Zen Technologies Ltd - 92% increase in quarterly sales

A company benefitting from the increasing war spending

Note - As we had anticipated, NIFTY50 index and overall broader markets(NSE:CNX500) corrected in the last 2 weeks. We continue to observe precaution in the current market conditions. The indexes have recovered a bit in this week, but they are still not back to a clear uptrend.

Company name - Zen Technologies Ltd

Last closing price(NSE:ZENTEC) - ₹1899.95 (as on 11-Oct-2024)

Estimated reading time - 3 minutes

New notes update - we have recently published a series on ‘How do we trade in the stock market?’. It answers many of your queries around trading.

The updated performance of all our past analyses is available here.

Executive Summary

Designs and manufactures combat training solutions: Zen Technologies specializes in developing high-tech training simulators for defense and security forces, which help enhance combat readiness.

The company has upgraded the revenue target(guidance) for this year to ₹900Cr, which will be 104% growth compared to previous year.

The company has reported significant quarterly sales growth of 92%.

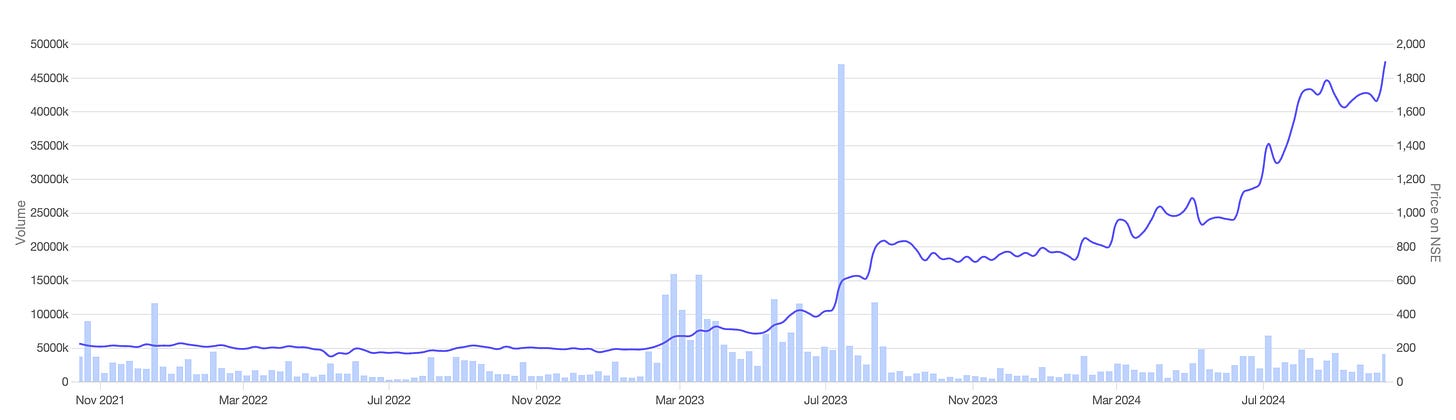

Stock price chart

Detailed analysis

About the company

Designs and manufactures combat training solutions: Zen Technologies specializes in developing high-tech training simulators for defense and security forces, which help enhance combat readiness.

