KFin Technologies Ltd - 58.1% quarterly net profit increase

A company with 46.1% market share in Issuer Solutions.

Note - As we had anticipated, NIFTY50 index and overall broader markets (NSE:CNX500) corrected in the recent weeks. We continue to exercise precaution in the current market conditions. The indices have recovered a bit in this week, but they are still not back to a clear uptrend.

Company name - KFin Technologies Ltd

Last closing price(NSE:KFINTECH) - ₹1109.45 (as on 16-Oct-2024)

Estimated reading time - 4 minutes

New notes update - we have recently published a series titled ‘How do we trade in the stock market?’. It answers many of your queries around trading.

The updated performance of all our previous analyses is available here.

Executive Summary

KFin Technologies provides comprehensive financial services and technology solutions to mutual funds, alternative investments, and pension schemes in India and internationally.

KFin Technologies holds a 46.1% market share in Issuer Solutions as of FY24. This market share is based on the number of folios and market capitalization of NSE 500 companies.

The quarterly net profit increased by 58.1% and EPS increased by 55.6%.

Stock price chart

Detailed analysis

About the company

KFin Technologies provides comprehensive financial services and technology solutions to mutual funds, alternative investments, and pension schemes in India and internationally.

The company operates across various business lines, including domestic mutual fund solutions, issuer solutions, and alternative investment fund administration.

KFintech has an asset-light, technology-driven model with offerings like registrar and transfer agent services, fund administration, and investor solutions for multiple asset classes

Learn something new: What are Issuer Solutions? The services include:

Registrar and Transfer Agent (RTA) services: These services manage the corporate share registry, handling transactions related to share transfers, dividends, IPOs, and other corporate actions for listed companies.

Corporate Actions Management: Supporting companies in managing activities such as IPOs, rights issues, bonus issues, mergers, and acquisitions.

Shareholder Relationship Management: Providing ongoing support to corporate clients in managing their shareholders’ data and interactions.

KFin Technologies holds a 46.1% market share in Issuer Solutions as of FY24. This market share is based on the number of folios and market capitalization of NSE 500 companies.

Revenue share of the three business segments -

Domestic Mutual Fund Solutions : ~60% (+12.3% YoY)

Issuer Solutions : ~30% (+21.3% YoY)

Alternative Investments & International Investor Solutions : ~10% (+28.6% YoY)

Future prospects

What is the company’s plan to maintain earnings growth in the future?

Expanding International Presence: They are actively growing their footprint across Southeast Asia, Canada, and other regions.

Diversification of Revenue Streams: Increasing the share of high-margin segments like Alternative Investment Fund (AIF) solutions and Value Added Services (VAS).

Growing Market Share in Domestic Mutual Funds: KFintech is targeting further growth in SIP inflows and equity AAUM market share, with their mutual fund AUM market share rising from 31.6% to 32.1% in FY24.

Potential risks that could hamper the future growth?

Market Volatility: KFintech’s business is sensitive to market conditions, particularly in the mutual fund segment. A significant downturn in equity markets could slow down AUM growth.

Regulatory Changes: Any unfavorable regulatory changes in the mutual fund or capital market space could impact the company’s operations, especially in its RTA services.

Competition: Increasing competition from global and domestic players in fund administration, AIF, and issuer solutions may pressure margins.

Financial analysis

Overview

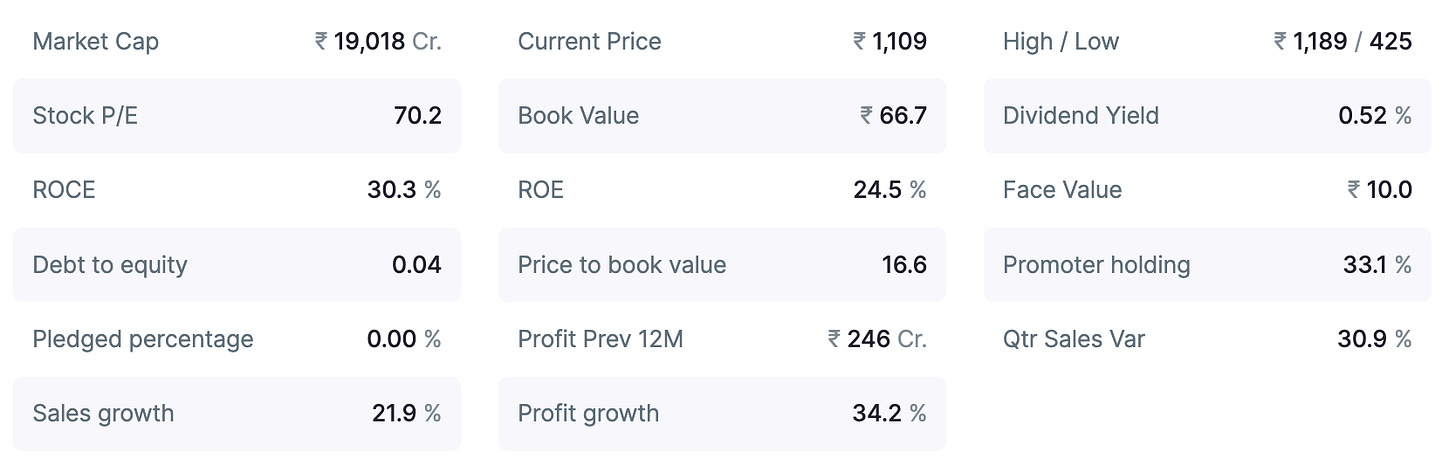

The promoter holding is 33.1%, and pledged percentage is 0%.

