Trade Management - p3 - Protecting Profits

Estimated reading time - 3 minutes

<pre-read - part 1 and part 2>

Hello,

This is a continuation of the series on ‘How we manage trades’. In this part 3, we share our approach to protecting and booking profits.

Setting Realistic Goals

Most new traders aim to beat their existing investments. While mutual funds on an average generate 10%-15% CAGR, if you calculate an overall return rate on all your investments including MF, FDs, savings accounts etc - the average rate would come out ~10%.

Achieving a 100% success rate on each trade is unrealistic. Even the most celebrated investors in the world don’t have a 100% success rate. The success rate will vary based on market conditions, stock valuations, and your timing.

When our success rate drops below 50%, it’s a sign to step back and reassess the situation. Cash is also a position; being fully invested all the time is unnecessary.

Risk-to-Reward Approach

The risk-to-reward ratio measures how much risk you take for a potential reward. For example, a 1:2 ratio means risking ₹1 to gain ₹2. While popular, we don’t follow this ratio rigidly for every trade because it doesn’t always suit small and mid-cap stocks.

1. Higher Volatility: Small caps can swing 5% down and hit stop-losses before reversing.

2. High Reward Thresholds: Aiming for 20% rewards with a 10% risk often results in missed gains.

Our Strategy: Protect Breakeven and Book Partial Profits

1. Move Stop-Loss to Breakeven

We shift our stop-loss to breakeven once a trade moves in our favour at +5% profit to secure initial capital.

2. Book Partial Profits at +10%

We sell 50% of our position at +10% profit and keep the remaining portion at breakeven stop-loss. This locks in gains and reduces risk.

3. Trailing Stop-Loss

For the remaining position, we adjust the stop-loss at every +5% milestone, capturing larger gains if the price moves favorably.

Why 10%?

Our research shows that mid-cap and small-cap stocks can move 10% to 100% if the timing of the analysis is right. However, predicting exact price moves is futile. Holding every trade for maximum gains can lead to missed opportunities.

Balancing Risk and Reward

Using a balanced risk/reward ratio over 100 trades is more effective than strict formulas, especially in volatile markets. We aim for an average ratio of 1:2 over time.

Practical Scenario: Why a 100% success strategy is not needed

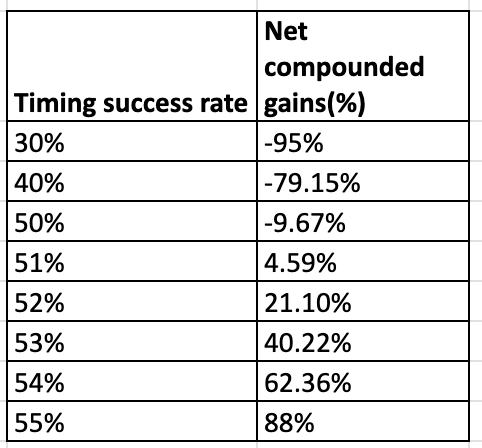

Let’s analyze the impact using different success rates:

Capital allocated per trade = 10%

Total trades = 100

Average loss = 5% (including the trades where we protect breakeven)

Average gain = 10%

This table demonstrates that, even with a 53% success rate, booking average profits at 10% and maintaining an average risk:reward ratio of 1:2 results leads to a positive net gain of 40% on your total allocated capital, making it a viable approach for consistent profitability.

Conclusion

By focusing on breakeven protection and partial profit booking, traders can maximize returns while keeping losses under control.

Lastly - Contrary to the popular belief, profit booking is one of the hardest thing to do in trading. There is always a hope for some more gain or a turn-around from losses tomorrow. It is an activity which a trader always regrets. Hence practicing this emotion-less discipline is important.