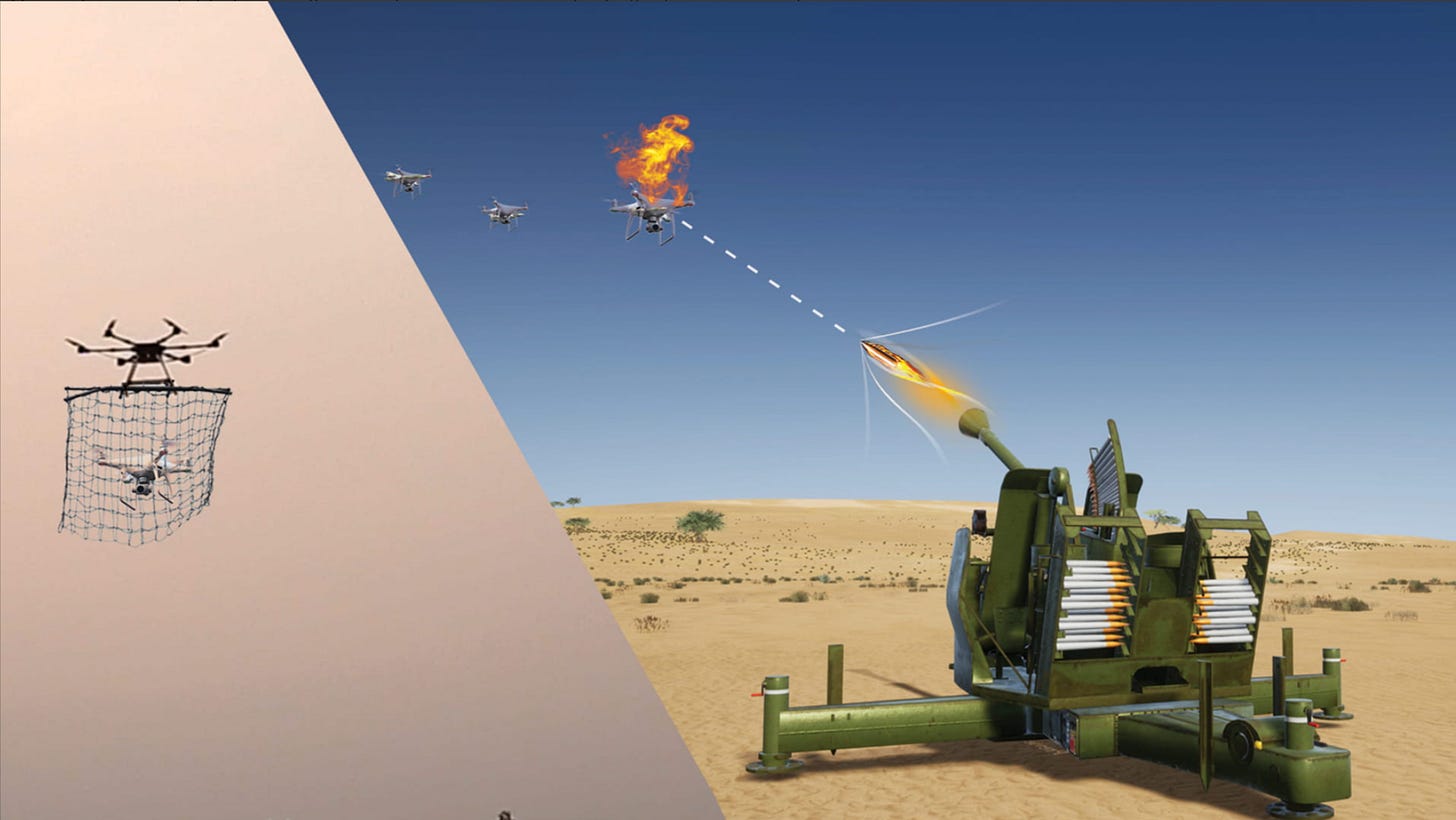

Develops counter-drone technologies: The company also focuses on anti-drone systems to detect, neutralize, and counter threats from unmanned aerial vehicles (UAVs).

Serves global and domestic markets: Zen caters to both Indian and international defense forces, supplying advanced, customizable solutions to meet different combat training and defense needs.

The company has upgraded the revenue target(guidance) for this year to ₹900Cr, which will be 104% growth compared to previous year.

Future prospects

What is the company’s plan to maintain earnings growth in future?

Focus on Counter-Drone Solutions: The increasing demand for counter-drone technology is a key driver. Zen is investing heavily in expanding its range of anti-drone systems, which are critical for modern defense.

Leverage India’s Defense Spending: Zen is well-positioned to capitalize on India’s increased defense budget and modernization efforts. The company aims to win significant contracts, especially for simulators and counter-drone systems, benefiting from the “Atmanirbhar Bharat” (self-reliant India) initiative.

Focus on New Markets: Zen aims to penetrate new geographies, particularly in the Middle East and African markets, which are showing strong demand for defense solutions.

Strong Order Book Execution: Zen’s current order book of INR 800 crore provides a solid foundation for revenue in FY 2025, with a focus on timely delivery and execution of these contracts.

Potential risks that can hamper the future growth?

Supply Chain Issues: The global supply chain was disrupted due to shortages in critical components, delaying production and increasing costs.

Regulatory Approvals: Government defense contracts often faced delays due to extended regulatory processes, affecting order timelines.

Rapid Technological Changes: Keeping up with fast-paced innovations in defense technology, particularly in the anti-drone space, remains a critical challenge. Zen is investing heavily in R&D, focusing on AI and machine learning to enhance its combat training solutions and drone defense systems.

