Platinum Industries Ltd - quarterly sales growth of 66%

The third-largest player in the domestic PVC stabilizer market.

Note - As anticipated, the NIFTY50 index and the broader market (NSE:CNX500) have corrected over the last 3 weeks. We will continue to exercise caution in the current market conditions until they return to a clear uptrend.

Company name - Platinum Industries Ltd

Last closing price(NSE:PLATIND) - ₹447.1 (as on 18-Oct-2024)

Estimated reading time - 3 minutes

New notes update - We have recently published a series on ‘How do we trade in the stock market?’. It answers many of your queries around trading.

The updated performance of all our past analyses is available here.

Executive Summary

Platinum Industries specializes in the manufacturing of PVC stabilizers, CPVC additives, and lubricants, catering to various industries such as agriculture, construction, healthcare, and consumer goods. It is ranked as the third-largest player in the domestic PVC stabilizer market, holding a 13% market share.

The capital raised from the March 2024 IPO is being strategically used to fund capacity expansions, working capital, and operational improvements, further boosting earnings growth.

The company has reported significant quarterly sales growth of 66%.

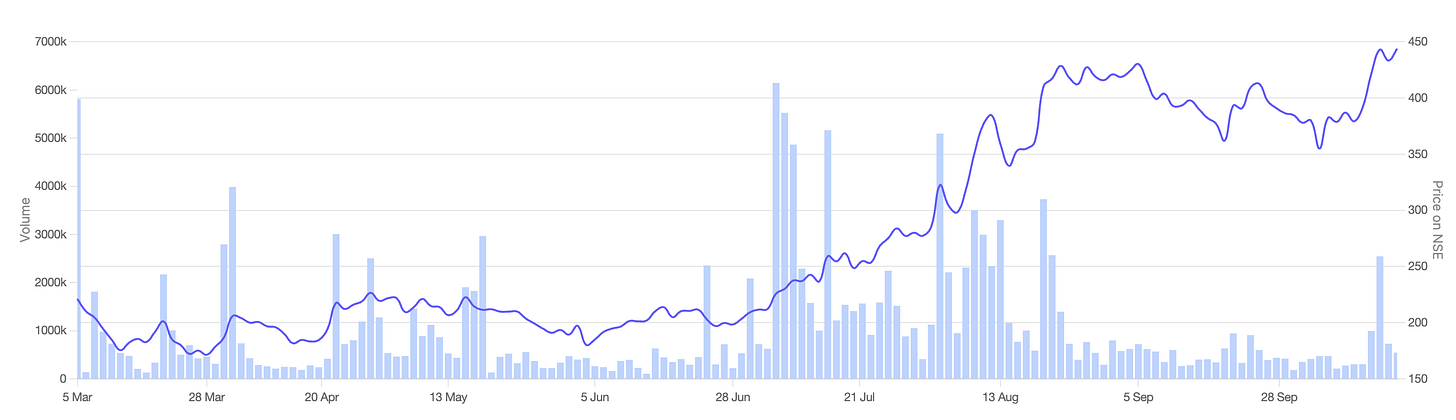

Stock price chart

Detailed Analysis

About The Company

Platinum Industries specializes in the manufacturing of PVC stabilizers, CPVC additives, and lubricants, catering to various industries such as agriculture, construction, healthcare, and consumer goods.

The company provides both lead-based and non-lead-based stabilizers, with a focus on eco-friendly alternatives like calcium-zinc stabilizers. They also manufacture CPVC compounds and lubricants like PE wax and OPE wax, which are crucial for PVC processing.

Platinum Industries operates globally, with a presence in over 30 countries, including a manufacturing facility in Egypt and an expanded facility in Palghar, Maharashtra.

Future Prospects

What is the company’s plan to maintain earnings growth in the future?

IPO and Capital Utilization: Following the company’s IPO earlier in the year, the raised capital has been effectively allocated towards expanding their manufacturing capabilities and meeting working capital requirements. This is allowing it to meet the rising demand without financial bottlenecks.

Capacity Expansion: The company is expanding its production capacity with new manufacturing facilities in Egypt and Palghar, enabling them to meet increased demand globally, particularly in high-growth regions like the MENA and LATAM markets

Global Market Penetration: Expanding presence in Europe, Asia, and MENA regions through their Egypt facility. The company is targeting to increase export contribution to 10% of total revenues, with a focus on emerging high-growth markets

Product Innovation & Diversification: Ongoing investment in Research & Development (R&D) to launch new, eco-friendly products such as lead-free stabilizers and other sustainable additives. This innovation will help them stay competitive and capture new market opportunities.

Potential risks that could hamper the future growth?

Raw Material Cost Volatility: Raw material cost fluctuations remain a challenge. The company plans to manage this by further diversifying its supply chain and leveraging cost efficiencies from new manufacturing facilities.

Global Competition: The specialty chemicals industry faces stiff competition globally. Platinum Industries aims to overcome this by increasing market share in high-growth regions like MENA and LATAM through their Egypt facility.

Energy Costs: Rising energy costs are a concern. The company is exploring process optimizations to reduce energy consumption at its plants.

Financial Analysis

Overview

The promoter holding is strong at 71%, and pledged percentage is 0%.

The company is almost debt-free with debt-to-equity of 0.03 and the ROCE is strong at 27.2%.

