Trade Management - p1 - Setting the Priorities

Estimated reading time - 3 minutes

Hello,

In this series, we will share our approach to taking trades and trades management in the stock markets.

Before we begin, a few important points -

Fear and greed - A typical trader’s emotions oscillate between greed and fear. The market movers feed on this, to ensure the uninformed and undisciplined traders loose more money than they gain. This emotional rush is more frequent in stock markets trading because of very frequent movement of prices than any other type of trading.

Keep emotions aside - If we want to make consistent good gains out of the market, we have to adopt a mechanical emotionless approach in trade-management.

Practice consistency and discipline - As with any new skill or approach, the only way to acquire a skill is to practice it with discipline consistently and give it time. It’s not easy at first, but as with everything, it can be turned into a habit with repetitions for months.

Priorities in Trading

1. Protecting Capital

Capital protection is the cornerstone of trading success. It ensures traders can withstand market downturns and have the opportunity to participate in future trades. There are two main priorities in order -

a) Protecting Loss: Setting stop-loss orders or predetermined exit points minimizes potential damage to capital. This avoids a situation where losses spiral out of control.

b) Protecting Breakeven: Once a trade moves favorably, adjusting the stop-loss to breakeven secures initial capital, preventing turning a profitable position into a loss.

2. Protecting Profits

After securing capital, the next priority is protecting accumulated gains. This involves trailing stops or taking partial profits to lock in gains while leaving room for further upside. We’ll share a detailed post on this separately.

Why Capital Protection is Critical

Protecting capital is vital because significant losses make recovery disproportionately difficult. A 50% loss, for example, requires a 100% gain just to return to the starting point. Thus, avoiding large losses ensures that traders don’t need extraordinary gains to stay profitable.

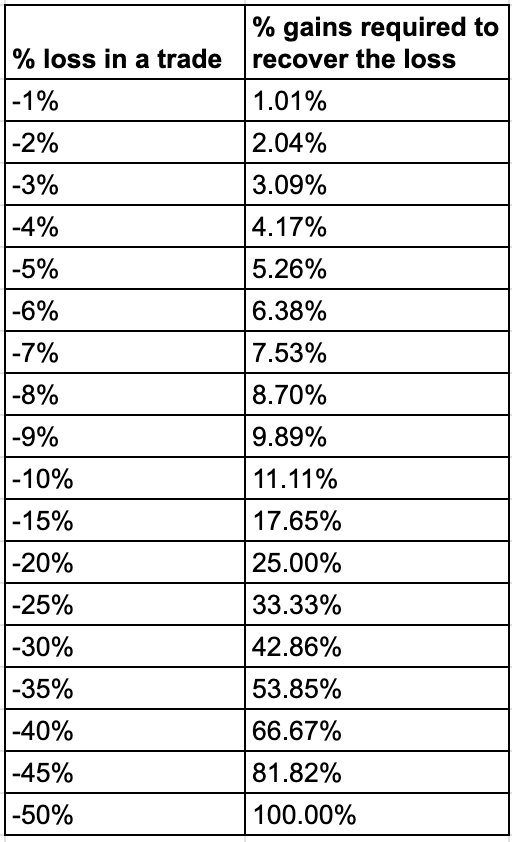

The Inverse Effect of Losses: Recovery Table

This table illustrates that the deeper the loss, the more significant the required gain to recover. For instance, a 10% loss needs an 11.11% gain to recover, while a 20% loss requires a 25% gain, showing the inverse relationship between loss and required recovery. The gap widens as losses go into double digits.

Opportunity Cost in Trading

Opportunity cost refers to the potential gain missed by keeping capital tied up in an underperforming or stagnant trade instead of reallocating it to a potentially profitable opportunity. Taking a small loss and freeing up capital allows traders to pursue more promising trades, ultimately maximizing overall profitability.

Limiting Losses to Minimize Opportunity Cost

To manage opportunity cost effectively, we usually aim to limit our losses to 8-10%. This ensures that we don’t suffer significant drawdowns, which are harder to recover from, and keeps capital free for new opportunities.

By focusing on these principles, traders can create a robust risk management framework that prioritizes capital preservation and profit protection, leading to more consistent trading success.

Read next -