Torrent Power Ltd - 87.2% growth in quarterly profit-after-tax

Company name - Torrent Power Ltd

Last closing price(NSE:TORNTPOWER) - ₹1688.35 (as on 10-Sep-2024)

Estimated reading time - 3 minutes

<Quick recap - we published an analysis of Epack Ltd on 8th Sep, and the stock price has moved +12% in the last 2 days.>

Executive Summary

Torrent Power Ltd is a leading integrated power utility company with presence across generation, transmission and distribution of power.

The company has a healthy ROCE of 14.8%, with pledged percentage 0%.

The company reported profit-before-tax quarterly growth of 94% on account of improved sales and the operating margin.

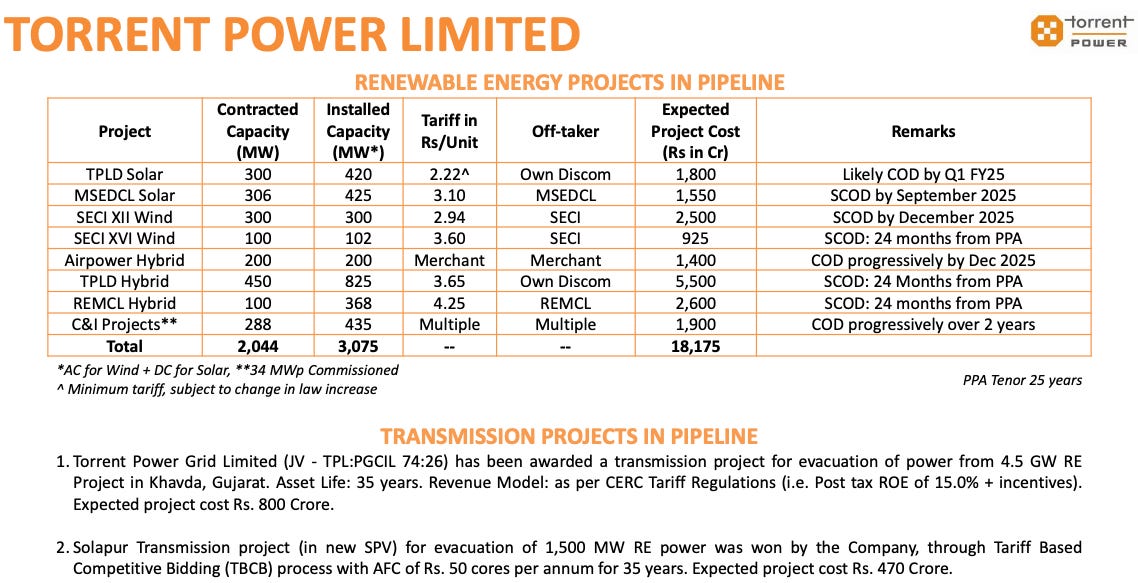

The company has a health pipeline of projects to continue the growth in FY 2025.

