Symphony Ltd - quarterly EPS increased by 366%

A company benefiting from global warming.

Note - As we had anticipated, NIFTY50 index and overall broader markets (NSE:CNX500) corrected in the last 2 weeks. We continue to exercise precaution in the current market conditions. The indices have recovered a bit in this week, but they are still not back to a clear uptrend.

Company name - Symphony Ltd

Last closing price(NSE:SYMPHONY) - ₹1755.75 (as on 15-Oct-2024)

Estimated reading time - 3 minutes

New notes update - we have recently published a series on ‘How do we trade in the stock market?’. It answers many of your queries around trading.

The updated performance of all our past analyses is available here.

Executive Summary

Symphony Ltd. manufactures and trades residential, commercial, and industrial air coolers globally. They are the largest air cooler manufacturer, with a strong presence in over 60 countries.

They are positioning their coolers as more eco-friendly versions to air-conditioners.

The company has reported significant sales quarterly growth of 76%, representing a turnaround. The operating profit increased by 426%, with the operating profit margin also increasing by 233%.

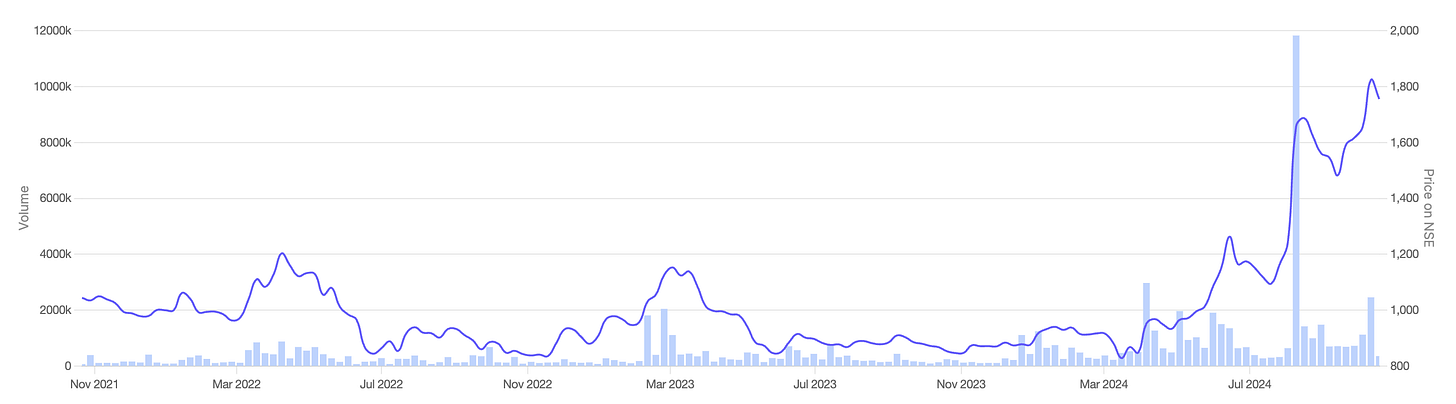

Stock price chart

Detailed analysis

About the company

Symphony Ltd. manufactures and trades residential, commercial, and industrial air coolers globally. They are the largest air cooler manufacturer, with a strong presence in over 60 countries.

The company holds approximately 50% market share in the organized air-cooler market.

27°C eco-friendly positioning - The company is running a ‘27°C campaign’ which is not just about cooling; it is about creating a sustainable world that Symphony envisions through their eco-friendly and energy-efficient air-coolers. The company emphasizes its role in mitigating climate change by providing products that consume significantly less energy than traditional air-conditioners while maintaining comfortable indoor temperatures.

Future prospects

What is the company’s plan to maintain earnings growth in the future?

Geographical Expansion: Symphony plans to further penetrate semi-urban and rural markets in India, which showed strong growth in Q1 FY2025. The company also aims to continue expanding its international footprint, leveraging its established presence in over 60 countries.

Product Diversification: The company intends to broaden its product portfolio by expanding into adjacent categories, such as portable coolers, commercial cooling solutions, and newer air-cooler models. This is expected to increase revenue streams and reduce reliance on any single product category.

Digital Sales and Direct-to-Consumer (D2C): Symphony is increasing its focus on digital channels, particularly its D2C platform, which has shown significant growth. By optimizing digital sales, Symphony aims to enhance margins (no cash-on-delivery model) and increase direct consumer engagement.

Potential risks that can hamper the future growth?

Dependence on Weather Patterns: Symphony’s growth is highly dependent on hot weather conditions. A weaker-than-expected Indian summer in FY2023 impacted sales significantly.

Economic Slowdowns in Key Markets: Economic challenges in international markets, particularly inflation in the USA and housing market troubles in Australia, could affect Symphony’s international revenue growth.

Rising Input Costs: While Symphony has managed to increase margins through cost control, sustained increases in raw material prices or logistics costs could squeeze profitability.

