Triveni Turbine Ltd - quarterly EPS increased by 31.9%.

A manufacturer of steam turbines for industrial and renewable energy applications

Note - As we had anticipated, NIFTY50 index and overall broader markets(NSE:CNX500) corrected in the last 2 weeks. We continue to observe precaution in the current market conditions. The indexes have revived a bit in this week, but they are still not back to a clear uptrend.

Company name - Triveni Turbine Ltd

Last closing price(NSE:TRITURBINE) - ₹795.8 (as on 11-Oct-2024)

Estimated reading time - 4 minutes

New notes update - we have recently published a series on ‘How do we trade in the stock market?’. It answers many of your queries around trading.

The updated performance of all our past analyses is available here.

Executive Summary

Triveni Turbine is primarily engaged in the design, manufacture, and supply of steam turbines for industrial and renewable energy applications, focusing on turbines with a capacity of up to 100 MW.

Triveni is well-positioned to leverage opportunities in the growing renewable energy sector, providing turbines for biomass, waste-to-energy, and geothermal projects. Their commitment to sustainable energy solutions aligns with global decarbonization trends.

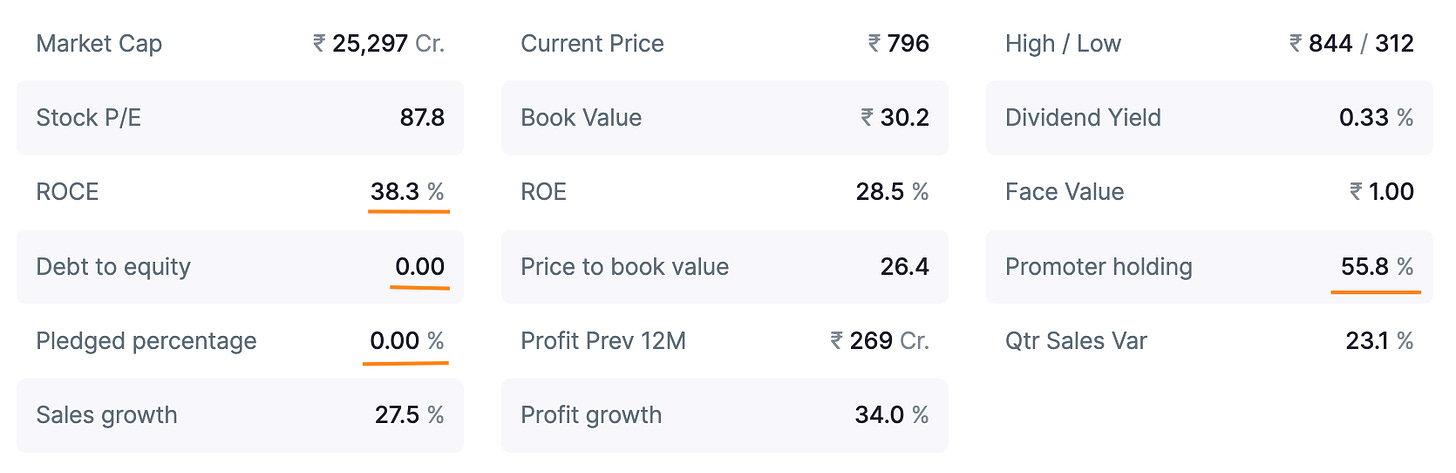

The company is debt free and the ROCE is strong at 38.3%.

The quarterly net profit increased by 31.1% and EPS increased by 31.9%.

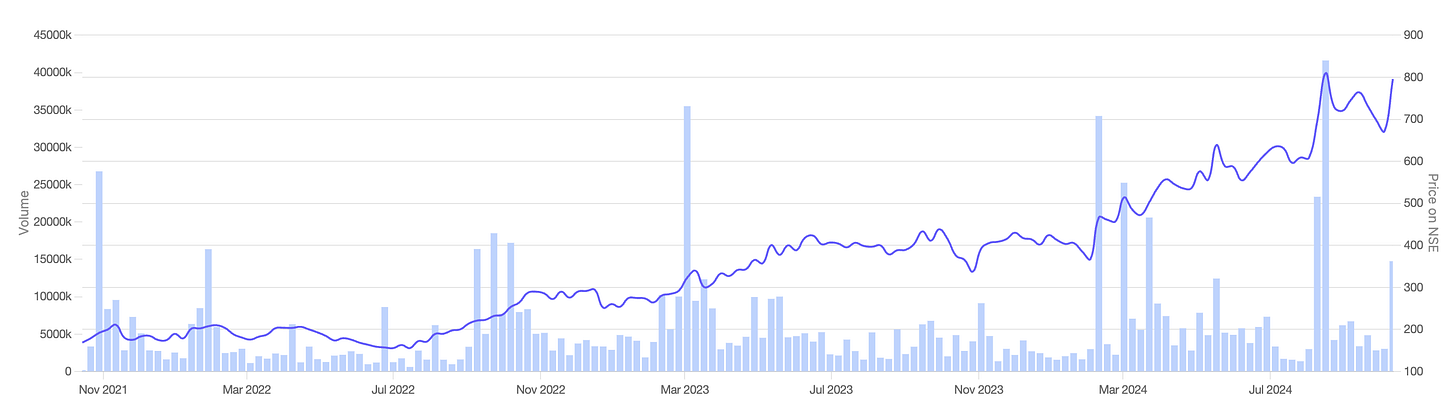

Stock price chart

Detailed analysis

About the company

Power Generation Solutions: Triveni Turbine is primarily engaged in the design, manufacture, and supply of steam turbines for industrial and renewable energy applications, focusing on turbines with a capacity of up to 100 MW.

Global Reach: The company caters to both domestic and international markets, with a significant presence in industries such as process industries (which require steam) and renewable-based applications.

