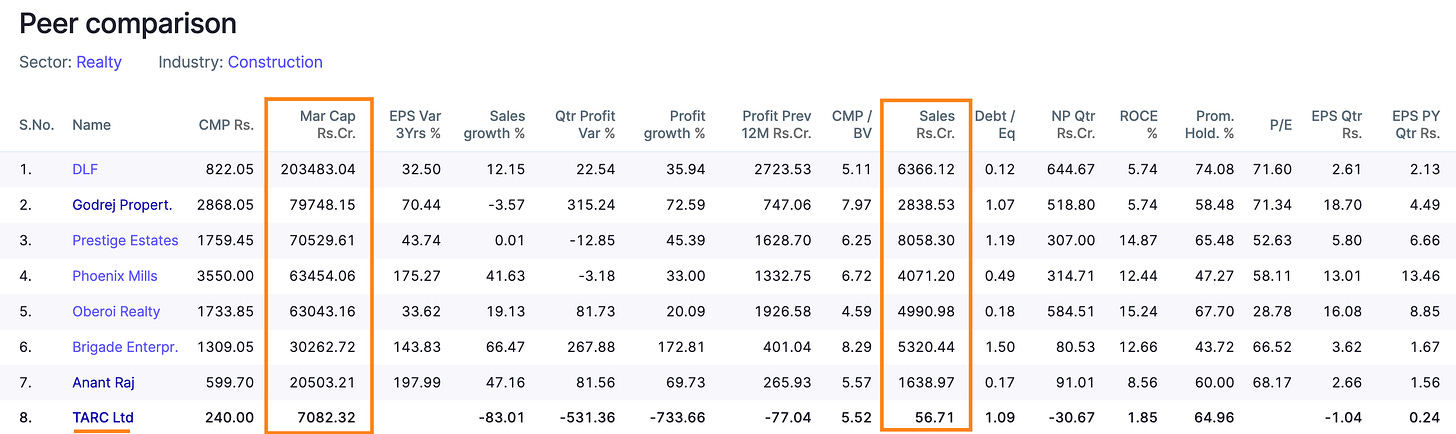

Peer comparison

With the guidance of ₹5000 Cr in the pre-sales targeted in the current FY 2025, the company’s market cap has potential to grow significantly.

The peers with an annual sales of ~₹5000Cr are valued 4x to 9x in market cap currently.

Timing analysis

Institutional volume signs seen in the week of 1st July with trading volume increasing 7x to average trading volumes of the company’s stock.

Did you find our analysis on TARC Ltd valuable? Share this ahead with your friends.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in