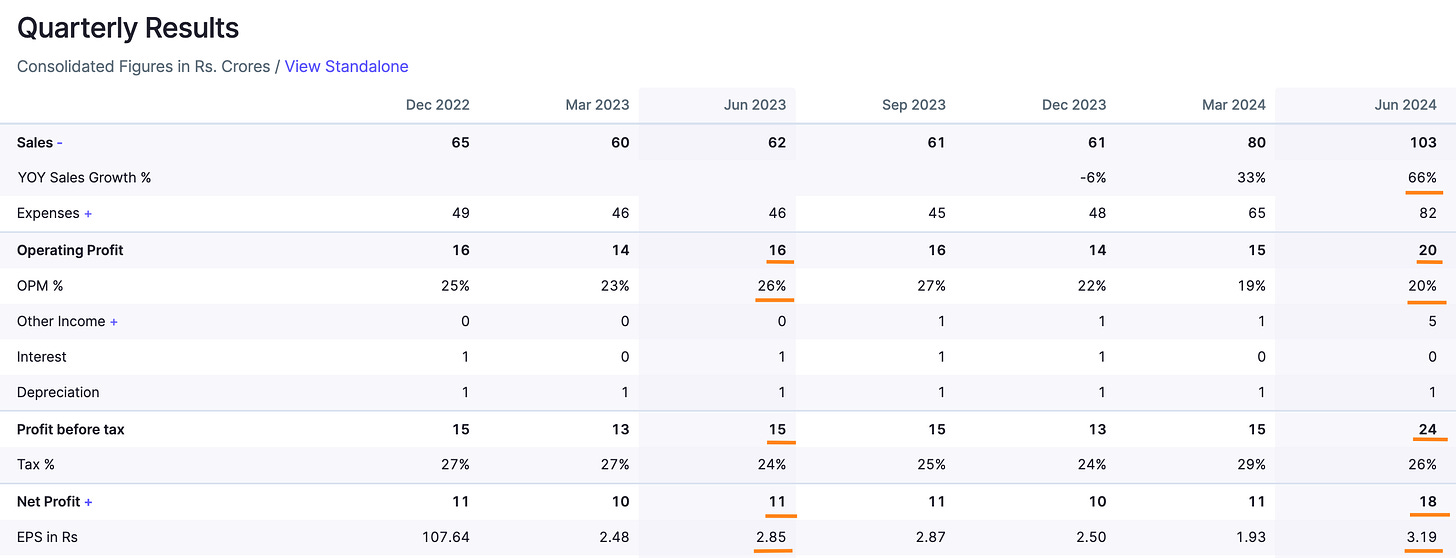

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has reported significant sales growth of 66%.

The operating profit increased by 25%, although the operating profit margin reduced by 23%.

The operating profit margin decreased due to expansion-related costs and market conditions.

The net profit increased by 63.6% and EPS increased by 11.9%.

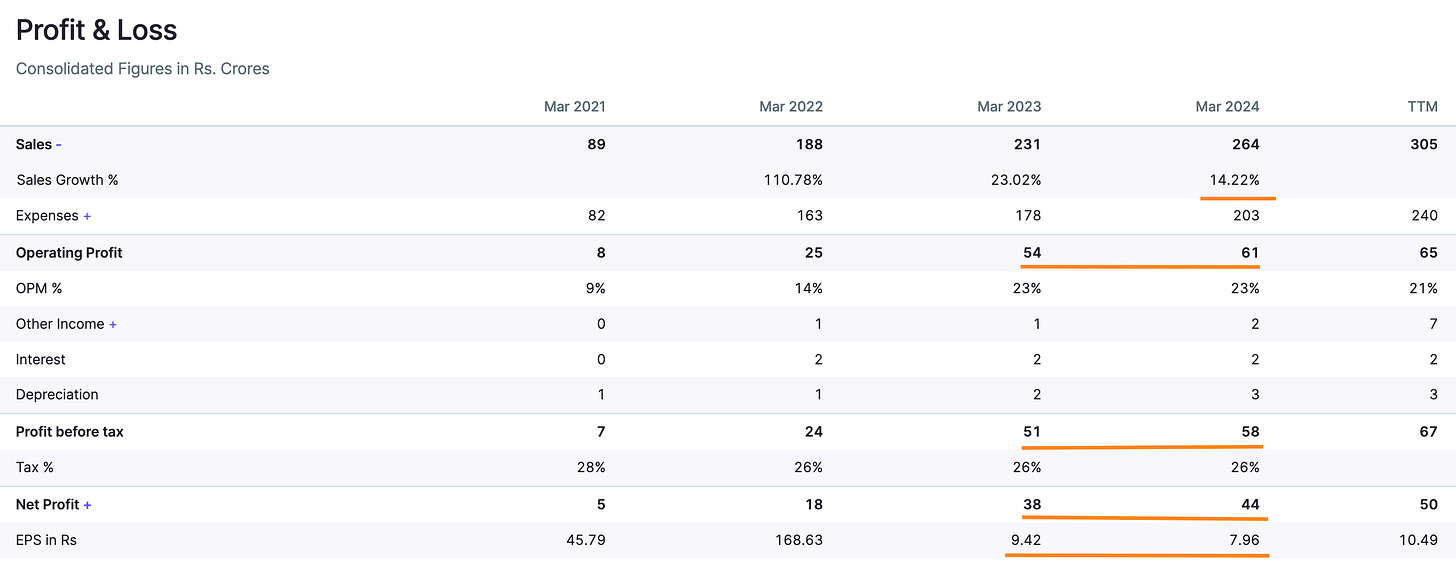

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a sales growth of 14.22%, and operating profit growth of 12.96%.

The net profit increased by 15.7% and EPS decreased by 15.4% as the company got listed in the market.

Timing Analysis

(To decide if this is a suitable time to buy, we look for signs of high institutional trading volumes in recent weeks. Read more on Timing analysis here.)

High institutional trading volume signs seen recently in the week of 14-Oct(3.2X).

Did you find our analysis on Platinum Industries Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock based on the data available today, and the viewpoint may evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in