Aftermarket Services: Triveni also provides comprehensive aftermarket services, including refurbishment, which is a major growth area.

Future prospects

What is the company’s plan to maintain earnings growth in future?

Global Expansion and Market Penetration:

Triveni aims to strengthen its global footprint, especially through its new subsidiary in Texas, USA, which will help build stronger customer relationships and local market presence. This is a key market for industrial turbines, and the company believes it will contribute significantly to future growth.

The company has a significant presence across 80 countries, with a strong focus on Europe, Southeast Asia, and Africa.

Focus on Renewable Energy

Triveni is well-positioned to leverage opportunities in the growing renewable energy sector, providing turbines for biomass, waste-to-energy, and geothermal projects. Their commitment to sustainable energy solutions aligns with global decarbonization trends.

Innovation and R&D

The company is investing heavily in developing supercritical CO2 turbines and exploring thermal battery solutions for energy storage, which are seen as future growth areas.

Aftermarket Expansion

The aftermarket segment, including refurbishment services and spare parts, remains a strong driver of growth. Triveni aims to expand this portfolio and tap into more international markets.

Potential risks that can hamper the future growth?

Order Booking Cyclicality: Triveni operates in a business where order bookings can be cyclical and lumpy. This could impact revenue predictability, although the company has managed this volatility with a strong order book providing visibility into FY 25 and FY 26.

Macroeconomic and Geopolitical Risks: The company faces risks from geopolitical tensions and economic slowdowns in advanced economies like Europe and Southeast Asia. Although Southeast Asia is showing positive trends in the service business (refurbishment), product orders in this region have been slower than expected.

Supply Chain and Inflationary Pressures: Global supply chain disruptions and inflation continue to be potential risks. However, the company benefits from a strong domestic supply chain, which provides resilience in times of global challenges

Financial analysis

Overview

The promoter holding is 55.8%, and pledged percentage is 0%.

The company is debt free and the ROCE is strong at 38.3%.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has consistent double digit sales growth with 23.08% growth reported in the latest quarter.

The operating profit increased by 35.2%, with operating profit margins increasing by 10.5%

The net profit increased by 31.1% and EPS increased by 31.9%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a sales growth of 32.58%, and operating profit growth of 36.59%.

The net profit increased by 39.37% and EPS increased by 39.3%.

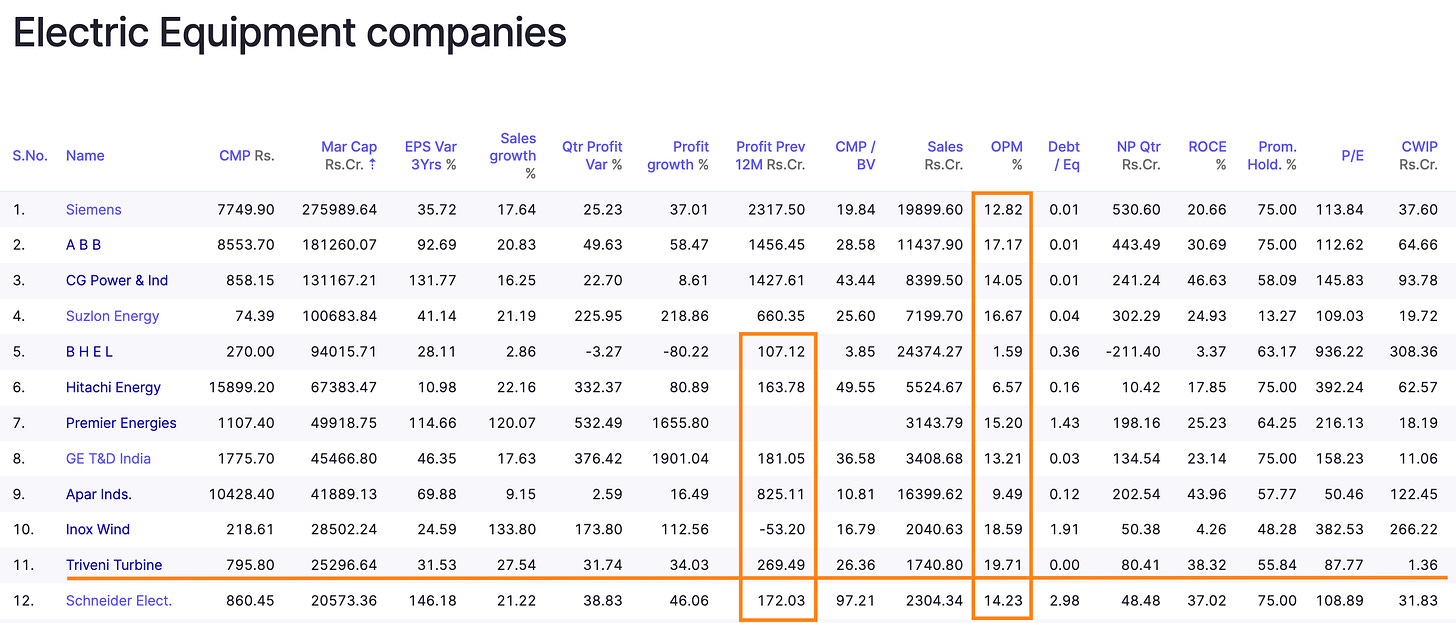

Peer comparison

The company has the 2nd highest net profit reported in the last 12 months at 269.49, among the peers in similar market cap range.

The company has highest operating profit margin among it’s peers at 19.71%.

Timing analysis

Institutional high trading volume signs seen recently in the week of 05-Aug(7.85X), 12-Aug(14.2X) and 07-Oct(5X).

Did you find our analysis on Triveni Turbine Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in