Trade Management - p2 - Capital Allocation

Estimated reading time - 4 minutes

Hello,

This is a continuation of the series on ‘How we manage trades’. In this part 2, we share our approach to capital allocation.

Before we begin, it’s important to understand -

The priority is to build trading as a skill first, and let it take it’s time. A skill or expertise can’t be built over night. It needs it’s own baking time, where you have to go through the different phases of market conditions, put in consistent effort, learn from the mistakes and improvise.

The analogy to think of is your journey of learning to speak, read and write the language English. While, today, you might be confident in speaking in English in public, it required a certain slow path and effort to reach here where you started small but kept at it with consistency.

As we mentioned in part 1, a typical trader’s emotions oscillate between greed and fear. Do not rush into excessive greed and go all-in. Rather, obsess over building the skill and the confidence which will come with it. It is a lifelong skill, and a life saving skill. And the markets are not going anywhere, so don’t feel FOMO of losing out on certain potential gains.

Risk Management in Stock Trading: Capital Allocation Strategy

Capital allocation is a key component that determines how much capital you allocate to trading and each individual trade. Proper allocation ensures that losses are manageable, emotions stay in check, and trading decisions are more structured. Let’s explore this concept further by breaking it down into two essential parts: overall capital allocation and per-trade capital allocation.

1. How Much Total Capital to Allocate

Think of capital allocation as learning to drive. When you start driving, it’s with a small car in safe environments, such as an open ground or internal roads, before venturing out to highways, congested areas, or steep slopes. Similarly, in trading, the initial focus should be on minimizing risks by allocating a small portion of total capital.

Begin with Caution: If you are a new trader, consider allocating 10% or less of your total capital. This allows you to gain experience, adapt to different market conditions, and refine your strategy without risking substantial capital. This approach also gives you time to build the emotional discipline necessary for trading.

