Bandhan Bank - +47% quarterly profit

A private bank with only 1.54 price-to-book value and highest net profits.

Company name - Bandhan Bank Ltd.

Last closing price(NSE:BANDHANBNK) - ₹207.1 (as on 13-Sep-2024)

Estimated reading time - 3 minutes

<summary of previous analyses available here>

Executive Summary

Incorporated in 2014, Bandhan Bank is a private sector bank focused on serving underbanked and under-penetrated markets in India.

Quarterly results - EPS increased by 37.5% and net NPA(Non-Performing Assets) improved by 47%.

The price to book value for peers is between 2 to 3, whereas for Bandhan Bank it’s currently 1.54. This shows a potential for market cap to grow.

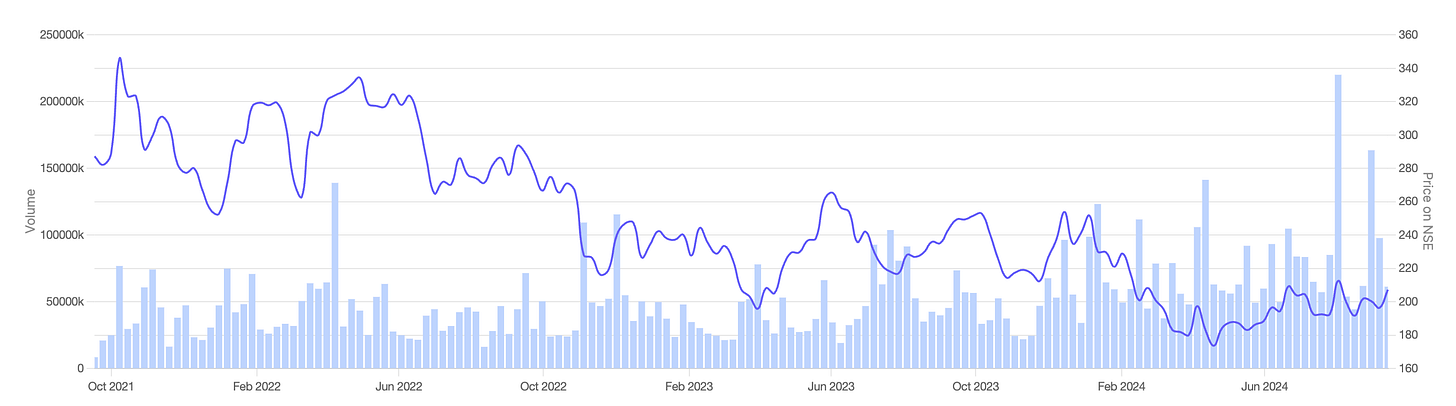

Stock price chart

Detailed analysis

About the company

Incorporated in 2014, Bandhan Bank is a private sector bank focused on serving underbanked and under-penetrated markets in India.

The company has a PAN-India presence and offers a wide range of banking products & services and asset & liability products and services designed for micro banking and general banking.

Financial analysis

Overview

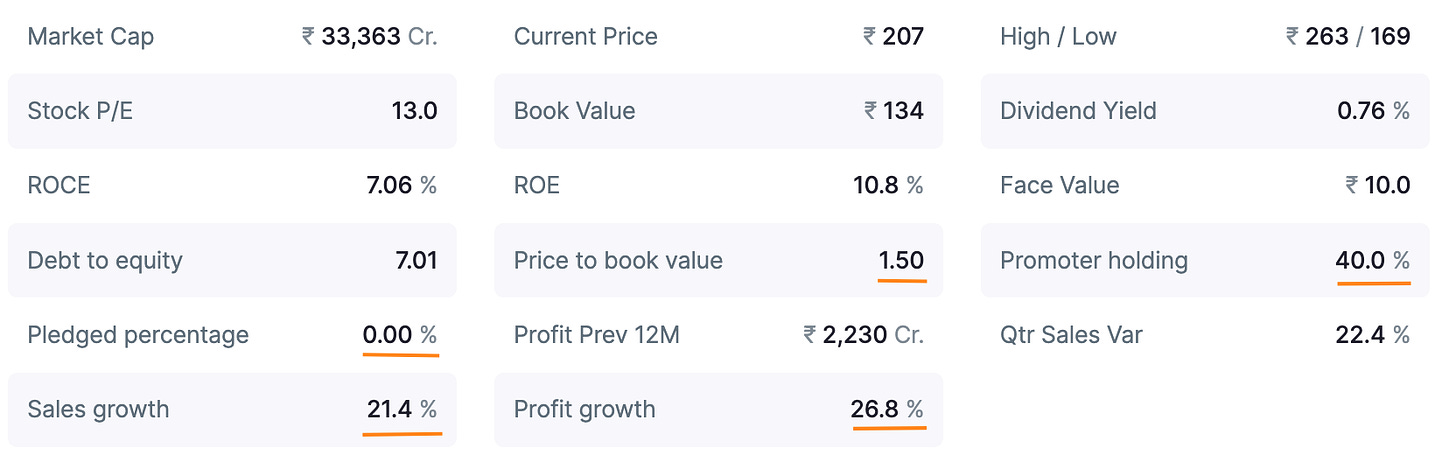

The promoter holding is 40% and the the pledged percentage is 0%.

Price to book value(PBV) is only 1.5.