Financial analysis

Overview

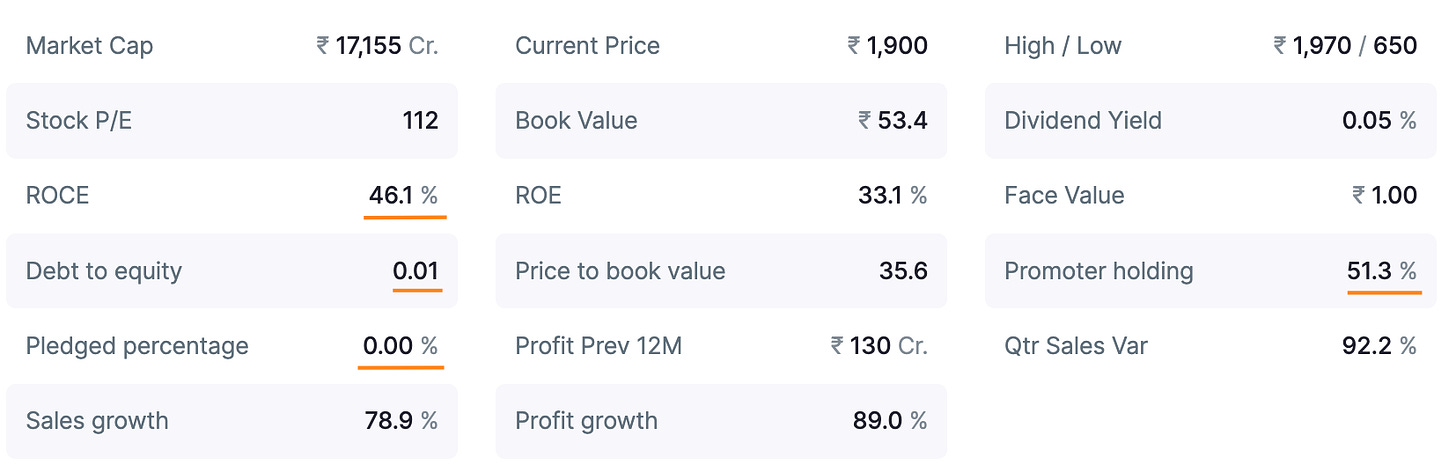

The promoter holding is 51.3%, and pledged percentage is 0%.

The company is debt-free and the ROCE is strong at 46.1%.

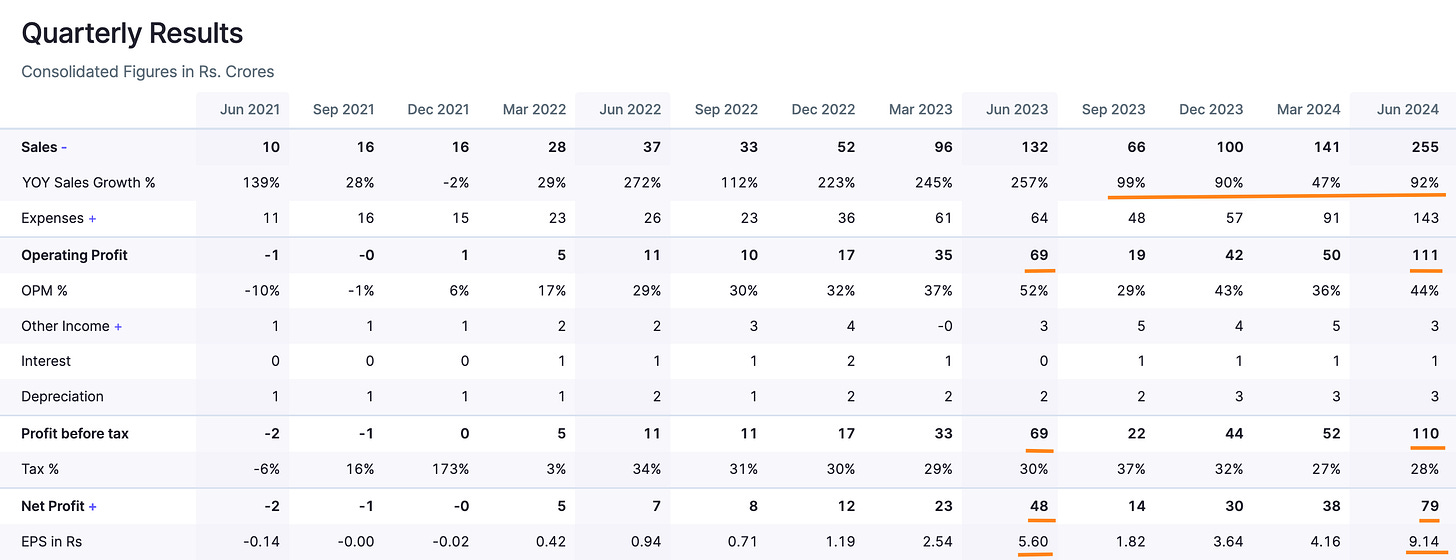

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has reported significant sales growth of 92%.

The operating profit increased by 60.8%.

The net profit increased by 64.5% and EPS increased by 63.2%.

