Themis Medicare Ltd - quarterly EPS growth 35.3%

A pharma company with signs of turnaround after 7 quarters

Company name - Themis Medicare Ltd

Last closing price(NSE:THEMISMED) - ₹269.4 (as on 13-Sep-2024 )

Estimated reading time - 3 minutes

<Summary of previous analyses available here>

Executive Summary

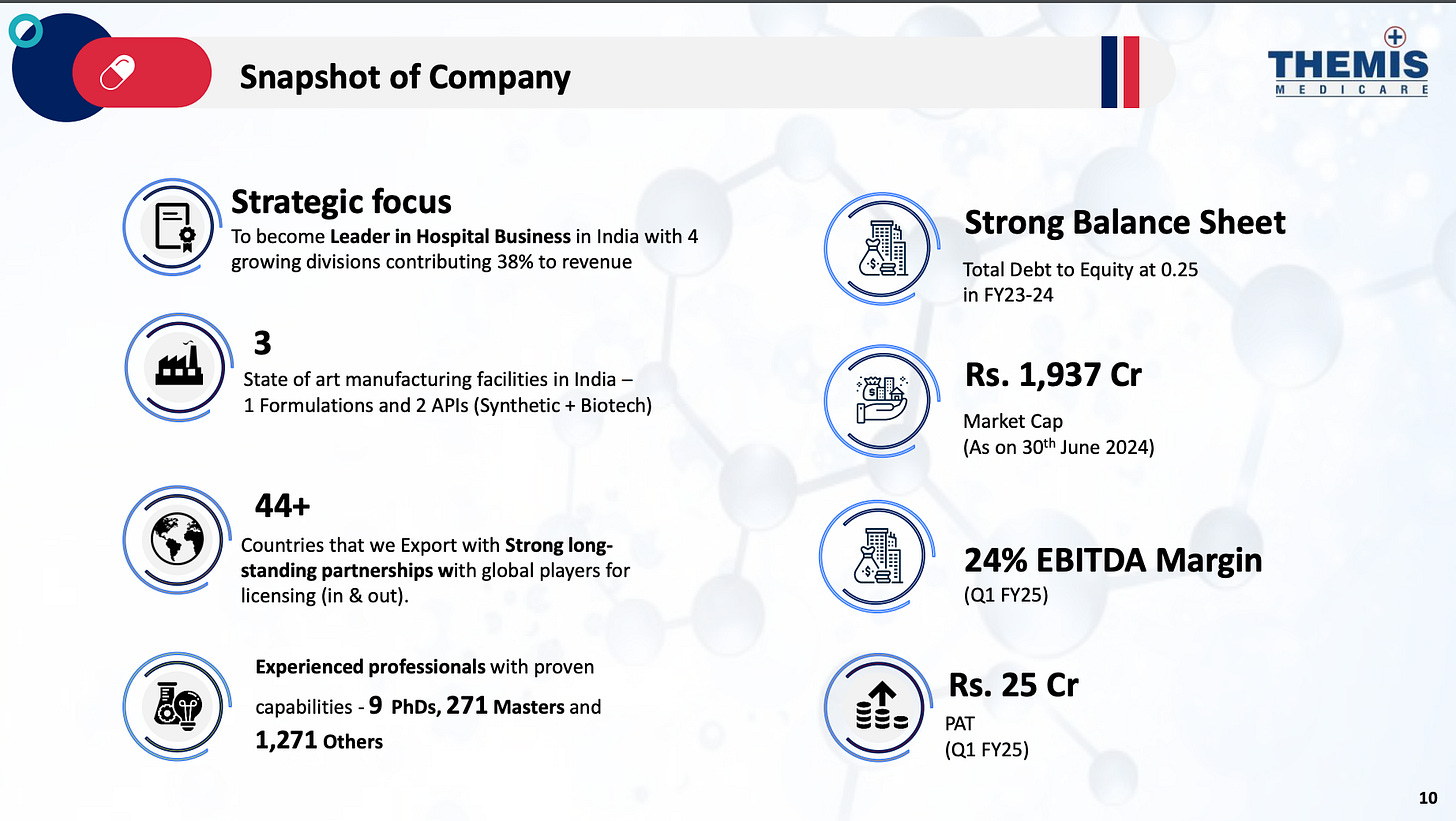

Themis Medicare is principally engaged in the activities pertaining to manufacturing of pharmaceutical products, especially in Formulation and API activity.

The promoter holding is 67.2%, and ROCE is 13.5%.

The company has reported a turnaround in sales with 22%+ sales growth in the last 2 quarters, while it was negative in the previous 7 quarters.

Quarterly EPS growth +35.3%.

