TBOTEK - EPS growth of 40%

Company name - TBO TEK LTD.

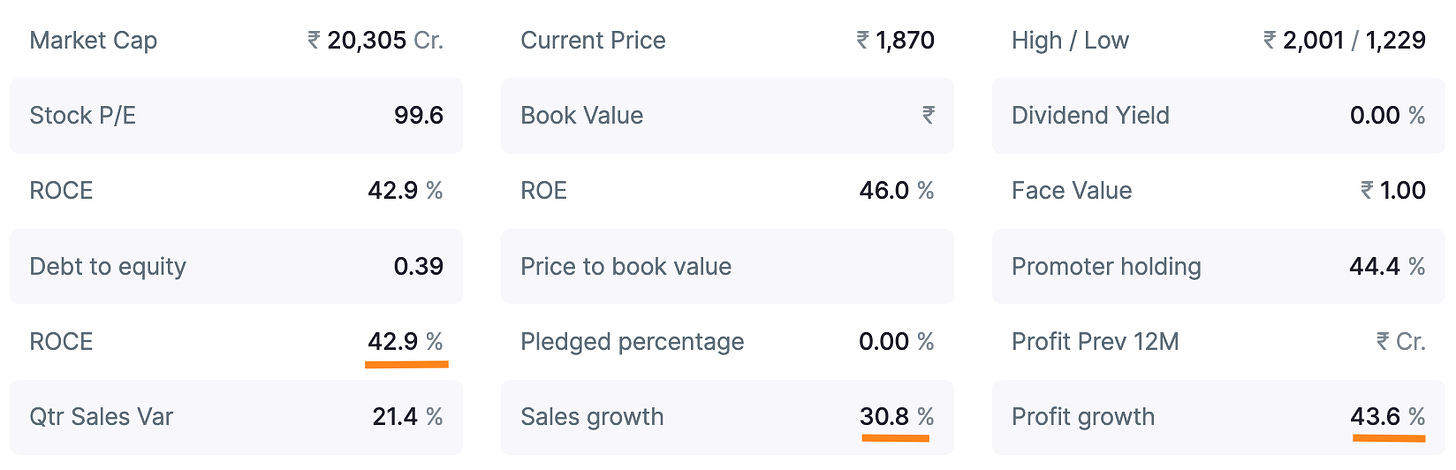

Last closing price(NSE:TBOTEK) - ₹1869.3 (as on 05-Sep-2024)