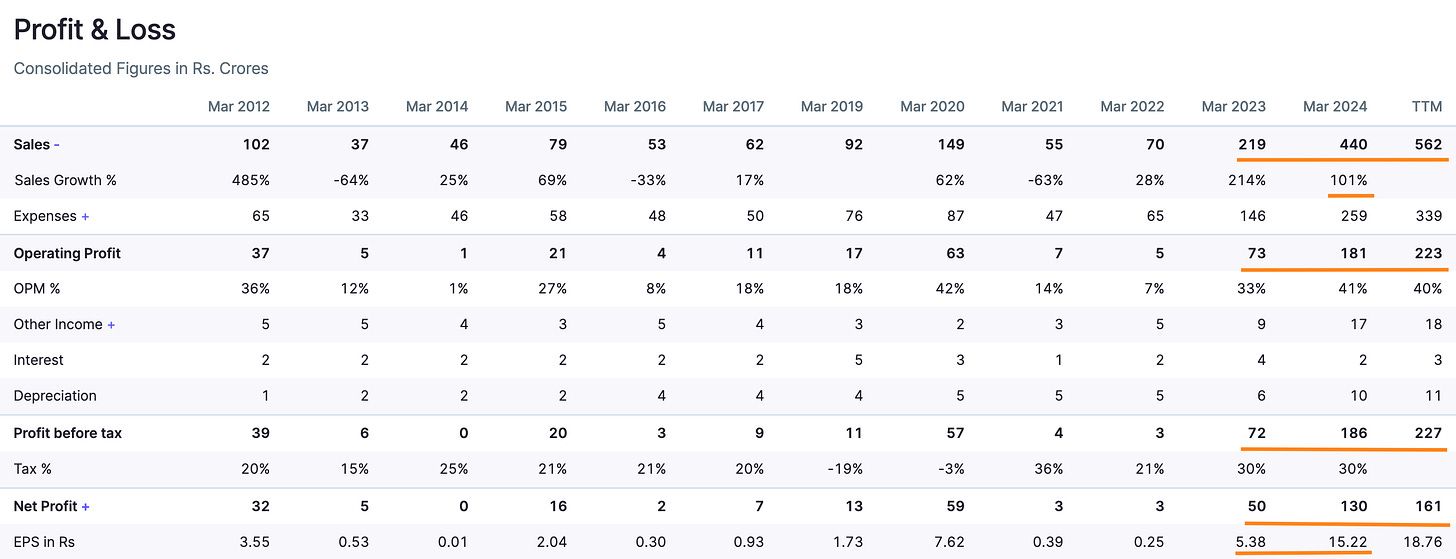

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a strong sales growth of 101%, and operating profit growth of 247%.

The net profit increased by 260% and EPS increased by 282%.

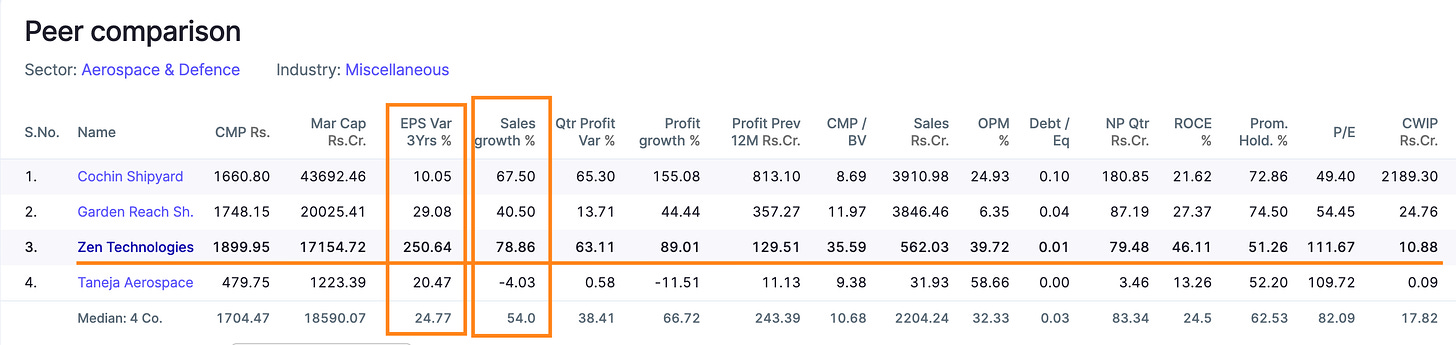

Peer comparison

The company has the highest EPS variance in 3 years at 250% and highest sales growth at 78.86%

Timing analysis

Institutional high trading volume signs seen recently in the week of 7-Oct(3X).

Did you find our analysis on Zen Technologies Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in