Stock price chart

Detailed analysis

About the company

Themis Medicare is principally engaged in the activities pertaining to manufacturing of pharmaceutical products, especially in Formulation and API activity.

The company operates 3 business segments -

Hospital business - 36% revenue

Trade business - 15% revenue

API business - 49% revenue

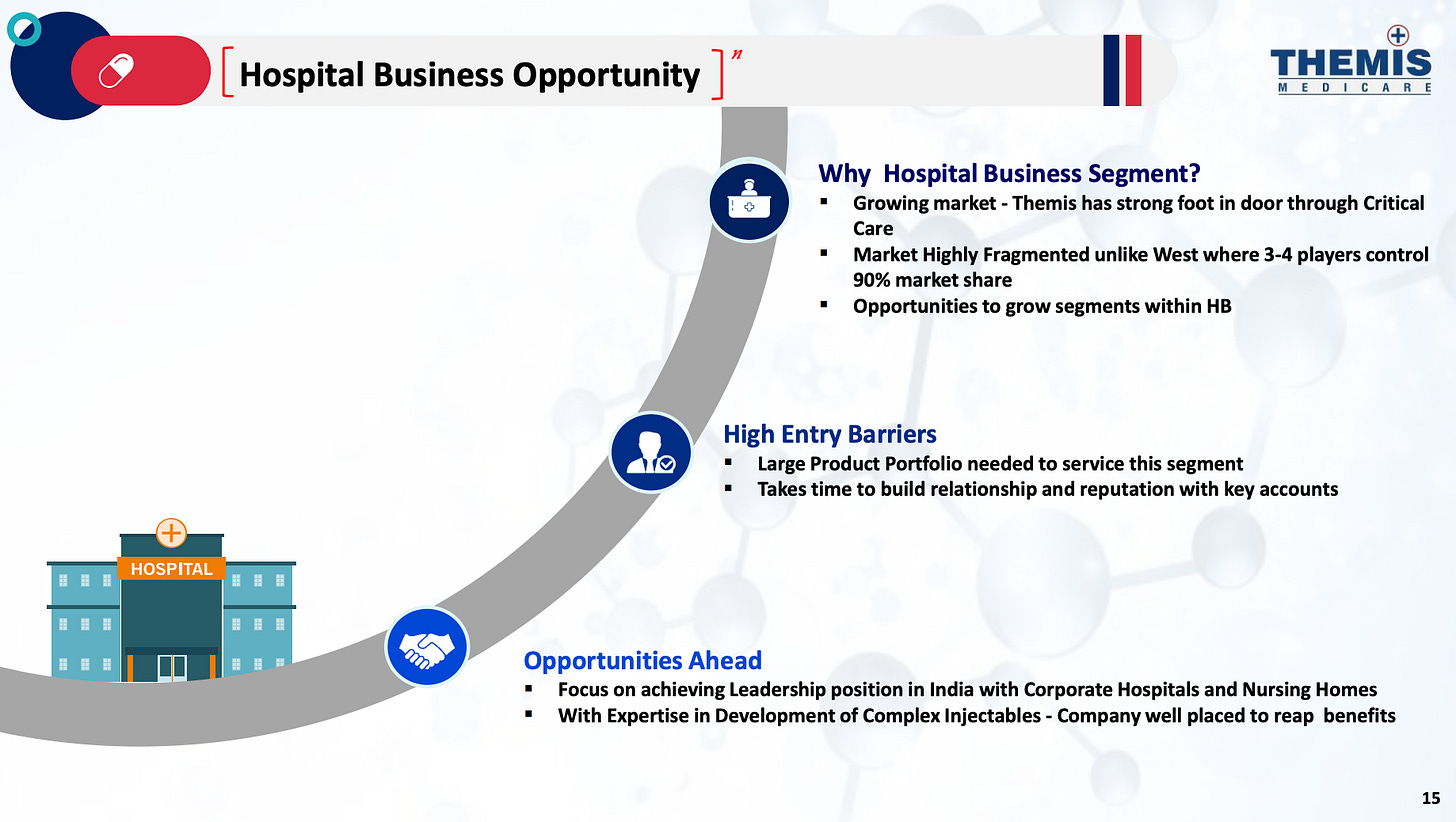

Among the 3 segments, the company is currently focused on hospital business segment as the major growth driver.