Financial analysis

Overview

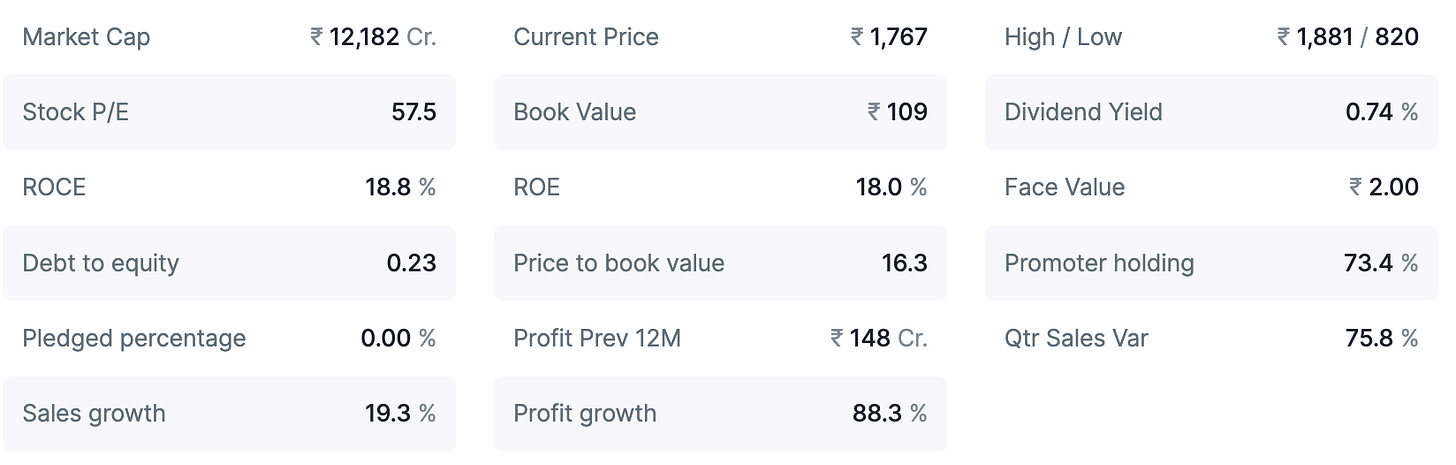

The promoter holding is high at 73.4%, and pledged percentage is 0%.

The debt-to-equity is in control at 0.23 and the ROCE is healthy at 18.8%.

Quarterly results

Growth in key metrics in the latest quarter Q1 - 2025 compared to the last year’s same quarter -

The company has reported significant sales growth of 76%, representing a turnaround on account of early onset of summer and an overall strong demand.

The operating profit increased by 426%, with the operating profit margin also increasing by 233%.

Operating margins improved to 21% due to a combination of factors such as operational efficiencies, value engineering, and strong international performance.

The net profit increased by 366% and EPS increased by 366%.

Annual results

Growth in key metrics in the last financial year 2024 compared to the previous financial year -

The company reported a negative sales growth of -2.65%, and operating profit growth of 22%.

The net profit increased by 27.5% and EPS increased by 29%.

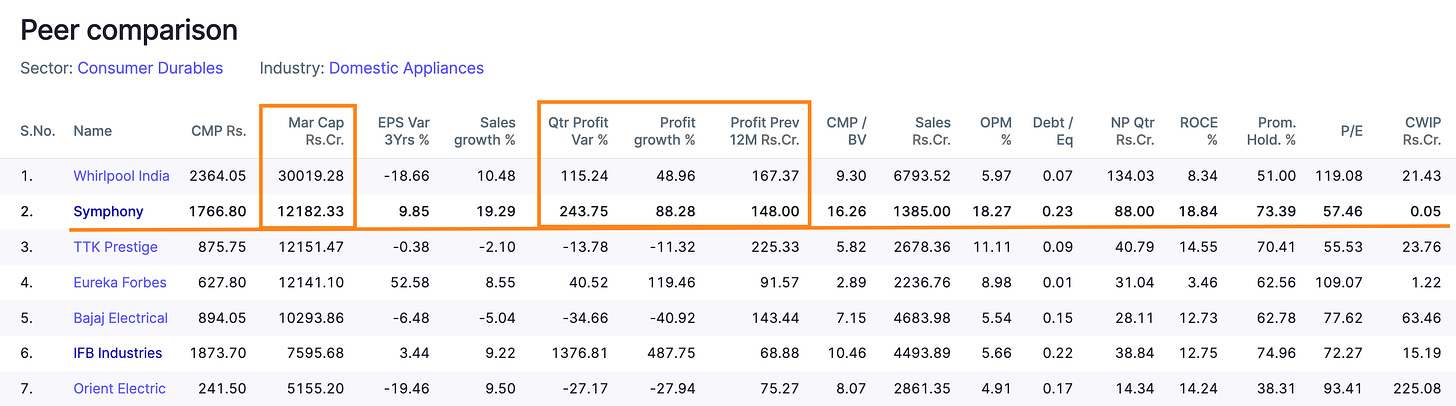

Peer comparison

If we compare Symphony Ltd, with Whirpool India which is the peer with a higher market cap (+2.46X):

Symphony has nearly double the quarterly profit variance%, profit growth and sales growth.

The profit in the last 12 months for Symphony is only 12.8% less than Whirlpool India.

There is a potential for Symphony’s market cap to grow if it is able to maintain its revived growth rate.

Timing analysis

(To decide if this is a suitable time to buy, we look for signs of high institutional trading volumes in recent weeks. Read more on Timing analysis here.)

Institutional high trading volume signs seen recently in the weeks of 05-Aug(18X) and 07-Oct(3.7X).

Did you find our analysis on Symphony Ltd valuable? Help us reach more investors like you.

This is not a stock recommendation. It’s an analysis of the stock basis the data available today, and the viewpoint can evolve in future. Please read our Disclaimer here.

Credits : Financial data source - screener.in