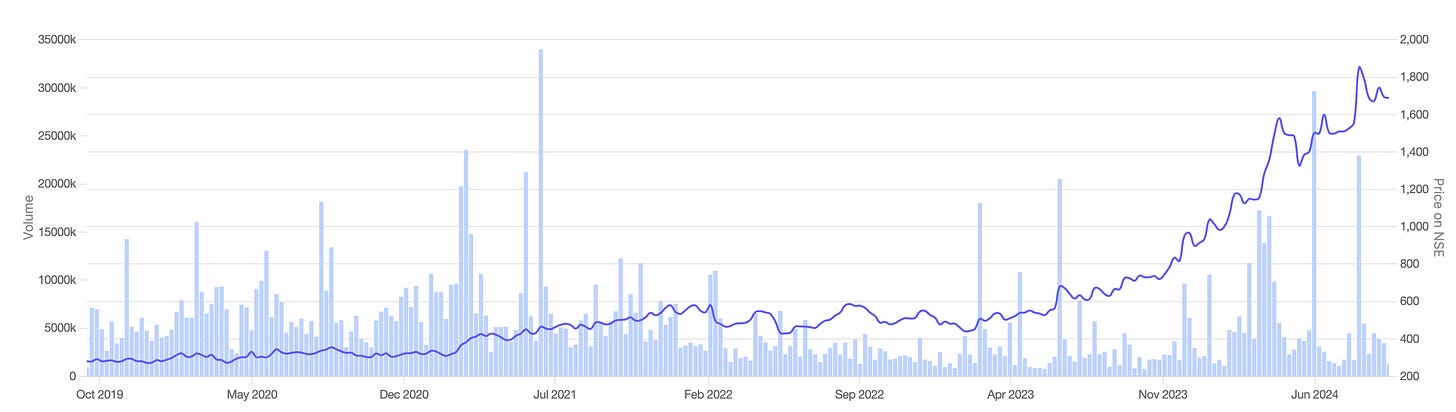

Stock price chart

Detailed analysis

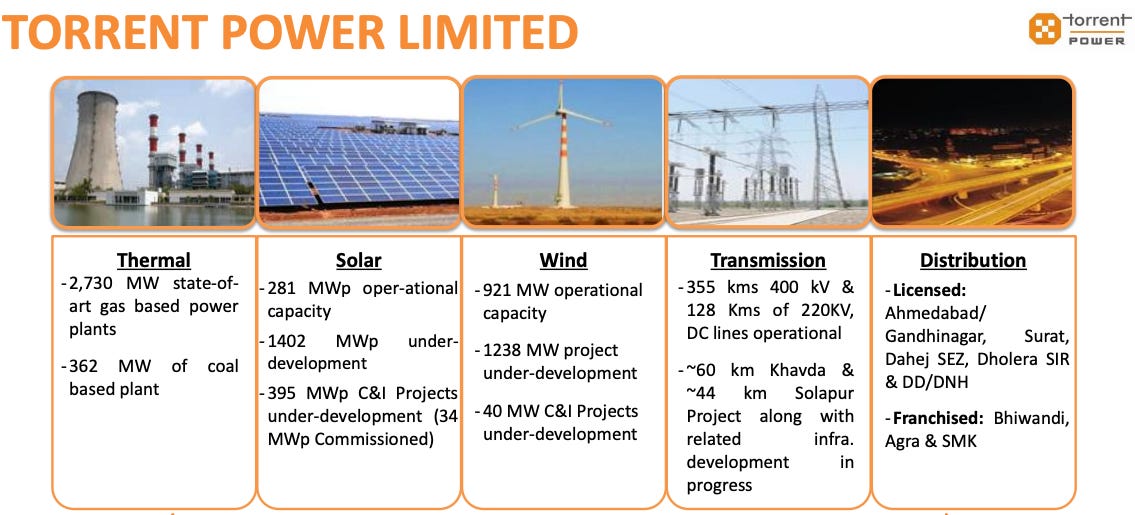

About the company

The Torrent Group is a business group with 3 business divisions - Torrent Pharmaceuticals Ltd, Torrent Power Ltd and Torrent Gas Ltd.

Torrent Power Ltd is a leading integrated power utility company with presence across generation, transmission and distribution of power.

Planned projects in pipeline -

Financial analysis

Overview

The company has a healthy ROCE of 14.8%.

The pledged percentage is 0%, and the promoter holding is at 53.6%

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter

Reported sales growth of 23.28%.

The operating margin improved by 31.25%.

Profit-after-tax growth of 87.2% reported on account of improved sales and the operating margin.

Out of the ₹1315 Cr in the profits reported, ₹102 is one-off and rest will be recurring as per the company management.

EPS growth of 91% reported.

Annual results

While the company posted a muted sales growth of 5.8% in FY 2024, the trailing twelve month(TTM) numbers are showing significant signs of growth -

TTM Sales growth is already at +6.2%.

The profit after tax(PAT) is trending at 24.47%.

The EPS growth is trending at 24.82%.

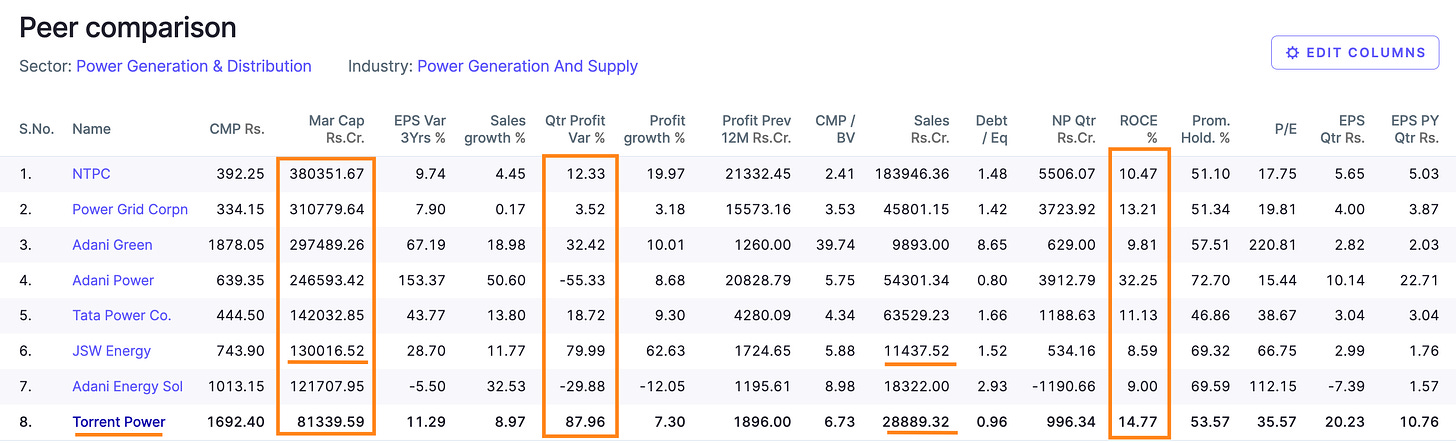

Peer comparison

The company’s ROCE is among the highest in the peers in the same sector.

The market cap of nearest peer JSW Energy is +59.8% higher than Torrent Power, while it’s total annual sales is 60% lower. This shows a potential for Torrent Power’s market cap to grow if they are able to maintain the growth rate.

Timing analysis

Institutional volume signs seen in the week of 29-July-2024 with a 13X spike in trading volumes.

Did you find our analysis on Torrent Power Ltd valuable? Share this ahead with your friends.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in