Future potential

Financial analysis

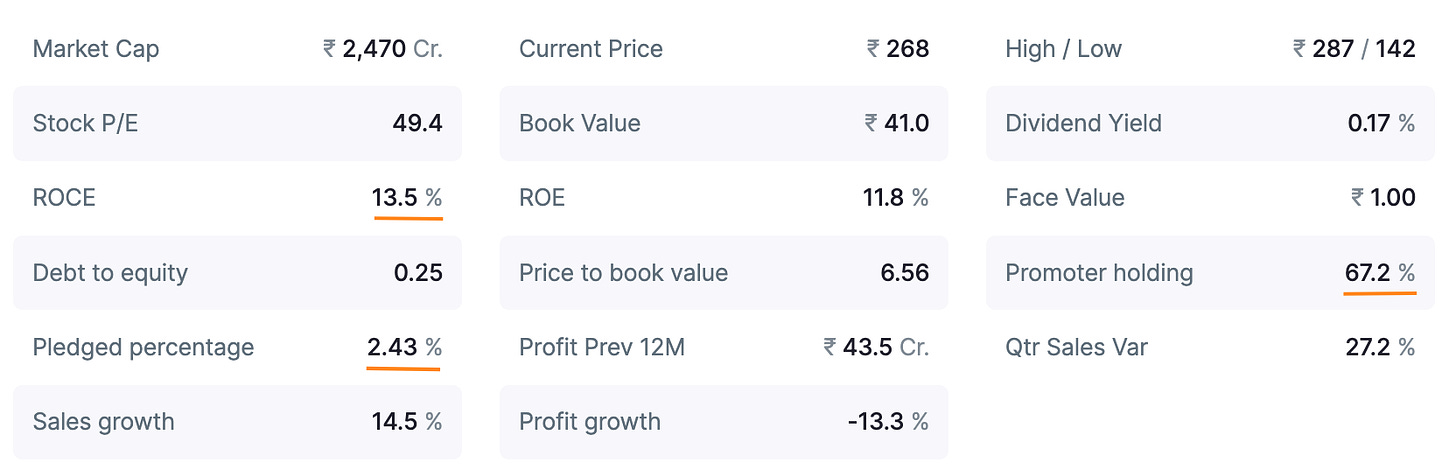

Overview

The promoter holding is 67.2%.

ROCE is 13.5% and pledged percentage is 2.43%.