Executive Summary

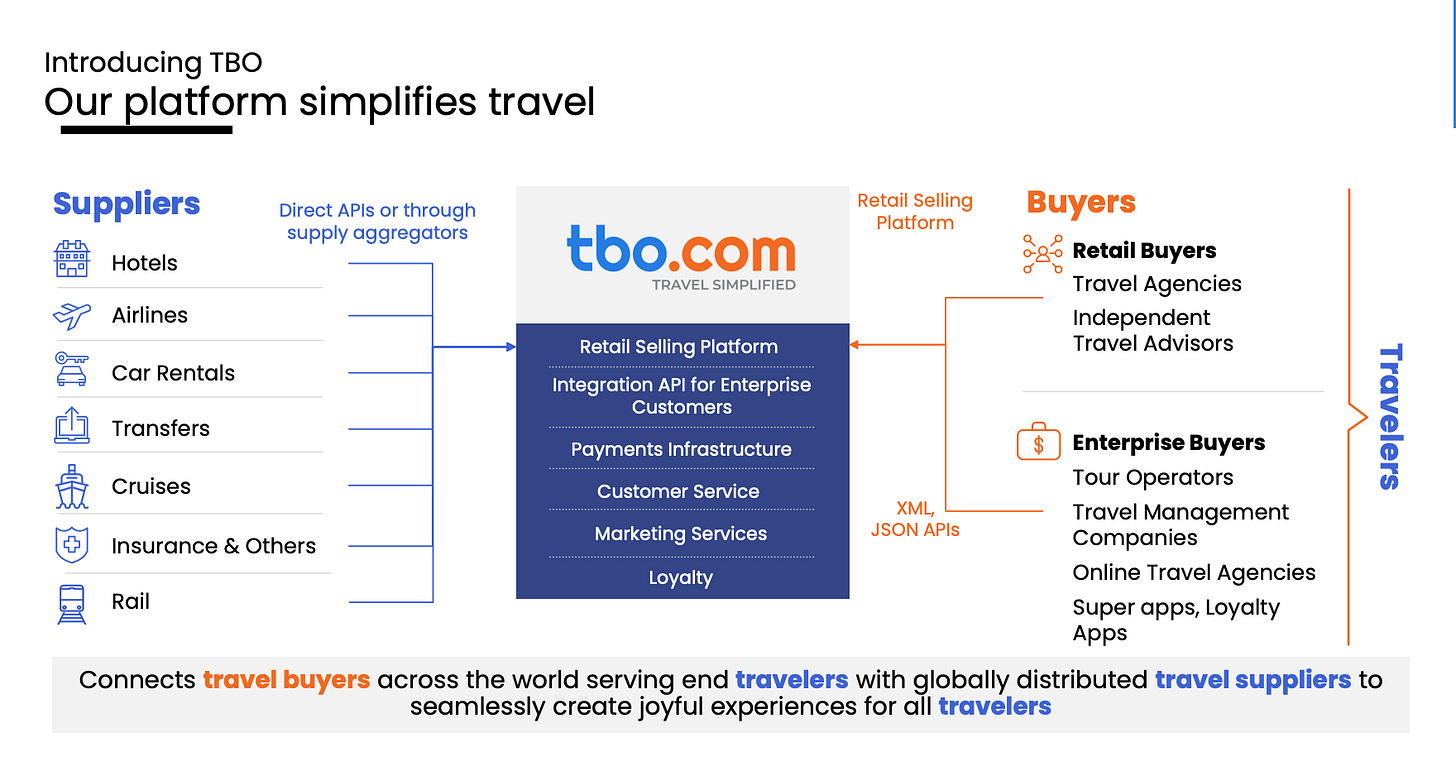

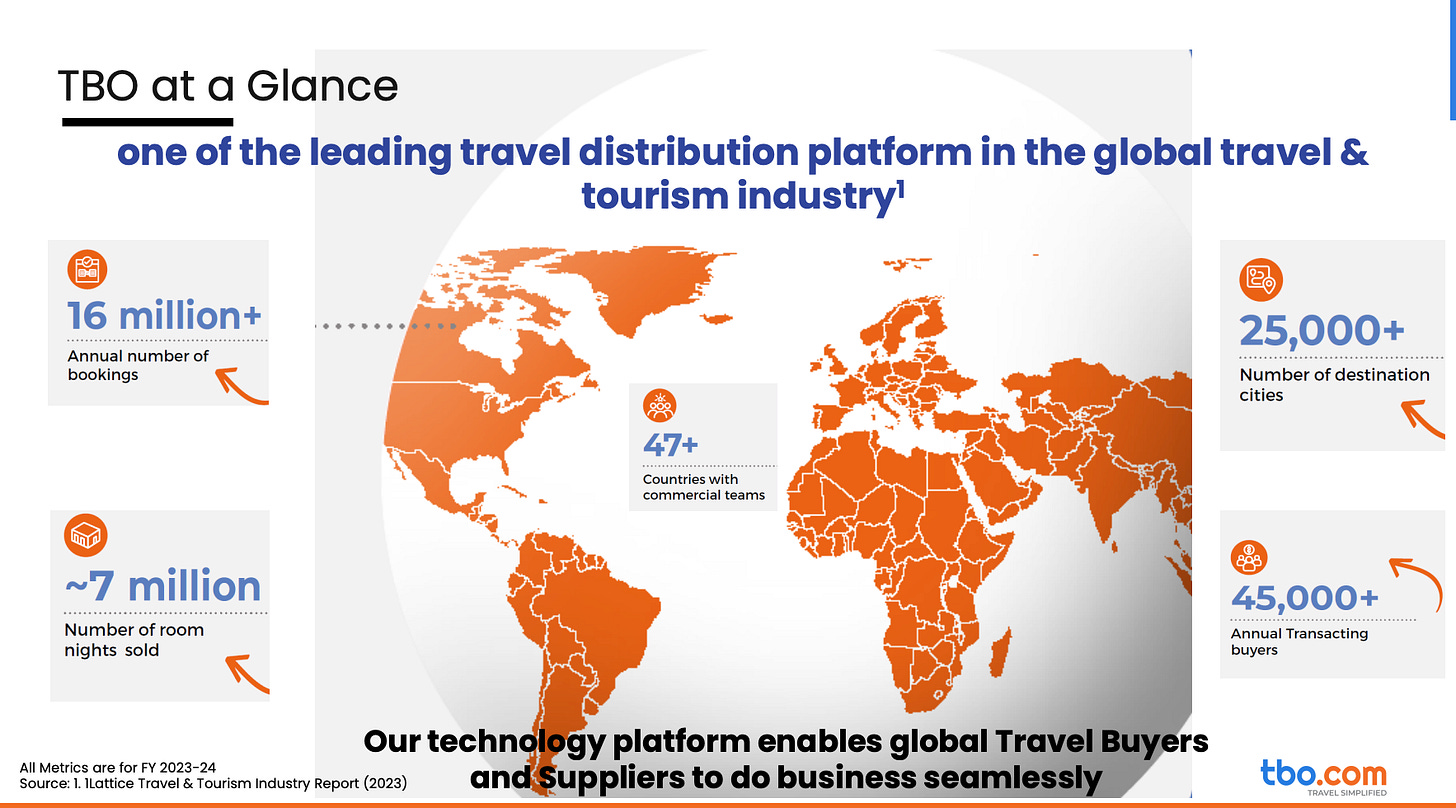

The company operates an online B2B travel distribution technology platform that provides a wide range of offerings and connects Buyers and Suppliers.

EPS growth of 40% (year-on-year) and 22.22% (quarter-on-quarter)

The company has a very strong ROCE(return on capital employed) of 42.9%.

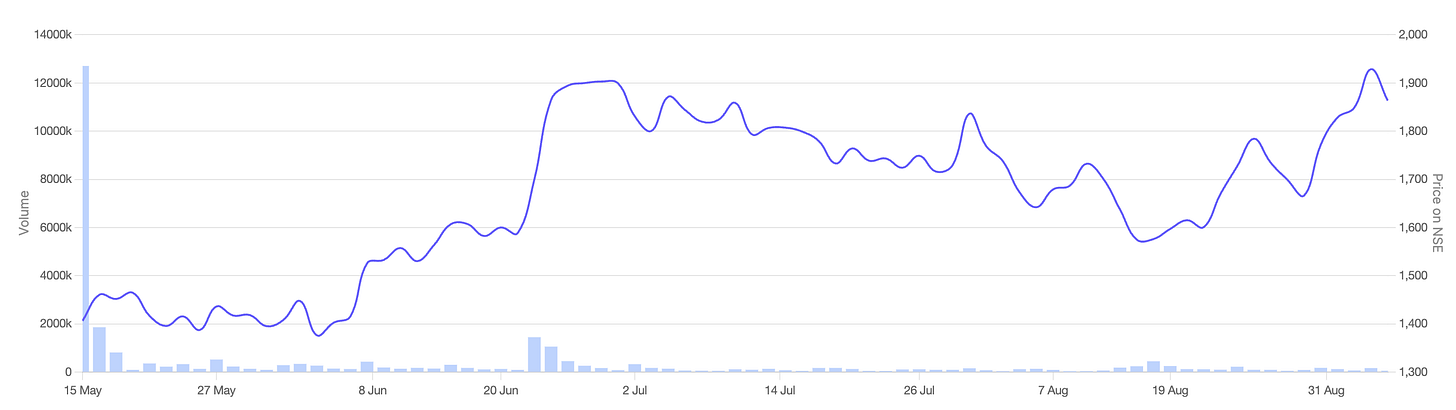

Stock price chart

Detailed analysis

About the company

Established in 2006, the company operates an online B2B travel distribution technology platform that provides a wide range of offerings and connects Buyers and Suppliers.

On the platform, the suppliers such as hotels, airlines, car rentals, transfers, cruises, insurance, rail and others can connect with buyers.

Performance summary

Financial analysis

Overview

The company has a very strong ROCE(return on capital employed) of 42.9%.

The debt to equity ratio is in control at 0.39.

Strong sales growth of 30.8% and profit growth of 43.6%.