The company is debt-free with a strong ROCE of 30.3%.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has reported consistent double digit sales growth over the last 4 quarters, with a 30.89% growth in the last quarter.

The operating profit increased by 42%, and operating profit margin increased by 7.6%.

The net profit increased by 58.1% and EPS increased by 55.6%.

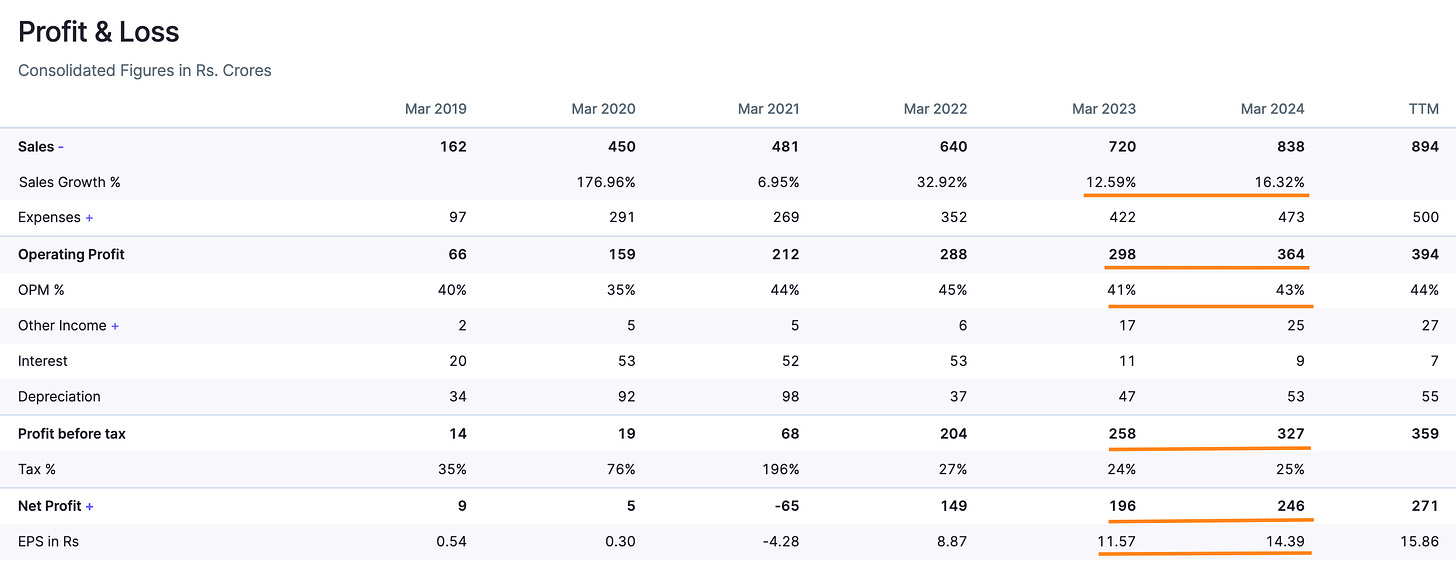

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a sales growth of 16.32%, and operating profit growth of 22.14%.

The net profit increased by 25.5% and EPS increased by 24.37%.

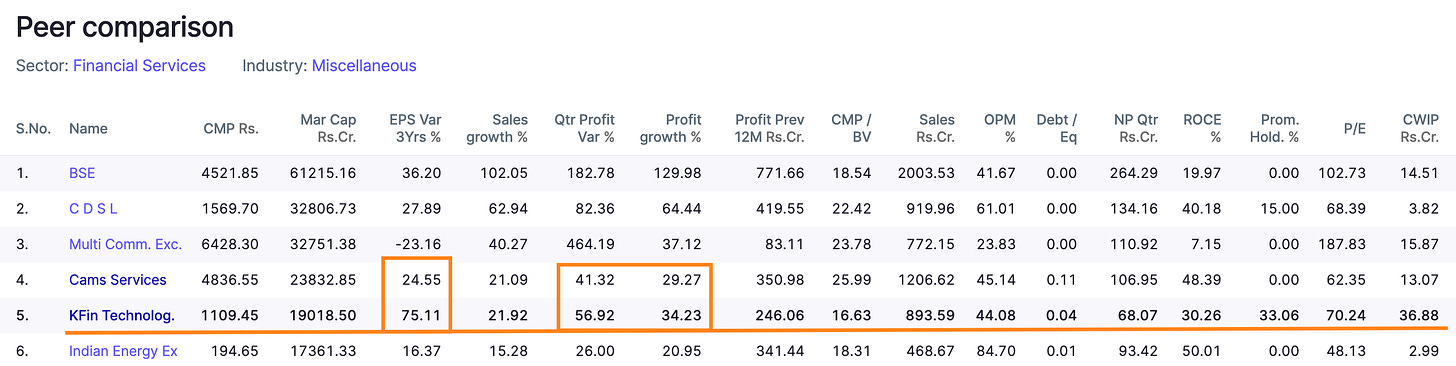

Peer comparison

The company’s EPS growth over the last 3 years is 3X that of its closest peer, CAMS services.

It is also ahead in quarterly and annual profit growth rate.

Timing analysis

(To decide if this is a suitable time to buy, we look for signs of high institutional trading volumes in recent weeks. Read more on Timing analysis here.)

High institutional trading volumes were observed recently in the weeks of 05-Aug(7.39X) and 26-Aug(7.1X).

Did you find our analysis on KFin Technologies Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock based on the data available today, and the viewpoint may evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in