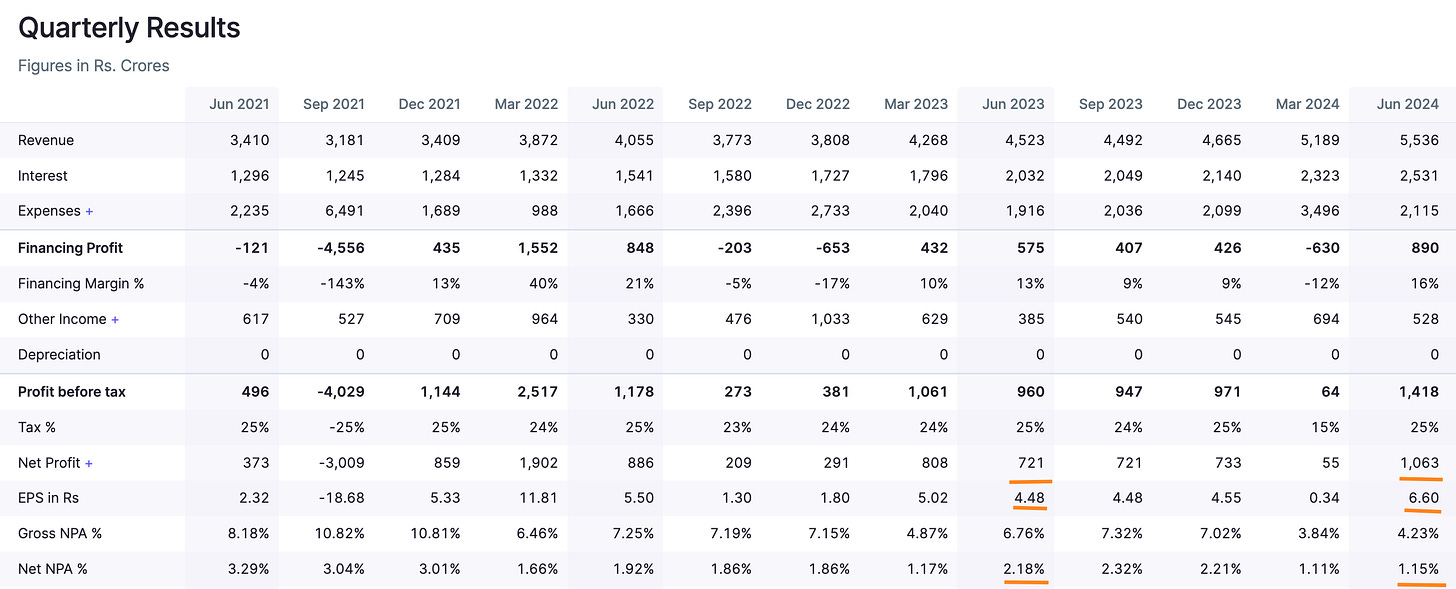

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The net profit increased by 47%

EPS increased by 37.5%

Net NPA(Non-Performing Assets) improved by 47%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The net profit reported in FY 2024 was muted at +1.5% but the TTM(Trailing-twelve-months) net profit is already trending at +15.3%. This is highest in the last 4 years, and expected to cross highest ever in the current FY.

The TTM EPS is at the highest in 4 years at 15.97 (+15.4%)

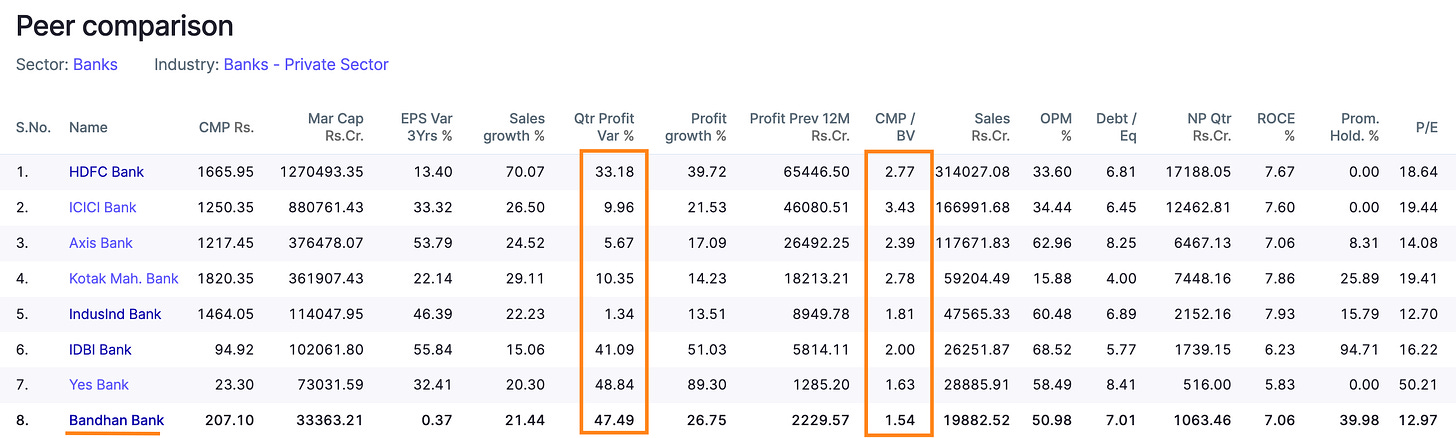

Peer comparison

The quarterly profit growth of 47.49% is second highest among peers.

The price to book value for peers is between 2 to 3, whereas for Bandhan Bank it’s currently 1.54. This shows a potential for market cap to grow.

Timing analysis

Institutional volume signs seen in the week of 29th July(4x) and 26-Aug(3x).

The private banks sector seems to be showing signs of strength currently. IDBI Bank which we covered on 4th Sep moved up 7.9% yesterday.

Did you find our analysis on Bandhan Bank Ltd valuable? Help us reach more investors like you.

Disclaimer

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can change in future.

Credits : Financial data source - screener.in