The Learning Curve

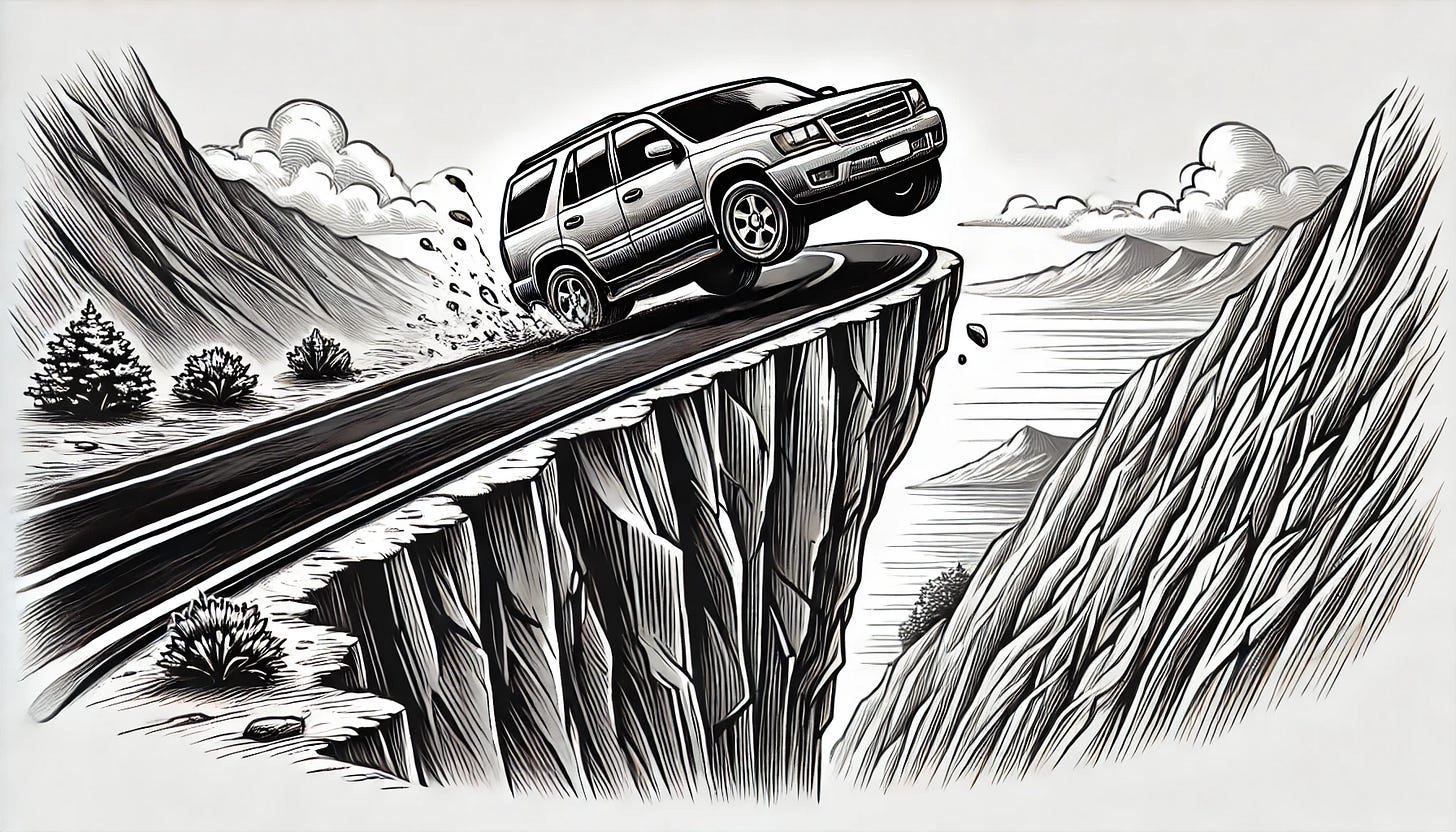

As with driving, where you progress from a small car to a sedan, and then to a luxury SUV as your skill improves, capital allocation should increase only when trading expertise and confidence grow. Sudden exposure to large capital in a high-risk environment, like starting with a luxury SUV on a steep cliff, can be detrimental. Therefore, increase your allocation gradually—after consistent results over a period, alteast a year—until you are confident in trading with a larger capital base.

Adapting to Market Conditions

As the market moves in different bear(downtrend) and bull(uptrend) phases, we will find our trades timing success rate also varying.

It is important to accept the market reality during such bear phases and reduce our total allocation further during bear phases, to protect our capital and the opportunity cost.

As the markets turn around, our trades and analysis timing success-rate will give us an indication of the market phase, and we can again increase the total allocation gradually.

Remember - Our goal is to make money in the markets, and not to prove that we are right all the time. The markets are never wrong.

2. How Much Capital to Allocate Per Trade

There’s a common belief that diversification is key to risk management. However, excessive diversification can dilute the impact of successful trades and make monitoring multiple positions overwhelming, turning it into what is known as “diworsification.”

Our approach advocates for a concentrated portfolio with focused management. Ideally, aim for 5-6 active trades at a time, though as a beginner, it’s reasonable to start with 8-10 trades to maintain a balanced risk profile.

Calculating Risk Per Trade: Assuming a 10% stop-loss per trade, the maximum loss across 10 trades should not exceed 10% of the allocated capital. If your comfort level is lower than this threshold, reduce overall allocation to keep risk within acceptable limits.

Real-World Application

If your total capital is ₹10,00,000, allocate ₹1,00,000 (10%) for trading purposes. With 10 trades, this means allocating ₹10,000 per trade. Implementing a 10% stop-loss on each position limits total risk exposure to ₹1000 per trade and a maximum of ₹10,000 if all trades incur losses. Adjust these allocations based on your risk tolerance.

Why Gradual Allocation is Crucial

Capital allocation is not just about limiting risk but about understanding your emotional threshold and the opportunity costs involved. It’s better to start small and experience different market phases and conditions rather than being forced into taking drastic measures due to a poorly sized position.

By embracing these principles of capital allocation, traders can create a solid foundation for long-term success, allowing for sustainable growth while managing risks effectively.

Read next -