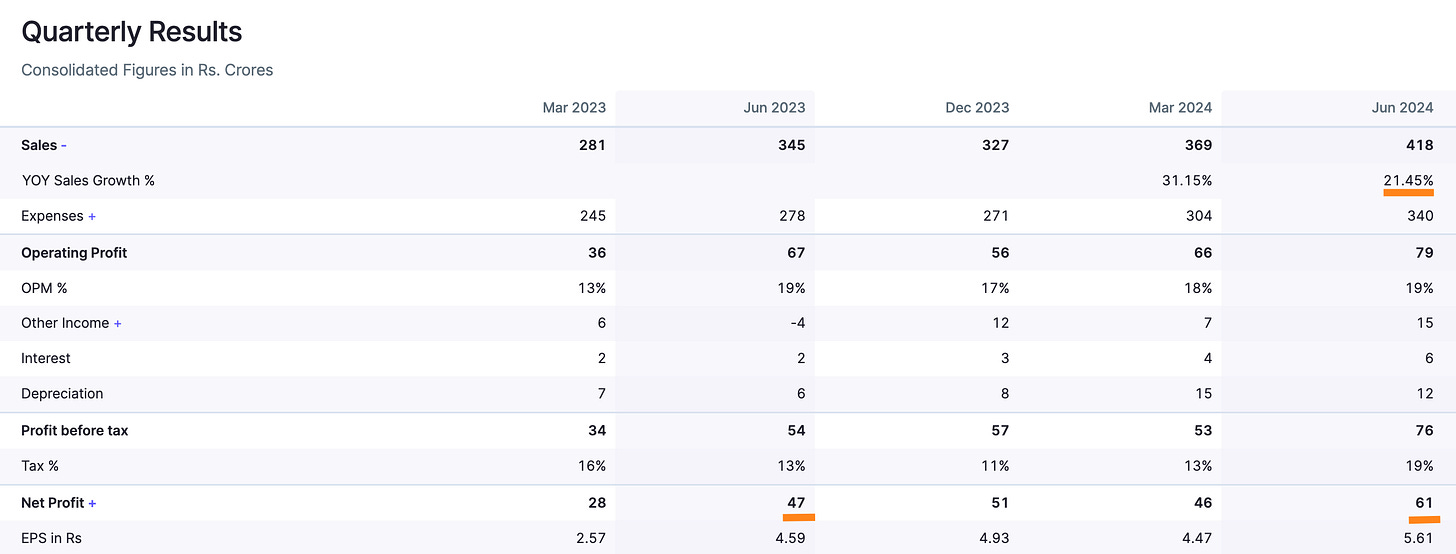

Quarterly results

Growth in key metrics compared to the last year’s same quarter in the latest quarter Q1 - 2025

Strong quarterly sales growth reported of 21.45%

Net profit improved by 29.78%

EPS growth of 22.22%

Annual results

Growth in key metrics in the last financial year 2024 compared to the last financial year

Consistent track record of sales growth, with sales growing 30.83%

Net profit growth of 35.81%

EPS growth of 40%

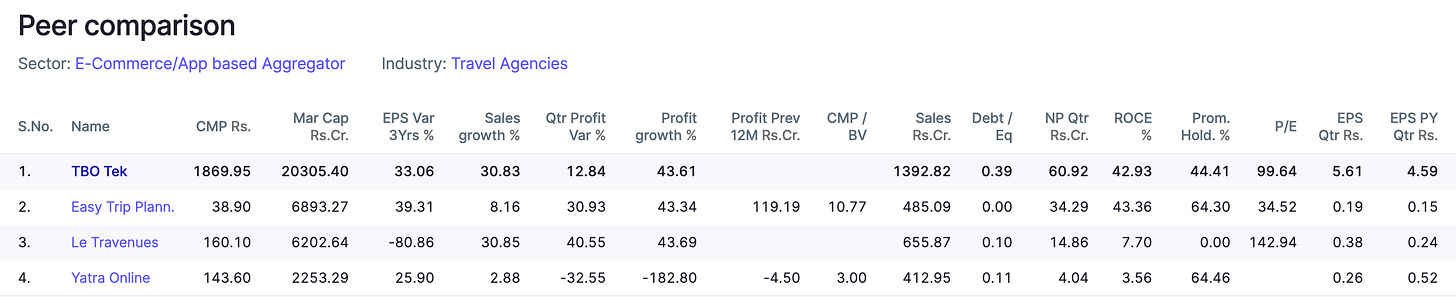

Peer comparison

The ROCE and profit growth is among the highest in the peers at 30.83% and 43.61% respectively.

Did you find our analysis on TBO TEK Ltd valuable? Share this ahead with your friends.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in