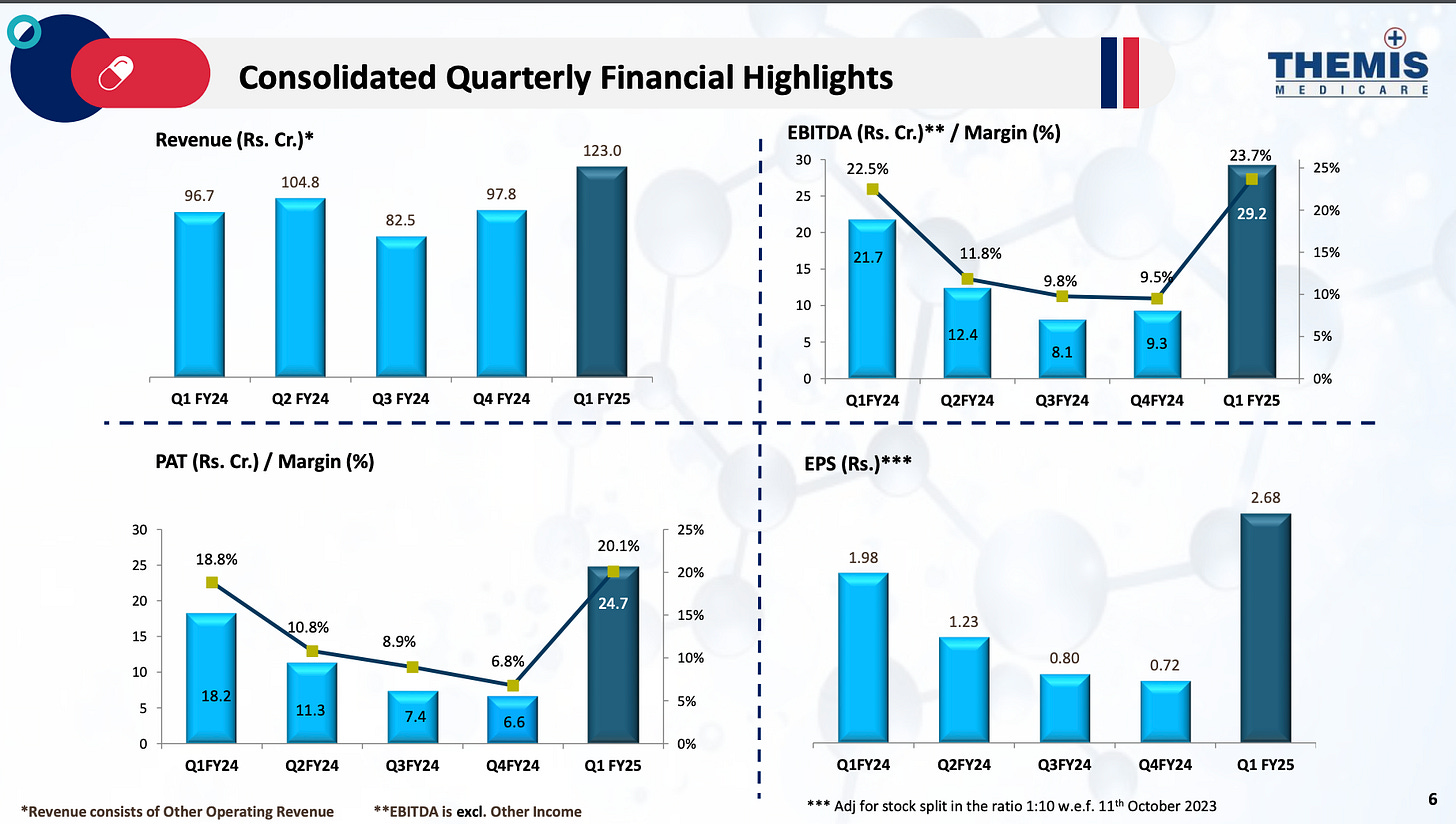

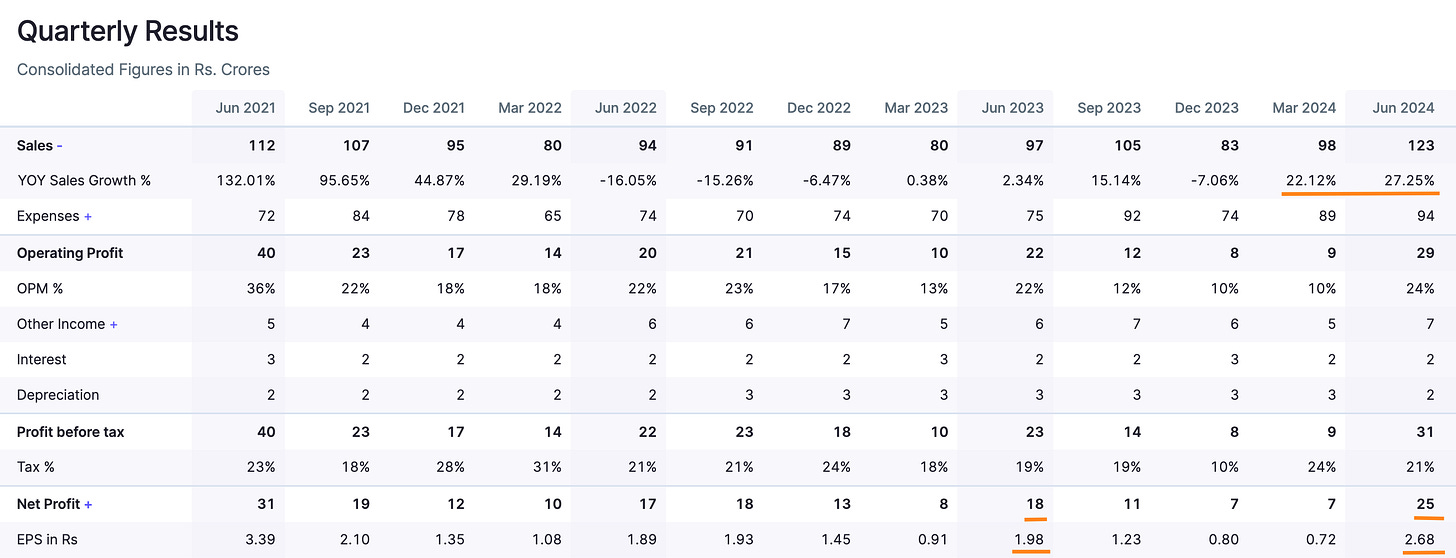

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has reported a turnaround in sales with 22%+ sales growth in the last 2 quarters, while it was negative in the previous 7 quarters.

Net profit increased by 38%.

EPS increased by 35.3%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the last financial year -

While the sales growth in FY 2024 was muted at 7.74%, with the revival of sales in the last 2 quarters, the trailing-twelve-months(TTM) sales is already trending at +6.8% and is expected to grow to double digits.

The company has controlled the debt and reduced it over the years.

TTM EPS is trending at +14.8%.

Peer comparison

Thermis Medicare Ltd has a sales growth of 14.46% and quarterly profit growth of 35.68% which is among the highest in the peers of same industry and having market-cap in the similar range.

Timing analysis

Institutional volume signs seen recently in the week of 12-Aug(4.7x) and 9-Sep(9.5x).

Did you find our analysis on Themis Medicare Ltd valuable? Help us reach more investors like you.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in